US Dollar Talking Points:

- This week’s economic calendar is dominated by the Jackson Hole Economic Symposium, where a who’s who of Central Banking will descend upon Jackson Hole, Wyoming to opine on trends and themes in Central Banking.

- Last year’s Jackson Hole event was a large market mover but historically that’s more seldom as each Central Bank has considerable opportunity to shape messaging through their own rate decisions. And for the US, next week brings multiple data points in the form of Consumer Confidence, PCE (the Fed’s preferred inflation gauge) and Non-farm Payrolls. These are all items that the Fed is likely going to want to incorporate before making any rate decisions and this highlights the possibility that Powell tries to refrain from saying anything too hawkish or too dovish at this week’s speech.

- This is an archived webinar that’s free for all to join. If you would like to join the weekly webinar on Tuesdays at 1PM ET, the following link will allow for registration: Click here to register.

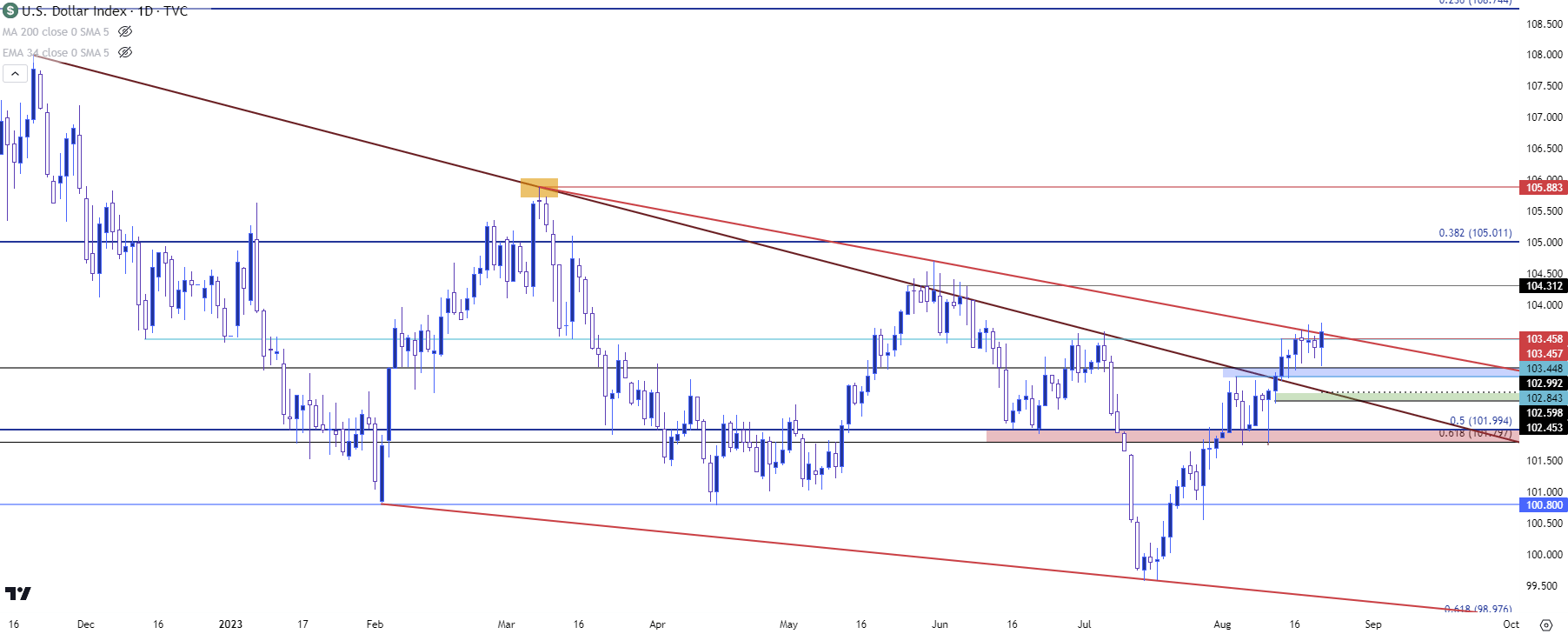

In the week since last week’s webinar, the US Dollar hasn’t made a fresh high (on a daily close basis), but the currency has remained strong largely on the basis of how bulls have responded to support.

