Monday US cash market close:

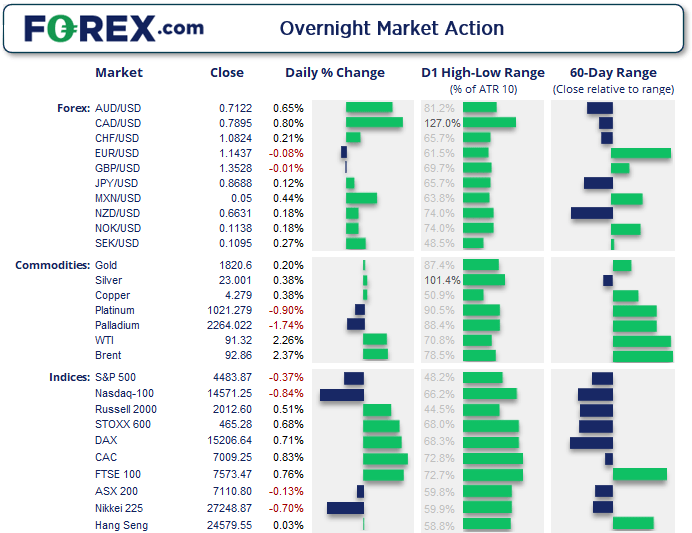

- The Dow Jones Industrial fell 1.39 points (0%) to close at 35,091.13

- The S&P 500 index fell -16.67 points (-0.38%) to close at 4,483.86

- The Nasdaq 100 index fell -123.103 points (-0.84%) to close at 14,571.25

Asian futures:

- Australia's ASX 200 futures are down -11 points (-0.16%), the cash market is currently estimated to open at 7,099.80

- Japan's Nikkei 225 futures are down -20 points (-0.07%), the cash market is currently estimated to open at 27,228.87

- Hong Kong's Hang Seng futures are up 115 points (0.47%), the cash market is currently estimated to open at 24,694.55

- China's A50 Index futures are up 21 points (0.14%), the cash market is currently estimated to open at 15,062.65

It was a mixed session for Wall Street that was on track to post minor gains until bears regained control in the later stages of the session. Yet volatility remained capped overall as the majority of markets tracked had daily ranges less than their average day. The S&P 500 formed a bearish inside day to close -0.4% lower, and the Nasdaq was down around -0.8%.

Euro rally loses steam following comments from Lagarde

The euro handed back some of Friday’s gains and was the weakest currency major yesterday, after ECB President Lagarde tried to walk back some of last week’s hawkish comments. Stating that inflation is unlikely to become entrenched and that inflation is likely to fall back to 2%, she does not yet see the need for big monetary policy tightening.

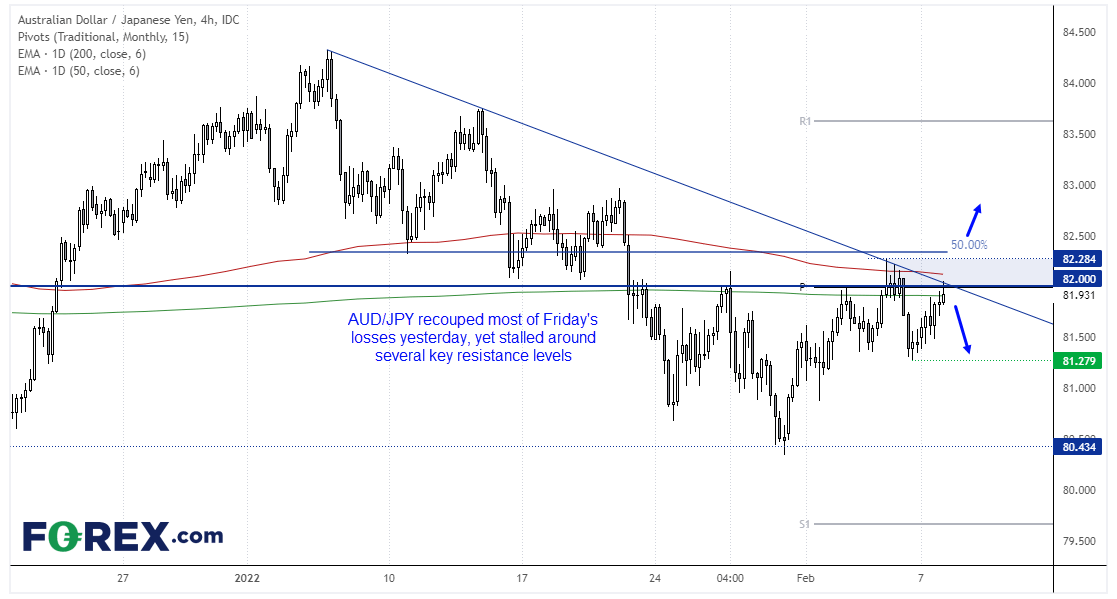

A strong rebound for Australia’s retail trade in January helped the Australian dollar rose across the board yesterday. As it failed to take out Friday’s low before recouping most of Friday’s losses, yesterday’s analysis needs updating.

Yesterday’s rally has stalled near several resistance levels including a bearish trendline, monthly pivot point and 200-day eMA. The 50-day eMA also sits just above yesterday’s high. Interestingly, if prices are to roll over from current levels it brings a potential head and shoulders top into focus on the four-hour chart. Due to the band of resistance levels nearby, we’d prefer to see a break or close above 82.30 at a minimum before considering long positions.

NAB business confidence at 11:30 AEDT

Australian business confidence nosedived in December due to the onset of the Omicron variant. And with a read of -12 it was more pessimistic than the print following the outbreak of Delta. Yet for that reason it’s possible we could see it recover, with some estimates landing around a flat zero from the prior month, with any number at one or above likely to provide more of tailwind for the Aussie.

Silver and gold outperformed metals

Silver hit our target around $23 overnight right on the 38.2% Fibonacci retracement level and 50-day eMA. The stochastic oscillator has also generated a buy signal so perhaps the path of lest resistance remains higher over the near-term. Gold rose to an 8-day high and trades just above $1820. The daily chart remains within a multi-month triangle, and momentum currently points higher within it after respecting the lower trendline last week.

WTI formed an inside day just below its 7-year high. This leaves the potential for a bull flag on the four-hour chart, although resistance is nearby at 93.30.

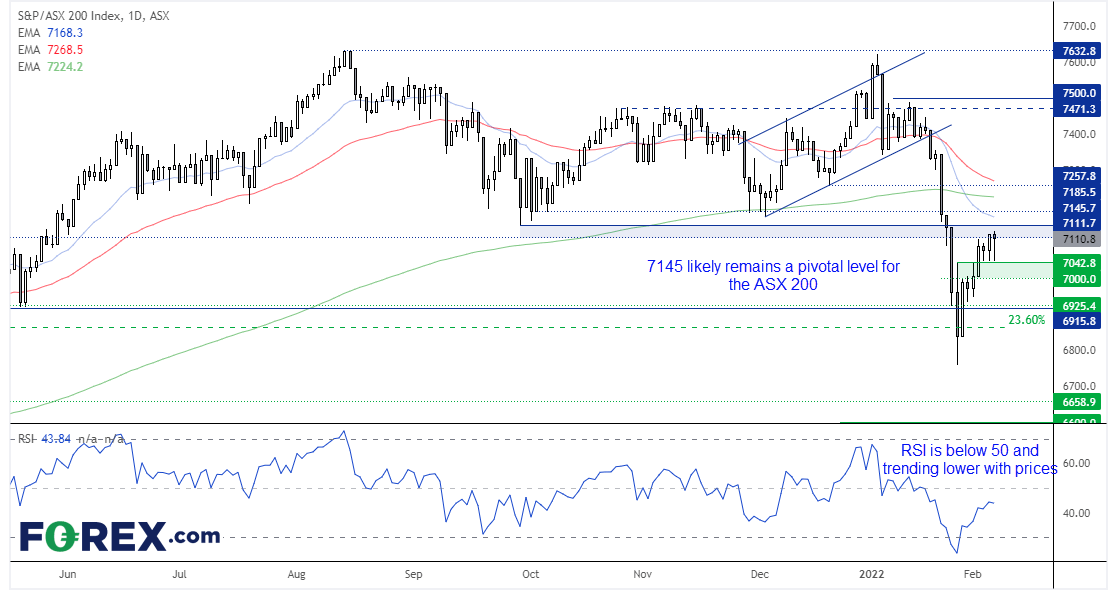

ASX 200 rally hesitates beneath the December low

It’s been seven trading days since the ASX 200 pierced the 6800 level, then reversed as part of a countertrend rally. It still remains unclear as to whether this really is a retracement, or the early stages of a full recovery for equities. But over the near-term we note that 7042.8 held as support over the past three session, yet prices remain hesitant to test, let along break above, the December low of 7145.7.A bearish hammer formed at the highs yesterday to warn of an interim top, which would be confirmed with a clear break below 7042. But if support holds then keep an eye out for a potential upside break of 7145, until which range trading strategies are preferred.

ASX 200 market internals:

ASX 200: 7110.8 (-0.13%), 07 February 2022

- Energy (1.59%) was the strongest sector and Healthcare (-1.28%) was the weakest

- 3 out of the 11 sectors closed higher

- 8 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 50 (25.00%) stocks advanced, 138 (69.00%) stocks declined

Outperformers:

- +7.8% - Flight Centre Travel Group Ltd (FLT.AX)

- +7.55% - Coronado Global Resources Inc (CRN.AX)

- +7% - Corporate Travel Management Ltd (CTD.AX)

Underperformers:

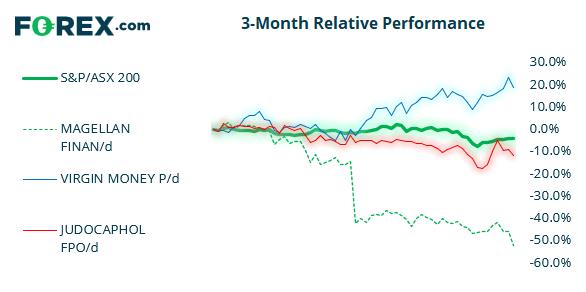

- -11.24% - Magellan Financial Group Ltd (MFG.AX)

- -3.66% - Virgin Money UK PLC (VUK.AX)

- -3.4% - Judo Capital Holdings Ltd (JDO.AX)

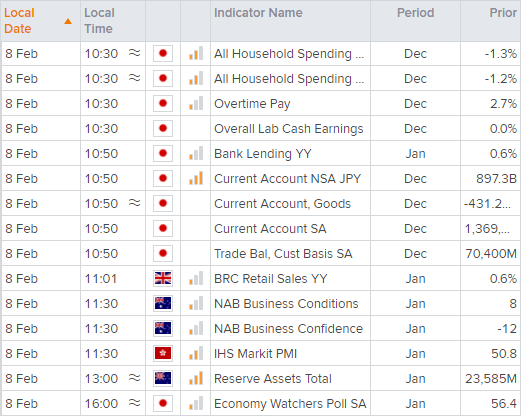

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.