Asian Indices:

- Australia's ASX 200 index fell by -177.9 points (-2.49%) and currently trades at 6,961.60

- Japan's Nikkei 225 index has fallen by -475.24 points (-1.72%) and currently trades at 27,113.13

- Hong Kong's Hang Seng index has fallen by -358.77 points (-1.46%) and currently trades at 24,297.69

- China's A50 Index has fallen by -127.31 points (-0.83%) and currently trades at 15,280.93

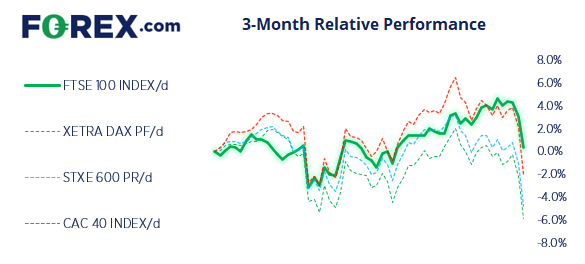

UK and Europe:

- UK's FTSE 100 futures are currently up 25 points (0.35%), the cash market is currently estimated to open at 7,322.15

- Euro STOXX 50 futures are currently up 20 points (0.49%), the cash market is currently estimated to open at 4,074.36

- Germany's DAX futures are currently up 81 points (0.54%), the cash market is currently estimated to open at 15,092.13

US Futures:

- DJI futures are currently down -338 points (-0.99%)

- S&P 500 futures are currently down -271.5 points (-1.87%)

- Nasdaq 100 futures are currently down -61 points (-1.39%)

Australia’s ASX 200 was led the declines thanks to (or not thanks to) decent inflation numbers. Yet it would have arguably been lower regardless as the theme of the overnight session was to offload riskier assets. The TOPIX and Nikkei both fell over -2% and China’s benchmark indices were off by around -1.2%. The question now is whether this is a prelude of things to come in Europe, or whether it’s simply an over-reaction to moves seen on Wall Street yesterday. Futures markets point towards the former as the FTSE, DAX and CAC are expected to open higher today, but then we also saw that very same pattern ahead of the Asian open so we shall find out shortly.

Australian inflation beat expectations

A decent set of inflation numbers in Q4 for Australia helped send the Australian dollar higher and raise expectations of a rate hike. Trimmed mean CPI rose to 1% y/y, its highest level since 2008 and CPI (including energy and food) rose to 2.6%m its highest level since Q2 2014. The 6-month OIS (overnight index swap) rose to a post-pandemic level although, at 0.177 still falls short of a full rate hike being priced in. And that is likely because the RBA remain defiantly dovish in regards to hikes, although it does add further pressure to wrap up QE at their next meeting.

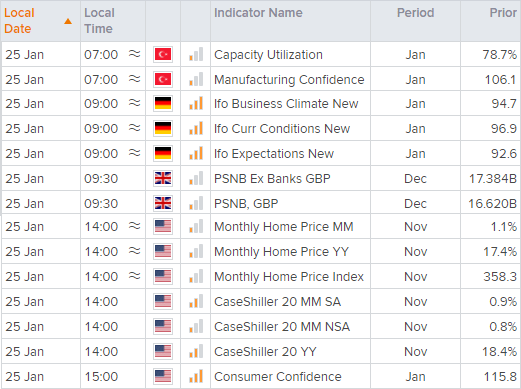

German IFO data up next

The monthly IFO business sentiment report is released at 09:00 GMT and should shed further light on the severity of the economic downturn. Business climate fell for a sixth month in December to 94.7 and is expected to remain flat later today. Current conditions are expected to fall to 96.1 from 96.9 and expectations is expected to rise slightly to 93 from 92.60.

Bundesbank warned in a report this week that GDP likely fell in Q4, although their outlook for the new year is slightly optimistic. Therefore, the outlook component of today’s IFO report could be one to watch as weak data from the region is not exactly new news.

What are economic indicators?

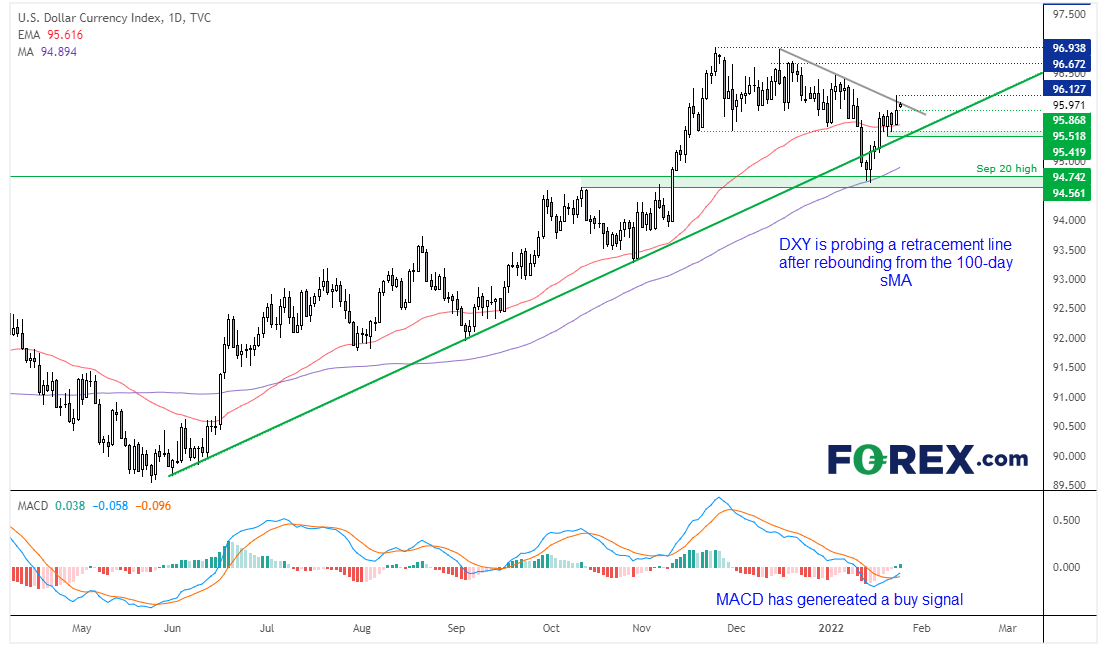

Dollar index set to resume its rally?

The US dollar index (DXY) is considering a break of a key trendline after spending several days in a small, sideways consolidation. Its correction from the November high seems to have completed with its temporary drop below 95, where support was found at the 100-day sMA and September highs. From here out bias remains bullish above 95.50 (just below the recent consolidation) although tighter risk management could be considered if we see a decent break above yesterday’s high.

FTSE 350: Market Internals

FTSE 350: 4123.56 (-2.63%) 24 January 2022

- 14 (3.99%) stocks advanced and 337 (96.01%) declined

- 4 stocks rose to a new 52-week high, 50 fell to new lows

- 30.48% of stocks closed above their 200-day average

- 22.51% of stocks closed above their 50-day average

- 7.12% of stocks closed above their 20-day average

Outperformers:

- + 7.31% - Unilever PLC (ULVR.L)

- + 4.53% - Vodafone Group PLC (VOD.L)

- + 4.40% - Playtech PLC (PTEC.L)

Underperformers:

- -14.62% - Darktrace PLC (DARK.L)

- -11.58% - Molten Ventures PLC (GROW.L)

- -11.03% - Reach PLC (RCH.L)

Up Next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.