When I looked at the USD last Tuesday it had just begun to re-test the resistance level at 103.45. A week later and there have still been no daily closes above that price, but bulls have held support above the 102.85 area of prior resistance which, deductively is somewhat bullish. As I had shared last week, that pullback could even run deeper while still retaining a bullish look for the USD.

At this point, follow-through resistance after the falling wedge break has held at another trendline. I talked about that in yesterday’s article, and support potential remains at the same 102.85-103.00 area, after which there’s secondary support potential around 102.45-102.60. If that doesn’t hold, then the 101.80-102.00 area becomes a third spot of resistance and if bulls can’t hold above that then the bullish breakout from the falling wedge will start to look like failure, similar to what happened on the other side of USD price action in July when bears couldn’t hold the lower-high.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

EUR/USD

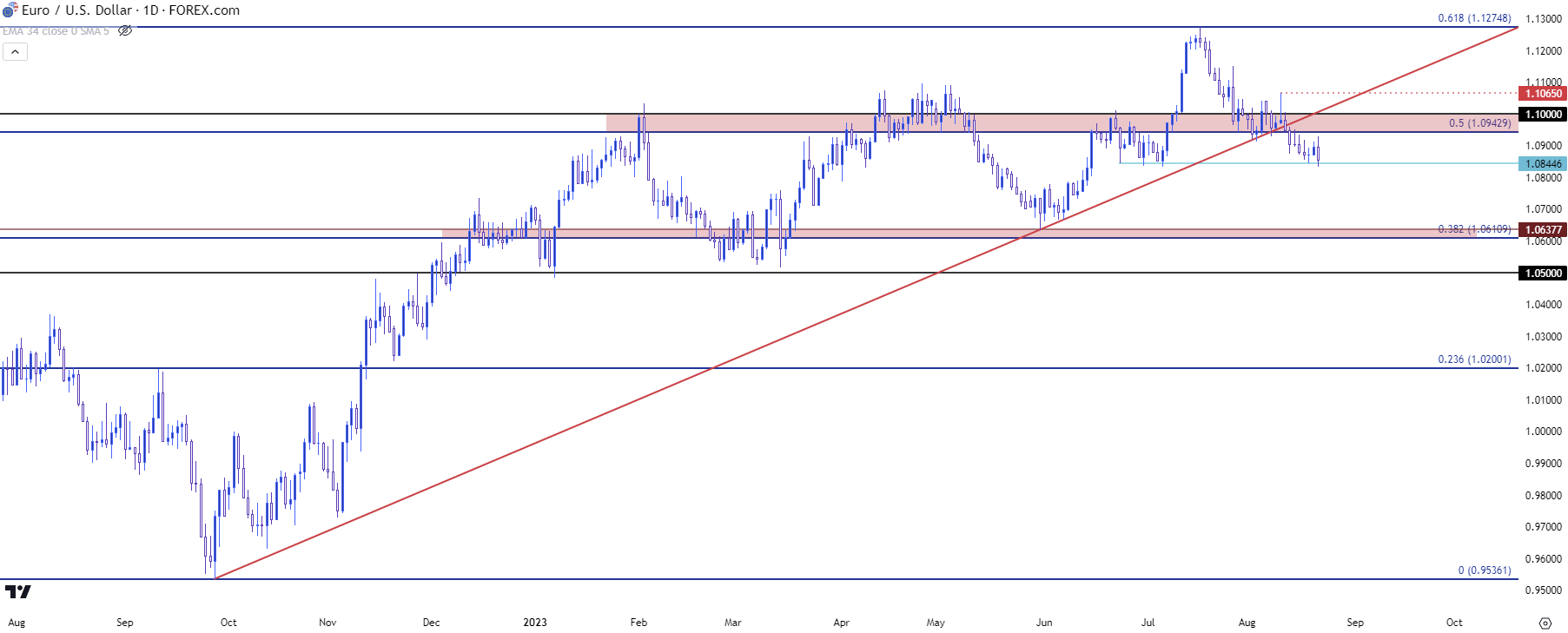

Whether that USD breakout takes hold or not will likely have something to do with the Euro, and this was a big item of change in the matter in July as European data started to take a turn for the worse. This brought upon fears that the ECB doesn’t have the same latitude to continue their fight against inflation as what the Fed has.

In EUR/USD, the month of July brought a strong reversal from Fibonacci resistance at 1.1275. But, ever since price started to re-test around 1.1000 sellers have been trepidatious, and we tagged the 1.0845 level that I’ve been talking about last Friday which has produced even more stall for the move.

As I shared on the webinar, if today’s daily bar cannot close below 1.0845 that would be multiple days of support holding at that level, which would keep the door open for pullback potential.

Given the 1.0943 level that has been in-play of late, that can produce a resistance zone from that level up to the 1.1000 big figure. And if sellers re-enter to hold a lower-high in that zone the door can remain open for bearish trend scenarios. The 1.1065 level appears relevant so if bulls can force a break above that, questions will pop up regarding bearish potential in EUR/USD.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

USD/JPY

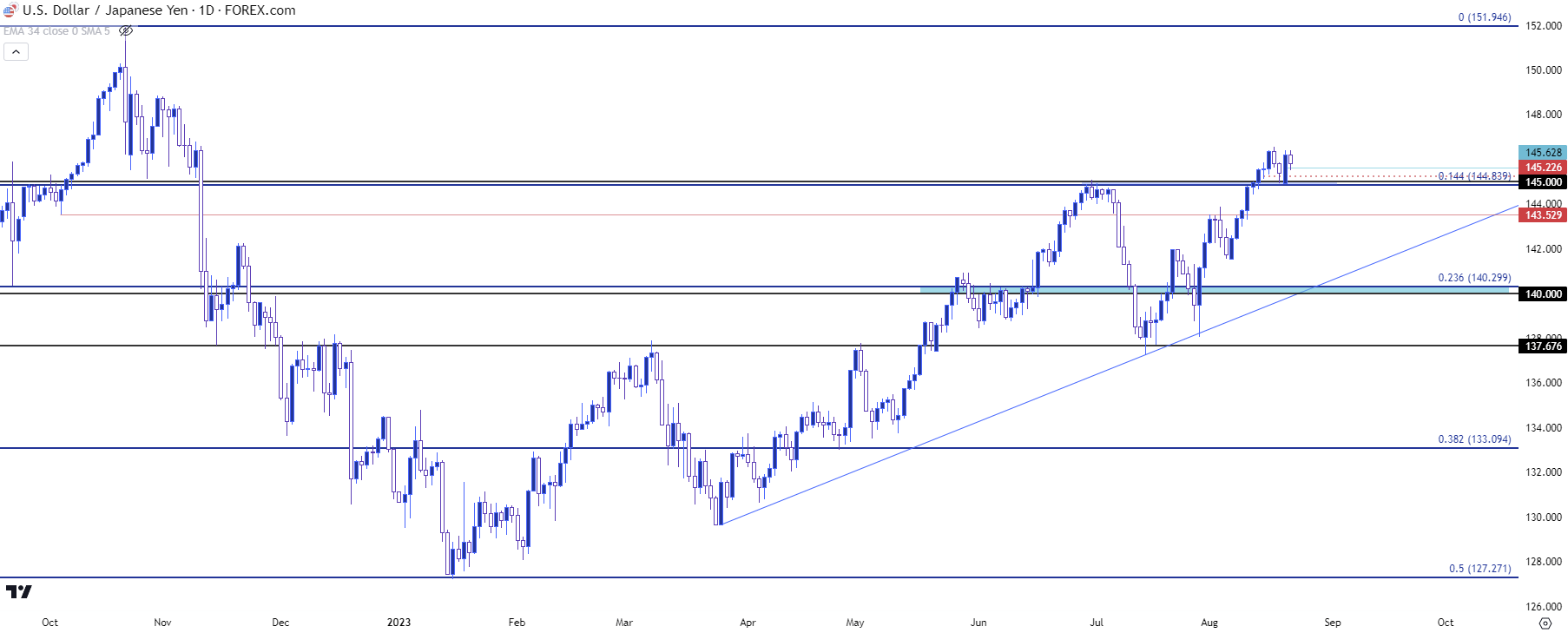

In USD/JPY it’s starting to feel like a game of cat and mouse regarding Japanese intervention, or the threat thereof. Last year it as the 145 level where this started to come into play but the 150 level when it produced an effect which helped to set last year’s high just inside of the 152 handle.

