- AUD/USD has held up well recently despite the tough environment

- Many headwinds for AUD are starting to wane

- China pessimism is a positive for AUD as it’s priced in

AUD/USD has been given every opportunity to continue spiraling lower recently and hasn’t, suggesting a degree of exhaustion among bears after another plentiful year. With energy security back in focus due to the escalation in hostilities between Hamas and Israel – threatening to bring major energy producers into the conflict – it suggests near-term directional risks for AUD/USD may be skewing to the upside given Australia’s energy riches. Throw in pessimism towards China’s economic outlook, providing the potential for even modest improvements in activity to deliver outsized moves in cyclical assets, and the recent lows below .6300 may prove tough to crack in the absence of a steep deterioration in the global economic outlook.

USD strength has been justified

The US dollar has justifiably been a standout performer among G10 FX recently, bolstered by continued hawkishness from the Fed, an economy that seemingly is immune to attempts to reign it in, especially relative to other major advanced economies, along with its traditional role as a safe haven in times of economic and geopolitical turmoil, benefitting from its reserve currency status. Another unappreciated tailwind this cycle compared to those of the past is growth in US energy production, neutralising the threat it formerly faced as a net-energy importer.

It's the latter that has led to the Australian dollar remaining pressured this year despite still historically high prices for the nation’s key commodity exports, helping to boost the role interest rate differentials and sentiment towards China play in determining the value of AUD/USD.

Rate differentials less of a headwind for AUD/USD

As things currently stand, both the Federal Reserve and Reserve Bank of Australia (RBA) are non-committal hawks after the largest and fastest tightening cycle in both jurisdictions in several decades, talking up the potential for further hikes without sounding overly convinced about the need to follow through. While traders deem another hike from both as a risk, even pricing more tightening from the RBA than Fed over the next six months, it’s a safe bet that we’re at or extremely close to the peak for short-end rate differentials this cycle. It’s been notable in recent days that several Fed officials have discussed the role higher long-end rates and tighter financial conditions are playing when it comes to the policy outlook, lessening the need for them to continue lifting rates at the front-end of the curve, especially when the US labour market and wages pressure is showing signs of softening.

Acute China pessimism is now AUD bullish

Another positive working for AUD/USD longs is how dire sentiment remains towards China, courtesy of its underwhelming rebound following covid disruptions of recent years. The property sector crackdown has removed a key growth driver for the industrial side of the economy, spilling over to well publicised problems in debt markets and growing concern about corporate governance standards. It’s no wonder Chinese assets are on the nose, especially those at the riskier end of the spectrum.

No one is pretending these problems will be addressed anytime soon, nor that China’s is likely to return to the rollicking growth rates seen in the past, especially with a declining population. But such is the pessimism towards the outlook, the lower the bar is becoming to impress. Citi’s economic surprise index for China has been turning neutral for a while now, underlining that weak activity is now perceived to be normal rather than abnormal. For cyclical plays such as the Australian dollar, it means Chinese economic data may only have to be less bad, let along actually improve, to generate positive market reactions in the months ahead.

PBOC intervention may be limiting AUD/USD downside

Related to the potential China boost, it’s notable the lengths the People’s Bank of China (PBOC) have gone to to combat US dollar strength this year, draining liquidity in money markets on occasion and setting the daily trading midpoint for USD/CNY far stronger than market forces would imply to prevent further weakening in the yuan.

As a liquid proxy for the Chinese yuan and other emerging market FX across Asia, these efforts, at the margin, are helping to underpin the AUD/USD, likely contributing to the relative stability in the pair at a time when other major G10 FX have succumbed to US dollar strength.

Trade ideas involving AUD/USD, EUR/AUD

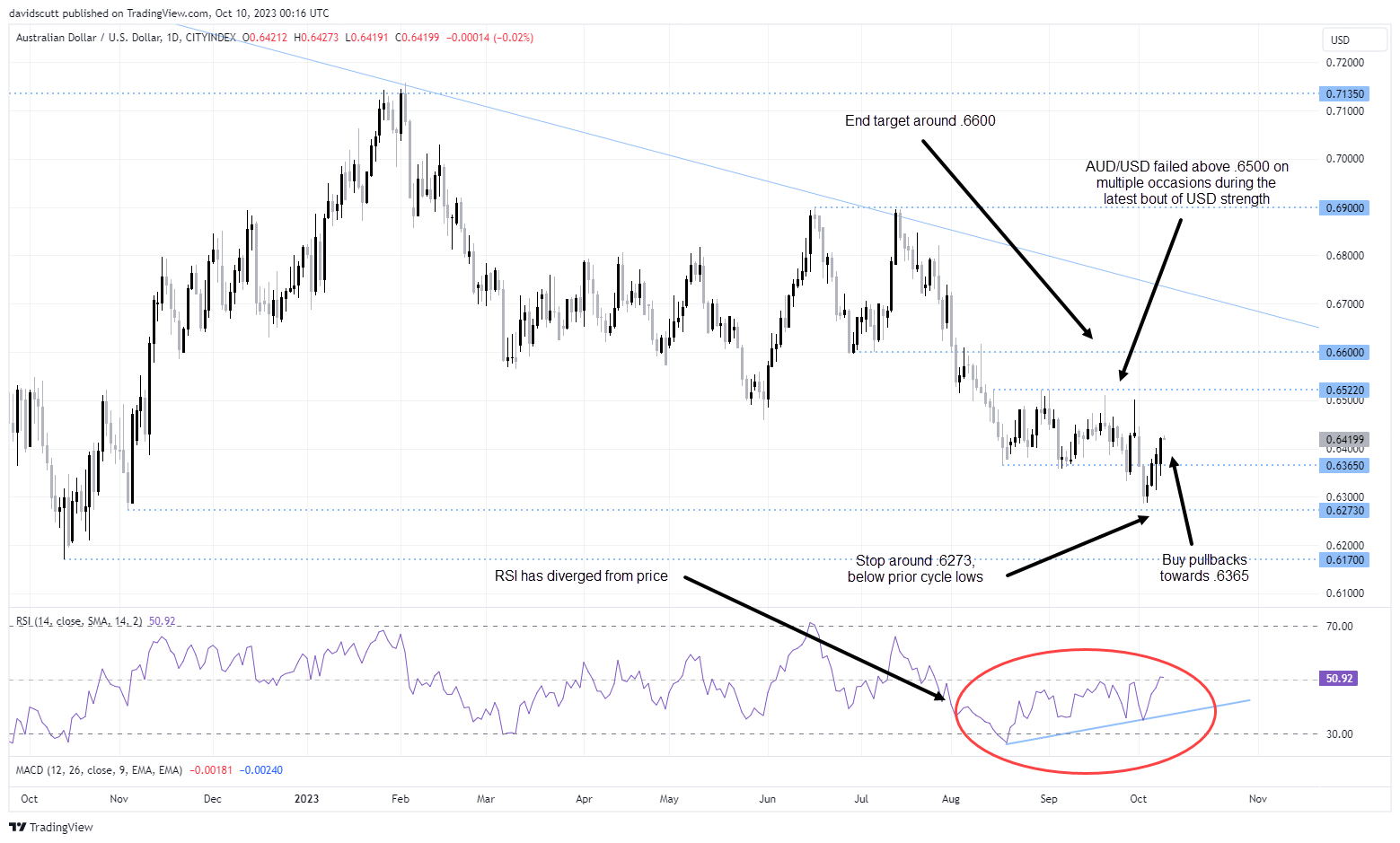

AUD/USD has firmed recently, helped by softening US data, less hawkish commentary from FOMC officials and higher energy prices. RSI has diverged, setting higher lows while the price continued to grind lower. Given the constructive price action, including the bullish hammer on payrolls day last Friday, one trade idea could be to wait for pullbacks towards .6365 targeting a move towards .6600. Resistance along the way likely to be located above .6460 and above .6500. A stop below .6275 would provide protection against reversal, providing a potential payoff of more than 2 to 1.

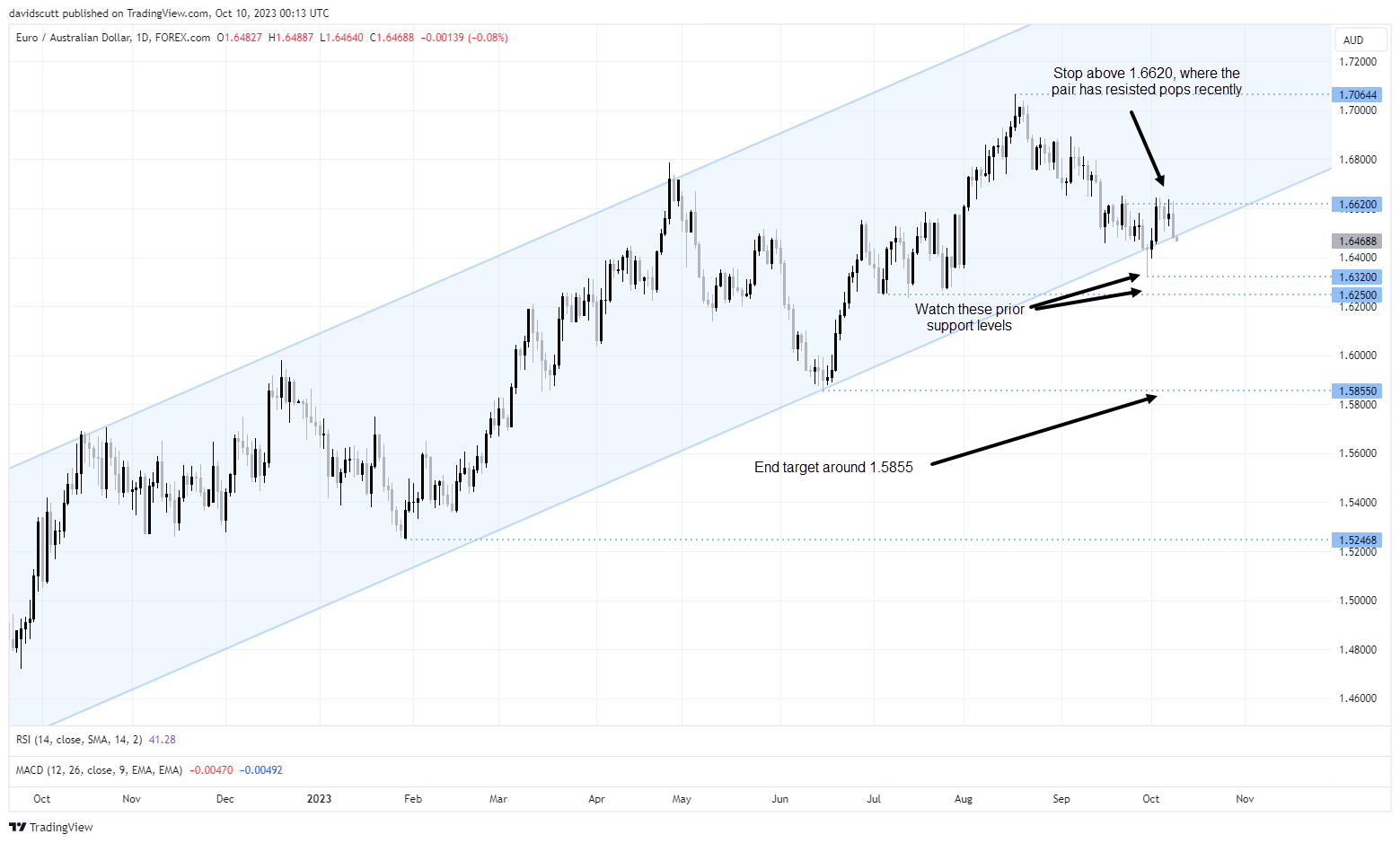

Given a key element of the trade is centered around a modest improvement in Chinese activity levels relative to expectations, there are also several potential long AUD trades against the crosses, including the Japanese yen, British pound and euro. The latter, EURAUD, looks particularly interesting, threatening to break out of the uptrend channel the pair has been in for well over a year.

A short around these levels targeting a move back to the June low of 1.5855 is one possible trade idea, especially when energy security is back in focus at a time when the eurozone economy is deteriorating noticeably with the full impact of prior rate hikes from the ECB yet to be felt. Support levels that would need to be breached along the way include 1.6320 and a more pronounced zone at 1.6250. A stop above 1.6620 offers decent protection against the threat of a reversal.

-- Written by David Scutt

Follow David on Twitter @scutty