Only a ‘hawkish hike’ from the Bank of England (BoE) is likely to be enough to turn around the fortunes of GBP/USD given rapidly weakening fundamentals, hinting the path of least resistance remains lower for the foreseeable future.

GBP/USD pressured as the case for BoE rate hikes crumbles.

Just a few days ago another 25-point rate hike from the BoE was deemed a near-lock by traders and economists alike. However, a deluge of softer domestic economic data has meant a meeting in which most were focusing on whether the Monetary Policy Committee (MPC) would retain a hawkish bias or not has now flipped to whether it will hike at all?

Just look at the data to see why the odds of another hike have been diminishing as fast as the English football team during a penalty shoot-out: GDP fell 0.5% in July, a result blamed on wet weather. Hmmm, never wet in the UK, right? On the labour market, the unemployment rate rose to 4.3% in July while unemployment surged by 207,000 in the space of three months, the largest decline since late 2020.

And then came the big kicker on Wednesday with headline and core consumer price inflation coming in well under expectations in August, adding to the raft of other lagging indicators suggesting the domestic economy is coming off the boil.

If not for strength in wages, which largely reflects public sector demands rather than the private sector, the BoE would be able to slink back to the sidelines and let the economic cycle play out. With services price disinflation evident in the inflation report, it must surely have provided some comfort the risk of a damaging wage price spiral forming is diminishing, adding to the case to pause.

Two-way risk for GBP/USD as BoE meeting becomes a coin-flip

Markets now deem a 15th consecutive increase in the bank rate as a literal coin-flip, meaning there are two-way directional risks for GBP/USD heading into BoE decision. However, much of the conversation is now centered on what the rate decision will be, rather than the guidance offered. Both are important, and only one outcome really stands out as likely to support GBP.

A “dovish hike” probably won’t, loosening financial conditions by lowering bond yields and supporting asset prices in signalling rate increases are over. The ECB wasted a hike last week by doing just that. I’m sure the BoE was watching. My favoured outcome, a “hawkish hold” where the BoE leaves the bank rate unchanged but signals the likelihood of further hikes, will also generate headwinds for the pound, creating doubts about the MPC’s willingness to act if the inflation threat begins to turn.

In reality, only a “hawkish hike” will be enough to spark a meaningful GBP/USD bounce. And with the domestic data turning, such an outcome appears highly unlikely.

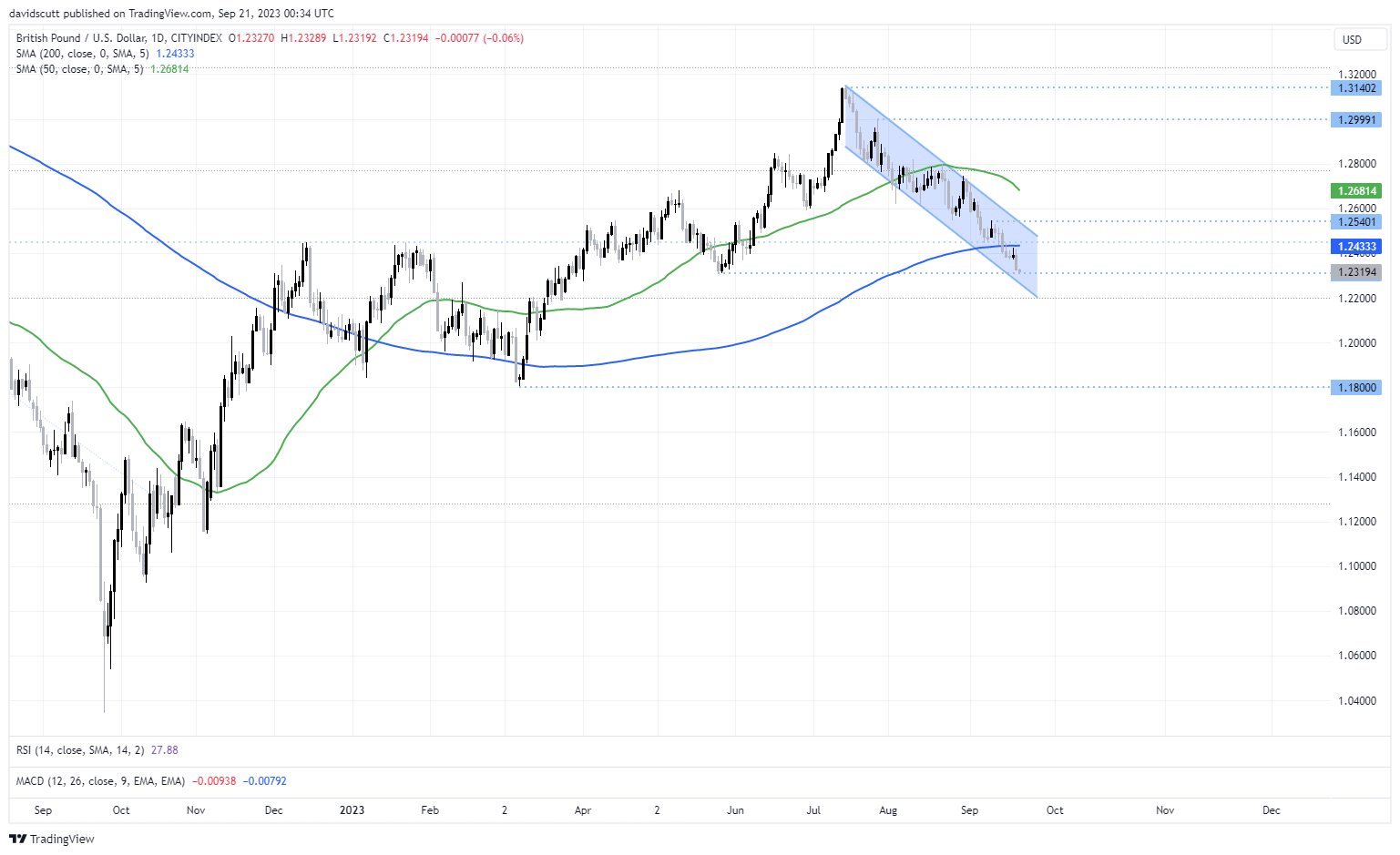

GBP/USD looking ugly on the daily chart

About the only thing GBP/USD has going for it on the daily chart is that it’s oversold on the RSI, meaning further downside is likely to be a grind rather than a flurry. Attempts to squeeze shorts are probable but will provide opportunities to sell at better levels. Just below 1.2400 looks decent given the difficulty the pair has endured tackling the 200-day MA. The latter also offers decent protection against a reversal of the prevailing trend.

For those unwilling to take the chance that we won’t see any pops, a break of 1.2310 – the low hit in May – could herald a move down to 1.1800. There is not a lot of visible support evident between the two levels other than around 1.2200.

-- Written by David Scutt

Follow David on Twitter @scutty