Market Summary:

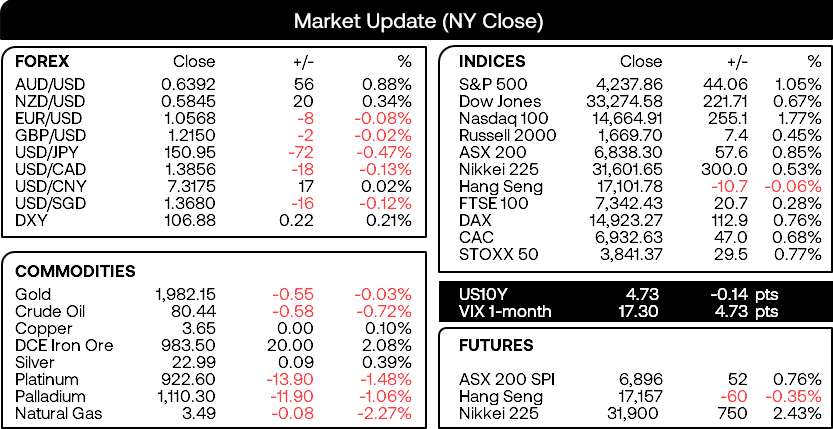

- The Fed left interest rates, tipped their hat to a strong economy and left the door open to a further hike. All of which was widely expected. However, markets took more notice of Powell’s comments that the Fed have “come far”.

- The ISM manufacturing report also shows the sector contracted faster than expected, falling to 46.7 from 49 previously (below 50 denotes contraction). New orders, process paid and employment also contracted to point to a rare weak sept in the economy. If backed up by a weaker ISM services report, it further solidifies up a case for the Fed being done with hikes.

- Fed fund futures continue to imply the current target rate range 5.25-5.5% is the terminal rate, and the odds of a hold in December have risen to 80.12% compared with 68.9% the day prior and odds of a January hike fell to 26% compared to 34.6% the day prior.

- US bond yields from the 2-month to the 30-year were all lower by Wednesday’s close, with the 2-year and above retracing over 10bp and bond prices rose

- This allowed Wall Street to rise for a third day with the Nasdaq 100 taking the lead with its 1.8% gain

- Gold closed the day flat but its lower wick hints at support around 1970 over the near-term. But we may find that gold prices remain trapped in the broader 1950 – 2000 range over the foreseeable future.

- New Zealand’s unemployment rate rose to 3.9% q/q, adding further conviction to calls that the RBNZ have reached their terminal rate of the tightening cycle

- Australian building approvals contracted -4.6% in September, although it is a notoriously volatile number at the best of times. The annual rate was -7.1% lower

Read AUD monthly wrap: November 2023 for a broader overview of the Australian dollar

Events in focus (AEDT):

- 10:50 – Japan’s foreign bond/stock purchases, monetary base y/y

- 11:30 – Australian housing finance, trade balance

- 18:30 – Swiss CPI

- 22:30 – Challenger job cuts

- 23:00 – BOE interest rate decision, MPC votes

- 23:30 – US jobless claims, unit labour costs

- 01:00 – US durable goods orders

- 01:15 – BOE governor Bailey speaks

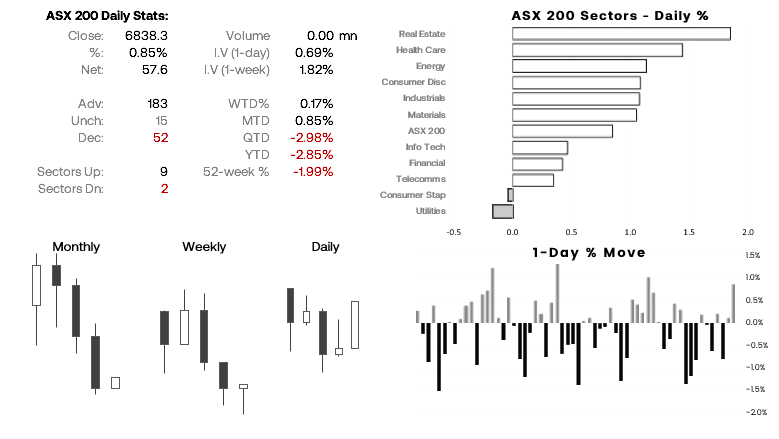

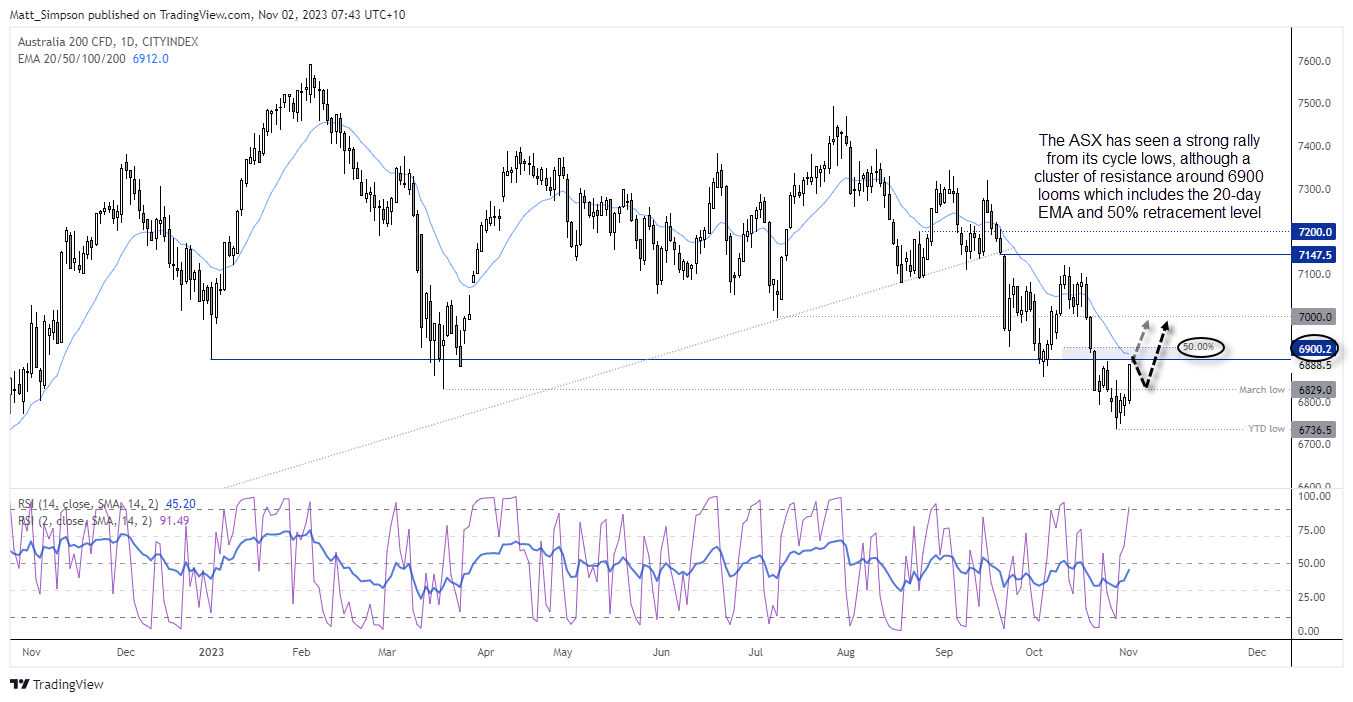

ASX 200 at a glance:

- The ASX 200 cash index enjoyed its best daily performance in three weeks on Wednesday to provide further evidence an important swing low may have formed on Monday

- 9 of the 11 ASX sectors rose on Wednesday, led by real estate and healthcare sectors

- A fly in the ointment for any runaway rally may be a hawkish RBA on Tuesday, but that could still allow the ASX time to extend a countertrend move heading into the weekend – assuming Wall Street and APAC stocks extend their gains

- Furthermore, its rally stalled around a key area of resistance including the 6900 handle, 20-day EMA and 50% retracement level

- It therefore may require a strong response from APAC stocks for the ASX to get swept away and produce a solid break of daily close above this level, or risks choppy trade around resistance

- Given the multi-week bullish divergence, an eventual upside break is the bias

- Yet with the RSI (2) in overbought with prices beneath a resistance zone, perhaps a pullback could help with a better-timed dip to consider around a lower support level

- In either case, I suspect 7,000 may also provide strong resistance

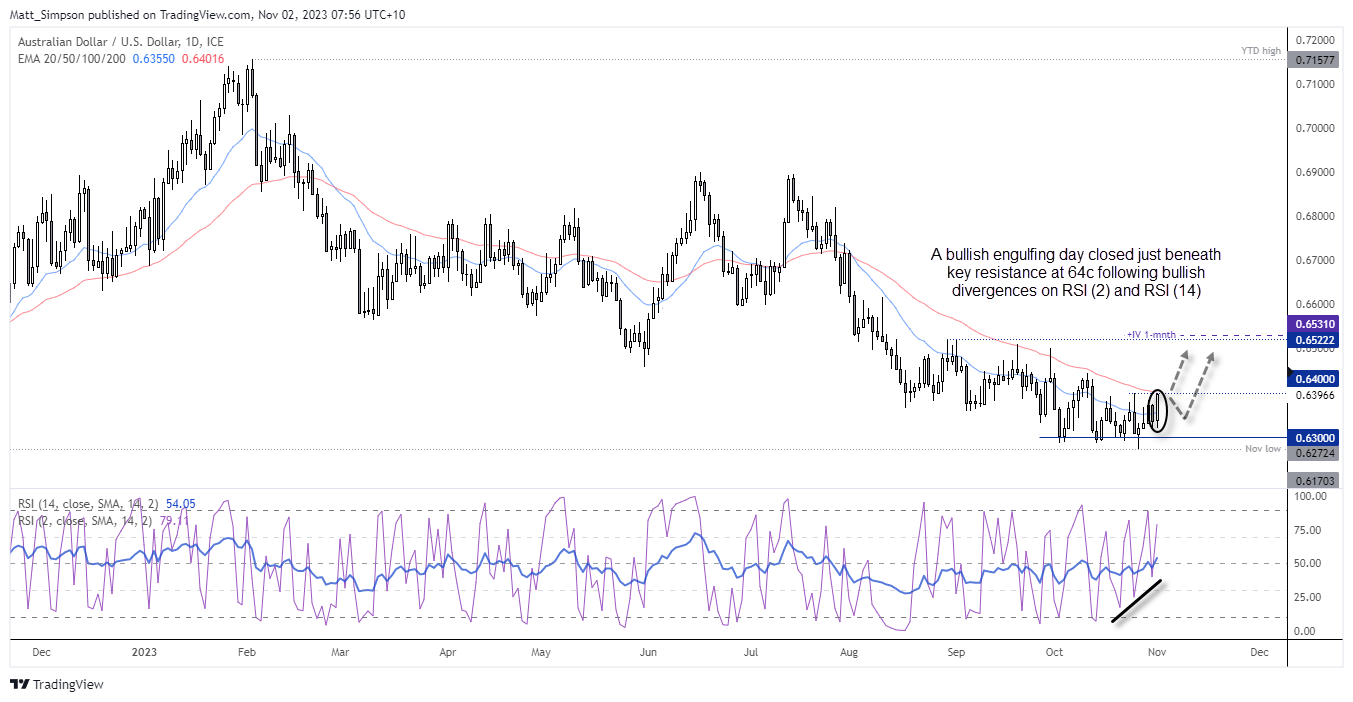

AUD/USD technical analysis (daily chart):

I have repeatedly noted the ability for AUD/USD to defy bears a sustainable break beneath 63c. And with a bullish divergence forming on the RSI (14) and more recently the RSI (2), I have been seeking dips towards 63c and for moves towards 64c. However, Wednesday’s bullish engulfing candle shows a change in sentiment within that range and suggests a break could be pending. The engulfing candle closed at the high of the day, just beneath the 64c handle and 50-day EMA. So it seems to be more of a question as to whether we’ll see a direct break higher, or initial pullback within range (to satisfy dip buyers) ahead of the expected break. Of course, a weaker US dollar and bond yields would help with any such break, and a hawkish RBA and refreshing bout of improved data from China could help extend any such rally from these cycle lows.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge