Asian Indices:

- Australia's ASX 200 index rose by 34.4 points (0.49%) and currently trades at 7,006.00

- Japan's Nikkei 225 index has risen by 51.64 points (0.19%) and currently trades at 27,052.56

- Hong Kong's Hang Seng index has risen by 252.18 points (1.07%) and currently trades at 23,802.26

- China's A50 Index has fallen by -254.78 points (-1.7%) and currently trades at 14,769.78

UK and Europe:

- UK's FTSE 100 futures are currently up 47.5 points (0.64%), the cash market is currently estimated to open at 7,511.87

- Euro STOXX 50 futures are currently up 45 points (1.09%), the cash market is currently estimated to open at 4,219.60

- Germany's DAX futures are currently up 129 points (0.84%), the cash market is currently estimated to open at 15,600.20

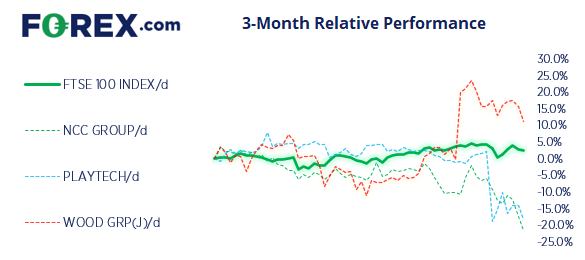

The KOSPI 200 was a top performer, rising 2.7% with the Hang Seng in second place at 2.7%. Shares in Japan were the weakest performers and are effectively flat for the day. We’re curious to see whether sentiment can improve in Europe as they have been the laggards of late, although futures markets point to a firm open. The STOXX 600 has failed to rally above 470 and that remains a key level for bulls to conquer. The FTSE closed on its 20-day eMA and formed a second consecutive inside day. Whilst compression suggests volatility is pending it provides little in the way of its next potential direction.

FTSE 100 trading guide

FTSE 350: Market Internals

FTSE 350: 4217.67 (-0.02%) 31 February 2022

- 277 (79.14%) stocks advanced and 69 (19.71%) declined

- 2 stocks rose to a new 52-week high, 6 fell to new lows

- 36.57% of stocks closed above their 200-day average

- 100% of stocks closed above their 50-day average

- 3.14% of stocks closed above their 20-day average

Outperformers:

- + 8.36% - XP Power Ltd (XPP.L)

- + 8.08% - Baillie Gifford US Growth Trust PLC (USAB.L)

- + 5.90% - Airtel Africa PLC (AAF.L)

Underperformers:

- -5.24% - NCC Group PLC (NCCG.L)

- -4.96% - Playtech PLC (PTEC.L)

- -3.81% - John Wood Group PLC (WG.L)

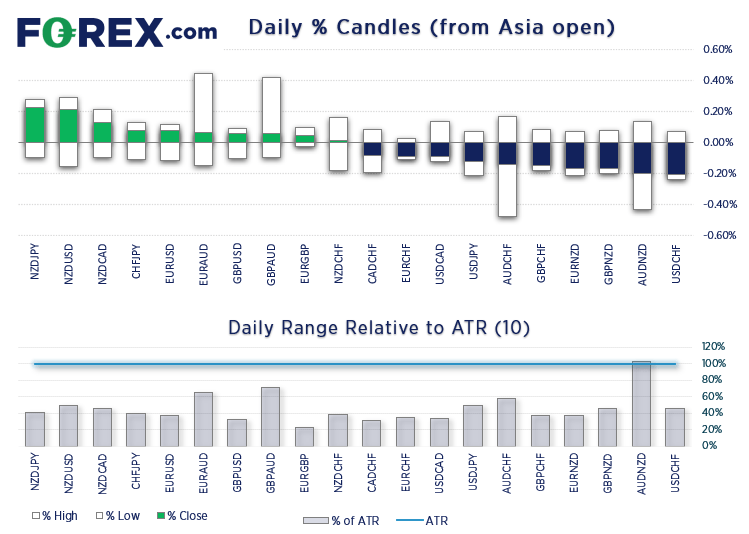

AUD weakest currency after dovish RBA meeting

Once again, the RBA reiterated their dovish stance in today’s meeting despite ending their QE program. They poured cold on any glimmer of hope of a hike this year, despite the Fed leading the way and other central banks in hawkish mode. The Aussie was broadly lower following the meeting but is now flat against (an also weak) US dollar.

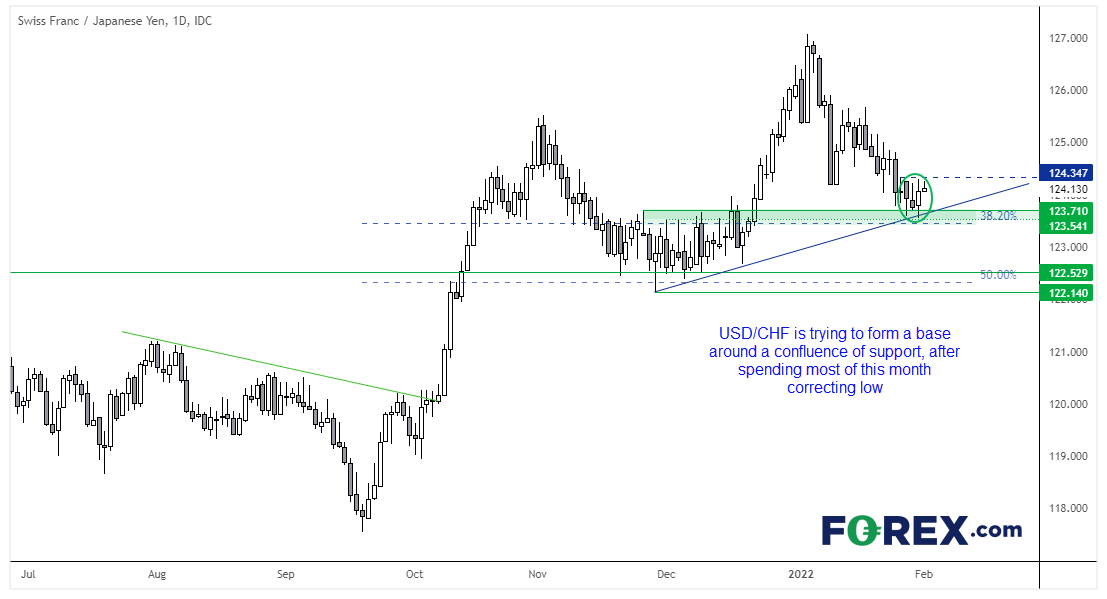

CHF/JPY to carve out its latest low?

The Swiss franc against the yen is not an immediate choice with currency traders but it is one we track as it can produce strong clean moves from time to time. Back in September it rallied 6.8% over the next month, then a further 4% in late December during risk-on trade. And as it tracks appetite for risk it could be an alternative market for bulls to consider if Wall Street extends yesterday’s rally.

The CHF/JPY daily charts shows that it has corrected lower for most of this year, although it is now trying to build a base around the 123.50-70 support zone (which is also near a 38.2% Fibonacci level). A bearish inside day formed on Friday followed by a bullish engulfing candle yesterday, so we’re no on guard for a decent break of yesterday’s high to signal its next leg lower.

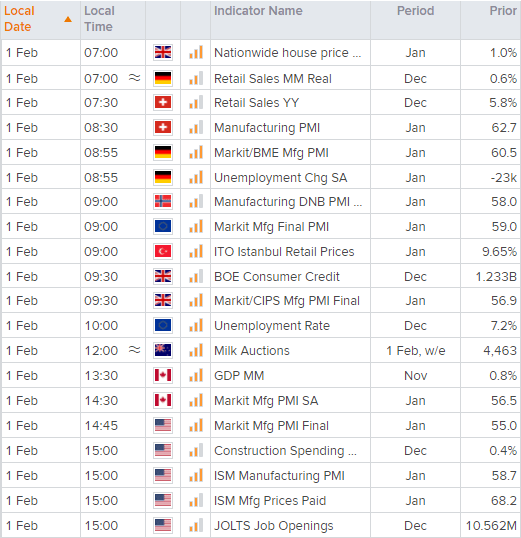

ISM manufacturing in focus at 15:00 GMT

ISM manufacturing data is scheduled for 15:00 GMT. December’s read revealed that, whilst activity had slowed somewhat, supply constraints were easing. But with the headline print at a 13-mont low of 58.8 then it continues to beg the question as to whether growth has indeed topped. And that remains a possibility given December’s report didn’t fully capture activity as Omicron swept its way across the globe, and the index peaked at 63.7 in March 2021.

Up Next (Times in GMT)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.