Gold Talking Points:

- Gold prices are trading at a fresh five-month-low today as US Dollar strength continues to show across global markets.

- The pace of the declines has been impressive as Gold prices have sold off for eight of the past nine days, and this raises the prospect of big picture mean reversion from the weekly chart.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

Gold prices are heading lower again and this time we have a breach of the 1900 psychological level, which, until yesterday, hadn’t seen a daily close below that price since early-March trade. That episode in early-March, of course, was when problems were showing in regional banks in the US, bringing with it the potential for a softer touch from the Fed as the central bank looked to avert larger issues in the banking sector. That anticipation for a softer path from the Fed helped to propel risk assets, Gold included, as stocks became unmoored on their way to fresh highs.

But as US economic data has remained strong and as the Fed has continued to address inflation, that theme has begun to shift, particularly since the August open as USD-strength has taken over following the false breakdown in July. Last week’s rally in the USD despite below-expectation core and headline CPI was the next major driver in that theme and the US Dollar has gained each day since.

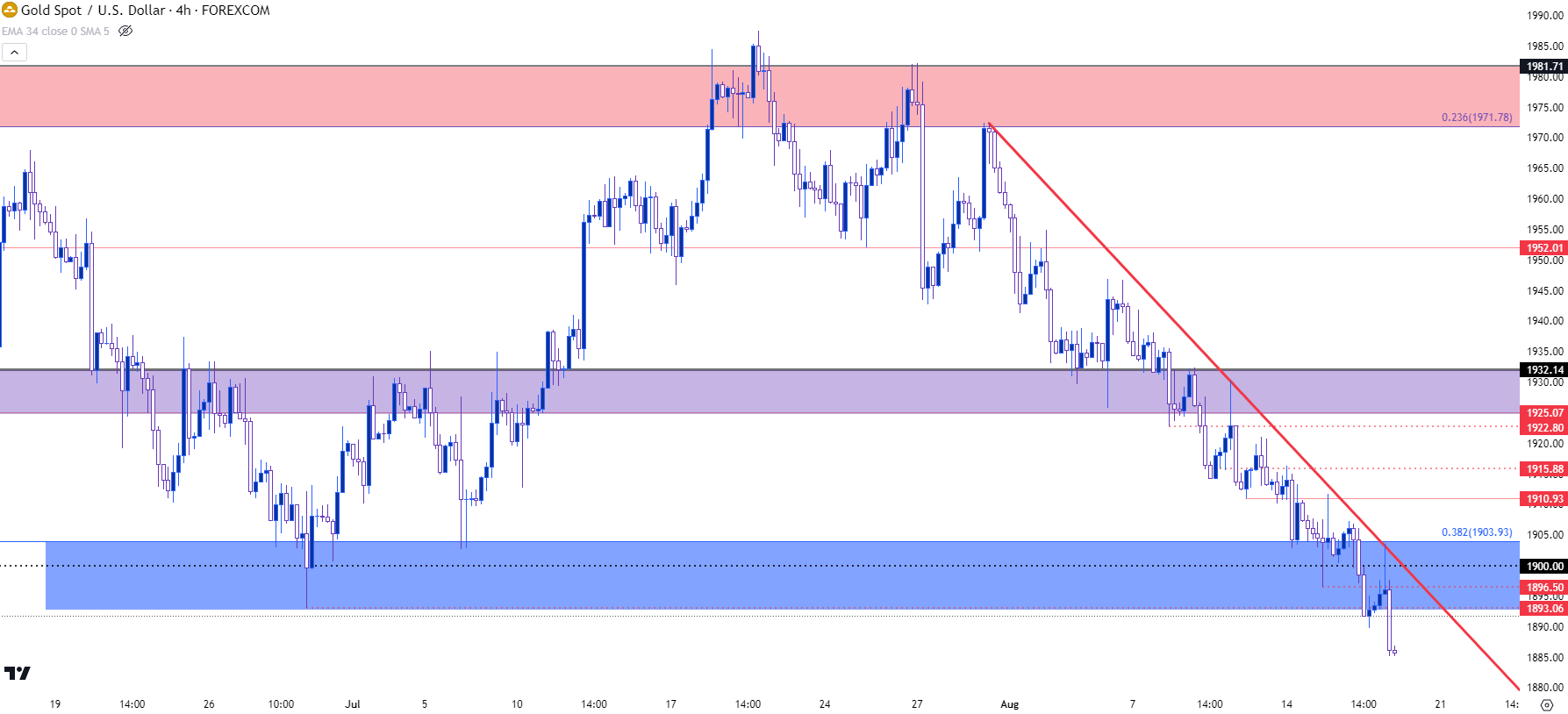

This theme can be seen well on the below four-hour chart, with the red trendline guiding the move lower and that trendline originated on the final trading day of August. This helps to show just how aggressive that bearish trend has been in Gold so far this month.

