Despite the fact that the Reserve Bank of Australia (RBA) lowered its cash rate by 25 basis points last week to a new record low of 1.50%, as was widely expected, the Australian dollar has continued to show persistent strength within a sharp uptrend that has been in place since late May.

After lowering interest rates last week, the RBA cited in a formal policy statement its concerns over the strength of its currency, low inflation, and uncertainty in China’s economy. Last week’s rate cut followed May’s 25-basis-point cut to 1.75%, the first such slashing of interest rates in a year. While a central bank rate cut, expected or not, typically results in a weakening of the relevant currency, quite the opposite happened. The Australian dollar climbed significantly on the day of the RBA’s action, and has continued to rise steadily since then. This was due in part to the market’s perception and speculation that the central bank may be done with its monetary policy easing for the time being.

The reality could be far different, however, if the Australian dollar continues to rise significantly. This would place increased pressure on the RBA to cut rates further in attempts to ward off excessive currency strength due to yield-seeking in a global low-yield environment.

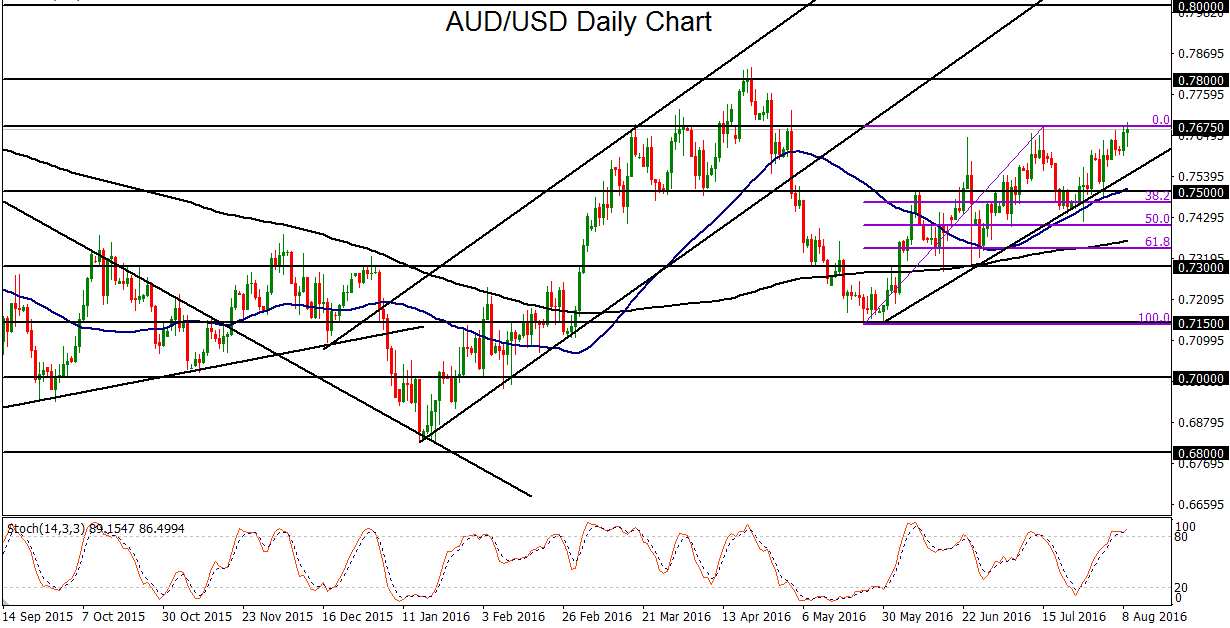

Despite this potential risk of further RBA easing, it should be unlikely in the near-term unless AUD/USD were to rise to the 0.8000 psychological level or above. For now, the currency pair has just reached a critical juncture, having established a new three-month high on Tuesday just slightly above July’s 0.7675 resistance high. As noted, AUD/USD has been trading in a clear uptrend since the 0.7150-area lows in late May. This uptrend has also been supported recently by both the 200-day and 50-day moving averages. With any clear and decisive breakout above 0.7675 resistance, which would continue the entrenched bullish trend, the next major target is around the 0.7800 resistance area, in the vicinity of April’s highs.

After lowering interest rates last week, the RBA cited in a formal policy statement its concerns over the strength of its currency, low inflation, and uncertainty in China’s economy. Last week’s rate cut followed May’s 25-basis-point cut to 1.75%, the first such slashing of interest rates in a year. While a central bank rate cut, expected or not, typically results in a weakening of the relevant currency, quite the opposite happened. The Australian dollar climbed significantly on the day of the RBA’s action, and has continued to rise steadily since then. This was due in part to the market’s perception and speculation that the central bank may be done with its monetary policy easing for the time being.

The reality could be far different, however, if the Australian dollar continues to rise significantly. This would place increased pressure on the RBA to cut rates further in attempts to ward off excessive currency strength due to yield-seeking in a global low-yield environment.

Despite this potential risk of further RBA easing, it should be unlikely in the near-term unless AUD/USD were to rise to the 0.8000 psychological level or above. For now, the currency pair has just reached a critical juncture, having established a new three-month high on Tuesday just slightly above July’s 0.7675 resistance high. As noted, AUD/USD has been trading in a clear uptrend since the 0.7150-area lows in late May. This uptrend has also been supported recently by both the 200-day and 50-day moving averages. With any clear and decisive breakout above 0.7675 resistance, which would continue the entrenched bullish trend, the next major target is around the 0.7800 resistance area, in the vicinity of April’s highs.

Latest market news

Today 02:05 PM