- Japanese yen analysis: USD/JPY weighed down by falling bond yields

- CAD/JPY creates another possible bearish reversal pattern

- GBP/JPY hurt by UK data and falling yields

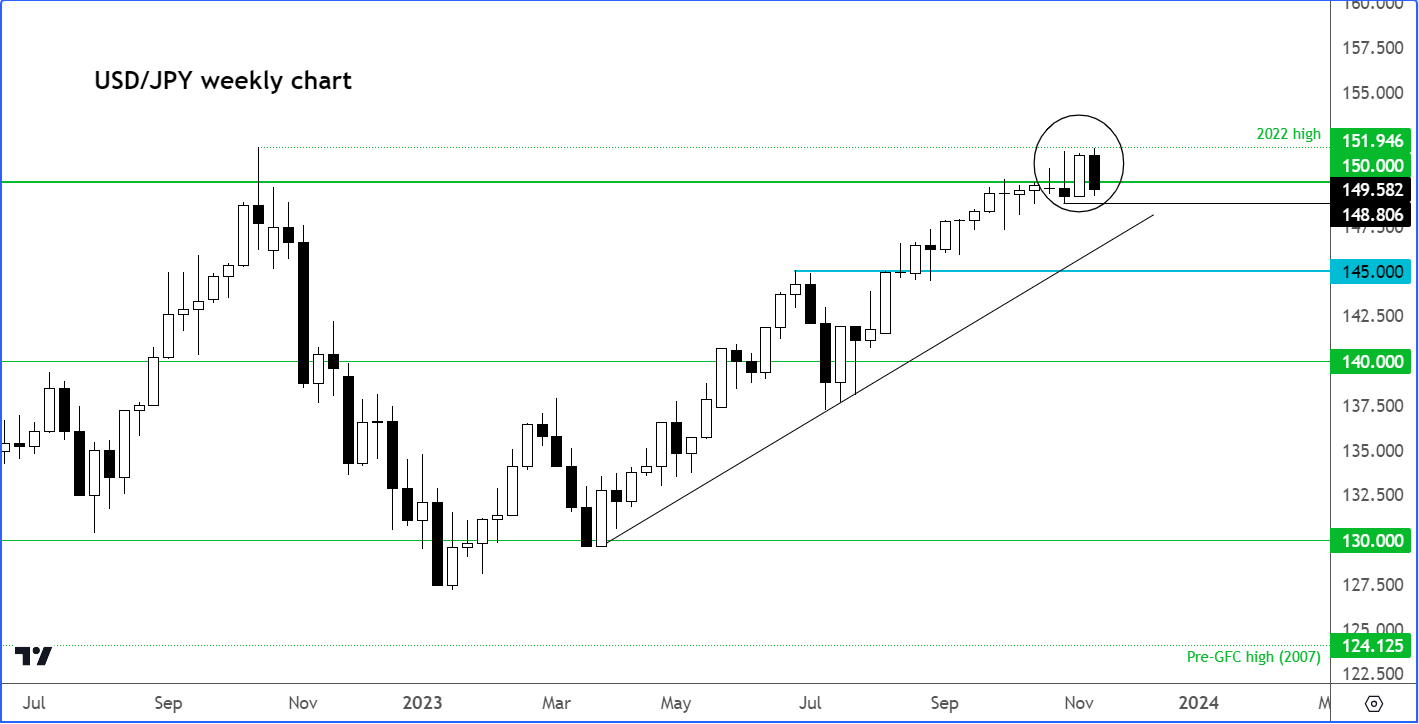

Japanese yen analysis: USD/JPY weighed down by falling bond yields

The Japanese yen has finally found some much needed support this week. It is all to do with the falls in global bond yields, and the unwinding of carry trades. US yields slumped earlier this week after US CPI fell more than expected, cementing expectations that the Fed (and other central banks) will no longer raise rates further. With a couple of other key US economic pointers also coming in weaker this week, such as industrial production and jobless claims data, as well as a sharp drop in oil prices, this has led to speculation that the Fed may start cutting rates sooner than expected in 2024. In addition, there’s anticipation of further intervention from the Japanese government, causing traders to ease their short bets against the yen.

The weekly chart of the USD/JPY shows price action has been quite wild in the past couple of weeks. An inverted hammer was formed two weeks ago. Last week it was completely invalidated by a bullish candle. But this week, price is displaying another large bearish candle with price back below the key 150.00 handle, after failing to take out last year’s high at 151.95. So, there is the possibility that the USD/JPY may have formed a double top against last year’s high, but we need to see some confirmation. Even if this turns out to be a correction in the bullish trend, we will still require some confirmation. Perhaps a break below recent low at 148.80 could be that.

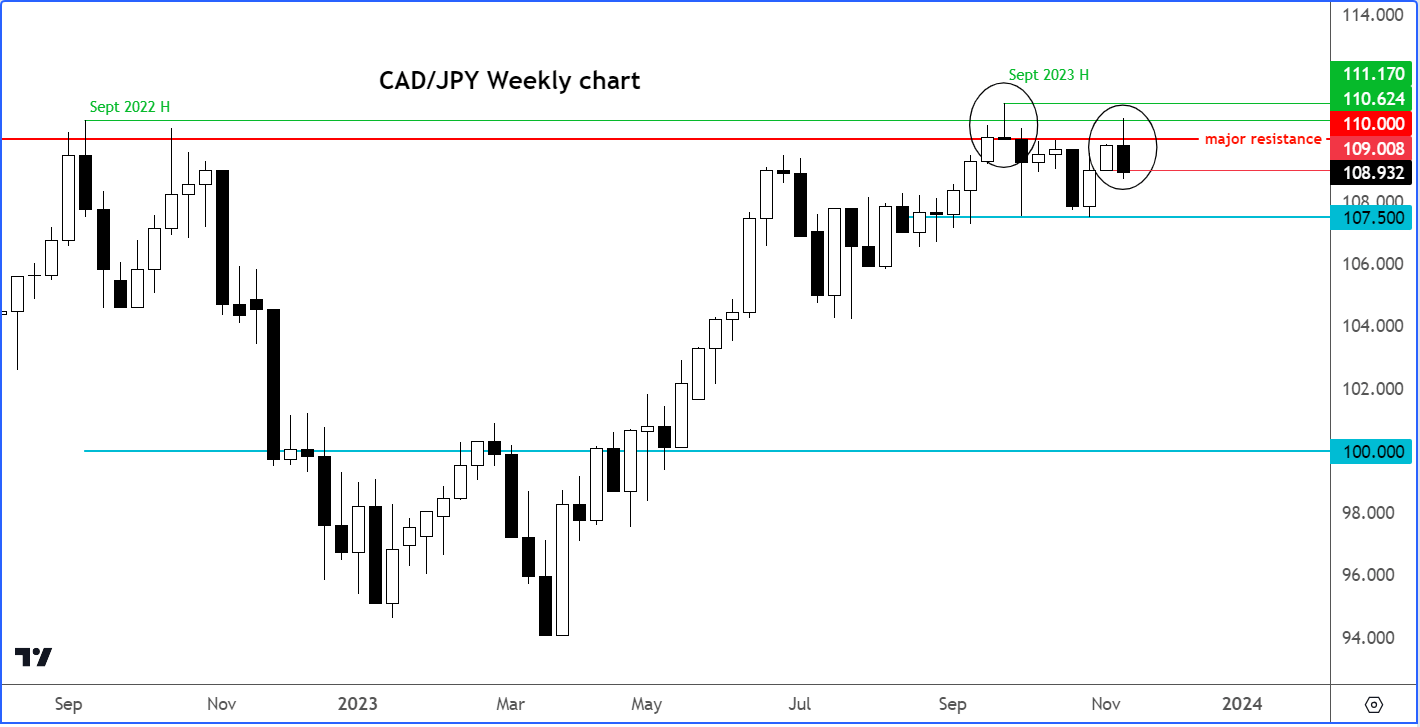

CAD/JPY creates another possible bearish reversal pattern

The CAD/JPY failed to hold the breakout above last year’s high of 110.62 in September, when it formed a bearish looking doji candle on the weekly chart. Since then, rates have fallen before bouncing twice to test last year’s high, with both attempts failing the bulls. Interestingly, we haven’t observed a single weekly close above the key psychologically-important level of 110.00. This week, the CAD/JPY has printed a bearish engulfing weekly candle that suggests more losses could be on the way, assuming it doesn’t rally later in the day to invalidate this pattern. Still, key support at 107.50 will need to break at some stage if we are to see more than just a small dip.

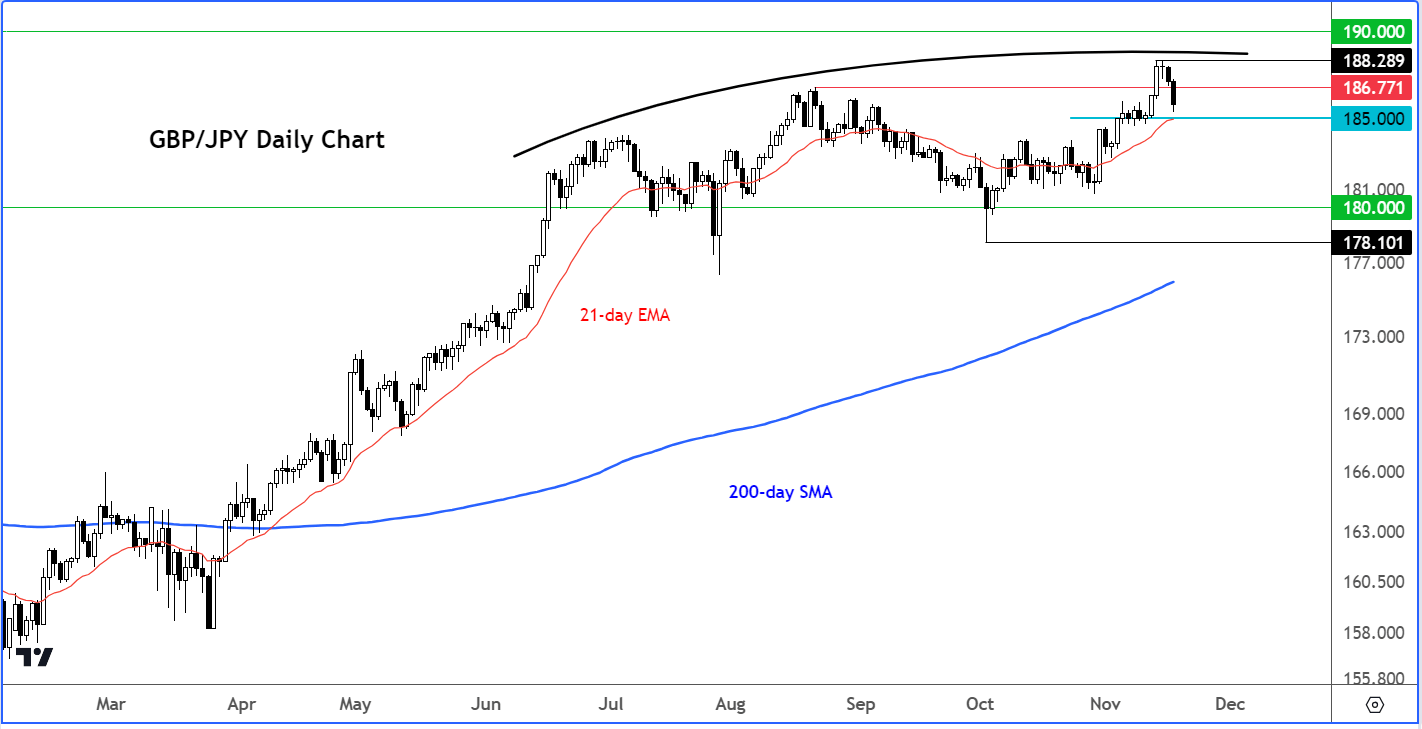

GBP/JPY hurt by UK data and falling yields

The GBP/JPY had been among one of the best pound crosses to trade on the long side, owing to the fact Japanese yen has been one of the weakest currencies out there. Until now. What has changed this week is that yields have fallen across the board, and this has boosted the appeal of zero and low yielding assets like the yen and gold. Given that we are continuing to see weakness in UK data, the GBP/JPY could be heading further lower along with global bond yields in the coming weeks.

Source for all charts used in this article: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R