Ahead of the Reserve Bank of Australia’s interest rate decision and monetary policy statement due to be released on Tuesday in Sydney, the Australian dollar continues to be weighed down against a still-rallying and recovering US dollar. Expectations for any interest rate changes by the RBA from the current record low of 1.50% remain very slim, as RBA Governor Philip Lowe stated in August that: "the next rate move will be up, rather than down, but it will not be for some time."

While it is uncertain how long “some time” will be, it is highly unlikely to happen on Tuesday. The last RBA statement in September highlighted improving conditions in the Australian and global economies, including strong employment growth, but also warned of weak wage growth and lagging inflation. This rather common concern among central banks these days regarding low inflation is likely to help preclude any rate hike from the RBA for the time being.

As for the US dollar, this Friday’s US employment data could have a substantial impact. The jobs data comes just as the US dollar has extended its recent recovery from long-term lows. Partially driving this recovery have been rising expectations for higher interest rates from the Federal Reserve in December and beyond. Any better-than-expected non-farm payrolls data on Friday could help reinforce these expectations. As it currently stands, due to the heavy economic impact on several southern states in the US from a series of recent hurricanes, expectations for job growth in September are sharply lower than they would otherwise have been. Therefore, the current consensus forecast for September stands at a relatively paltry 88,000 jobs added. Because these expectations are so low, an upside surprise could be likelier than would normally be the case. Also of major importance on Friday will be US wage growth, which should likewise play a significant role in the Fed’s policy stance.

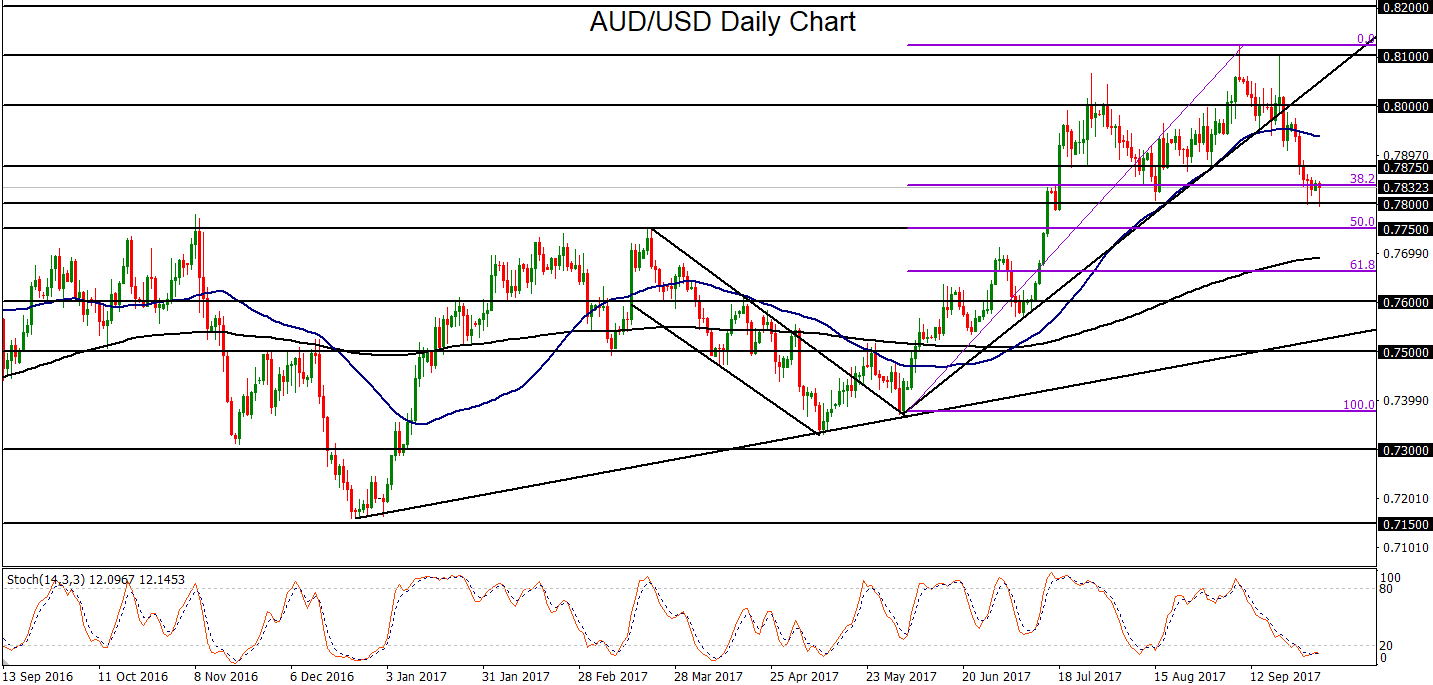

Ahead of the RBA decision and US jobs report, AUD/USD has been in a sharp downside correction since pulling back from its early-September multi-year highs just above the key 0.8100 resistance level. Given the differing market expectations currently for US interest rates (hawkish) and Australian interest rates (neutral for now), AUD/USD could be poised for further losses after its recent breakdowns. With any bearish follow-through below the important 0.7800 support level, the next key downside targets in the short-term are around the major 0.7750 and 0.7600 support areas.