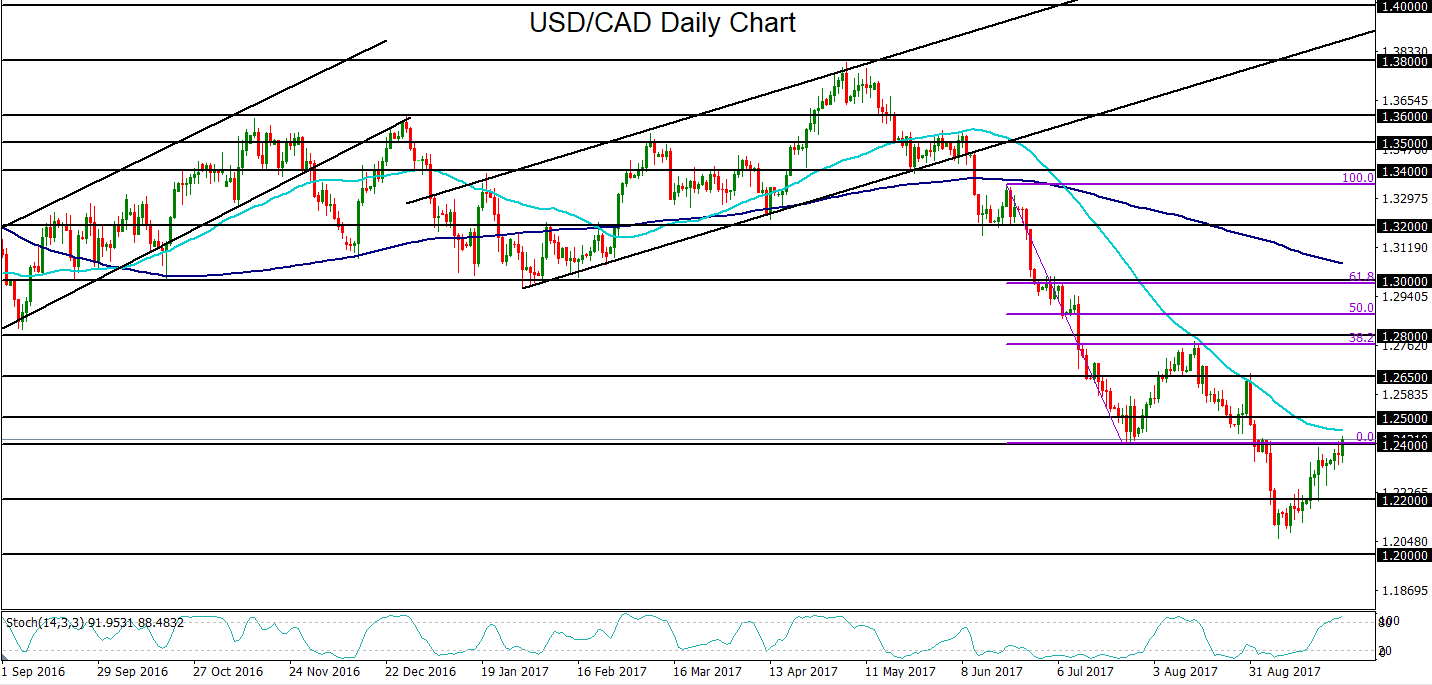

The Canadian dollar has not performed well against the rebounding and recovering US dollar within the past three weeks. And surging crude oil prices this month have not been able to help the typically energy-linked Canadian dollar from sliding sharply against the greenback. This CAD weakness against the USD in the past few weeks can be readily seen on the daily chart of USD/CAD, which shows the currency pair rising from more than a two-year-low around 1.2060 in early September up to its current position fluctuating above and around the key 1.2400-area price level.

The recent precipitous 4-month USD/CAD plunge from early May to early September was driven in part by the increasingly sharp contrast between a hawkish Bank of Canada and a hesitant US Federal Reserve that had seemingly become more dovish throughout much of this year. This dynamic shifted last week when the Fed issued its latest statement essentially affirming its objective for normalizing monetary policy and raising interest rates further. This provided a boost for the previously battered and well-oversold US dollar, which had already begun to rise off its recent multi-year lows.

Despite Fed Chair Janet Yellen’s warnings on Tuesday that the Fed may have “misjudged” labor market conditions and inflation expectations, which could ultimately warrant a slower rate of policy normalization, the US dollar remained well-supported and resumed its rise on Wednesday. Market expectations of a December rate hike by the Fed stayed well above 70% after Yellen’s comments, and even rose further to break above 80% on Wednesday.

On the Canadian dollar side, the currency took a further hit on Wednesday after Bank of Canada Governor Stephen Poloz stated in a speech that there would be “no predetermined path for interest rates,” and then went on to state that “monetary policy will be particularly data-dependent in these circumstances and, as always, we could still be surprised in either direction.” These statements come after the Bank of Canada recently established itself as one of the most hawkish major central banks when it raised interest rates back-to-back in July and September. Poloz’s Wednesday remarks appeared to back off from this hawkish stance.

Given this dovish-leaning tone from Poloz, if expectations continue to run high with respect to interest rate increases from the Fed, USD/CAD could be set to rise further. From a technical perspective, as noted, USD/CAD has tentatively broken above key resistance around 1.2400, which also represents previous support for the late-July lows. With any further follow-through to the upside and sustained rise above 1.2400 on a divergent shift in expectations between the Fed and BoC, near-term upside targets are at the 1.2500 and 1.2650 resistance levels.