Monday US cash market close:

- The Dow Jones Industrial fell -171.89 points (-0.49%) to close at 34,566.17

- The S&P 500 index fell -16.97 points (-0.39%) to close at 4,401.67

- The Nasdaq 100 index rose 14.756 points (0.1%) to close at 14,268.60

Asian futures:

- Australia's ASX 200 futures are down -64 points (-0.9%), the cash market is currently estimated to open at 7,179.90

- Japan's Nikkei 225 futures are down -40 points (-0.15%), the cash market is currently estimated to open at 27,039.59

- Hong Kong's Hang Seng futures are down -99 points (-0.41%), the cash market is currently estimated to open at 24,457.57

- China's A50 Index futures are up 9 points (0.06%), the cash market is currently estimated to open at 14,961.22

It was another volatile day’s trade on Wall Street with the US closing its embassy in Kyiv and Ukraine President announcing a Russian invasion could be on Wednesday. Earlier reports claimed Russia would continue talks with NATO and the US. And the invasion claim has since been walked back by a senior official which helped US indices recoup earlier losses, with tech stocks even posting a minor gain. Small bullish hammers formed on the Dow Jones and S&P 500 daily charts and the Nasdaq 100 posted a minor gain of around 0.3% by the close.

Yet energy prices weren’t taking any chances on conflicting reports of a Russian invasion, as they simply rose on demand concerns. Crude oil is up around 1.8%, natural gas rose 5.6%, heating oil gained 1.2% and gasoline around 1%.

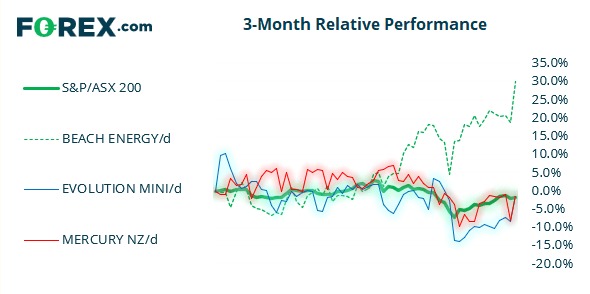

ASX 200 to get off lightly again today?

The ASX 200 defied the gravity of a Wall Street selloff yesterday, dare we say, may get off lightly again today. The utilities and financial sectors, which account for around 50% of the index, continue to perform well overall and were top performers last week, which is providing a decent level of support for the broader market. And with energy prices higher overnight then logic assumes the energy sector will continue to shine. It’s up 16% YTD, rose over 3% yesterday and looks set to be the top performer again today.

ASX 200: 7243.9 (0.37%), 11 February 2022

- Energy (3.36%) was the strongest sector and Healthcare (-1.37%) was the weakest

- 6 out of the 11 sectors closed higher

- 5 out of the 11 sectors closed lower

- 4 out of the 11 sectors outperformed the index

- 82 (41.00%) stocks advanced, 107 (53.50%) stocks declined

Outperformers:

- +9.43% - Beach Energy Ltd (BPT.AX)

- +7.9% - Evolution Mining Ltd (EVN.AX)

- +7.35% - Mercury NZ Ltd (MCY.AX)

Underperformers:

- -10.8% - Novonix Ltd (NVX.AX)

- -9.52% - Imugene Ltd (IMU.AX)

- -7.89% - Liontown Resources Ltd (LTR.AX)

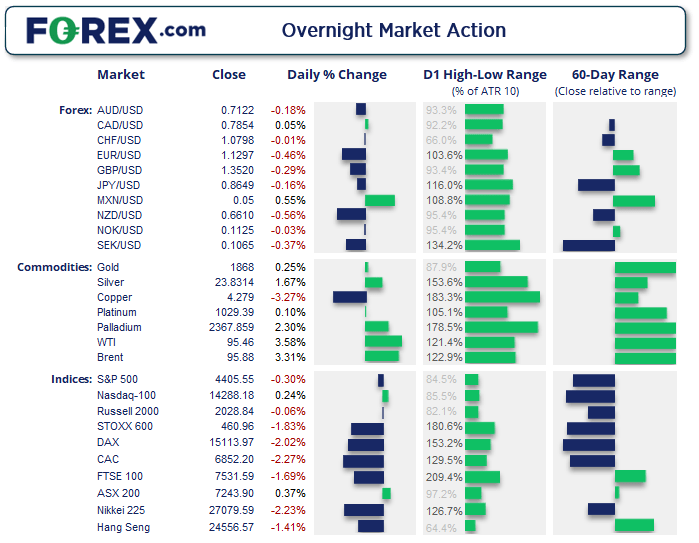

USD and yen took safe-haven bids

The US dollar was the strongest major throughout most of the session as it enjoyed its safe-haven bid yet, similar to US indices, saw a reversal later in the session to hand back earlier gains. Strong oil prices ultimately helped CAD take the top spot, the US dollar index rose to a 9-day high on the back of a weaker EUR.