As US traders returned to their desks this morning, the dominant theme was US dollar weakness. The US Dollar Index, which had rallied to above 95.00 to approach its highest level in over 10 months last week, was hit by a bout of selling in Asian and early European trade to hit its lowest price in a week and a half in the mid-93.00s.

Over the weekend, political leaders from various G7 nations criticized and condemned the Trump administration’s decision to impose tariffs on the country’s allies, suggesting that the simmering global “trade war” could get worse before it gets better. Traders will be keeping a close eye on comments out of this weekend’s G7 summit to see whether the US will soften its stance, as well as any signs of escalation from other countries.

Meanwhile, the euro has caught a bid today after some decent unemployment data out of Spain, where the unemployment rate has dropped a full 10% over the last five years (from 27% to 17%). At the same time, the FX market remains optimistic ahead of the first EU ministerial meeting for the new Italian political leaders tomorrow. For now, traders believe that the populist government is willing and able to pursue its agenda within the current structure of the Eurozone, and given the stakes, Mr. Di Maio and company may be hesitant to “rock the boat” too much.

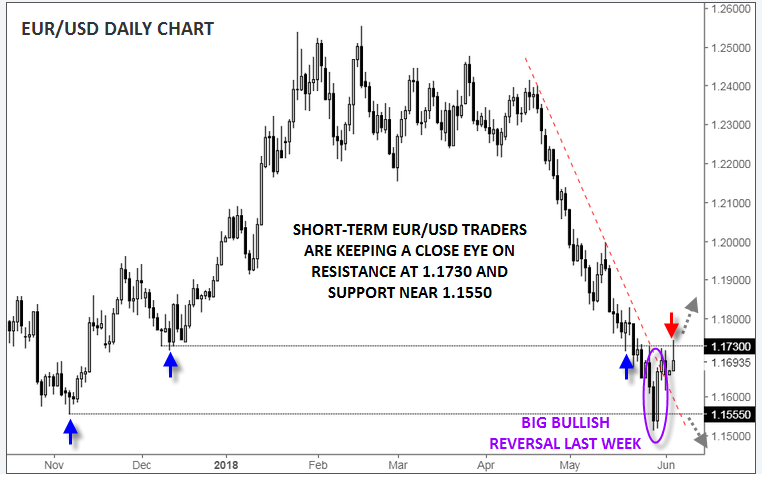

After shedding over 1,000 pips off its high in mid-February, EUR/USD bulls are finally trying to put a floor under the pair. As the chart below shows, the world’s most widely-traded currency pair briefly dipped to a 10-month low before seeing a strong bullish reversal last Wednesday. The pair has since broken its 6-week bearish trend line, potentially opening the door for a more meaningful rally this week.

Source: Forex.com, TradingView

That said, the greenback has staged a bit of a rally this afternoon, showing that dollar bulls (EUR/USD bears) are defending the previous-support-turned-resistance level around 1.1730. For now, the pair has yet to see a meaningful higher high & higher low form on a closing basis, leaving the short-term trend murky.

A close above the 1.1730 area in the next few days would open the door for a more substantial rally toward 1.19 or 1.20 in the days to come. Meanwhile, a close back below the December lows at 1.1550 would suggest that the medium-term downtrend has resumed and would likely expose 1.14 or lower next.

In other words, EUR/USD traders will be watching for a confirmed break of the high and low of last week’s wide-bodied candle to guide their decisions in the weeks to come.