Key takeaways

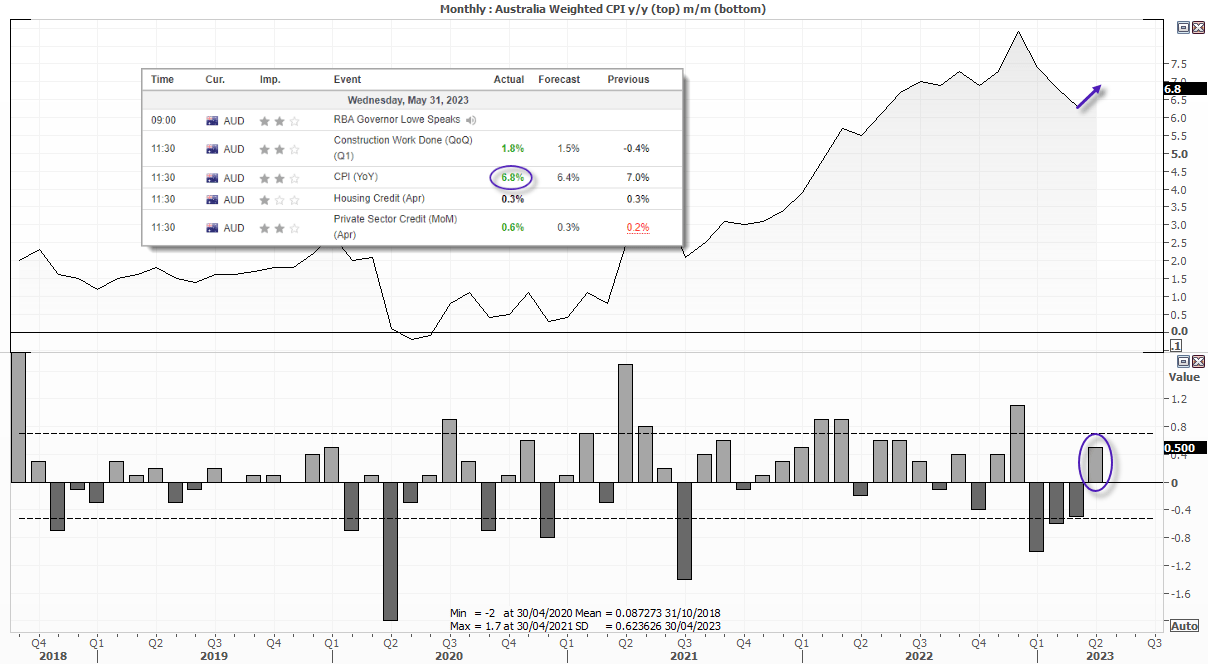

- Australian inflation rose unexpectedly at 0.5% m/m and 6.8% y/y

- Whilst AUD pairs initially spiked higher, they were promptly dragged lower by weak China PMI data

- Bets for another RBA hike are on the rise

- Governor Lowe said earlier that inflation risks are to the upside

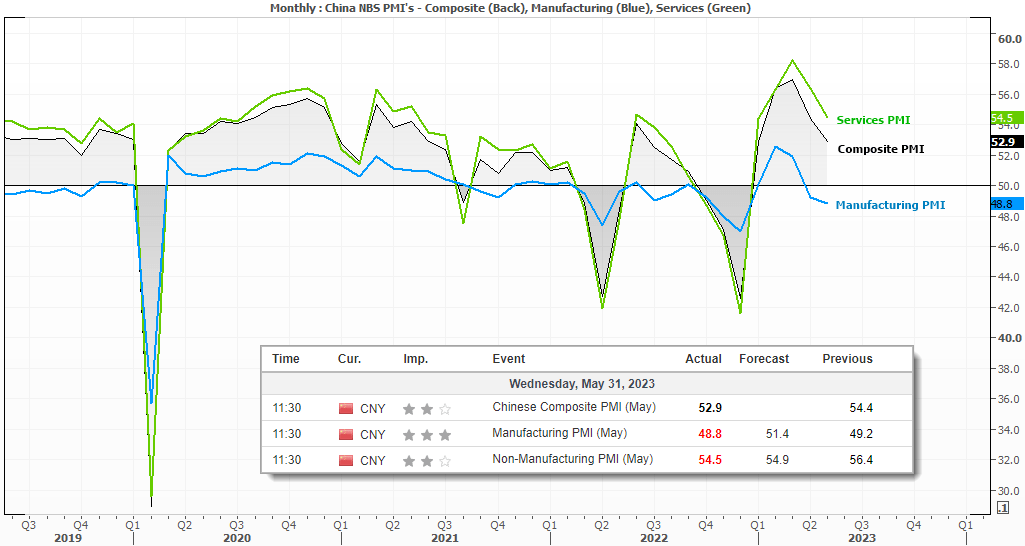

- China’s manufacturing and services PMIs disappointed, weighing on sentiment in Asia and overshadowing Australia’s uncomfortably hot CPI figures

- CPI rose 6.8% y/y (6.4% expected, 7% prior)

- Rents rose 6.1% y/y (a series high), housing up 8.9% y/y

- Within the food group, 6 or the 7 indices rose on a monthly basis led by Dairy and related products 2% m/m (or 14.5% y/y)

Two contradictory reports wreaked a bit of havoc on the Australian dollar today, with the Aussie initially moving higher on rate-hike bets before being slammed back down thanks to weak China PMI data. Now algo’s have enjoyed their knee-jerk reactions and the dust has settled, I suspect traders will realise that today’s inflation report for Australia surely tips the RBA’s hand to hike interest rates again, even if growth prospects for China remain weak. A cursory glance at the report reveals rising prices on a monthly basis, and that is hardly what anyone wants to see with an annual rate at 6.8% y/y.

RBA governor Lowe testified in front of parliament today, warning that weak productivity growth could become a driver of inflation. Whilst the government’s latest budget has not changed the RBA’s view, they do remain in ‘data dependant’ mode (which means they’ll make their rate decisions on a per-meeting basis) and that not a single variable will determine their decisions. Whilst inflation expectations remain ‘well anchored’, this cannot be taken for granted and that the RBA. And perhaps the bigger takeaway from his speech is that the "…risk to inflation is to the upside and we need to be attentive to that."

China’s PMIs disappoint

Further signs are materialising that China’s recovery has stalled and that their GDP target for 2023 of around 5% seems unlikely, without fresh rounds of stimulus. Official government data form the NBS showed that manufacturing PMI contracted at its fastest pace in six months and services PMI fell to a 4-month low. Which of course will have a knock-on effect for global growth figures.

- China’s stock markets dragged sentient and Asian indices lower and pulled the S&P 500 futures market below Friday’s ‘debt-ceiling rally’ high

- The ASX 200 fell to a 9-week low on the combination of weaker China growth prospects and increased odds of an RBA hike

- The Japanese yen and US dollar received safe-haven inflows whilst NZD and CAD were the weakest majors

- We suspect AUD would have been much weaker were it not for renewed RBA-hike bets following an unwelcomed strong inflation report

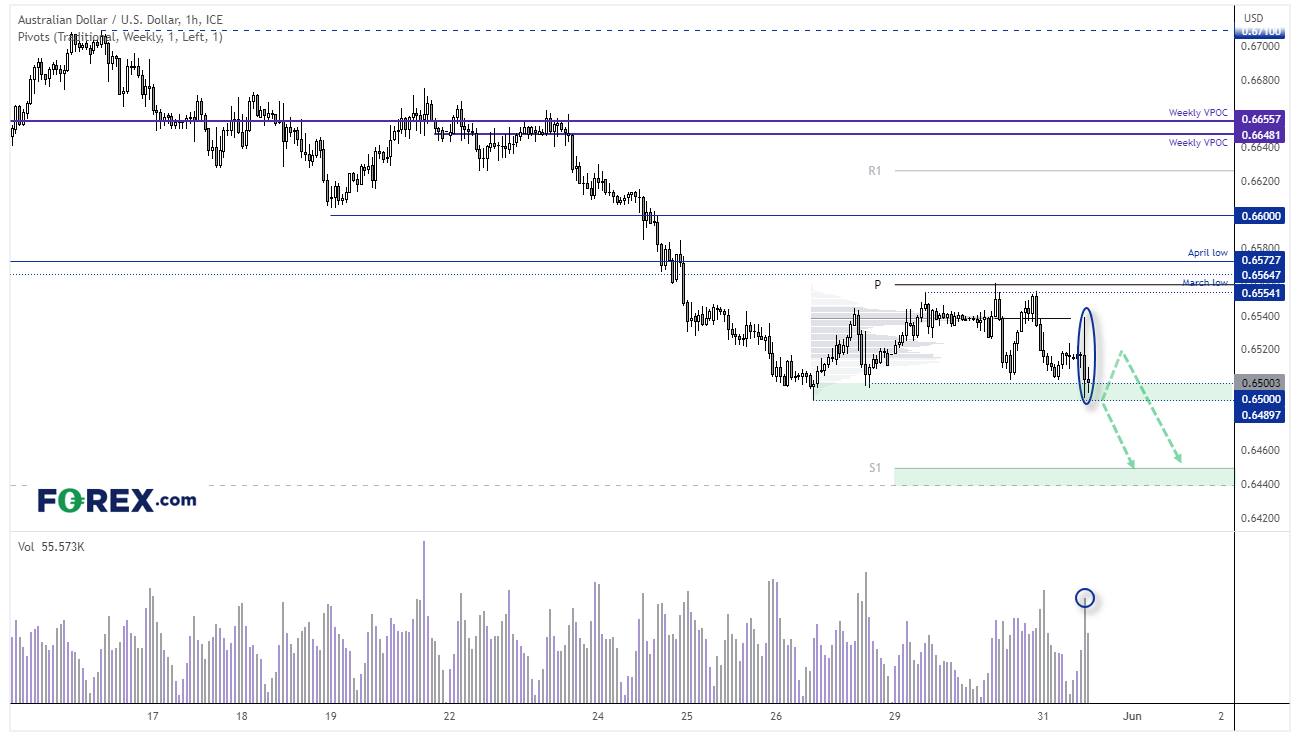

AUD/USD 1-hour chart

The initial spike higher was ‘short’ lived, with China’s weak PMIs forcing sentiment quickly lower. Take note that today’s current high was almost perfectly on the HVN (high volume node) highlighted in today’s Market Brief report.

And as it marks a bearish engulfing candle on high volume, we currently favour a downside break to a fresh YTD low whilst prices remain beneath today’s high. Bears could either seek bearish setups within the last hour’s candle range or wait for a break to a new YTD low.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge