The USD/CAD outlook is subject to a major revision this week with investors looking forward to the release of US CPI and a rate decision from the Bank of Canada. For this reason, the Loonie is our featured currency pair of the week.

USD/CAD outlook: Key macro highlights for Loonie this week

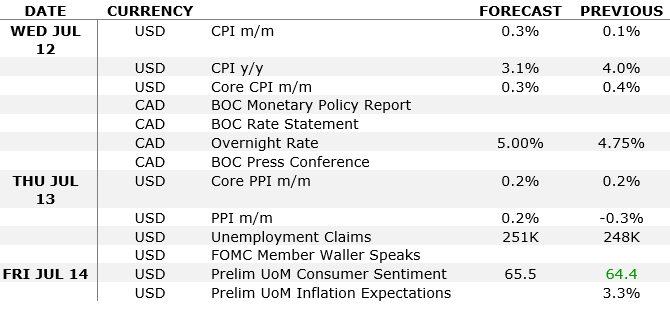

Here are the key data releases likely to impact the USD/CAD outlook this week:

As per the calendar, it is all happening from around mid-week, with Wednesday in particular arguably being the most important day of the week for the USD/CAD currency pair.

US CPI

Wednesday, 12 July

13:30 BST

The probability of a Fed rate hike on July 26 has steadily been climbing thanks to US data remaining more resilient than expected, and inflation slow to fall. If there’s one piece of data that could single-handedly influence the Fed’s decision to hike or hold, it would be the CPI report. So, expect lots of volatility around the data release.

CPI is expected to show that consumer prices cooled to 3.1% annual pace in June. The actual reading will need to be substantially below 3% for the odds of a 25-bps hike to fall meaningfully from the current level of around 90%.

BOC rate decision

Wednesday, 12 July

15:00 BST

The Bank of Canada was among several central banks surprising the market in June with a rate hike. While the odds of another rate rise in July have fallen slightly, the BOC remains quite concerned over whether enough has been done to bring inflation sustainably back to the 2% target. A final 25 bps hike appears more likely than not. The monthly Canadian employment report was published at the same time as the US jobs report on Friday, which meant it went a bit under the radar. But those trading the CAD probably got the confirmation they were waiting for: that the Bank of Canada would probably go ahead with another hike on Wednesday. That’s because almost 60 thousand jobs were added in June, the most since January and 3x higher than 20K expected. However, the jobless rate still rose to 5.4% from 5.2%, although this is unlikely to be a reason for the BOC to keep rates on hold come Wednesday.

HERE’s our full week ahead preview, written by my colleague Matt Simpson

Dollar in focus

Following Friday’s US dollar sell-off, in reaction to the weaker-than-expected jobs report, the greenback started the new week on the front-foot earlier, before edging lower. The jobs report wasn’t weak enough to dissuade the Fed from hiking in July, I don’t think. I reckon the greenback has room to the upside anyway, in order to catch up with the recent rally in bond yields. The next big scheduled risk event – US CPI – is not due until Wednesday, which means there’s plenty of time for the dollar to make back some ground until deciding on its next directional move when the inflation data is published.

On Friday, the nonfarm payrolls report disappointed expectations on the headline front at 209K vs. 224K eyed, although the downward revisions to the prior readings meant it was a bigger miss than the headline figure suggested. Still, the drop in the unemployment rate back to 3.6% coupled with a bigger than expected rise in wages (+0.4% vs. +0.3%) means at least on the employment front there are no major recessionary worries.

Last week we also saw a much stronger ADP private payrolls report (+497K vs. +228K forecast), while the ISM services PMI also topped expectations (53.9 vs. 50.3 last), reinforcing the Fed’s view that the strong labour market could help prevent a hard landing in the economy. The main weakness was once again observed in manufacturing, with the sector’s PMI coming in well below expectations again (41.8 vs. 44.0) to its lowest level since May 2020, at the height of the pandemic.

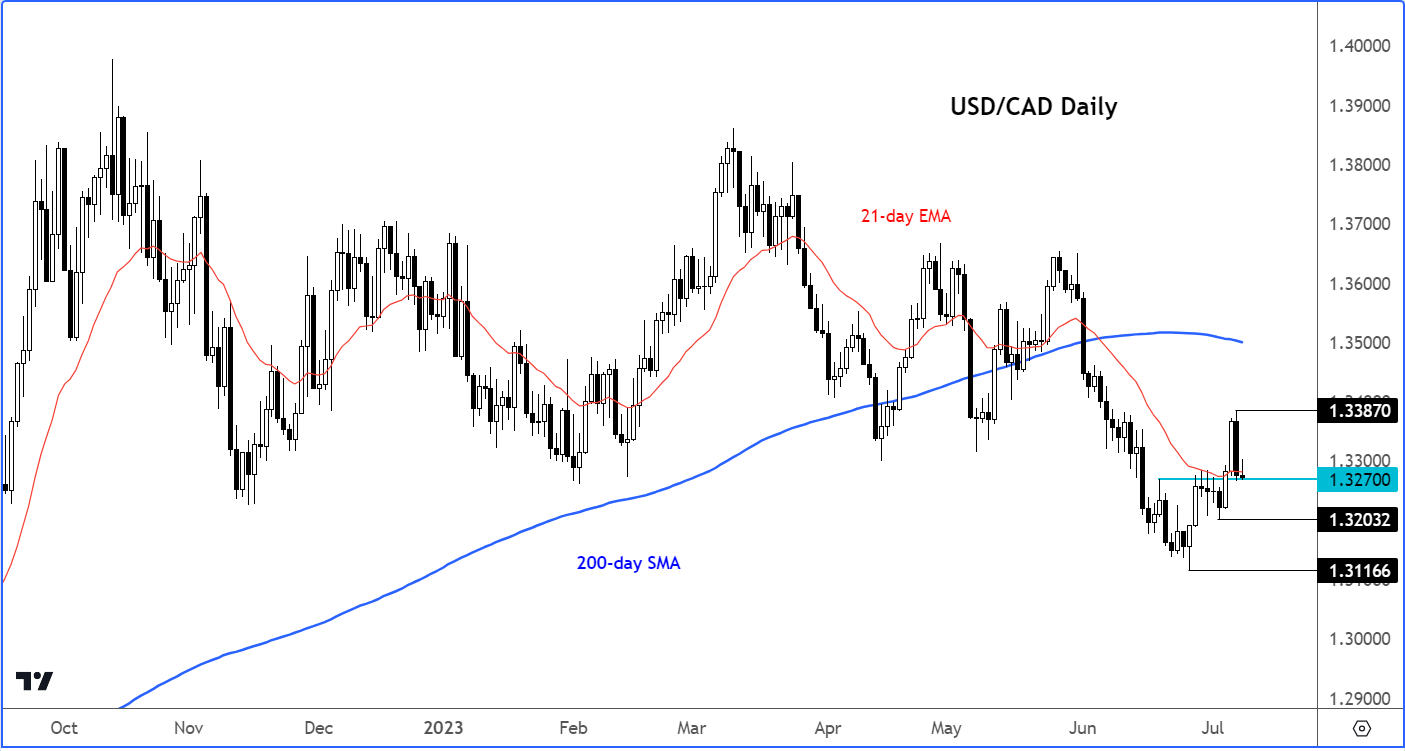

USD/CAD outlook: Technical analysis

The short-term USD/CAD outlook is as clear as mud, as you would expect ahead of two major events. At the time of writing, price was testing support and the 21-day exponential average, around 1.328ish. The buyers were clinging on, fighting against Friday’s bearish engulfing candle that was printed on the back of a stronger Canadian jobs and a weaker US nonfarm payrolls report.

Friday’s bearish engulfing candle now needs to find fresh selling pressure, otherwise the lack of follow-through on the downside would be another bullish signal, after the recent higher lows that have been created. So, A close above Friday’s low is what the bulls would be eyeing, while the bears would love to see some downside follow-through.

In the event the bulls manage to cling on, then this could see the USD/CAD rise to above Friday’s high in the next day or two, where the sellers’ stops would be resting.

But the line in the sand is around 1.3200, last week’s low. If that level breaks, then any technical bullish bias would have to be dropped.

Source: TradingView.com

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R

Currency pair FAQs

How do you choose a currency pair to trade?

Choosing a currency pair to trade all comes down to personal preference. A lot of traders will consider factors such as how liquid a currency is, how volatile it is, how actively traded it is, and when it’s most traded.

Learn more about FX market hours

Which currency pair is the most profitable?

The most profitable currency pair to trade comes down to your strategy and risk management. But most traders choose to stick to the major FX pairs because they are the most actively traded so offer more liquidity. These are: EUR/USD, USD/JPY, GBP/USD and USD/CHF.

Learn about major currency pairs

Which currency pair is best for scalping?

The best currency pairs for scalpers tend to be the major FX pairs, as they have the largest amount of trading volume, which means positions can be entered and exited easily. That’s the goal of any scalping strategy, to open and close positions quickly, taking advantage of just seconds of price action.

Learn more about scalping in forex