- USD/JPY dropped back below 114.00 as the Japanese yen surged on Monday, ahead of the Bank of Japan’s (BoJ) monetary policy decision and statement scheduled for early Tuesday in Japan.

- The BoJ is not expected to make any substantial changes to its negative interest rate policy or its extensive quantitative easing program at the current time.

- The yen has generally been strengthening since the beginning of the new year as the US dollar has lagged, prompting a sharp pullback for USD/JPY.

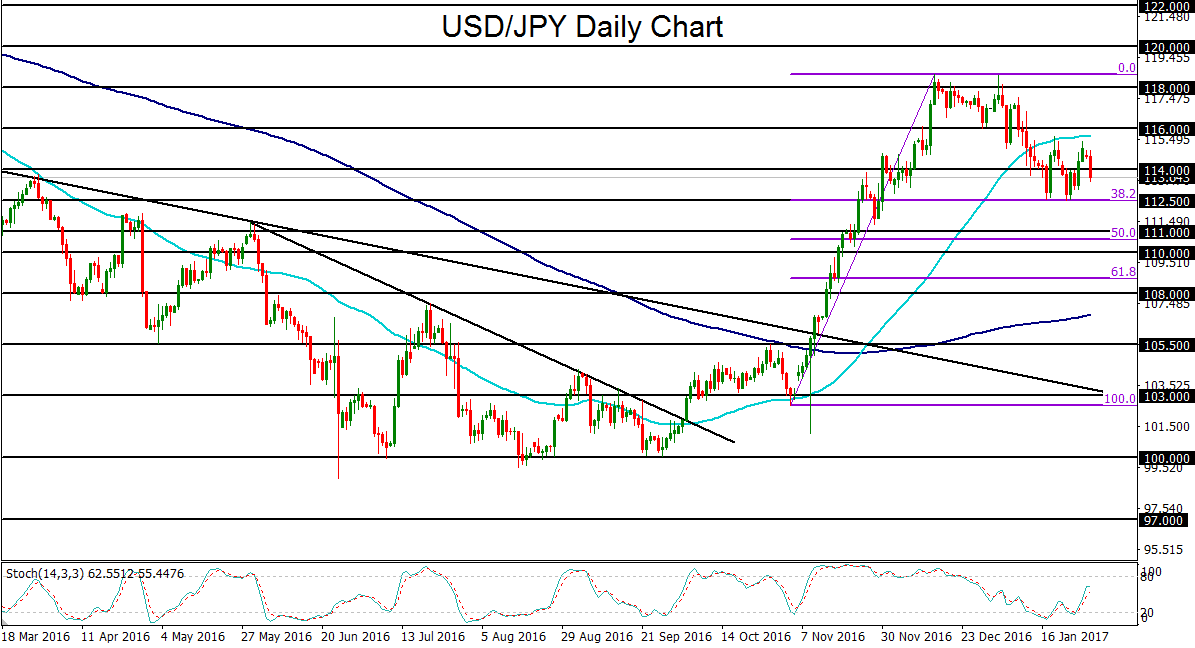

- The past two weeks have seen a double-bottom chart pattern around 112.50 for USD/JPY, which could potentially serve as an upside reversal of January’s pullback.

- The double-bottoming pattern occurred at a key support level right around the 38% Fibonacci retracement of the uptrend from early-November to mid-December.

- The outlook for the US dollar continues to be bullish overall in view of US President Trump’s broad fiscal stimulus plans and the Federal Reserve’s increasingly hawkish stance. The Fed holds its policy meeting on Wednesday – no further interest rate hike is expected then, but any more hawkish talk could boost the dollar.

- The bullish bias for USD/JPY is further supported by the monetary policy divergence between the Fed and BoJ, as well as low safe-haven demand for the yen in the midst of extended rallies in global equity markets.

- If the 112.50 support level holds after this week’s Bank of Japan and Fed meetings, a USD/JPY rebound could push the currency pair back up towards 118.00 and a potential resumption of the underlying bullish trend.

Latest market news

Today 02:05 PM