US Dollar Talking Points:

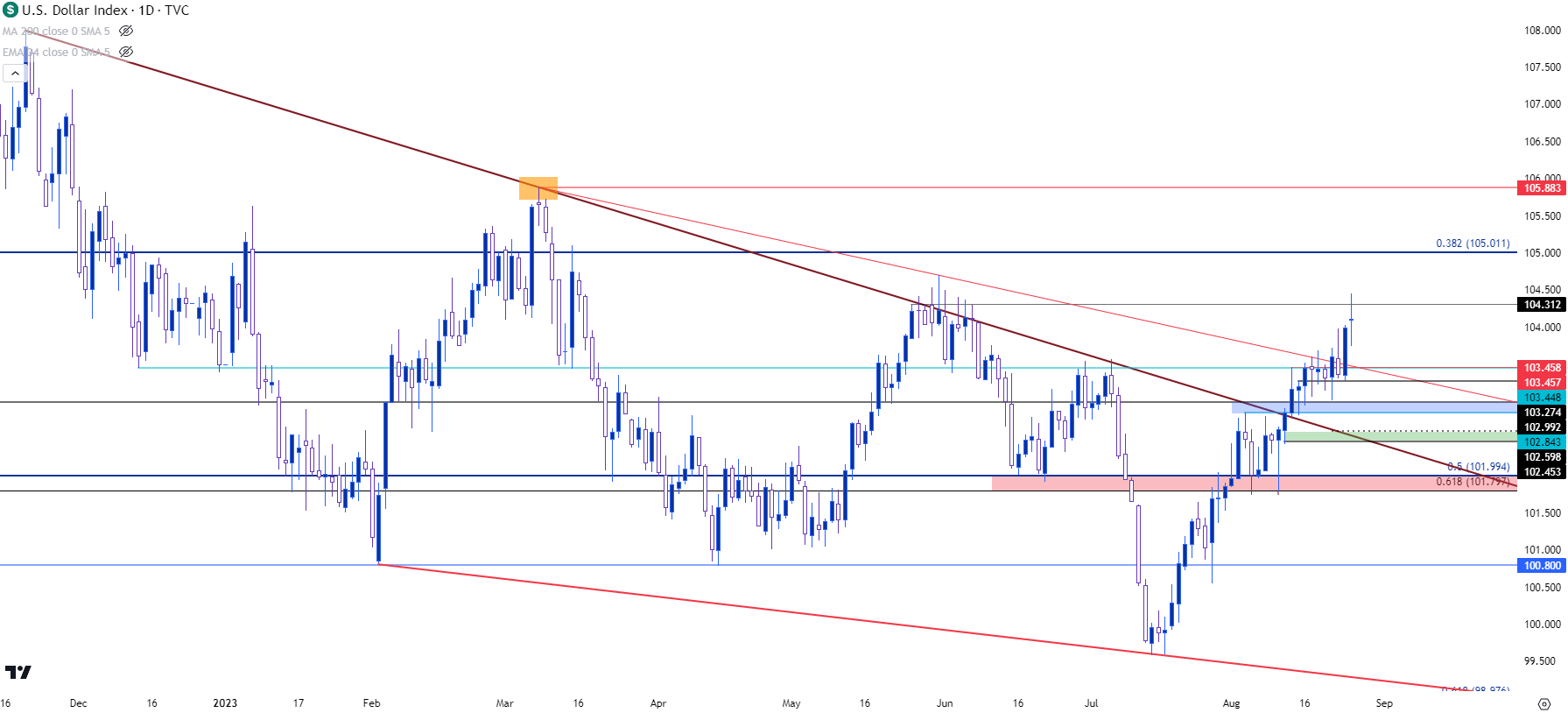

- It was another week of strength for the US Dollar as it looks to finish with its sixth consecutive weekly gain.

- The failed breakdown in July has led into this bullish run, which entailed a bullish breakout from a falling wedge pattern two weeks ago. Witnessed again this week, USD bulls vigorously defended support, even in light of drivers that may not have been all that bullish like the PMI report on Wednesday.

- I’ll be discussing these themes in-depth in the weekly webinar on Tuesday at 1PM ET. It’s free for all to register: Click here to register.

The US Dollar continued to show strength last week as DXY works on its sixth consecutive weekly gain. This would be the longest stretch of green candles on the weekly chart since May of last year. Perhaps ironically that prior run ended with a resistance test at 105, which led to a pullback before the bullish trend heated up a few weeks later, eventually spiking into September trade.

For this move, the 105 level sits overhead and this week saw USD bulls continue with the vigorous defense of support, even in light of what were otherwise bearish factors. The US Dollar daily chart closed with a bearish pin bar on Wednesday in the lead up to Jackson Hole. That pullback was helped along by some soft PMI reports out of the US and, reasonably, this opened the door for pullback in the bullish trend ahead of the Economic Symposium.

But Thursday saw a massive bullish response as buyers came back to rebuke that bearish formation with a bullish outside bar. The run continued through Friday morning with prices in DXY eventually cresting up to the next spot of resistance at 104.31.

The next resistance sitting overhead – is the same 105 level that caused pullback in May of last year. At this point it’s also a Fibonacci level so there’s a bit of confluence there, as this the 38.2% retracement of the 2021-2022 major move.

That 105 level will loom large into next week as there’s considerable resistance potential there, and for support there’s a few different spots of interest given the past week’s dynamics. The level at 103.27 came in as the higher-low on Wednesday and Thursday so that’s the spot that would need to remain defended to keep short-term bullish strategies in order.

All is not necessarily lost for bulls if that level gets taken out, although there should be question marks if bulls’ excitement wanes enough to allow for a lower-low. But at that point there’s additional support structure from the 102.85-103.00 zone. And if bulls can hold a higher-low above the prior point of resistance at 103.45, that could be construed as a bullish indication as given by another fresh higher-low.

US Dollar - DXY Daily Price Chart (indicative only, not available on Forex.com platforms)

