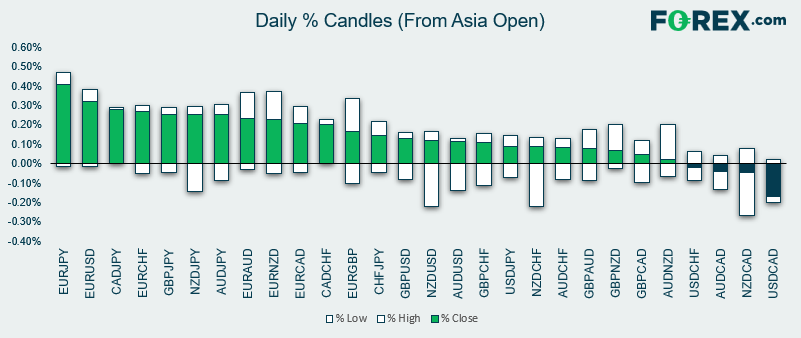

- EUR spiked higher today to become today’s strongest major. Whilst the initial driver was unknown – rumours surfaced it could be MUFG’s $6.4bn purchase of DZ Bank Aviation going through, hence EUR/JPY flows.

- Singapore’s MAS ended their tightening policy in today’s meeting, following the Fed with their shit to neutral.

- On the Fed, it’s been reported that the Powell asserted Fed independence at a Democrat’s retreat, whilst unnamed sources claim Powell think rates are in the right place.

- RBNZ’s Governor Ore isn’t sur eon a May cut, saying they continue to watch incoming data and the mixed picture is hard. NZD was the weaker currency earlier on the session on the back of weaker PMI data and global growth concerns. Markets continue to wait for China trade data with NZD/USD holding above key support.

- RBA cited ‘increased risks’ to the household sector in today’s Financial Stability Review.

Latest market news

Today 02:05 PM