Gold (XAU/USD) Four-Hour Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Gold Grind Goes Through Key Support

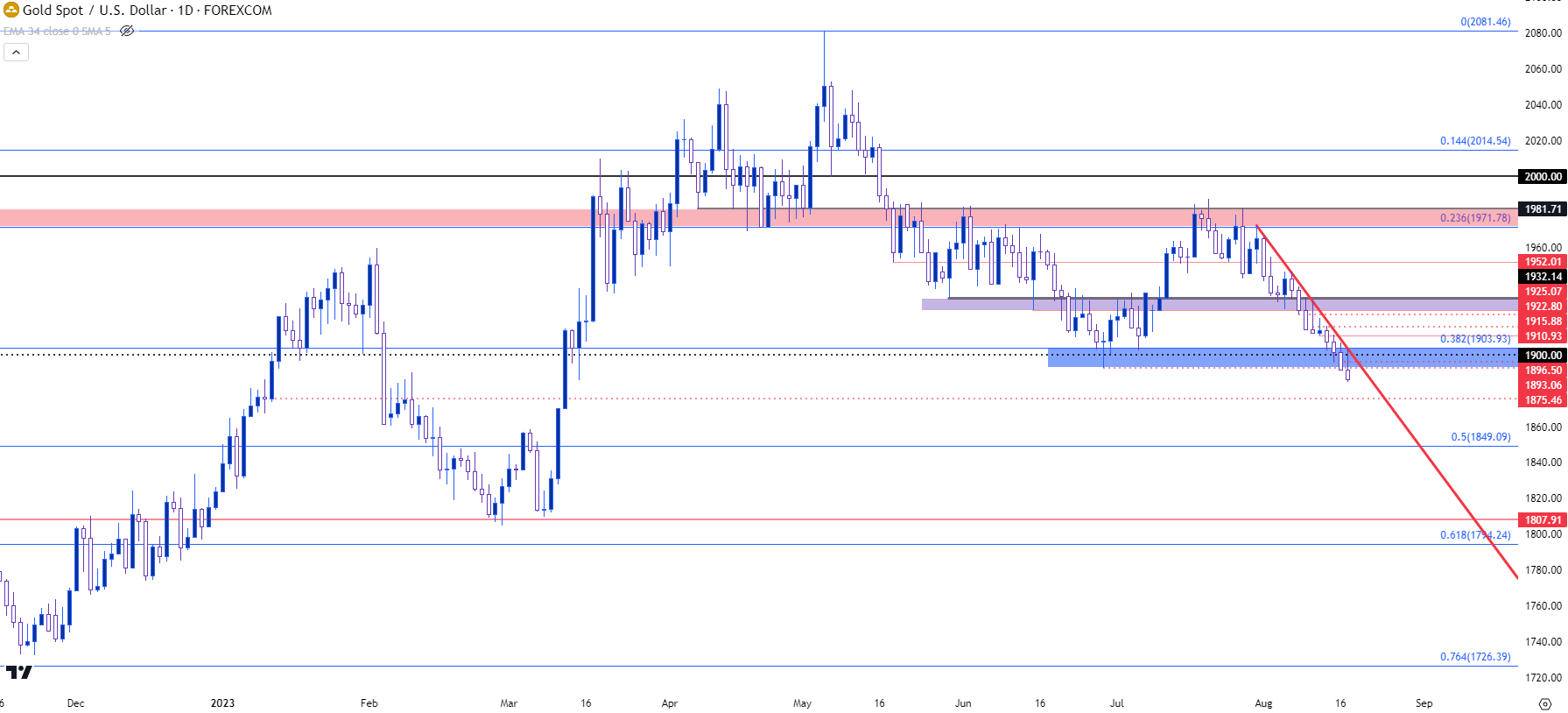

From the daily chart below, we can see the smoothness with which that bearish trend has priced-in, which complicates matters from a strategy standpoint as there’s simply been little pullback for bears to follow for trend continuation purposes.

And at this point, we have that bearish trend testing below a key spot of support on the chart, as the $1,900 psychological level had helped to set support in late-June, substantiating an element of confluence at the big figure. That zone did help to slow the sell-off, but it didn’t elicit much for pullbacks as we’re now seeing gold sell-off for its eighth day out of the past nine outings.

This could produce a challenge for bears that are looking to chase the breakout – but it also highlights a zone of prior support that could be resistance potential for pullbacks, running from around the June low of 1893 up to the Fibonacci level at the 1903 price.

Gold Daily Price Chart

Chart prepared by James Stanley, Gold on Tradingview

Gold Big Picture

I’ve been discussing this in webinars for a while now but, the weekly and monthly charts remain relevant, in my opinion, particularly when we mesh gold price action with the fundamental backdrop.

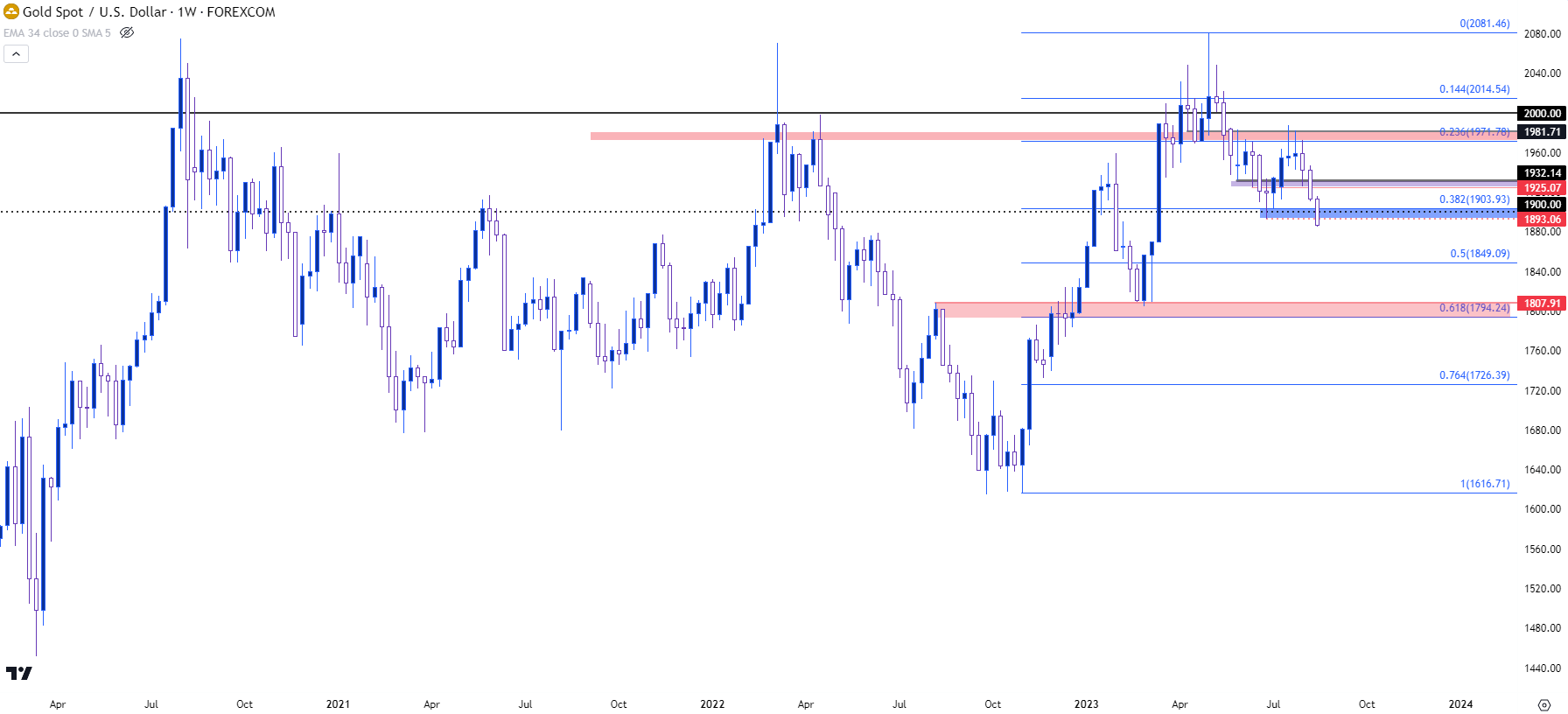

From the weekly chart below, we can see Gold prices holding in a range over the past three years, initially propelled by the Fed’s stimulus cannons in response to Covid in 2020. That helped to push Gold above the $2,000/oz mark but that hasn’t exactly been a clean run, as each instance of Gold pushing over the 2k mark has been met with pullback.

The first test above the big figure failed in 2020, as did the next test in early-2022, which happened around the time that Russia was invading Ukraine. The third instance happened in March and April of this year as gold prices were being pushed by that very first theme we discussed in this article, when regional banks were under pressure and markets started to expect the Fed to mold policy with consideration of that risk.

Well, that hasn’t really panned out but gold prices still remain elevated on a relative basis, indicating mean reversion potential in the longer-term theme.

This isn’t to say that Gold cannot take out the 2k level in a lasting way. But I’m ascribing this to something similar as what happened at the $1,000/oz level back in 2008 and 2009. The level was first tested in March of 2008 but Gold didn’t finally mount above that price until September/October of 2009, after the Fed had deployed stimulus cannons on to global markets. Something similar can happen in Gold at the $2,000/oz level but it seems that an accommodative Fed would be a necessary component for that scenario to take place, and with core inflation remaining above 4% we’re not quite there yet.

The next major spot of support for Gold is around the $1,850/oz level, after which a pocket of support shows from around the Fibonacci level at $1,794 up to the swing low at $1,807.

Gold Weekly Price Chart

Chart prepared by James Stanley, Gold on Tradingview

--- written by James Stanley, Senior Strategist