Headline inflation rose by 0.8% over the quarter vs. expectations for a rise of 0.8%, while the annual rate of headline inflation fell to 3%, vs. expectations of 3.1% as base effects continued to fade.

However, core inflation as measured by the RBA's preferred measure, the "trimmed mean," surprised to the upside printing at 0.7 q/q vs. market expectations of 0.5%q/q, with the annual rate rising to 2.1% vs. expectations of 1.8%. Thereby seeing the core inflation rate return to the RBA's 2-3% band for the first time in six years.

There has been a tendency to look through lockdown affected economic data of late. Still, due to surging global inflation on supply bottlenecks and higher energy prices, today's inflation data was very much in focus.

Particularly after robust inflation data in New Zealand last week saw front end yields reprice higher in New Zealand and Australia, pointing to an early start to rate hikes in Australia than forecast by the RBA that interest rate hikes are unlikely before 2024.

The Reserve Bank of Australia has previously stated that it wants to see inflation return "sustainably" within its 2 percent to 3 percent target band and wages growth above 3 percent on an annualised basis before it starts to normalise policy. As such, the RBA will likely look through today's data.

However, the interest market is not taking such a sanguine view of the world. Front end yields have moved sharply higher, challenging the RBA to step in again to protect or remove a key part of its monetary policy settings, the 0.1% Yield Curve Control target on the April 2024 bond.

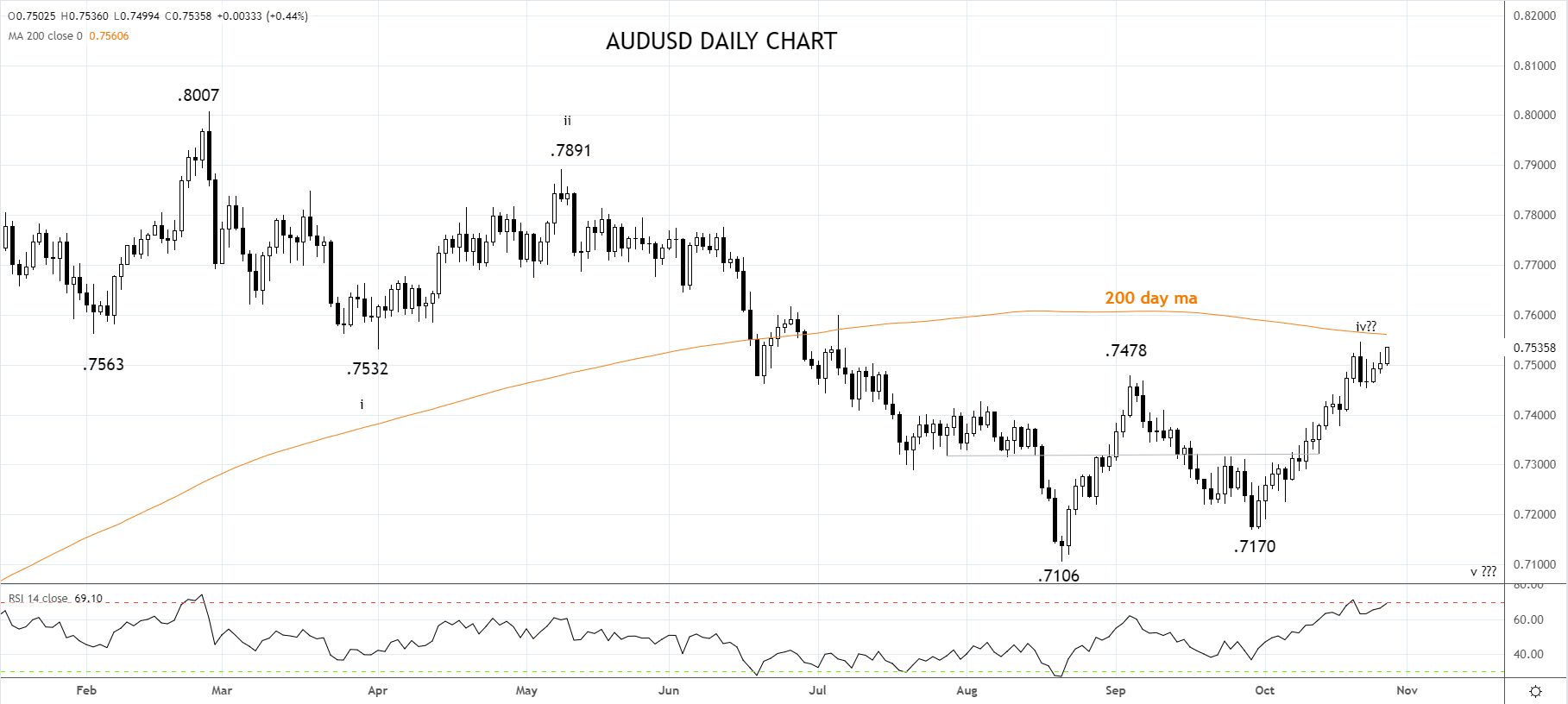

In response to higher yields, the AUDUSD has rallied from .7510 to .7533 at the time of writing, eying significant resistance at .7550/60c coming from wave equality and the 200-day ma.

We aren't necessarily convinced that the AUDUSD will see a sustained break above this resistance; however, with the reflation trade making a return after a five-month hiatus, we aren't looking to pick a fight with the AUDUSD at this point either.

Source Tradingview. The figures stated areas of October 27th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.