A lively start to the week saw gold plunge alongside the US yield curve, the Dow Jones leave the S&P 500 and Nasdaq 100 for dust to reach a record. The USD index also provided a minor pullback to allow EUR/USD back above 1.05.

Gold posted its worst day's decline in four years thanks to two key developments: Israel agreed to a ceasefire deal with Hezbollah "in principle" and Trump nominated Scott Bessent as US Treasury Secretary, both of which likely saw gold's safe-haven demand drop alongside prices. While Bessent's economic views tend to back economic growth and therefore be seen as inflationary, he is deemed as a highly experienced, level-headed safe pair of hands for Trump's cabinet. And someone who may take the sting out of some of Trump's policies, such as aggressive tariffs which many feared were indeed inflationary.

This saw investors step back into the bond market with gusto, particularly at the middle-to-long end of the curve (10-30 years) and suppress yields. The 10, 20 and 30-year yields suffered their worst day in three months, the 2-year its worst in two months.

Still, the 200-day MA is nearby to provide potential support over the near term. But if Bessent lives up to expectations, we may see the sting taken out of Trump trades which could cap gains on the USD and yields, if not send them lower.

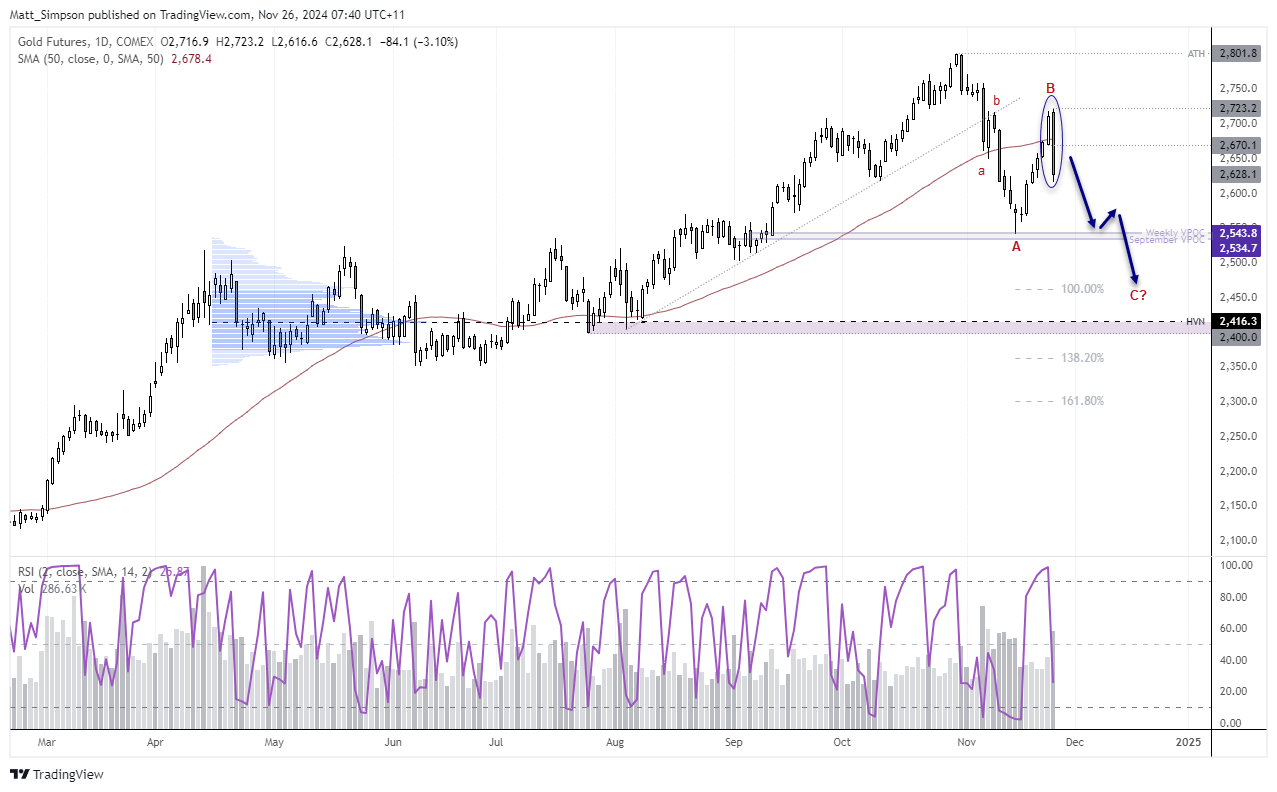

Gold technical analysis:

A prominent bearish engulfing candle has formed on gold’s daily chart, with its 3% loss on the day being its worst since November 2020. Daily volume was its highest in nine days, suggesting that bears piled in while bulls also ran for cover.

Given the decline from the all-time high (ATH) to the weekly and monthly volume points of control (VPOC) occurred in three waves, it is likely that the 2541.5 low marked the end of wave ‘a’ for an ABC correction. Assuming Monday’s high was the end of wave ‘b’, wave equality for wave ‘c’ could land around 2460.

The bias is for gold prices to continue lower, which could allow bears to fade into rallies. Note that Friday’s low (2670) lands around the 50-day SMA (2678), which could allow bears to reload if prices retrace there.

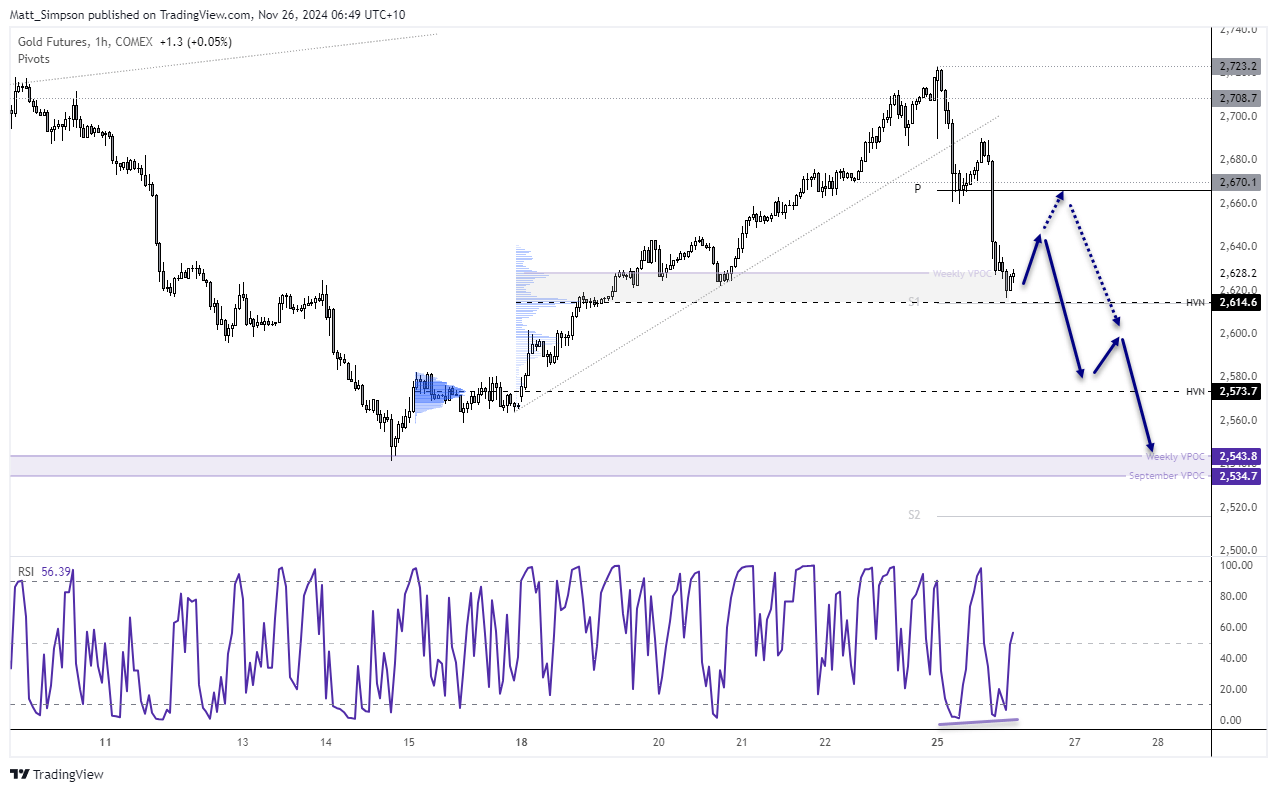

The 1-hour chart shows a strong bearish trend has developed. Support has been found around a high-volume node (HVN) and weekly S1 pivot at 2614.6, and a bullish divergence has formed in the oversold zone on the RSI (2). Perhaps we’ll get at least a minor bounce before prices continue lower. Note another HVN at 2573.7 and the weekly and monthly VPOC’s around 2340 which could provide potential support along the way.

Events in focus (AEDT):

- 10:50 – JP corporate services price index

- 16:00 – JP CPI (BOJ)

- 16:00 – SG industrial production

- 19:00 – UK BOE, PMC member Pill speaks

- 21:00 – EU ECP McCaul speaks

- 00:00 – US building permits

- 01:00 – US house prices

- 02:00 – US consumer sentiment

- 06:00 – US FOMC minutes

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge