PMI data for the US was better than expected, which helped the US dollar index rally from a key support area on Tuesday and weigh on oil prices. The S&P Global report suggests the economy expanded at its fastest pace in three months with flash composite PMI rise to 51, up from 50.2. Services PMI accounted to the baulk of the rise with its flash PMI rising to 50.9, above 49.8 expected and 50.1 prior.

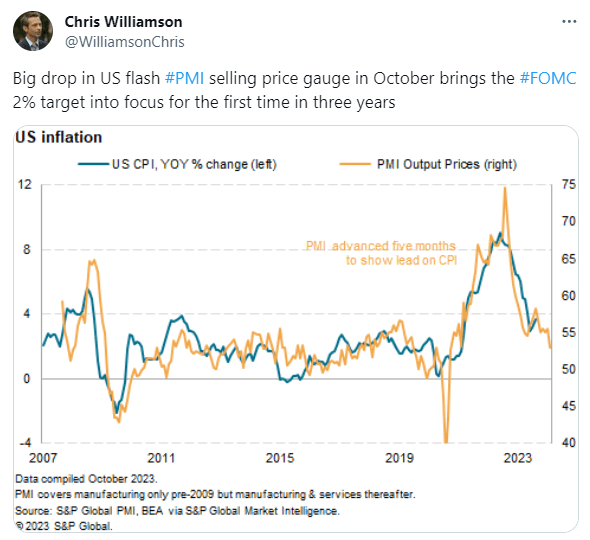

Whilst this could initially be seen as slightly inflationary which could add pressure on the Fed to hike at least once more, price pressures are easing which could actually lower the need for further hikes. If prices pressures are easing, it could also weigh on headline CPI and inflation expectations. And that could also be bearish for oil prices. And this flies in the face of current news flows, with the potential for the Middle East conflict to escalate and send oil prices higher (alongside food, energy and inflation expectations).

S&P Global’s Chief economist thinks that inflation could reach the Fed’s 2% inflation target “in the coming months” without the economy tipping into contraction. If so, it means inflation pressures are falling faster than anticipated and that the US could avoid a recession. Whilst this is supportive to oil prices to a degree (on the assumption on greater demand than a recession would usually bring), it could also cap upside potential and pour cold water on calls for oil in excess of $100. Assuming World War III is avoided.

S&P Global’s Chief Business Economist “The survey’s selling price gauge is now close to its prepandemic long-run average and consistent with headline inflation dropping close to the Fed’s 2% target in the coming months, something which looks likely to be achieved without output falling into contraction”.

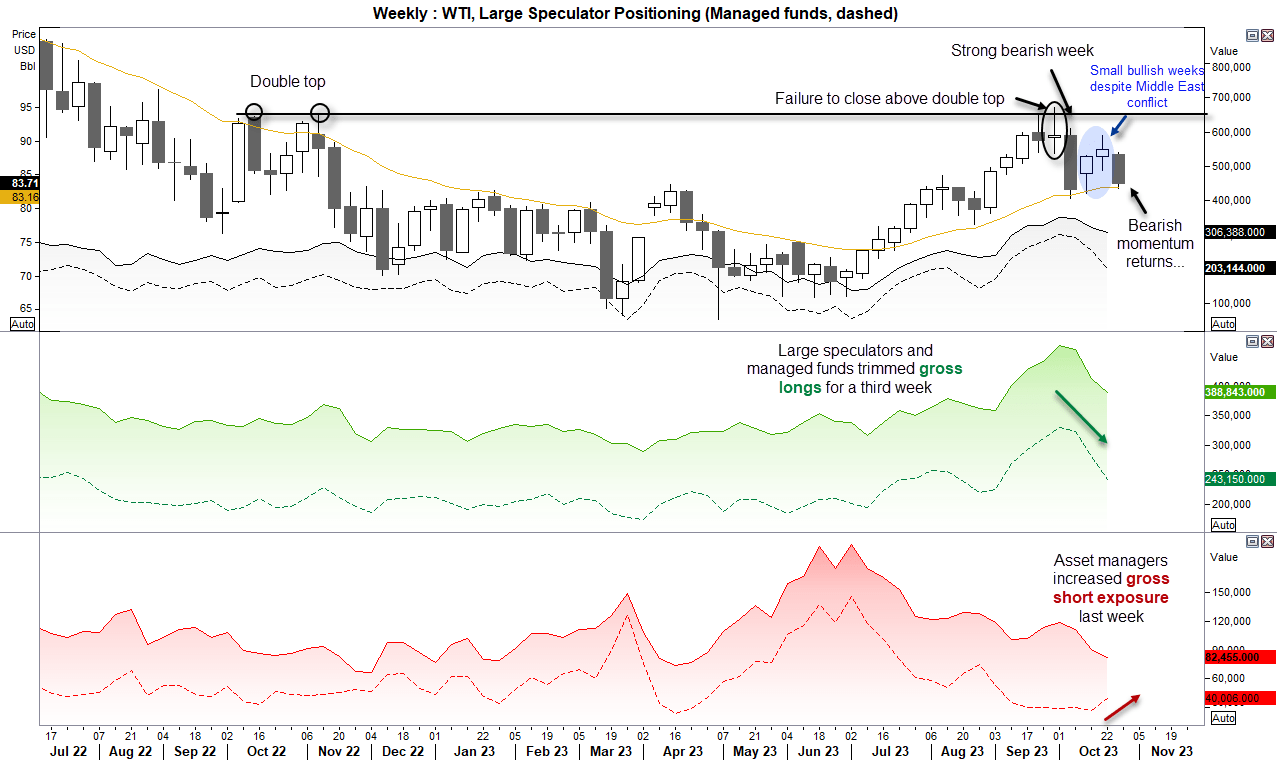

WTI crude oil technical analysis (weekly chart)

I noted in Monday’s COT report that large speculators and manage funds trimmed longs over the past three weeks, and that managed funds increase shorts last week despite the Middle East conflict. And it is worth mentioning again.

The weekly chart appears to be bearish over the near term to my eyes, and already we can see momentum has turned lower for the week. The Q3 rally failed to close above the ‘double top’ highs and formed an indecision week, before momentum turned swiftly lower. And the fact that we then saw two relatively small bullish candles whilst headlines of a Middle East conflict took centre stage further raised my bearish suspicion. Momentum has turned lower for the week, and if US GDP disappoints of Jerome Powell is more dovish (or less hawkish) as expected, it could reduce Fed hike expectations, weigh on short duration yields and oil prices. Weak data from Europe is also another factor which could weigh on oil prices, and in all the time the Middle East conflict remains contained, oil does not look overly bullish all of a sudden.

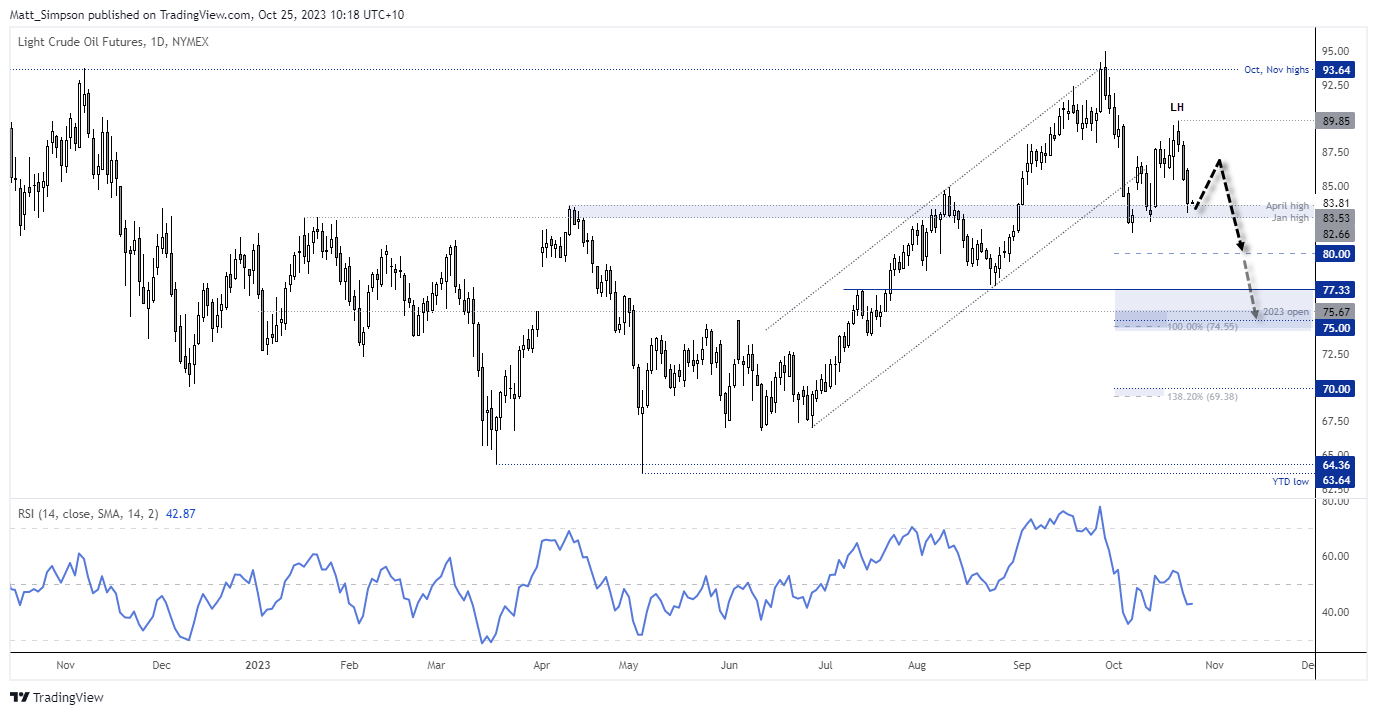

WTI crude oil technical analysis (daily chart)

The daily chart shows that bearish momentum since the September peak has outweighed the strength of bullish momentum leading up to the peak. To me that suggests there could be further downside to come, which leaves it a case of identifying adequate reward to risk ratios for bearish setups.

Given support has been found around the January and April highs, I’d prefer to see a bounce from current levels to allow a fade (sell into a rally), on the assumption that prices will finally break support and head for $80. A break beneath which brings 77.33 into view.

However, if this is the beginning of a deeper correction, $75 and $75 may not be out of the question, which reside near the 100% and 138.2% Fibonacci projection levels.

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge