US Dollar Talking Points:

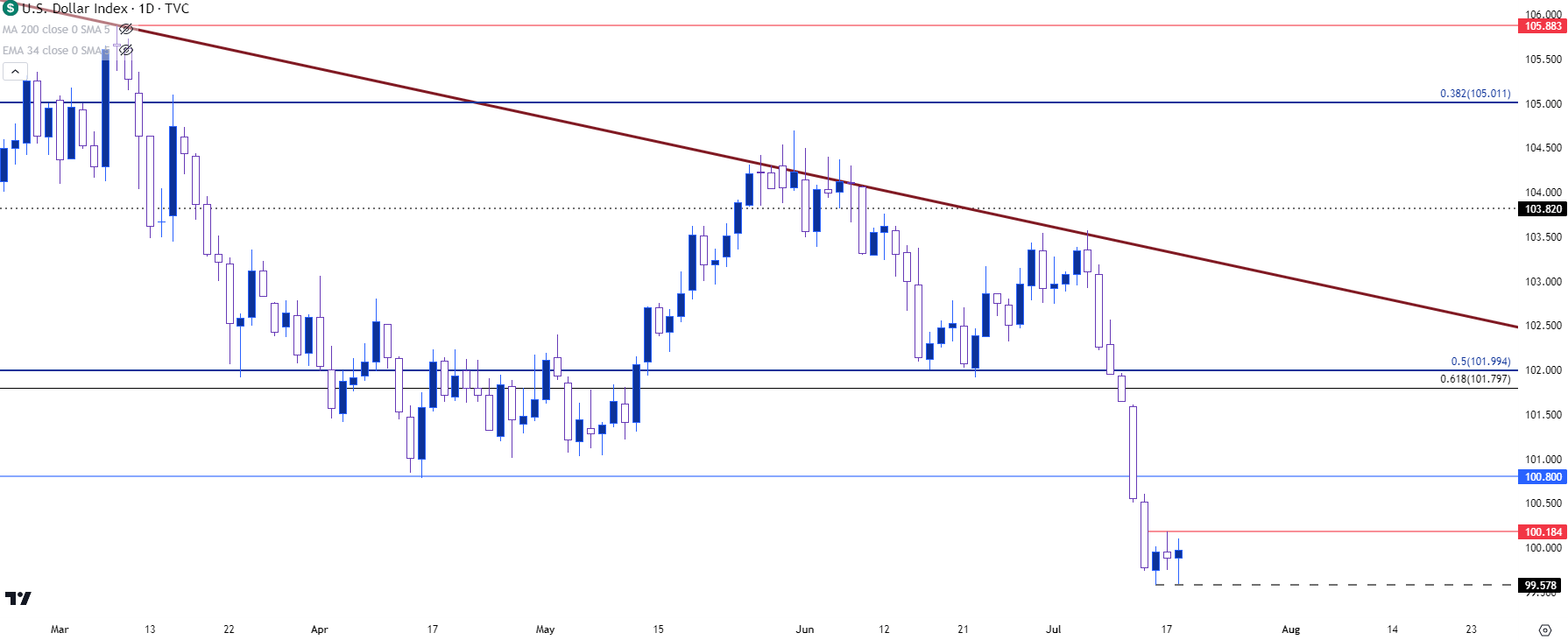

- The US Dollar put in a strong breakdown last week, and now the onus is on bears to continue the move.

- DXY has shown support for two days at the same level, setting up a short-term double bottom formation. This could set up short-term reversal potential which can put bears back in the spotlight to continue the bigger picture move. There’s now resistance potential from prior supports in the 100.80-101 level, after which the 102 level comes back into the picture.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The US Dollar spent the first half of the year consolidating, and last week finally led to a break of that theme when sellers pushed price down to a fresh yearly low. Along the way, a descending triangle formation triggered, which is bearish, and a double bottom formation was nullified. This puts bears in the driver’s seat and the question now is whether they can continue the move.

In the webinar, I looked at a few different areas of reference for near-term price action. At this point price is holding on to the same low that was in-play on Friday. This sets up a short-term double bottom which can keep the door open for a pullback in the bearish theme, with focus on prior support, taken from around the 100.80-101 area on the chart.

If sellers remain aggressive this could be an ideal area to show lower-high resistance. If they fail, there’s another level a little higher that’s of note around the 102 handle, which is the 50% mark of the 2021-2022 major move.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

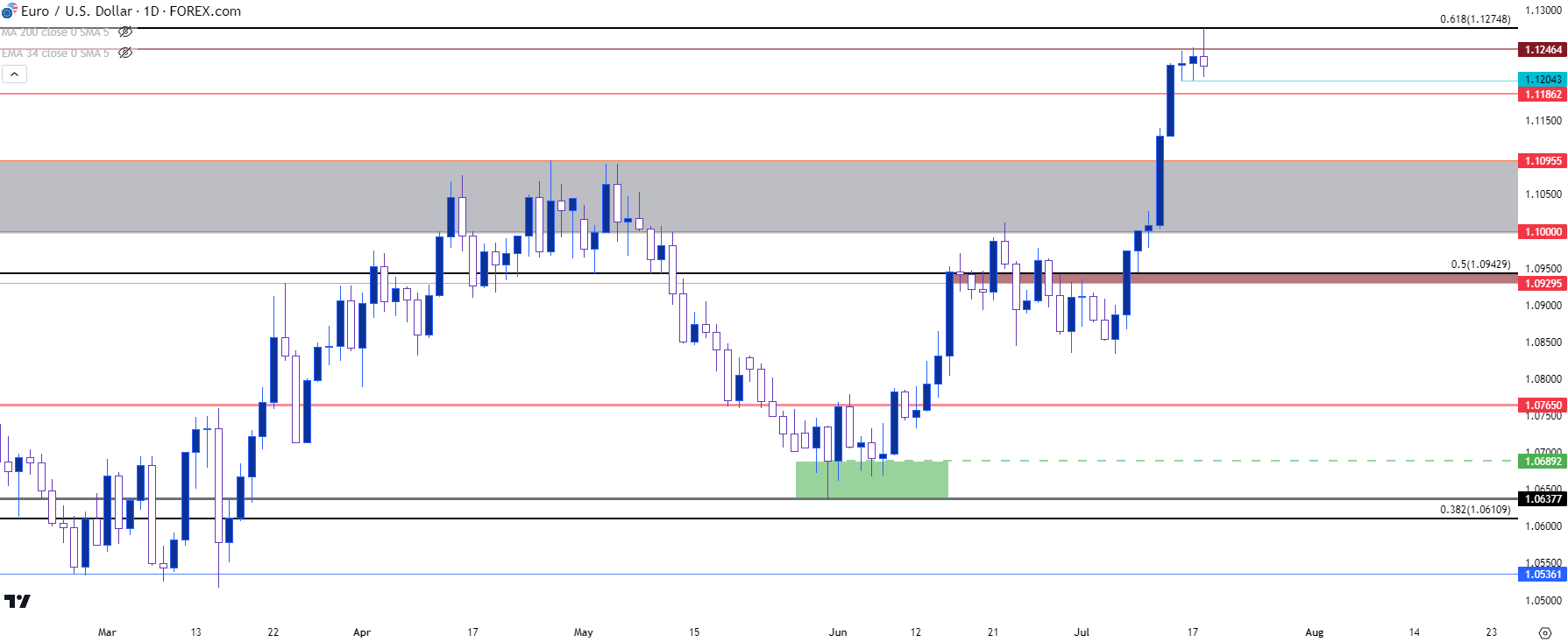

EUR/USD

In a similar move EUR/USD put in a strong topside breakout last week after CPI data was released on Wednesday. Thursday brought follow-through, but Friday showed stall just inside of the 1.1250 psychological level, which held through Monday trade, as well. On Tuesday, bulls initially pushed for another fresh high but were quickly rebuffed, with resistance playing in at 1.1274 which is the 61.8% Fibonacci retracement of the 2021-2022 major move.

This hold of resistance combined with a greater show from sellers so far today illustrates overbought dynamics in the pair. Given last week’s breakout, that makes sense, but the larger question is whether bulls take profits to help deliver a greater pullback, and in a related matter, whether bulls show up to hold higher-low support in those pullback scenarios.

In EUR/USD, there’s a nearby level at 1.1186 that could come into play as higher-low support if bulls remain very aggressive; but if they don’t, and price pulls back even more, there’s a large zone of reference in EUR/USD as prior resistance in the 1.1000-1.1100 area.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

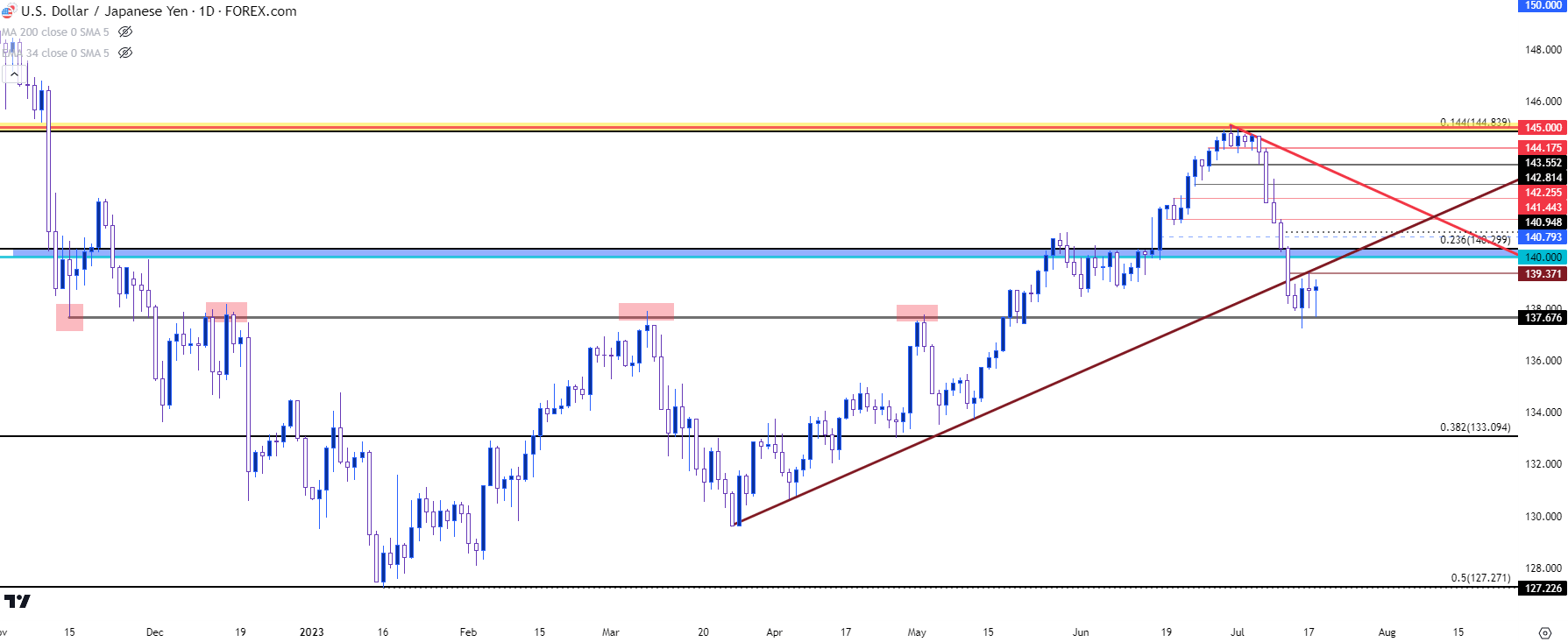

USD/JPY

USD/JPY was driving into July trade as there was little sign of change around the Bank of Japan. And as the Fed continued to talk up rate hikes this retained rate divergence in the pair with the carry still tilted to the long side. As long as the bullish trend continues, that can be attractive; but when there’s a sign of reversal the exit door from that carry trade is only so wide and this can lead to an aggressive pullback, such as we saw over the past couple of weeks, and that’s also very similar to the Q4 outing in USD/JPY.

Last week I looked at a key level of support in USD/JPY when asking where the low might be, and that price has since come into play to help cauterize support. This is the 137.68 level that was support in November and then resistance on multiple occasions in the first half of this year.

That price helped to hold support on Friday and was back in-play again this morning, and that second iteration showed a higher-low. This keeps the door open for bounce scenarios with the next big test around the 140.00 handle, which is close to a Fibonacci level at 140.30 to create a zone of lower-high resistance potential.

If sellers can’t defend that resistance while holding the lower-high, reversal scenarios will begin to look more attractive as that carry factor remains an issue.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

Gold: Bulls Back in Control

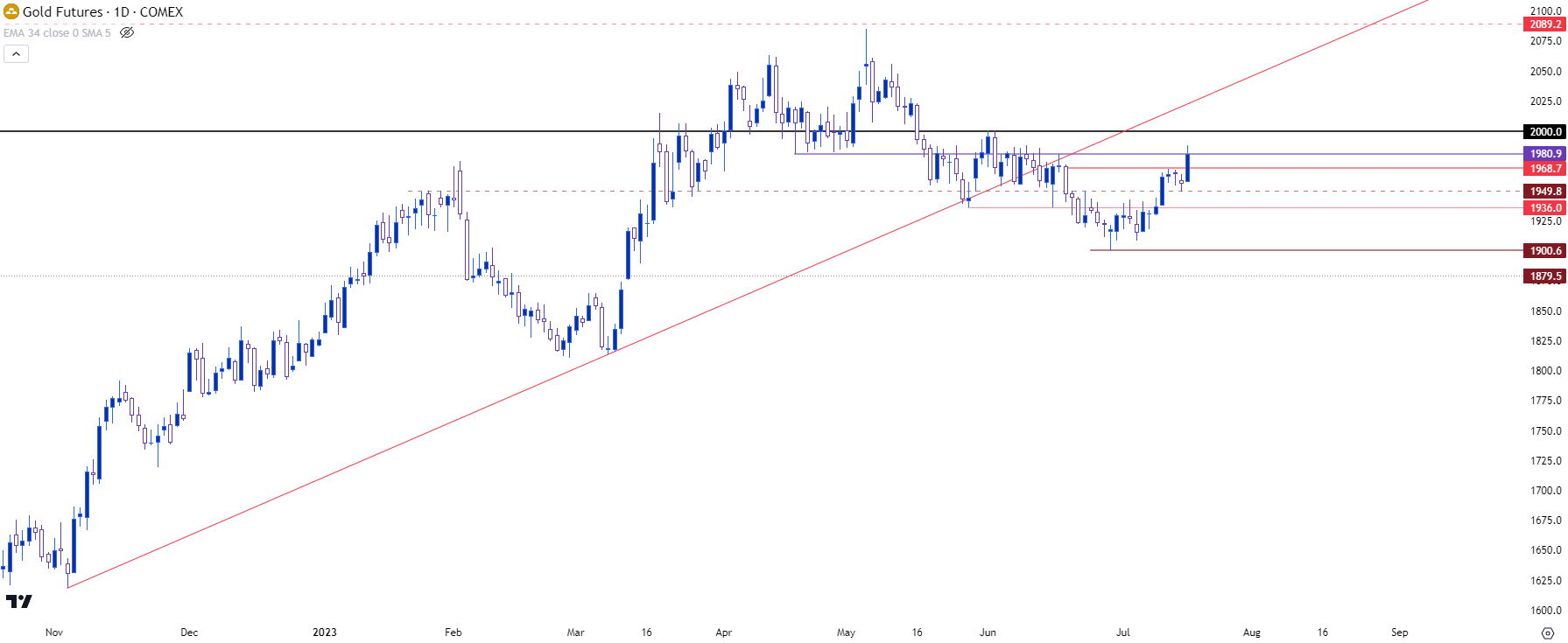

Gold remains in a long-term range that’s been in-play for more than three years now. The upper end of that range is around the 2k level, which held a key test over the past couple of months as bears started to take a greater and greater role on price action.

This led to a lower-low test around the 1900 handle a couple of weeks ago. And that’s around the time that bears began to stall, leading to a second consecutive doji on the weekly chart with a higher-low, and that led into last week’s bullish move that’s put buyers back in the driver’s seat.

This morning saw continuation of that breakout with a re-test of the 1980 resistance level. This sets up possible higher-low support around prior resistance, taken from around 1968, for re-test potential at the 2k psychological level.

After that? Well, we’re just going to have to see how strongly bears respond to that 2k resistance test, if it happens, as that’s been a stumbling block for the topside move of late.

Gold Futures - Daily Price Chart (indicative only)

Chart prepared by James Stanley, Gold on Tradingview

Chart prepared by James Stanley, Gold on Tradingview

--- written by James Stanley, Senior Strategist