Euro Outlook: EUR/USD

EUR/USD extends the advance from the monthly low (1.0761) to snap the recent series of lower highs and lows, with the recovery in the exchange rate pulling the Relative Strength Index (RSI) out of oversold territory.

Euro Forecast: EUR/USD Recovery Pulls RSI Out of Oversold Zone

EUR/USD may stage a larger rebound over the remainder of the month as the RSI climbs above 30 to indicate a textbook buy signal, and it remains to be seen if the exchange rate will retrace the decline following the European Central Bank (ECB) rate cut as the Governing Council shows a greater willingness to further unwind its restrictive policy.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Fresh remarks from ECB board member Philip Lane suggest the central bank will continue to switch gears as ‘the analysis of underlying inflation suggests that 2024 is a transition year,’ with the official going onto say that ‘the analysis of underlying inflation also indicates that the disinflation process is well on track’ while speaking at an event held by Federal Reserve Bank of Cleveland and the ECB.

In turn, Lane states that ‘inflation is set to return to target in the course of 2025,’ and the ECB may continue to pursue a neutral policy over the coming months as the central bank achieves its one and only mandate for price stability.

With that said, EUR/USD may face headwinds as the ECB appears to be on track to unwind its restrictive policy faster than its US counterpart, but the exchange rate stage a larger recovery over the coming days as it clears the bearish price series from earlier this week.

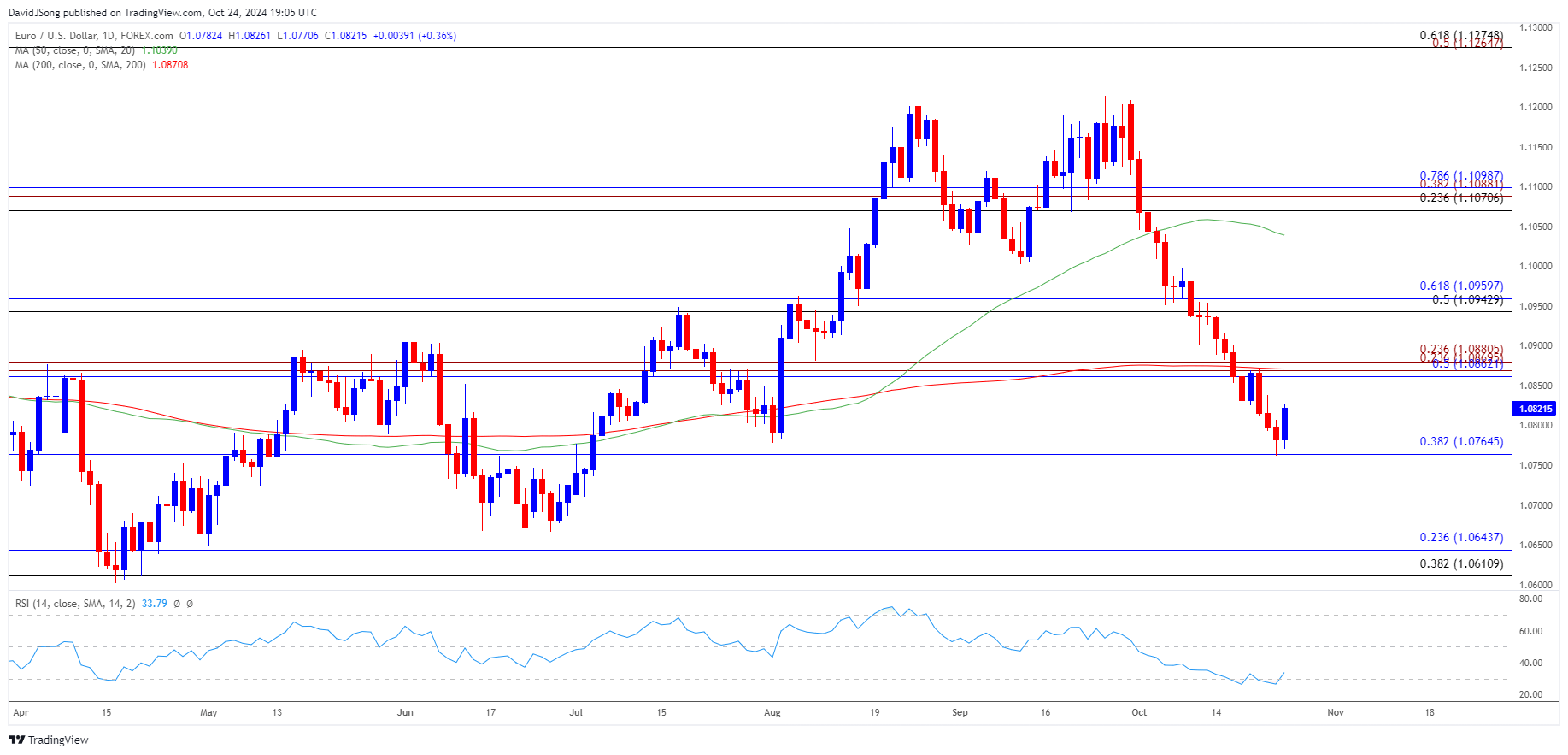

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD halts a three-day selloff following the failed attempt to close below 1.0770 (38.2% Fibonacci retracement) with a break/close above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region bringing the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) zone back on the radar.

- Next area of interest comes in around 1.1070 (23.6% Fibonacci retracement) to 1.1100 (78.6% Fibonacci retracement) but EUR/USD may hold within the weekly range if it struggles to break/close above the 1.0860 (50% Fibonacci retracement) and 1.0880 (23.6% Fibonacci extension) region.

- Need a close below 1.0770 (38.2% Fibonacci retracement) to open up the June low (1.0666), with the next region of interest coming in around the May low (1.0650).

Additional Market Outlooks

USD/CAD Defends Post-BoC Reaction to Eye August High

GBP/USD Vulnerable as Bearish Price Series Persists

US Dollar Forecast: USD/JPY Rally Triggers Overbought RSI Signal

US Dollar Forecast: AUD/USD Falls Toward September Low

--- Written by David Song, Senior Strategist

Follow on Twitter at @DavidJSong