Chart prepared by James Stanley; data derived from Tradingview

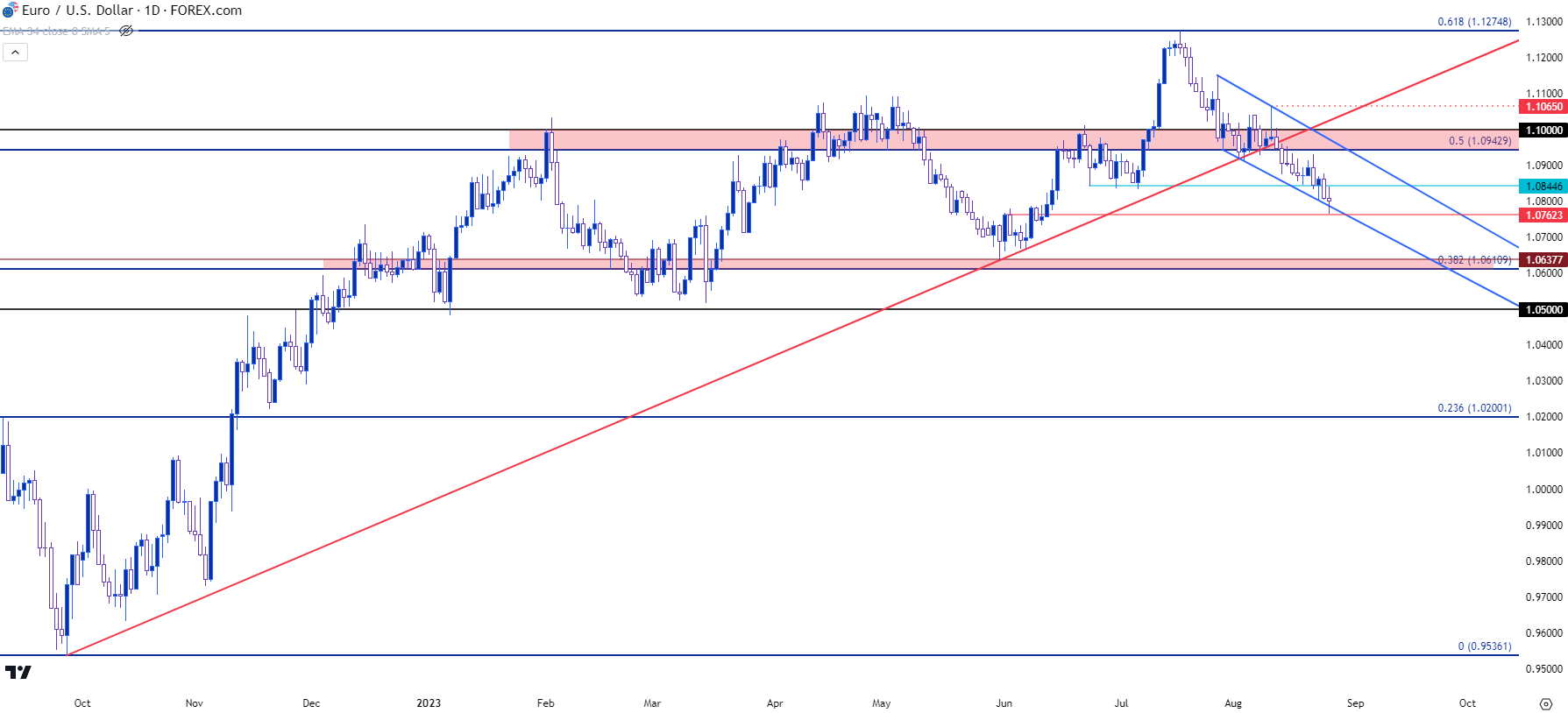

EUR/USD

The Euro is becoming a bit more worrisome as the currency hasn’t been able to hold a bid for most of the past month. And it’s been a stark change of pace since mid-July when the pair found resistance at the Fibonacci level at 1.1275. It’s largely been a one-way move since then and little has stopped the flow of sellers, save for a support bounce at 1.0943 along with a bit of stall at support of 1.0845 earlier this week.

While questions remain around US policy and lag effects of the rate hikes from last year, the picture has been a bit clearer in Europe where there’s been stacking signs of a slowing economy, even if inflation is remaining stubbornly high. Last week saw EUR/USD push below a bullish trendline that connected lows from last September and this May. But given the context, where EUR/USD was consolidating for the first half of this year, there could still be some support defense left to be seen.

For the weekly low, price action found support at prior resistance. And just a little lower is a massive zone that runs from the Fibonacci level at 1.0611 up to the swing-low at 1.0638. That latter price is especially key as this was the swing-low from March of 2020 and it came in to catch the low in late-May, just before EUR/USD bulls went to work.

If bears can elicit a breach of that zone, we’re looking at fresh five-month lows and that can open the scope for a deeper drop, with the 1.0500 area as the next active area of support potential.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

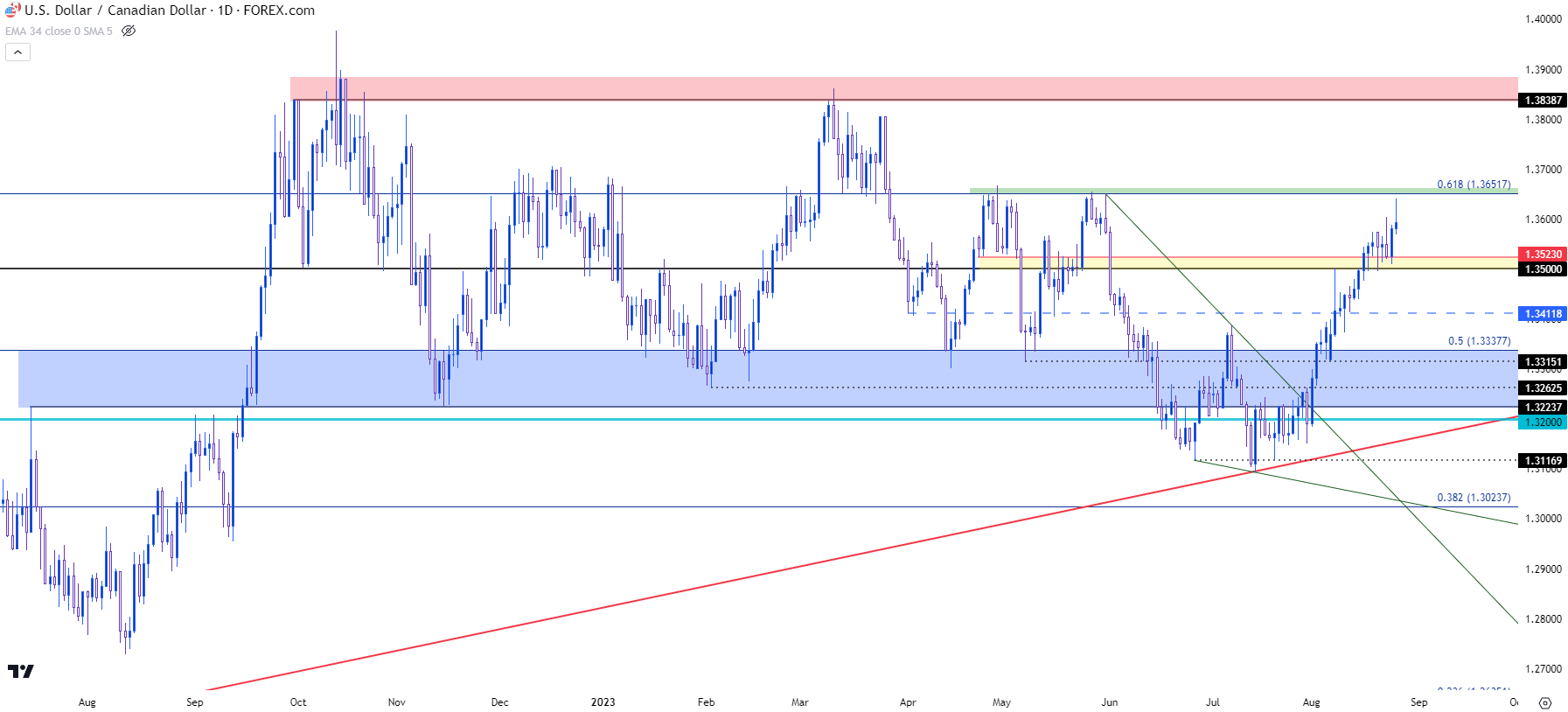

USD/CAD

USD/CAD has remained one of the strongest major pairs during this recent period of USD strength. And this week saw another deductively bullish item, as the pair had an open door for a pullback after the Wednesday sell-off in the USD, but USD/CAD grasped at support and drove up to another fresh high.

This week brought a fresh two month high into the mix with another support hold above the 1.3500 psychological level. That price helped to set support on Monday and then a higher-low developed on Thursday, which highlights anticipation from bulls which played through the following day with a strong run above the 1.3600 level that could not hold, with prices pulling back in the latter portion of the session.

This could keep the pair as one of the more attractive venues for scenarios of continued USD-strength. Continued defense of the 1.3500 support zone would be key for this to continue, although there could be scope for support at the 1.3412 spot if prices do pose a deeper pullback. Given how quickly the bullish trend has priced-in there could reasonably be some concerns of the move getting overcrowded so even if the pullback does extend – bulls showing a response to support could keep the trend pushing.

USD/CAD Daily Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

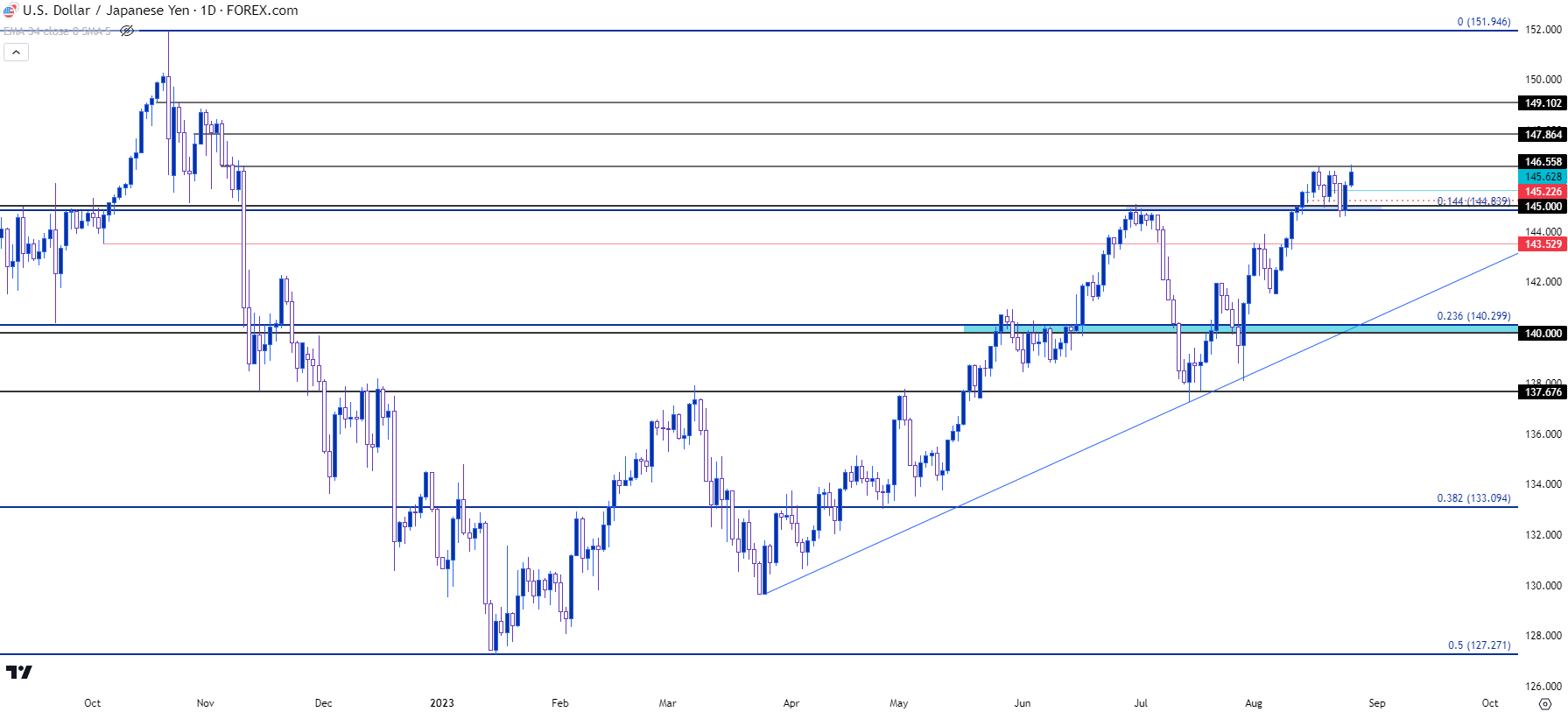

USD/JPY

The complication in USD/JPY is now the threat of intervention, and this was a story that we saw less than a year ago. Last September, USD/JPY stalled its bullish run for about a month as price held at the 145 psychological level, eventually bursting through in October before rushing up to the 150 level. And it was around the 150 level where things began to change as the order from the Ministry of Finance to intervene helped to produce a top in the pair.

And then the next three months saw 50% of the trend erased that took 21 months to build in what was a violent sell-off. Support finally showed in January of this year and the pair has been clawing its way back ever since.

On the bullish side of the pair, rollover or carry remains strongly tilted to the long side, so this provides incentive for bulls to continue to defend the bid, particularly if there’s seemingly less threat of intervention out of Japan.

This helps to explain why bulls have been trepidatious around highs yet fairly vigorous around support, and this can continue to act as a hindrance to bullish trends while support could remain attractive given the fundamental context around the pair.

For support, the spot around 145 remains key, and below that 143.53 is the spot that bulls would need to hold to retain bullish potential. Otherwise, it’ll begin to look like that overcrowded trade may have capitulated. On the resistance side of the coin, 150 is the big level and that’s quite obvious, but along the way there’s 147.86 and 149.10 that remain relevant.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

USD/CHF

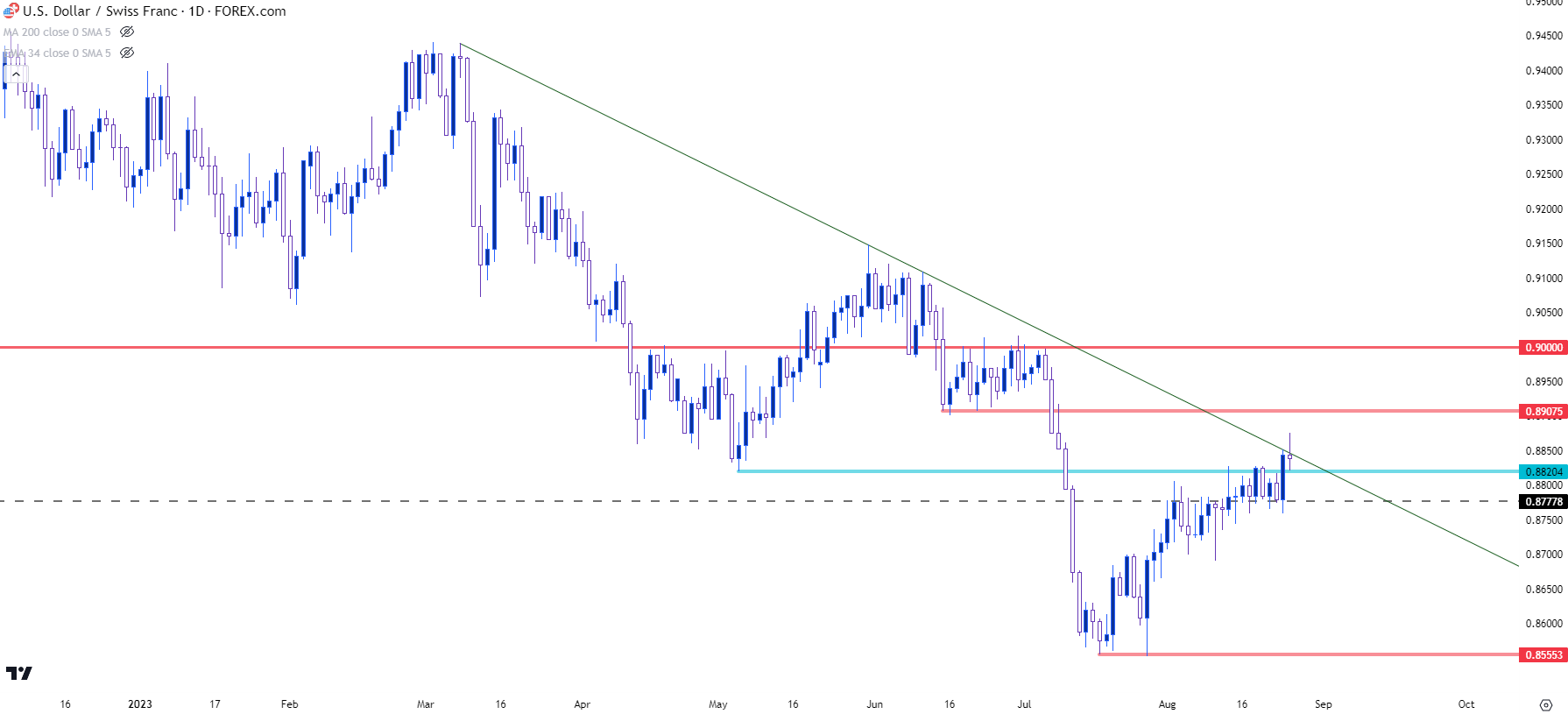

USD/CHF is a pair I don’t frequently follow but as I shared on the webinar two weeks ago, there was an interesting backdrop that had begun to build given this recent spate of USD-strength. That theme has continued to develop, and this week saw another higher-high and this keeps the door open to continued breakout.

The price of .8820 was resistance until the Thursday breakout, and then Friday produced a doji after a trendline test which indicates that bulls still aren’t overly excited upon tests of fresh highs. But, perhaps more important for the early stage of a bullish move buyers have continued to defend support as price tries to force its way into a fresh trend. The .8778 level was resistance in the first half of August and for the past week, it was support, showing that buyers have been defending the higher-low.

That allowed for a bullish outside bar on Thursday to push the break beyond .8820, and on Friday the doji held lows at that prior spot of resistance. This keeps the door open for bulls with focus on follow-through resistance at the .8908 level followed by the .9000 big figure.

Notably, while the bullish theme has continued to develop here it does seem a bit more reticent than the USD strength shown elsewhere, such as the USD/JPY or USD/CAD setups above. So, if we do end up with a USD reversal there may be a more attractive case on the bearish side of USD/CHF. But a few factors would need to play out first for that scenario to be at the forefront.

USD/CHF Daily Price Chart

Chart prepared by James Stanley, USD/CHF on Tradingview

--- written by James Stanley, Senior Strategist