- EUR/USD analysis: ISM Manufacturing PMI and JOLTS disappoint

- All eyes on FOMC – expect a hawkish hold

- Eurozone data improvement boosts appeal of euro

The US dollar consolidated its gains from the day before, with investors wary of a potentially more hawkish Fed later today. Today’s US data releases were far from great, but more signs of stickly inflation emerged from the manufacturing sector. The EUR/USD was trading in a small range, mirroring price action in most other major currencies. Things could get wild with the FOMC coming up next, ahead of key NFP and ISM services PMI data on Friday.

ISM Manufacturing PMI and JOLTS disappoint

The ISM survey showed US factory activity fell in contraction after spending only one month in expansion threshold since September 2022. However, the report also revealed that input prices in the manufacturing sector rose at the fastest pace since 2022, fanning inflation fears further a day after we saw a bigger-than-expected rise in employment cost index. Today’s employment market data signalled the labour market is softening, with JOLTS job openings reaching their lowest point in over three years. Additionally, the quits rate dropped to its lowest level since August 2020, indicating a potential slowdown in wage growth in the upcoming months. Meanwhile, construction spending fell 0.2% month-on-month versus a gain of 0.3% expected. Elsewhere, crude oil stocks surged by 7.3 million barrels, which took the oil market by surprise and caused prices to collapse. Not a great day for US data, which helps explain the slight weakness in the greenback and a small rise in the EUR/USD exchange rate.

How will the Fed respond to hot inflation and soft survey data?

Recent robust inflation figures have tempered expectations of rate cuts in 2024. But while hard data has been strong, we have seen softer survey-based figures. Pointing to further economic weakness was today’s release of ISM manufacturing PMI, which followed an abysmal Chicago PMI from the day before. The US dollar bulls will need to factor in the fact that the hawkish repricing may already be factored in. Higher inflation and weaker leading economic indicators point to a sharper economic downturn, which may require a faster pace of policy loosening down the line. So, while the Fed may delay the start of the cutting cycle because of sticky inflation right now, once it starts cutting, we could see a fast move lower in interest rates. This argues against a sustained rise in the US dollar against currencies where the economic recovery is starting to take shape – for example the euro.

EUR/USD analysis: Euro outlook has improved thanks to recovery signs in Europe

The EUR/USD couldn’t hold onto its mild gains at the start of the week, all thanks to a strong recovery in US dollar amid inflation concerns. However, growth data, particularly in Southern Europe, has been on the ascendancy. As a whole, the Eurozone GDP expanded 0.3% in the first three months of the year, which was totally unexpected. With the unemployment rate remaining low, wages strong to boost consumer spending, and a more moderate inflation growth, things are finally looking brighter. The stronger performance of the Eurozone economy in Q1 and the slightly hotter than expected CPI data means the ECB may not be too eager to start an aggressive easing cycle. The euro could climb further against currencies where the central bank is already more dovish than the ECB. But as far as the EUR/USD is concerned, well it faces a key test this week with the upcoming FOMC policy decision and jobs report on Friday, among other macro highlights.

Recent economic data from Germany suggests the eurozone’s economic powerhouse is slowly turning the corner. While a bank holiday in much of Europe meant there was no data out today, we saw plenty of stronger macro pointers the day before. German GDP expanded by 0.2% in Q1, while retail sales showed a strong increase of 1.8% month-over-month. The rebound in consumer spending signals positive momentum for the broader economic recovery and indicates a potential turning point for the German and eurozone economies. These figures complement the recently released stronger-than-anticipated levels of business and consumer confidence.

Growth was broad based in Eurozone, with southern Europe again surpassing the north. Spain and Portugal enjoyed the strongest growth in the euro area, of 0.7% in the quarter. Italy’s growth accelerated to 0.3%, while France saw a more modest quarter-on-quarter growth of 0.2%.

Nevertheless, the slight expansion of Europe’s largest economies still signifies progress despite not being exceptional. As a whole, Eurozone GDP expanded by 0.3%, marking the most robust growth since the onset of a long period of stagnation that was triggered by the energy crisis in the third quarter of 2022.

However, food inflation is still going strong at 2.8% annual pace in April vs. 2.6% previously. Headline inflation remained stable at 2.4% as expected, although core inflation dropped in April to 2.7% from 2.9%, with services inflation moderating the most.

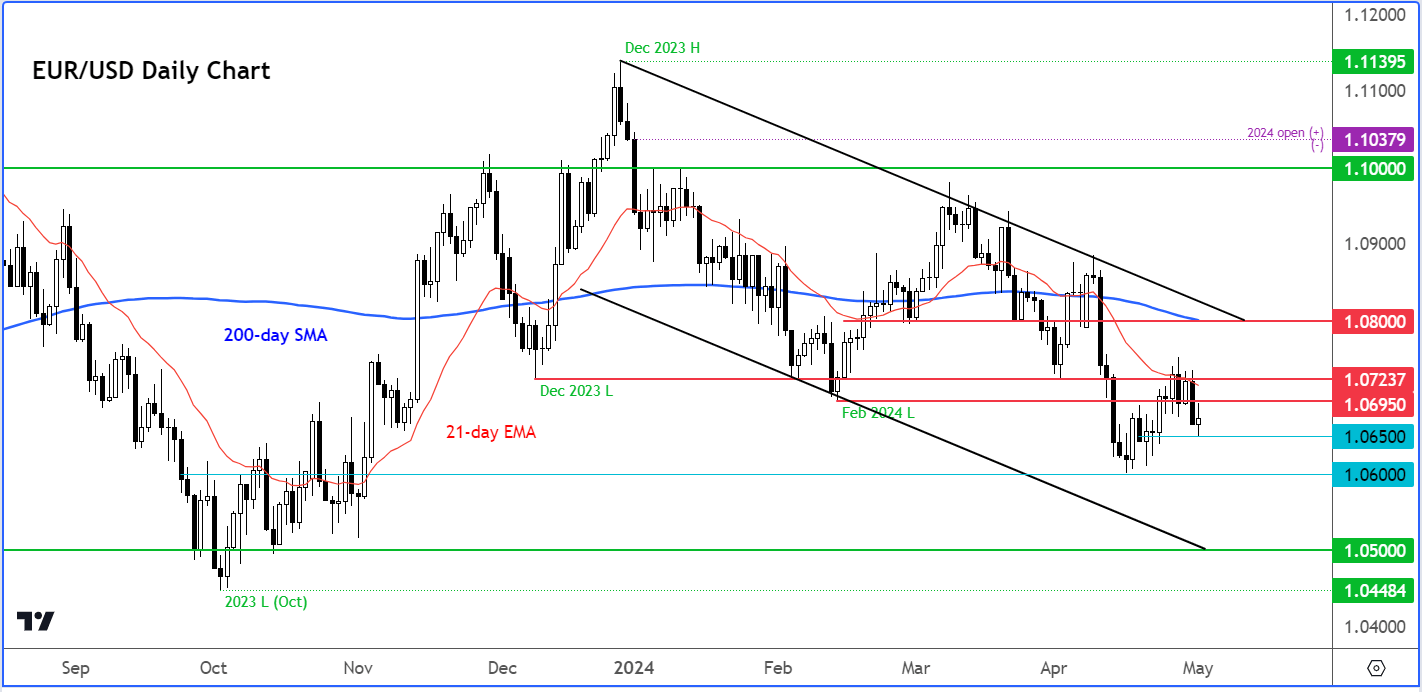

EUR/USD analysis: Technical levels and factors to watch

Source: TradingView.com

The EUR/USD has been stuck inside a tight range of late. Despite the improvement in Eurozone data, it needs to do more to reverse the larger bear trend. The EUR/USD has remained inside a large bear channel since December. A potential rise towards the resistance trend of the channel at 1.0800 could be on the cards, if the Fed is not as hawkish as markets fear, or we see NFP data disappoint badly on Friday. This is also where we have the 200-day moving average coming into play.

Support is seen around 1.0600 initially, ahead of 1.0500 next.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R