In the webinar, I looked at the rollover on the pair as an explanation behind the bullish bias. This also raises the questions as to how far the Ministry of Finance will let the theme run as there remains bullish motive as produced by the rate divergence between the two economies represented.

The challenge is that the bearish factor, whenever it appears, can be entirely subjective based on when the Ministry of Finance wants to jolt markets. And given Japan’s position, where their own monetary policy is encouraging the very trade that it’s trying to buffer, it would seem strategic for this to come out of the blue as a surprise to keep market participants on their toes.

But this also means chasing the pair while holding at highs or while stalling just inside of highs can be a challenging time to investigate long stances. Support could remain attractive, however, as we’ve seen show at the 145 level so far this week. Below 145, the 143.50 level could remain of interest and if bulls can’t hold a daily close above that price, the door will open for a deeper pullback down towards the 140 psychological level.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Gold

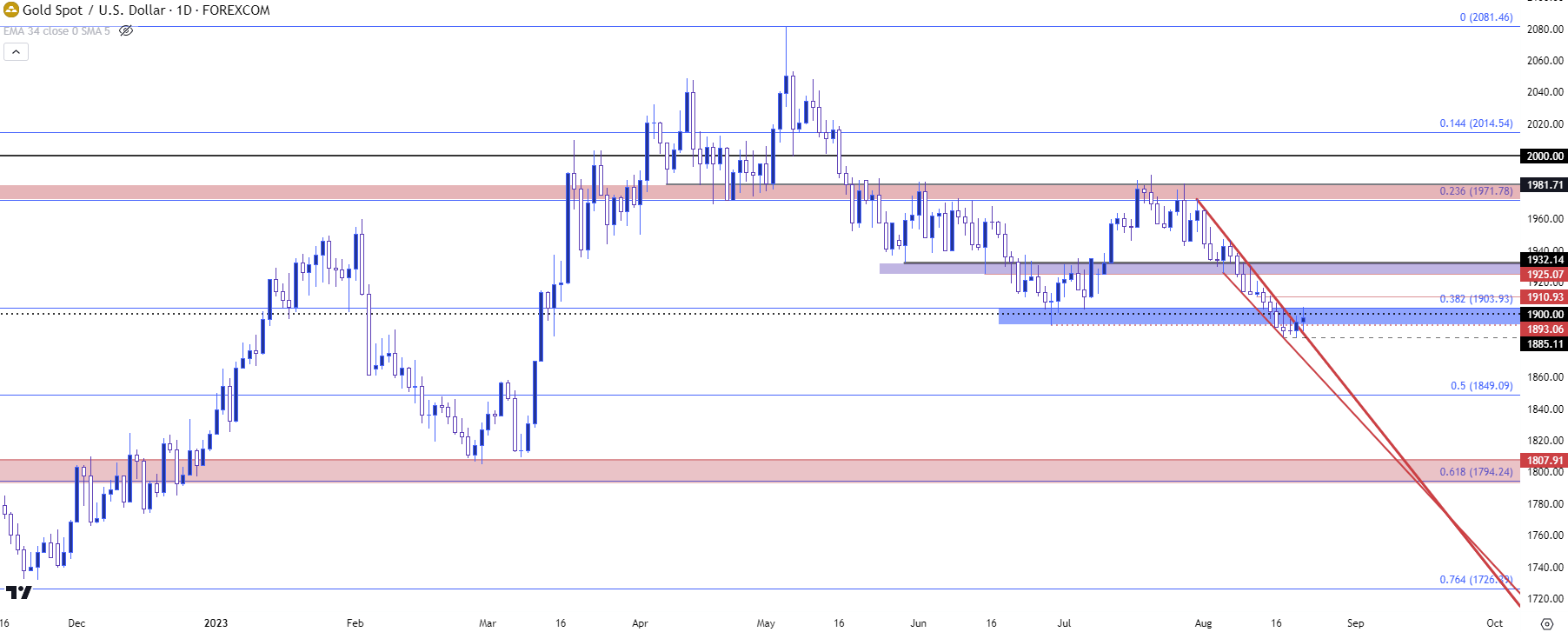

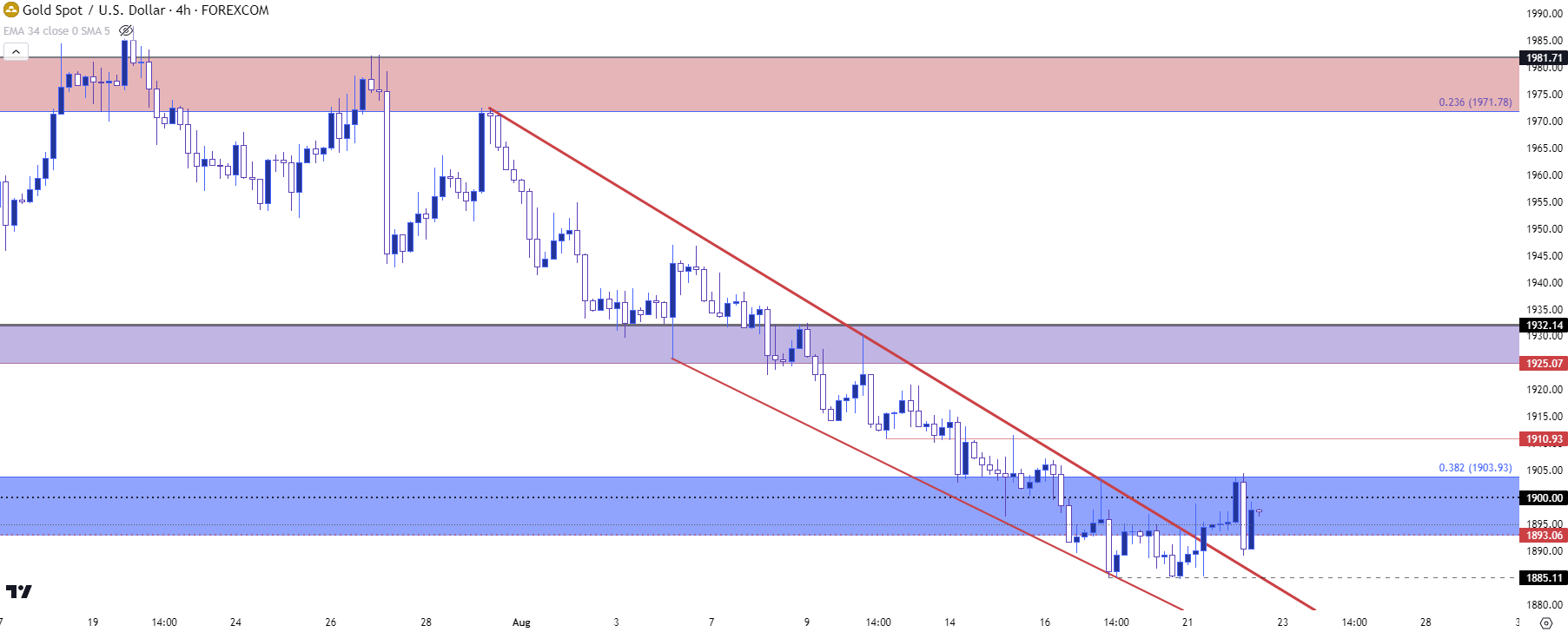

I’ve been talking about Gold’s penchant for brewing bear traps on webinars of late, and there may be another one of those situations taking place at the moment.

Last week saw spot Gold close below the 1900 level for the first time since March, around the time that the banking crisis came into the equation. For bears, it would seem like an opportune scenario as price was sitting at the low, below the psychological level and through support. Yet last Thursday’s daily bar produced a doji, and then the same happened on Friday.

Along the way price had built into a narrow channel during the August slalom, and this can be expressed by an aggressively sloped trendline on the daily chart.

That stall at support over the past few days began to allow for price to venture out of the topside of a falling wedge formation.

Gold (XAU/USD) Daily Price Chart

Chart prepared by James Stanley, Gold on Tradingview

On a shorter-term basis, the door is now open for pullback. Today’s high has so far held at the Fibonacci level at 1903 and that’s the 38.2% retracement from the same study that produced the 23.6% retracement at the 1971 level, which marked the high just before the August sell-off began.

