Summary of RBA’s November statement:

- The board decided to raise rates by 25bp to 2.85%

- Inflation in Australia is too high – and forecast to peak at around 8 per cent later this year up from 7.75% previously)

- CPI inflation to be around 4¾ per cent over 2023 (CPI was to be a ‘little above 4%’ in the October statement)

- Medium-term inflation expectations remain well anchored, and it is important that this remains the case

- Australian economy continues to grow solidly, but growth is expected to moderate (with GDP’s forecast moderately lowered)

- Wages growth remains lower than other economies

- The board will pay close attention to labour costs and price setting behaviour from firms

- Outlook for the global economy is a source of uncertainty (which reads like a ‘get out of jail free card’ for the potential poor forecasts and policy errors ahead)

- The Board expects to increase interest rates further over the period ahead

- Incoming data to guide size and timing of futures hike

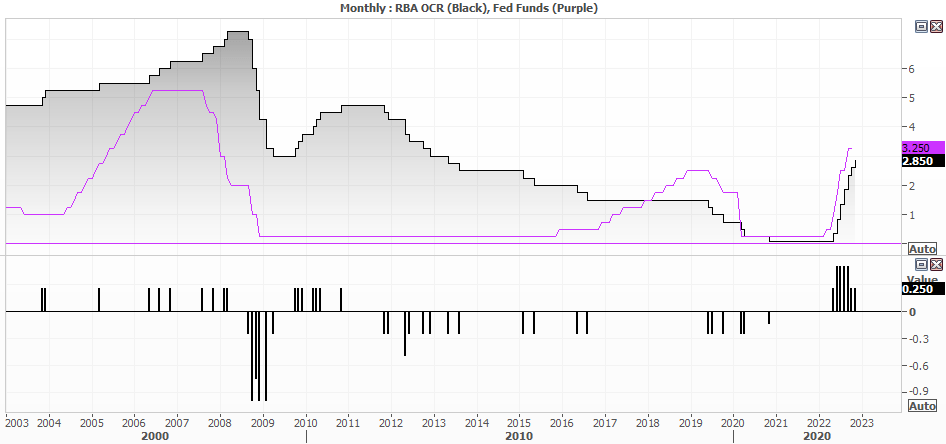

The RBA hiked the overnight cash rate by 25bp to 2.85% - its highest levels since 2013. It’s also their 7th hike this cycle which now totals 275bp from their 0.1% record low. More rate hikes are coming and the RBA seem content with 25bp going forward, as they’re seemingly happy to fight the inflationary fire with as little water as possible.

We’ll have to wait for the minutes of the meeting to see if the 25 v 50bp debate remained ‘finally balanced’. But skimming over the statement shows there is still a case for them to do so, given they have upgraded their inflation forecast for 2022 and 2023 – and future size and timing of hikes will be decided by incoming data.

Furthermore, RBA’s cash rate remains 50bp below the Fed funds after today’s hike. And that will widen to 125bp differential if the Fed do indeed go for the 75 bike this week. And if the highly anticipated hint that the Fed won’t slow down their pace of tightening, it adds pressure on the Fed to hike more aggressively further out. And that pressure will grow intensely if we see inflation expectations de-anchor and begin to rise.

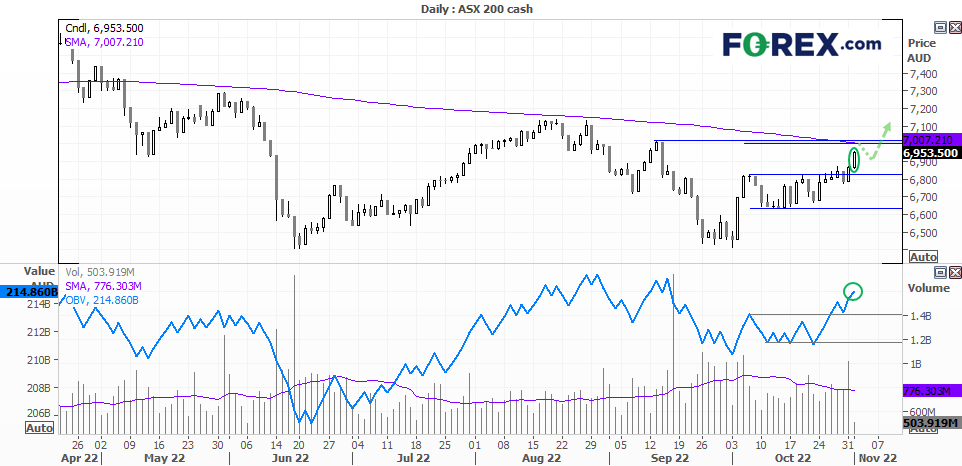

ASX 200 daily chart:

The ASX 200 has enjoyed today’s decision, and on Melbourne-cup day too. It now trades less than an average-day’s trade from 7,000 which sits right near the 200-day MA. Yesterday’s candle saw strong volume and the OBV (on balance volume) is trending higher with prices after breaking out of its own range. A test of 7,000 seems appealing – and a likely level for a pullback. But as long as global equities do not reverse course, an eventual break above 7,000 is currently favoured.

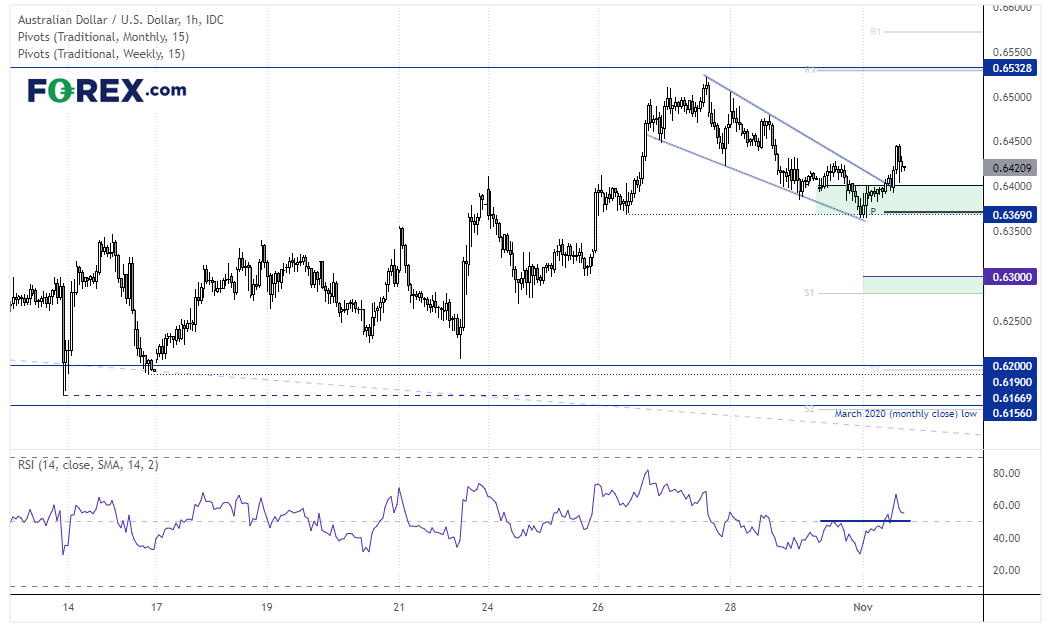

AUD/USD 1-hour chart:

The Australian dollar has pulled back from its October high, and price action appears to be corrective with some form of bearish wedge. Prices have broken higher thanks to China’s PMI data beating expectations (but still within contraction) before the RBA meeting handed back those gains. Ut with 0.6365 potentially marking an important low, low volatility dips may appeal to bears for a move to 0.6500.

How to trade with City Index

You can trade with City Index by following these four easy steps:

-

Open an account, or log in if you’re already a customer

• Open an account in the UK

• Open an account in Australia

• Open an account in Singapore

- Search for the market you want to trade in our award-winning platform

- Choose your position and size, and your stop and limit levels

- Place the trade

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.