The US dollar slumped and risk assets rallied on the back of weaker US macro data and signs of a weakening labour market ahead of Friday’s non-farm jobs report. The AUD/USD forecast took another boost after holding its own well on the back of a hawkish-leaning RBA minutes and hotter-than-expected Australian inflation report last week.

Bad news is good news for risk assets

Bad news is good news. That’s how risk assets reacted in the aftermath of today’s US data releases, which all came out weaker than expected. Most notably, the ISM services PMI dropped below the boom/bust level of 50.0, printing its lowest reading in 4 years, as all the major components fell, including business activity, new orders and employed. This came on the back of a weaker manufacturing sector PMI reading we saw earlier in the week, and several other ugly-looking US macro data including for example factory orders, ADP private payrolls and construction spending. Not that it all mattered for the stock markets of course, with investors cheering bad data as it boosts the probability of a sharp rate reduction cycle from the Fed. Indeed, the Nasdaq 100 hit a new all-time high, while gold and silver extended their earlier advance.

AUD/USD forecast already boosted by Aussie inflation

Meanwhile the AUD/USD, which had held its own quite well of late thanks to strong Aussie inflation and a hawkish RBA, led the major FX pairs higher, rising to its highest since January as the weaker-than-expected US data boosted speculation about rate cuts.

Overnight we also have two more forecast-beating Aussie data releases, namely retail sales and building approvals. The former came in at +0.6% m/m vs. +0.3% expected while the latter printed 5.5% m/m vs. +1.5% eyed.

Last week, the latest inflation report for the month of May came in surprisingly strong, printing 4.0% y/y vs. 3.8% expected and 3.6% in April. As a result, investors are now pricing in around 50% odds of one more rate increase by the RBA, just as the odds of a rate cut by the Fed are rising.

AUD/USD forecast supported by technical breakout

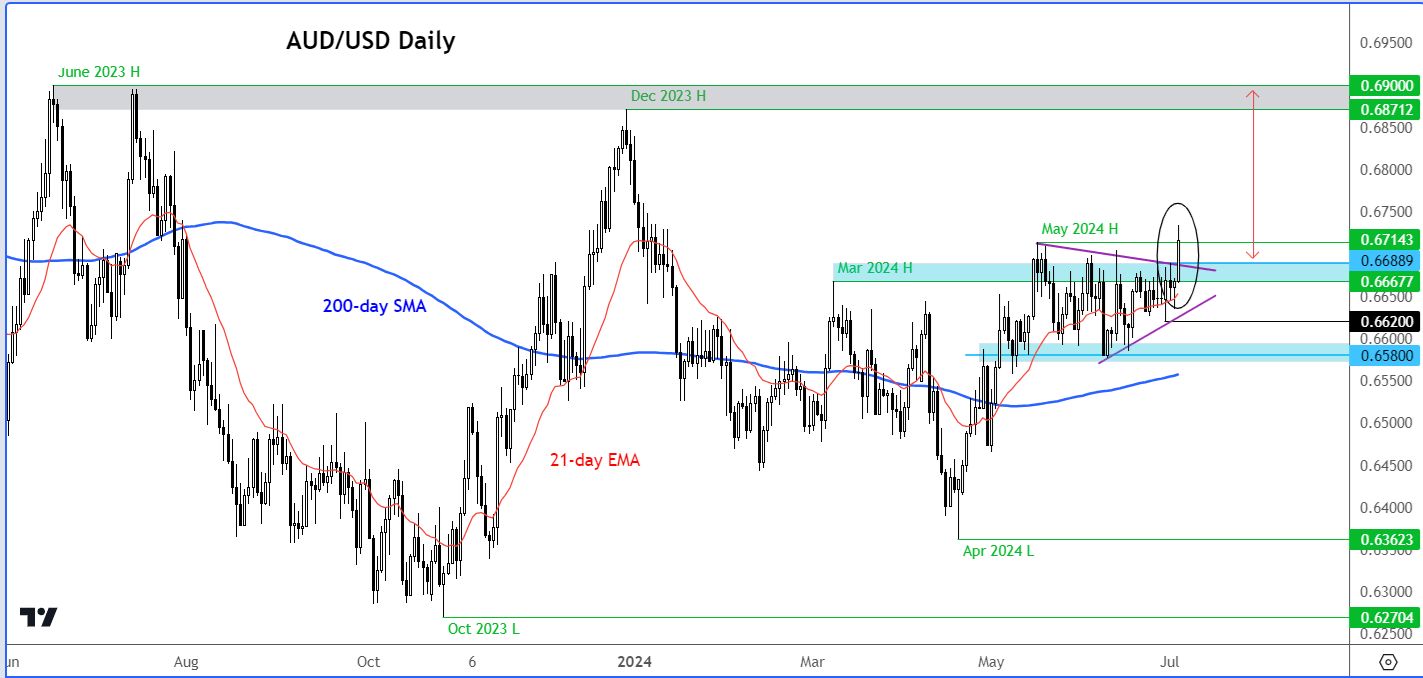

Last but not least, it is important not to ignore the AUD/USD bullish price action over the last several weeks. While currency pairs like the EUR/USD, NZD/USD and GBP/USD had all weakened to at least multi-week lows and in the case of the JPY/USD to decade lows in recent times, the AUD/USD was holding its own rather well, consolidating inside a bullish continuation pattern near its highs...

Source: TradingView.com

... Well today, the AUD/USD has broken out to hit its best level since January. If the breakout holds and we don’t go back below the most recent low at 0.6620 again, then we may very well see follow-up technical buying in the days ahead, particularly if Friday’s US jobs report also disappoints.

So, the technical AUD/USD forecast is aligning with the fundamentals, making it an ideal currency pair to trade on the long side, with sound risk management, than, say, a pair like the EUR/USD which faces election risks or the USD/JPY which carries significant risk of government intervention.

-- Written by Fawad Razaqzada, Market Analyst

Follow Fawad on Twitter @Trader_F_R