- AUD/USD has been highly correlated with commodity and US stock futures over the past fortnight

- Those markets stabilised on Thursday following the recent rout

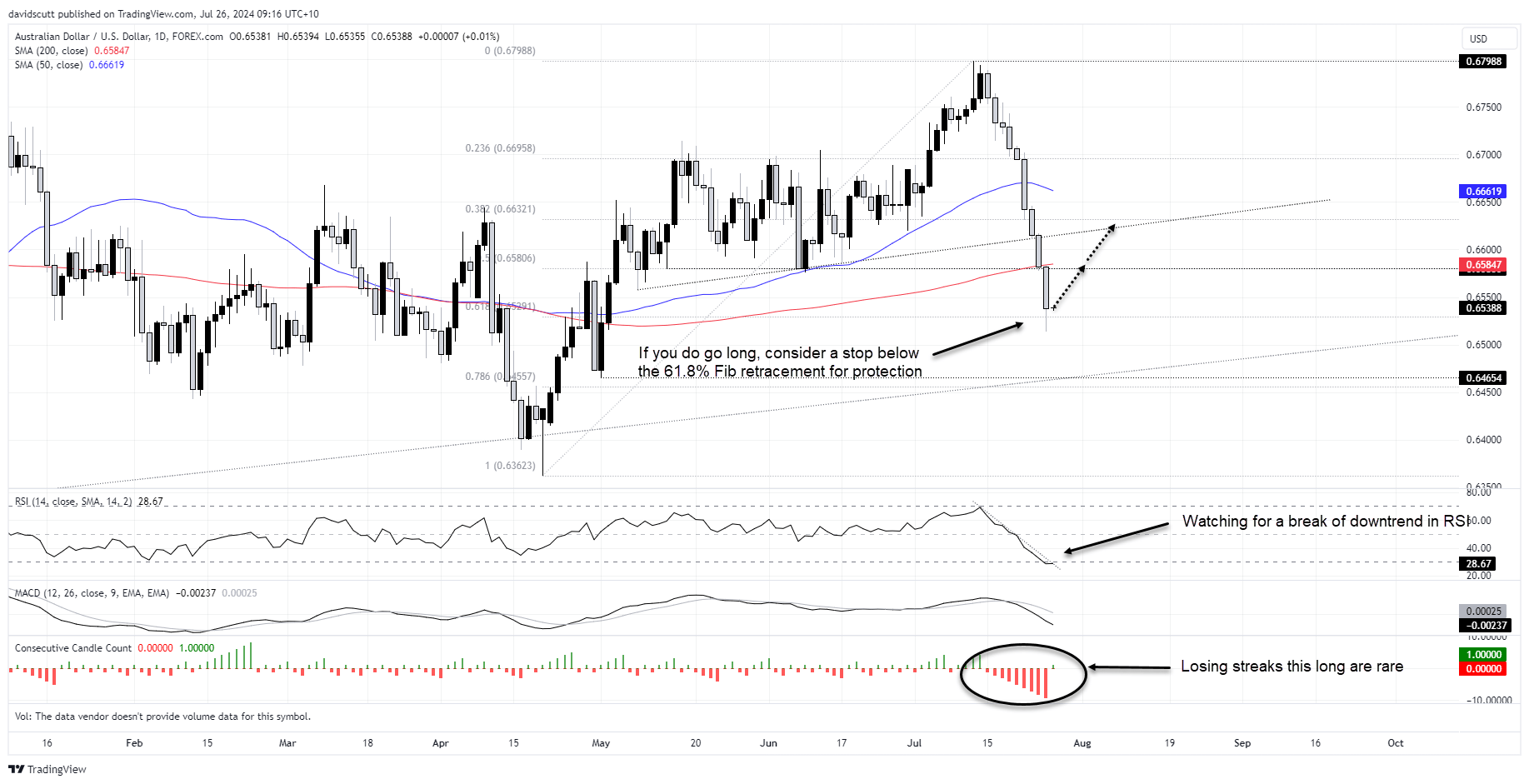

- AUD/USD has equaled its longest losing streak since August 2019

- China’s market opening likely to be influential on Friday

AUD/USD losing streak the longest in five years

AUD/USD has equaled its longest losing streak since August 2019, hammered by deteriorating sentiment towards the outlook for the Chinese economy and investor risk appetite, especially towards big tech. Should it decline again on Friday, it will be the equal-longest losing streak in decades.

But I’m not sure we’ll see a new record set. Given its strong correlation with commodities such as copper, iron ore and crude oil over the past fortnight, along with US equity index futures, the stabilisation in those markets overnight suggests we may see profit taking in Aussie to close the trading week.

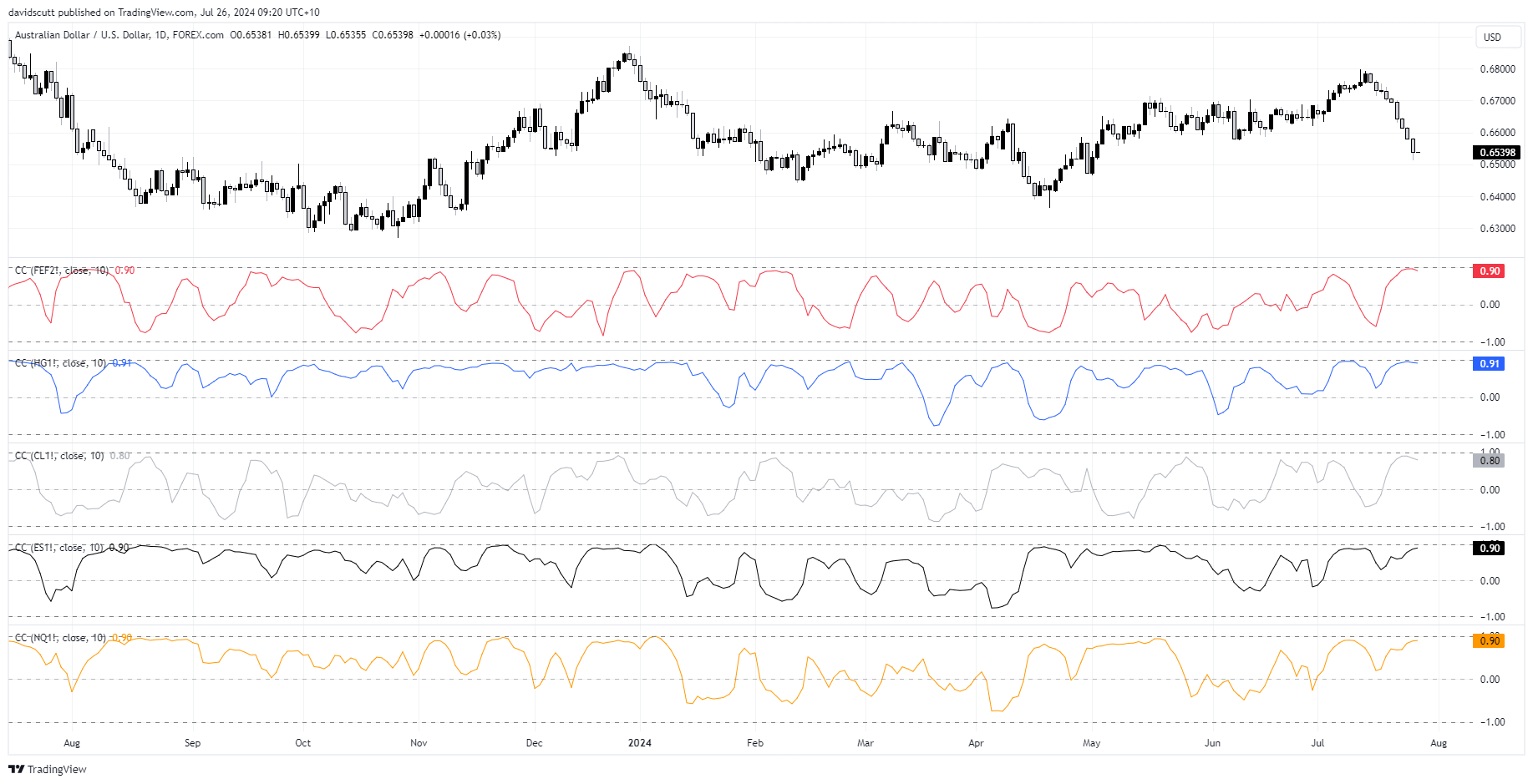

AUD/USD a proxy for risk appetite

This chart shows the rolling 10-day correlation between AUD/USD with SGX iron ore futures in red, COMEX copper in blue, crude oil in grey, S&P 500 e-minis in black and Nasdaq 100 futures in yellow. Every single correlation sits north of 0.8 with four of the five at 0.9 or higher. The higher the score, the greater the relationship between the two variables.

Taking a step back, the strong correlations suggest AUD/USD is being used as proxy for risk sentiment, a role it has often played previously when we’ve seen boarder risk-on-risk-off moves in markets. That means if we see even a modest improvement in risk appetite, as seen on Thursday when the latest batch of US economic data suggested premonitions of an imminent recession may be misplaced, the AUD/USD could find buyers.

The price action in commodity futures is another potential sign that the worst of the rout is over, at least for the moment.

