Asian Indices:

- Australia's ASX 200 index fell by -97.6 points (-1.44%) and currently trades at 6,661.20

- Japan's Nikkei 225 index has fallen by -364.37 points (-1.34%) and currently trades at 26,726.49

- Hong Kong's Hang Seng index has fallen by -188.23 points (-1.13%) and currently trades at 16,399.46

- China's A50 Index has fallen by -107.52 points (-0.84%) and currently trades at 12,712.57

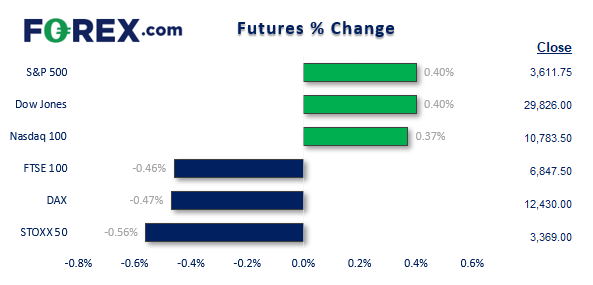

UK and Europe:

- UK's FTSE 100 futures are currently down -32 points (-0.47%), the cash market is currently estimated to open at 6,826.79

- Euro STOXX 50 futures are currently down -18 points (-0.53%), the cash market is currently estimated to open at 3,363.73

- Germany's DAX futures are currently down -55 points (-0.44%), the cash market is currently estimated to open at 12,382.81

US Futures:

- DJI futures are currently up 112 points (0.38%)

- S&P 500 futures are currently up 35.75 points (0.33%)

- Nasdaq 100 futures are currently up 13.25 points (0.37%)

All eyes are on the UK’s bond market today to see what they make of Jeremy Hunt’s weekend changes to Liz Truss’s economic programme. Bond prices continued to slide into Friday’s close (sending yields higher) as markets disapproved of Truss’s decision to raise taxes on company profits. Today we will find out if bond traders approve of Hunt’s weekend overhaul of the budget. Whatever happens, the British pound is likely to remain sensitive to political developments and the to what degree the BOE supports the markets.

China’s President Xi Jinping doubled down on his zero-Covid strategy when speaking at the CCP congress yesterday, which is likely to continue weighing on growth for the region. Asian equity markets were mostly lower overnight as they tracked Wall Street’s close form Friday and absorbed Xi’s comments.

With no major economic data released today Asia, currency markets mostly traded within tight ranges which they seemed hesitant to break out of. Gold and AUD/USD lifted themselves slightly from Friday’s lows but buyers lacked conviction, which makes it look more like technical repositioning over any fundamental move.

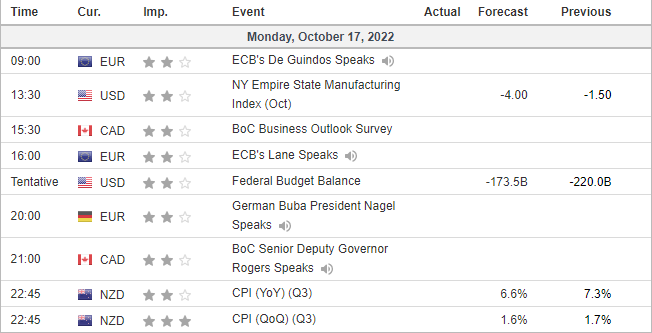

The BOC (Bank of Canada) release their quarterly business outlook survey, which looks at anticipated sales growth, inflation expectations, labour market conditions and more. As noted in a recent report, Canadian business increasingly expect higher inflation and for it to remain sticky.

Recent analysis: The BOC just dropped one of their preferred CPI measures

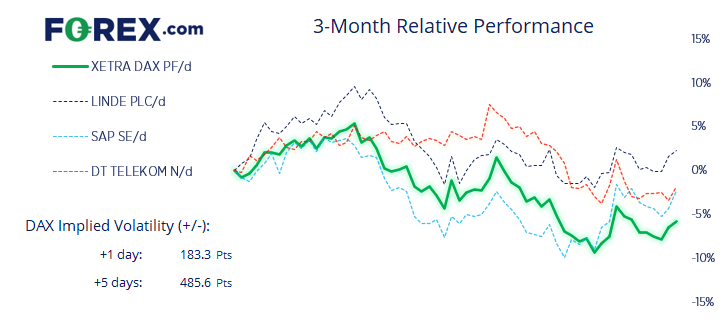

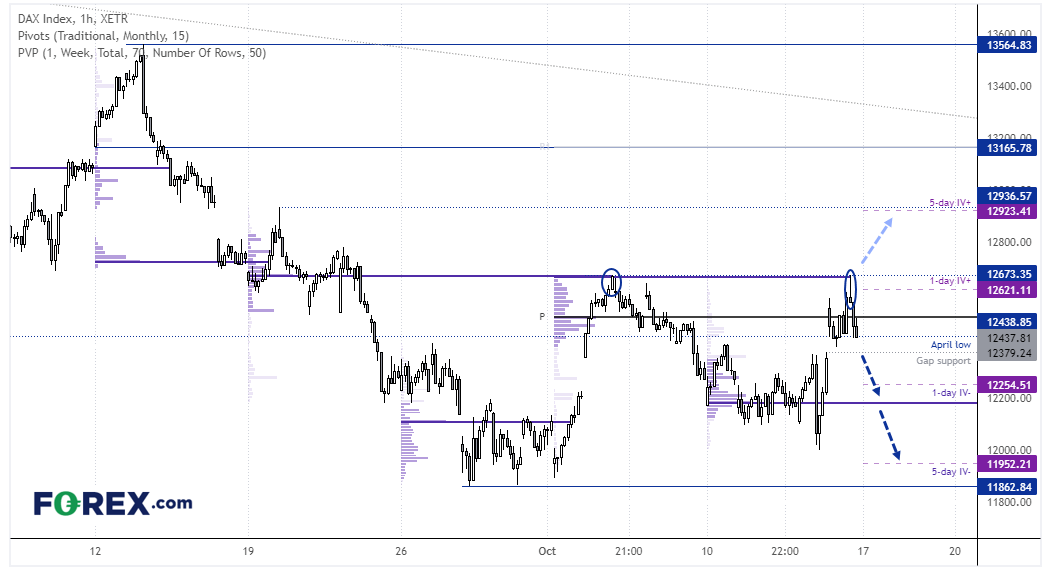

DAX performance:

On Friday we outlined a bias for the DAX to find resistance around the monthly pivot point before topping out, which worked out quite well after its initial gap higher. Friday closed with a bearish candle and nearly closed its opening gap.

We can see on the 4-hour chart that a double top has occurred below 12,700. Range-trading strategies are preferred whilst prices remain between 11,860 – 12,700, so today’s bias is to the downside whilst 12,700 resistance area caps. A move below gap support at 12,379 assumes bearish continuation. Friday’s VPOC (volume point of control) is at 12,186 which is just below its 1-day implied volatility target around 12,254. Also note that the 5-day IV downside target is just below 12,000 but above the range low.

FTSE 350 – Market Internals:

FTSE 350: 3776.27 (0.12%) 14 October 2022

- 229 (65.43%) stocks advanced and 112 (32.00%) declined

- 0 stocks rose to a new 52-week high, 4 fell to new lows

- 12.57% of stocks closed above their 200-day average

- 50.57% of stocks closed above their 50-day average

- 5.43% of stocks closed above their 20-day average

Outperformers:

- + 8.41% - Wizz Air Holdings PLC (WIZZ.L)

- + 6.73% - Pagegroup PLC (PAGE.L)

- + 6.61% - Workspace Group PLC (WKP.L)

Underperformers:

- -10.5% - International Distributions Services PLC (IDSI.L)

- -6.17% - Ferrexpo PLC (FXPO.L)

- -5.60% - WAG Payment Solutions PLC (WPS.L)

Economic events up next (Times in BST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.