Friday US cash market close:

- The Dow Jones Industrial fell -179.9 points (-0.53%) to close at 33,614.80

- The S&P 500 index rose -34.62 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index fell -197.383 points (-1.41%) to close at 13,837.83

Asian futures:

- Australia's ASX 200 futures are up 28 points (0.4%), the cash market is currently estimated to open at 7,138.80

- Japan's Nikkei 225 futures are down -230 points (-0.88%), the cash market is currently estimated to open at 25,755.47

- Hong Kong's Hang Seng futures are down -310 points (-1.42%), the cash market is currently estimated to open at 21,595.29

- China's A50 Index futures are up 6 points (0.04%), the cash market is currently estimated to open at 14,423.24

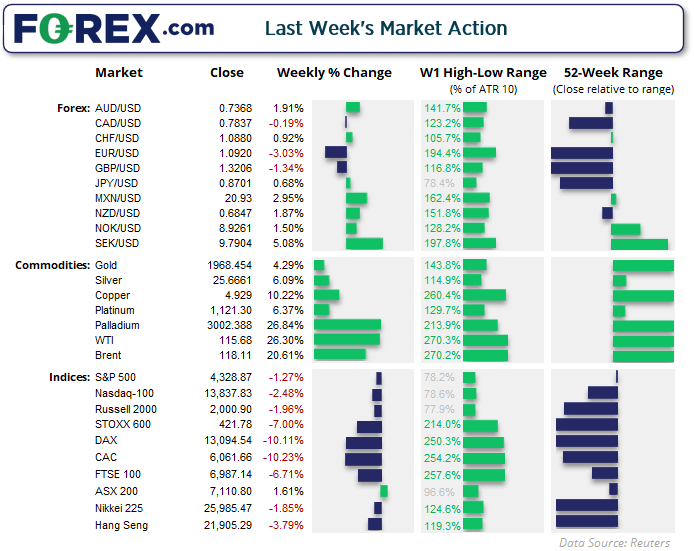

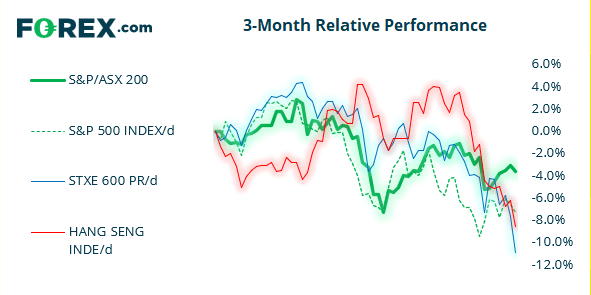

European equity markets bore the brunt of a widespread sell-off on Friday, which saw the DAX tumble to a 16-month low and the FTSE to a 4-month low. And it’s not often you see the DAX and CAC fall over -10% in a week, compared to just -1.3% on the S&P 500 and -2.5% on the Nasdaq. Of all the major benchmarks we track it was just the ASX 200 which managed to post a gain for the week, rising 1.6%.

ASX 200:

Perhaps not so surprisingly, the energy sector was the top performer last week and rose over 8%, closely followed by the materials sector. The index rose 1.6% but didn’t have a great end to the week, closing -0.57% although it initially fell over -1.8%. The index remains beneath its 20-day eMA and formed a hammer on Friday. Our bias remains bearish below 7200 and 7000 remains the initial downside target.

ASX 200: 7110.8 (-0.57%), 05 March 2022

- Consumer Staples (1.17%) was the strongest sector and Information Technology (-3.58%) was the weakest

- 8 out of the 11 sectors closed lower

- 6 out of the 11 sectors outperformed the index

- 53 (26.50%) stocks advanced, 135 (67.50%) stocks declined

Outperformers:

- +2.76% - Newcrest Mining Ltd (NCM.AX)

- +2.74% - Yancoal Australia Ltd (YAL.AX)

- +2.35% - Cromwell Property Group (CMW.AX)

Underperformers:

- -14.53% - Paladin Energy Ltd (PDN.AX)

- -8.02% - Zip Co Ltd (Z1P.AX)

- -5.74% - Sandfire Resources Ltd (SFR.AX)

Not a great week for the euro

Like their equities, the euro also took a battering last week and was broadly lower against all major currencies. EUR/AUD fell to a 4.5 year low, with the Australian dollar defying the gravity of risk-off trade due to roaring commodity prices. EUR/USD sank to its lowest level since May 2020 and EUR/JPY suffered its worst single-day loss since January 2019. The Swedish Krona was a top performer as it tracked oil higher, whilst the Australian dollar was the best performing major.

Gold closed to a 16-month high

Gold closed at its highest level since September 2020, at the high of the week. Clearly it has been a favoured safe-haven asset during the Ukraine crisis, although commodity prices are broadly higher in general due to fears of supply disruptions. The Thomson Reuters CRB commodities index rose to a 7-year high, and WTI closed at its highest level since August 2008.

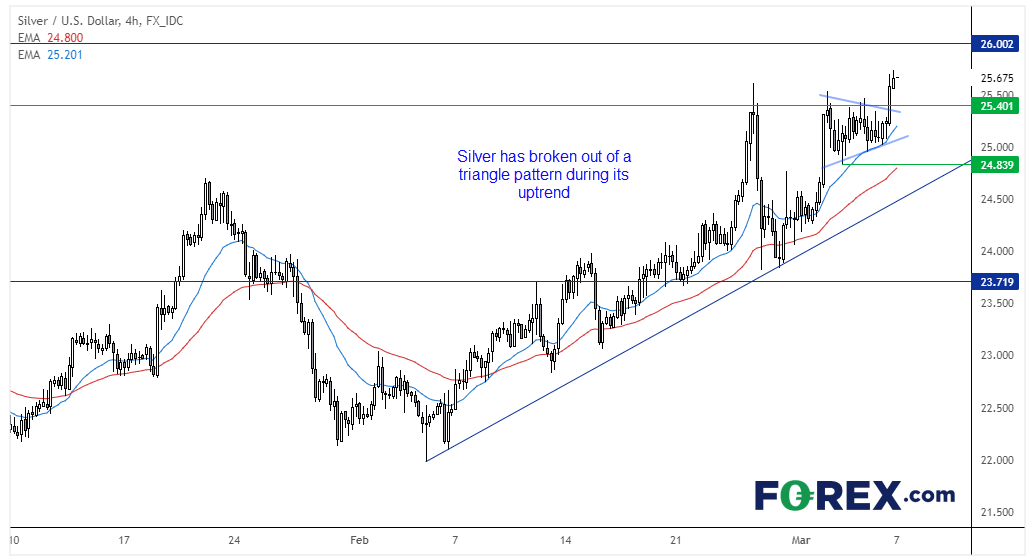

Silver bulls eye $26

With gold stealing the headlines it is easy to forget about silver. Yet it remains in a strong uptrend on the four-hour chart and prices broke out of an ascending triangle on Friday. We’d welcome any pullbacks toward 25.40 support, and if a higher ow forms around/above it then provides an area to consider for stops. $26 is the next level of resistance and makes a viable target for bulls.

Oil fuels the commodities rally

And there is currently little reason to believe that oil prices cannot continue higher, with US Secretary of State Antony Blinken confirming that they are in a “very active discussion” with European partners at the prospects of banning Russian oil and natural gas imports. Although what could potentially soften the blow is the revived Iran deal. WTI closed to its highest level since September 2008.

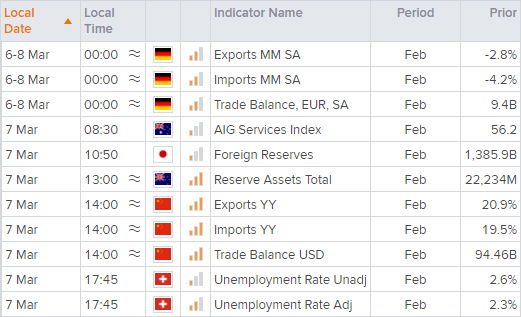

Up Next (Times in AEDT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.