Gold Talking Points:

- Gold has shown another astounding topside trend to push towards the $2600 psychological level.

- Markets are currently showing a stronger probability for a 50 bp cut today and that getting priced-in has likely played a role in Gold’s advance. But if the bank goes for 25 instead and chooses to use the dot plot matrix to buffer that, there could be a case for mean reversion in those prior themes which could allow for a deeper pullback for Gold prices.

- I’ll be looking into these setups in the Tuesday webinar and you’re welcome to join, click here for registration information.

It’s been an astoundingly strong year for gold prices so far in 2024. And undeniably one of the major driving factors has been the shift amongst global central banks into a move-dovish posture. As a case in point, Gold was battling at the 2500 level for a few weeks until last week’s rate cut from the ECB, which helped to produce yet another bullish breakout in the metal as prices made a forward-advance towards the $2600 level. But so far this week bulls have shied away from a test of that big figure and, at this point, the move is starting to look a bit frothy on the long side.

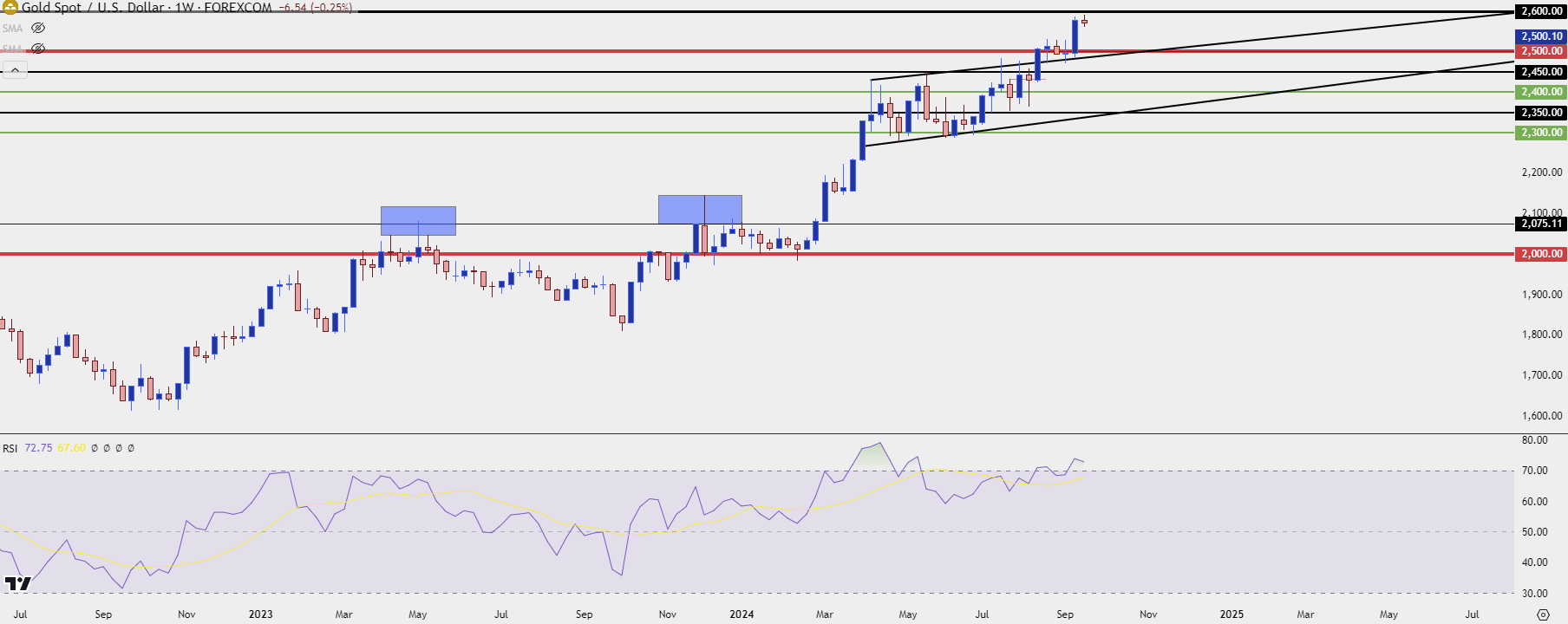

On the image below, we can see where RSI on the weekly chart of Gold has pushed back into overbought territory. This isn’t necessarily a death knell for gold prices as the prior instance of the same saw price continue to accelerate for a few weeks after. But this does highlight the fact that the move is already a bit long-in-the-tooth and chasing at current levels could be a challenge.

Gold Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

Gold Pullbacks in 2024

Perhaps most impressive around gold so far this year has been the pullback episodes. Given the degree of breakout that was seen in the March-April episode, there would normally be considerable motive for profit taking from longs. But that didn’t hit very hard and if anything, that pullback looked rather shallow as buyers simply built-in defense of the $2300 level. That led to another breakout in August and, similarly, pullbacks remained rather light. Price did test prior range resistance as fresh support over a couple of different instances but that then led into the September ramp that set a fresh high on Monday.

At this point it seems difficult to chase the move-higher. This is also something I wouldn’t want to get very bearish around at this point as all that we’ve seen is a herculean effort by bulls. But – this does highlight pullback potential into FOMC, particularly if we get the 25 bp cut scenario.

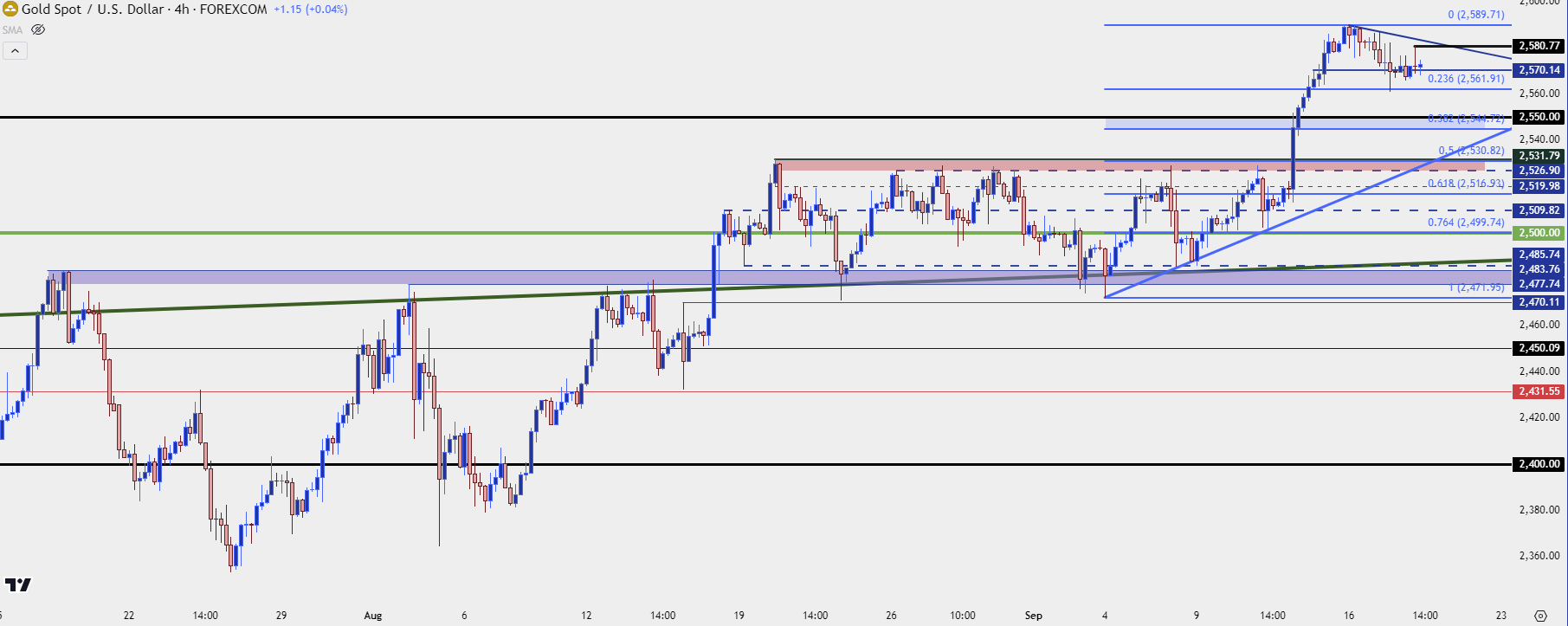

In yesterday’s webinar I shared a few levels of interest for such. The Fibonacci retracement produced by the September move has a 23.6% retracement at 2561 and, so far, that’s held the low from the pullback.

The 50% retracement of that same move is confluent with 2531, which was prior range resistance, and that remains of particular interest.

But there’s also the $2544 level which I’m considering as confluent with the $2550 minor psychological level. If bulls show up there and hold the low today, that would be an indication that they were unwilling to wait for support at prior resistance, and that could be read as another bullish item for gold price action.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist