Monday US cash market close:

- The Dow Jones Industrial fell -39.54 points (-0.11%) to close at 34,411.69

- The S&P 500 index rose -0.9 points (2.51%) to close at 34,058.75

- The Nasdaq 100 index rose 17.548 points (0.13%) to close at 13,910.76

Asian futures:

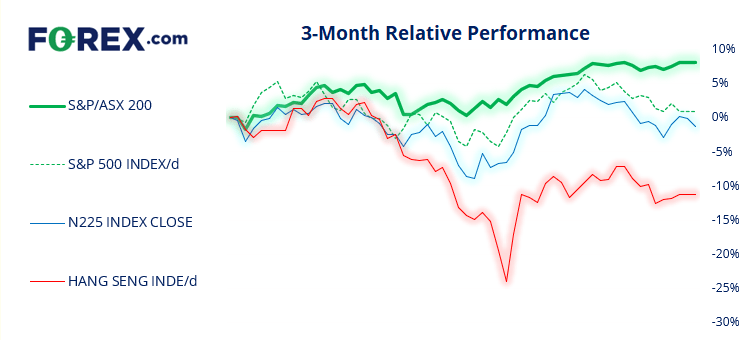

- Australia's ASX 200 futures are up 0 points (0.54%), the cash market is currently estimated to open at 7,523.40

- Japan's Nikkei 225 futures are up 170 points (0.64%), the cash market is currently estimated to open at 26,969.71

- Hong Kong's Hang Seng futures are down -169 points (-0.79%), the cash market is currently estimated to open at 21,349.08

- China's A50 Index futures are up 68 points (0.49%), the cash market is currently estimated to open at 13,879.12

US markets were open overnight although volatility and trading volumes were lower, due to the long Easter weekend. The S&P 500 and Nasdaq were effectively flat after a choppy session, with investors juggling higher yields alongside Russia’s latest round of attacks in Ukraine. Bank of America posted a strong quarterly earnings report. Markets in Australia, Hong Kong and Europe are set to reopen today.

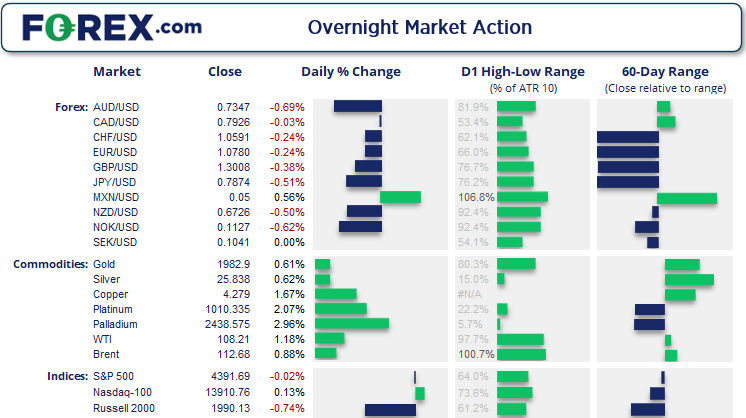

Oil prices rose for a fourth consecutive day with WTI tapping 109 before handing back some of its earlier gains. Natural gas rose another 8% and closed above 7.00. Gold tapped $2000 for the first time in 5-weeks although both gold and silver both printed bearish pinbars on the daily chart to warn of near-term exhaustion to their uptrends.

ASX 200:

ASX 200: 7523.4 (0.59%), 18 April 2022

- Materials (1.31%) was the strongest sector and Financial (-0.26%) was the weakest

- 10 out of the 11 sectors closed higher

- 1 out of the 11 sectors closed lower

- 7 out of the 11 sectors outperformed the index

- 146 (73.00%) stocks advanced, 43 (21.50%) stocks declined

Outperformers:

- +7.54% - Webjet Ltd (WEB.AX)

- +7.47% - Yancoal Australia Ltd (YAL.AX)

- +7.07% - Qantas Airways Ltd (QAN.AX)

Underperformers:

- -6.33% - Bank of Queensland Ltd (BOQ.AX)

- -4.56% - New Hope Corporation Ltd (NHC.AX)

- -3.42% - Ingenia Communities Group (INA.AX)

USD broadly higher following hawkish Fed comments

The US dollar index closed at its highest level since April 2020 following further bullish comments form the Fed. James Bullard thinks the Fed Funds rate should be at 3.5% by the year end which would require more than a 50-bps hike at each Fed meeting this year. Yet in an attempt to not sound too hawkish (which would take some doing) he said the base case is not for any hikes to be above 50 bps, so assuming all meetings deliver a 50-bos hike then the Fed are on track for rates to be at a target of 3.0% - 3.25%. In doing so he thinks the Fed can tame inflation without hurting the labour market, and still sees unemployment falling to below 3%.

The US dollar was broadly higher overnight and saw USD/JPY tap 127 for the first time since May 2002. EUR/USD closed below 1.08 for the first time in 20 years, AUD/USD fell to a 4-week low and NZD/USD a 7-week low. Separately, EUR/CAD hit two of our targets on Thursday following the BOC’s 50 bps hike, including the 1.3600 and the triangle target of 1.3550 which we set back in March.

Everything you need to know about the Federal Reserve

GBP/USD considers a break below 1.3000

The British pound was not spared either, with GBP/USD falling to a 3-day low and testing 1.3000. Two weeks ago we outlined our bearish bias on the pound and noted that prices were coiling up below the 1.3200 resistance zone. Since then, we have seen the pair form two lower highs, with the most recent at 1.3147 suggesting the pair may now be ready to complete wave five around 1.2900 or even 1.2800. Although as 1.2900 sits around the lower trendline of the bearish channel we may find it a higher probability target, at least initially.

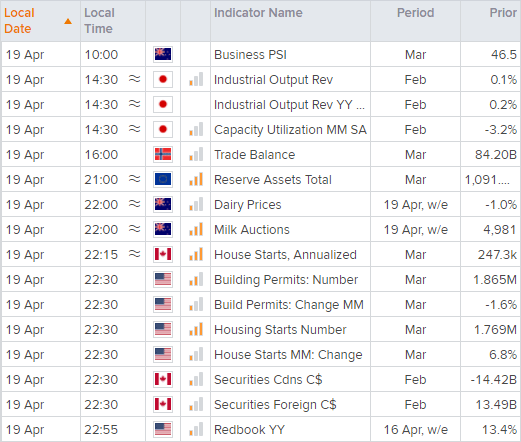

Up Next (Times in AEST)

How to trade with FOREX.com

Follow these easy steps to start trading with FOREX.com today:

- Open a Forex.com account, or log in if you’re already a customer.

- Search for the pair you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.