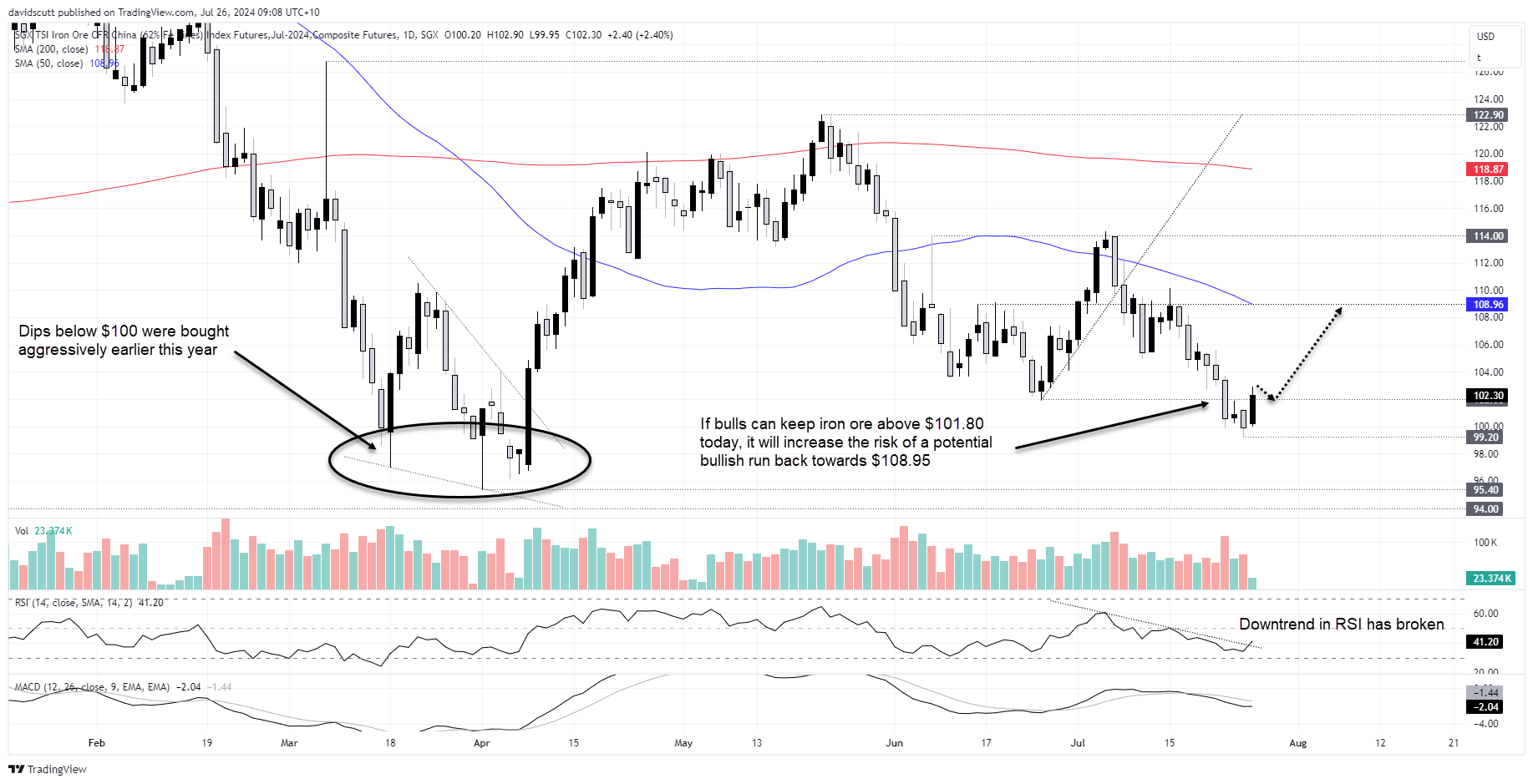

SGX iron ore rebounds above $100

SGX iron ore futures bounced strongly from below $100 during Thursday’s night session, repeating the pattern over the past two years when dips below this psychological level were bought aggressively.

While the price action during the night session has not always been a reliable indicator for what we see when heavier volumes are traded during the day, it’s noteworthy that RSI has broken the downtrend dating back to early July, indicating a possible easing of bearish momentum that’s yet to be confirmed by MACD.

If SGX iron ore can push meaningfully above the June 25 low of $101.80, it will bode well for long Aussie positions, pointing to a possible push back towards resistance at $108.95 and 50-day moving average.

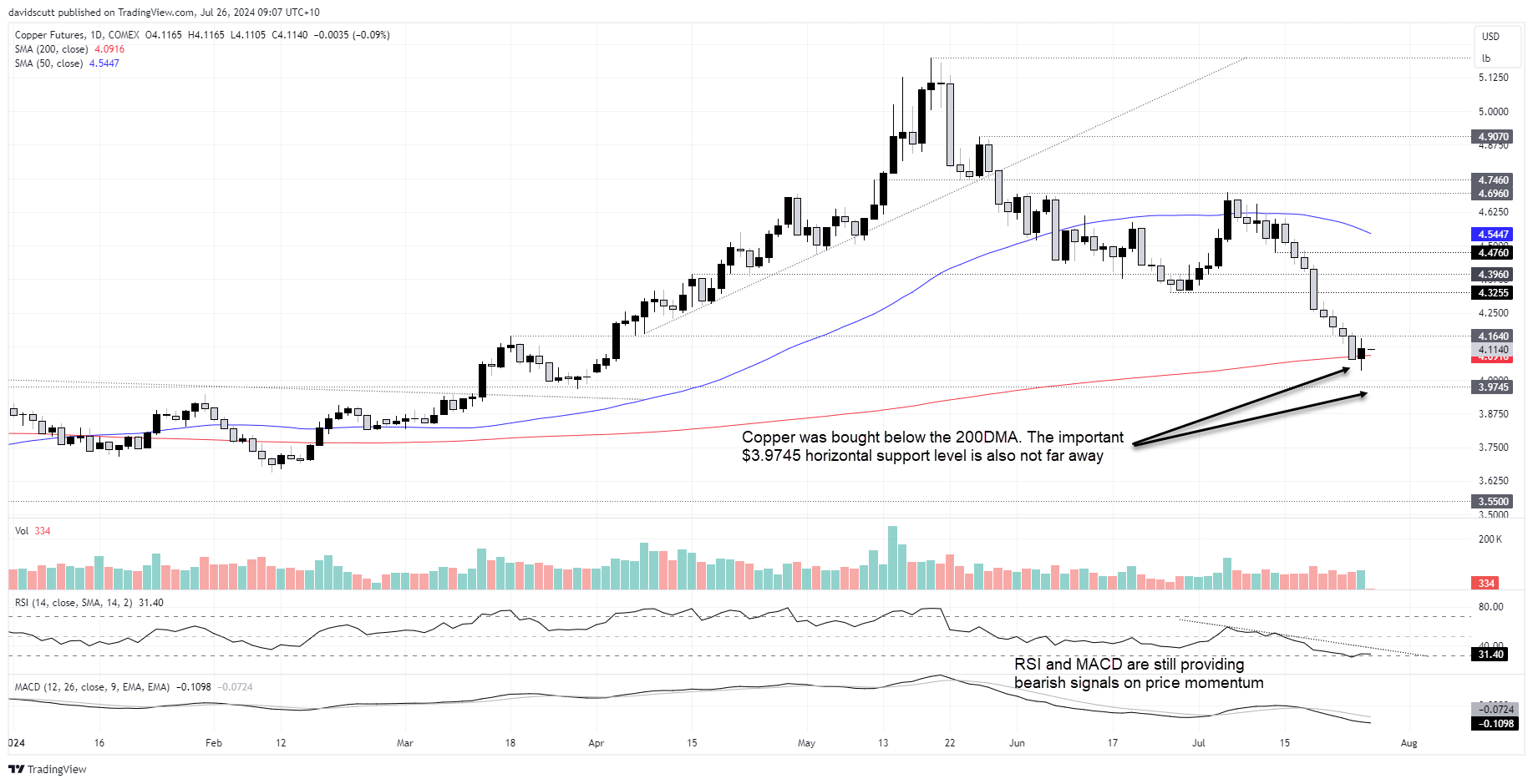

COMEX copper finds bids at 200DMA

Like iron ore, there were also fleeting signs of stablisation in COMEX copper futures on Thursday after eight consecutive daily declines, bouncing after dipping below the 200-day moving average for the first time since February.

RSI and MACD are still providing bearish signals on momentum, so it’s still too early to get excited about getting long, but with a major support level located not far below at $3.9745, perhaps we’re seeing the early signs of bottoming.

I’d like to see a push back above $4.164 before considering longs, allowing for a stop to be placed below the 200-day moving average for protection.

AUD/USD squeeze risk growing?

With tentative signs of stablisation in commodity futures and US equity index futures pushing higher in early Asian trade, the prospects for some form of squeeze higher in AUD/USD appear to be growing.

You can see just how violent the selloff has been over the past two weeks, leaving it oversold on RSI (14) for the first time since August 2023. But the modest reversal on Thursday after breaking the 61.8% Fib retracement of the April-July low-high is about the closest thing to a bullish signal we’ve seen for the AUD/USD in a while.

It’s tempting to go long with a stop below the fib level for protection, but it would be nice to see RSI break its downtrend first to provide confidence that the bearish price momentum is ebbing.

Given the acute focus on China, the reaction to the PBOC’s CNY fix in FX markets, and opening of Chinese stock futures, may provide a strong tell on where the near-term path of least resistance lies. If they open firmer, it may increase the probability of AUD/USD upside.

-- Written by David Scutt

Follow David on Twitter @scutty