But a hold of support above the 1885 level that sellers had stalled at keeps the door open for a deeper pullback, and there’s resistance potential at 1910 and then the 1925-1932 zone. That latter zone could be especially interesting for longer-term bears if it comes into play.

Gold Four-Hour Price Chart

Chart prepared by James Stanley, Gold on Tradingview

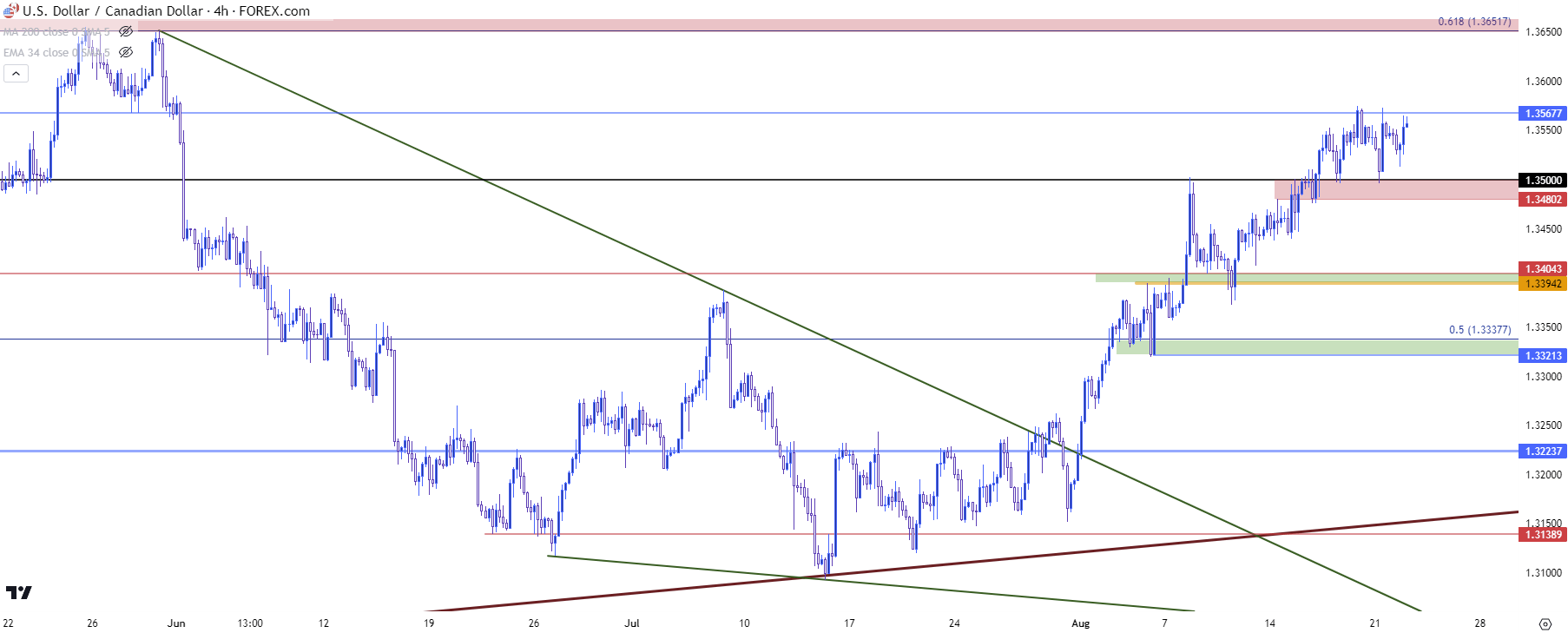

USD/CAD

USD/CAD has been one of the more attractive venues for scenarios of USD-strength. In the webinar I compared the DXY chart to the USD/CAD chart, which shows the additional strength in the USD/CAD pair as introduced by a weak Canadian Dollar.

In USD/CAD, price has started to range in a similar format as short-term USD. The 1.3500 level has remained as support after showing up as resistance for last week’s webinar. The 1.3567 level has since held resistance after the follow-through of the breakout.

USD/CAD Four-Hour Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

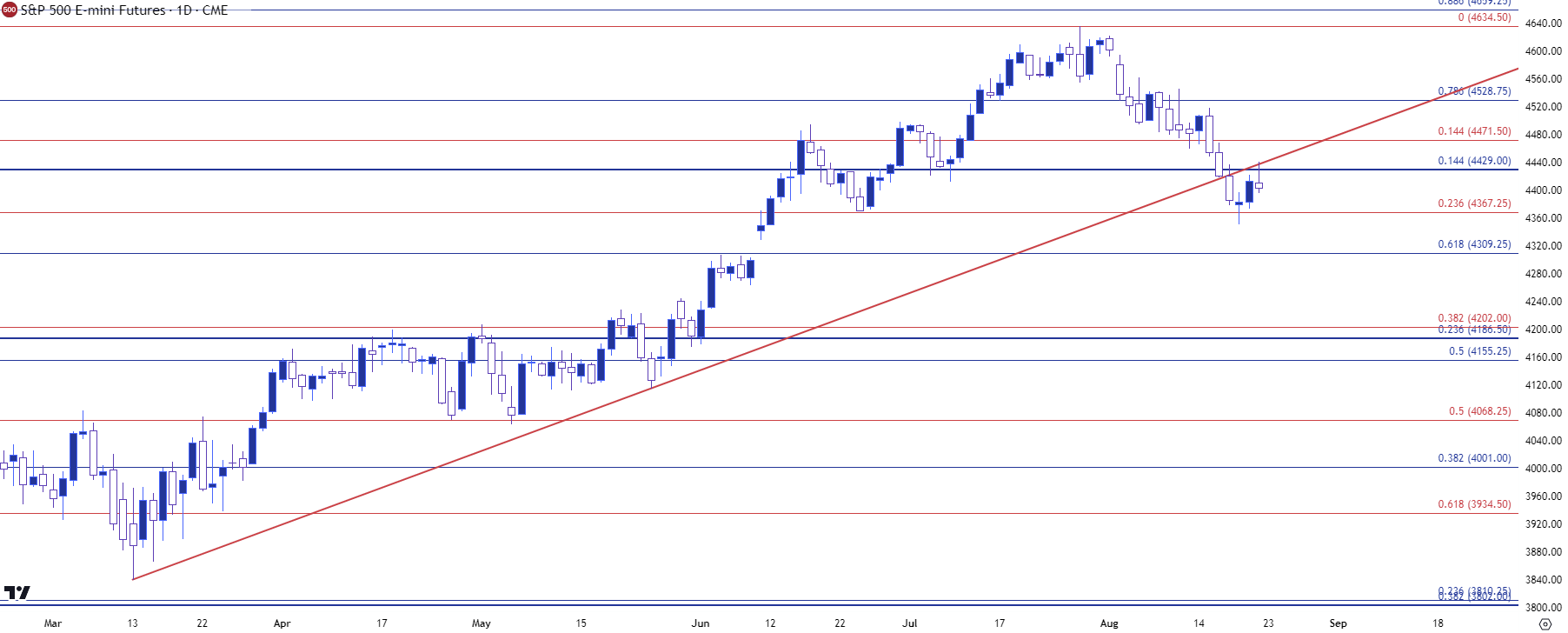

SPX and US Stocks

US equities remain in the spotlight as there’s been a change of pace so far in August, and that’s the fact that we’ve started to see a series of lower-lows and lower-highs print.

Taking a step back on the matter and it’s the rally from the March lows that remains up for debate, as much of that move was fueled by the thought that the Fed may be nearing an end of their rate hikes. But, five months later and inflation remains well-above the bank’s target, and there’s no sign yet that the FOMC is done with rate hikes despite the fact that we’ve already seen two moves of tightening since the banking crisis came into the equation in March.

And on one hand, rate cuts could be a positive for stocks in that it makes for a more accommodating backdrop. But, on the other side rate cuts would also signal to the market that rates have likely topped, and this would incentivize investors to buy bonds before yields move lower. And then perhaps more to the point if the Fed is talking about cuts anytime soon, which they’ve avoided doing, then what else is going on that has them worried? With some of the shifts being seen in China and elsewhere, that could spell for some considerable uncertainty for market participants and if there’s one thing that markets hate, it’s uncertainty.

At this point, S&P 500 futures have just completed a morning star formation as of yesterday’s daily bar. But, so far that bullish impulse has failed as the current non-completed daily bar is showing as a shooting star.

S&P 500 Futures - ES Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist