Market Summary:

The RBA are widely expected to hike their cash rate by 25bp today, and quite rightly so. The current rate of 4.1% remains relatively low compared with their peers, and with inflation not softening quickly enough it leaves little choice but for the RBA to hike to 4.35% and retain a hawkish tone. If they don’t, the RBA risks losing credibility very early under Michelle Bullocks tenure. At the very least, the statement needs to include the classic signoff “Some further tightening of monetary policy may be required”. So, it really comes down to how hawkish the markets perceive the statement and how many more hike/s they believe will follow, as to how markets will react.

- Australia’s PM Albanese has become the first to meet with China’s Xi Jinping in over seven years, after their meeting in Beijing on Monday

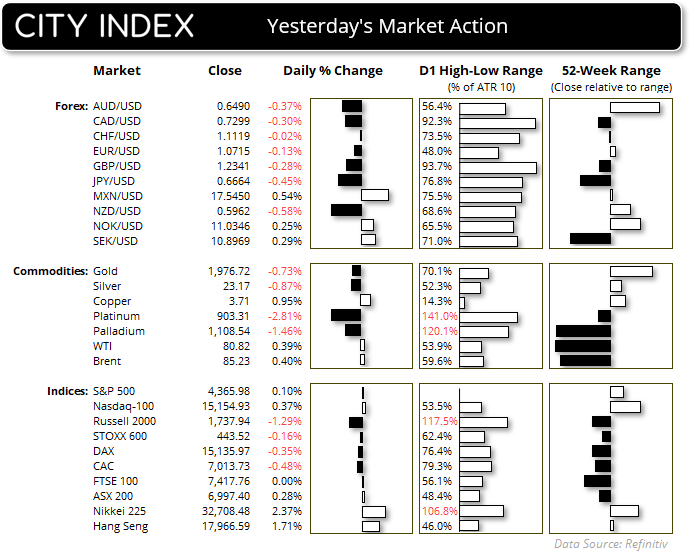

- Rising US bond yields saw the US dollar recoup some of Friday’s losses and its FX major peers retrace, although volatility remained low overall

- It was a very quiet session on Wall Street with US indices trading in tight ranges around last week’s highs

- Gold formed a bearish engulfing day following Friday’s shooting bar (which itself was a lower high and false break of $2000). The path of least resistance appears lower for a potential move to 1950 - 1960 from a technical perspective

- WTI crude oil continues to meander around its 200-day EMA yet hold above $80, a clear level of support for oil bulls to defend over the near-term

Events in focus (AEDT):

- 10:30 – Japan’s average cash earnings, China trade balance

- 14:30 – RBA cash rate decision, statement

- 16:00 – German industrial production

- 19:35 – Eurozone PPI

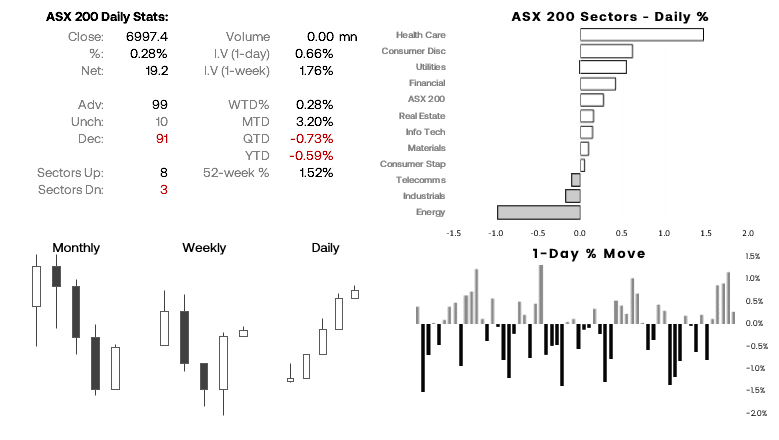

ASX 200 at a glance:

- The ASX 200 has produced a strong rally into the 7,000 handle leading into today’s RBA meeting

- The 50-day EMA is also capping as resistance which makes the 7,000 area the more pivotal

- Failure for the RBA to deliver a hawkish tone alongside a hike risks sending the ASX 200 higher and brings the 7100 resistance zone into focus

- A hawkish tone could mark a swing high and see the ASX 200 move towards 6900 (the more hawkish the tone, the deeper the move lower could be)

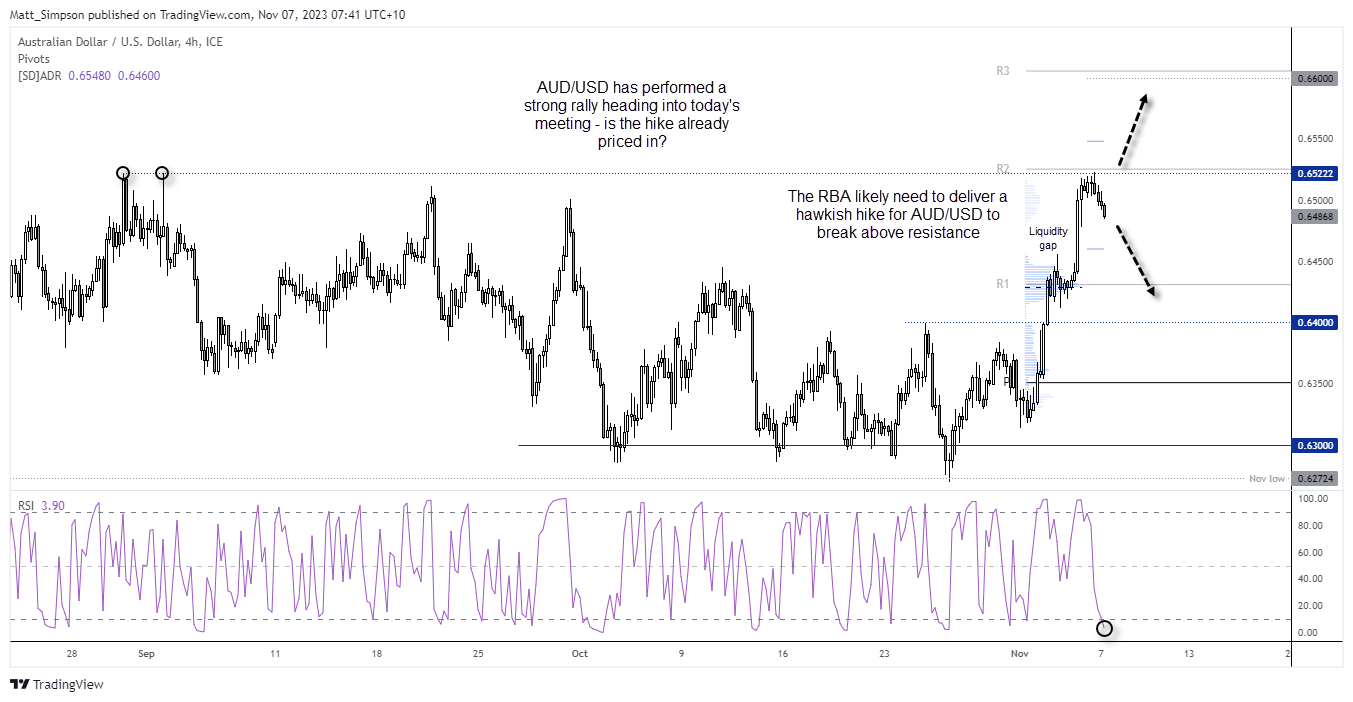

AUD/USD technical analysis (4-hour chart):

As AUD/USD has already posted strong gains heading into today’s meeting, is begs the question as to whether the anticipated 25bp hike has already been priced in. And that risks a move lower on AUD/USD if the RBA simply deliver the expected hike and stop short of including a hawkish bias (threat of further hikes).

Monday’s high met resistance around the September highs (and double top) and the monthly R2 pivot point, making it an important level of resistance for bulls to conquer. Prices are pulling back, and they might continue to do so heading into the meeting as prices try to fill the ‘liquidity gap’ left during its strong rally.

If the RBA fumble the meeting, a move to 0.6430 seems plausible given the high-volume node (which can act as a magnet for prices) which sits near the monthly R1 pivot. A break beneath it brings 0.6400 into focus.

A hike could send AUD/USD back to the cycle highs, but a sustainable break above it may require a hawkish hike.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge