Military analysts often draw a distinction between "hot" wars, which involve armed military conflict between nations, and "cold" wars, where enemy factions use economic and political means to jockey for an upper hand against their rivals. While we feel the term "currency war" is a bit overhyped by the media, the recent easing actions by the world’s most powerful central banks make the cold/hot currency war analogy too perfect to ignore. As the war heats up, we’re seeing how effective each central bank’s "weapons" (policies) are on the actual "battlefield" (the market).

This year’s initial shot was fired by the Bank of Japan back in late January when Haruhiko Kuroda and company shocked traders by cutting Japan’s main interest rate to -0.1%. Though this was hardly the first time a major central bank has enacted a negative interest rate policy (NIRP), it is the first time the BOJ has crossed that Rubicon despite decades of lackluster economic growth and inflation. However, the BOJ’s NIRP weapon turned out to be a dud in the battlefields of the market: the yen initially fell, but within a week, the currency had risen far beyond its pre-announcement level to hit multi-year highs against most of its major rivals. If the BOJ had hoped that its actions would stimulate exports by weakening the yen, it couldn’t be more disappointed by the result. Now the BOJ is doubling down on interest rate cuts, noting that it could theoretically reduce interest rates to -0.5% if needed.

Last week, the ECB sought to break out a big bazooka of its own with a suite of easing measures including decreases to three separate interest rates, an expansion of its QE program, and structural tweaks to other easing measures. Much like the BOJ though, this attempt to devalue the euro was extremely short-lived: the euro had reversed its earlier losses within a few hours and has since rallied to test its 5-month high against the US Dollar.

After years of denying that they’re actively seeking to devalue their currencies, developed market central banks are becoming increasingly explicit in their efforts to drive down their currency values. It’s an open secret that the Bank of Japan stands ready to intervene if the yen strengthens further (XXX/JPY falls); indeed, some speculate that the central bank conducted a "rate check," a common precursor to intervention, in the depths of the USD/JPY drop on Thursday. Earlier this week, we also noted that the Swiss National Bank has resorted to explicit threats of direct intervention in the currency market, perhaps favoring this more direct policy after witnessing the recent failed maneuvers of the BOJ and ECB.

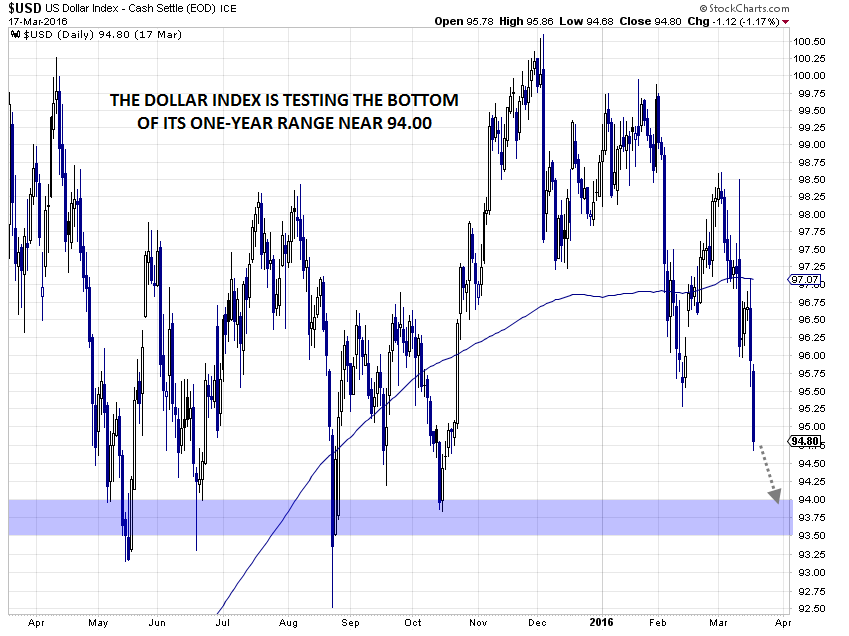

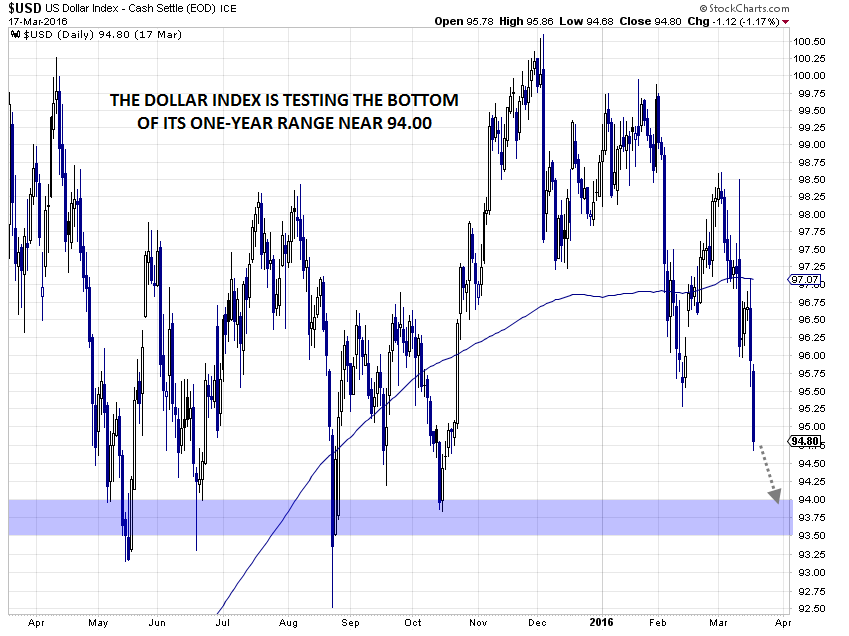

Amidst this backdrop, the Fed took a dovish plunge of its own earlier this week. Even though (or in a roundabout way, perhaps "because") the Fed didn’t make any actual changes to its policy, the dollar has dropped precipitously as the median FOMC member’s expectation for interest rate increases this year dropped from four to just two rate hikes. We’re hesitant to declare it "DDV-Day" (Dollar Devaluation Victory Day) so soon, but the dollar index is holding at its lowest level in five months and is within striking distance of the bottom of its one-year range near 94.00.

Source: Stockcharts.com, FOREX.com. Note that this chart is only updated through Thursday’s close.

So why has the currency war heated up?

In a word: trade.

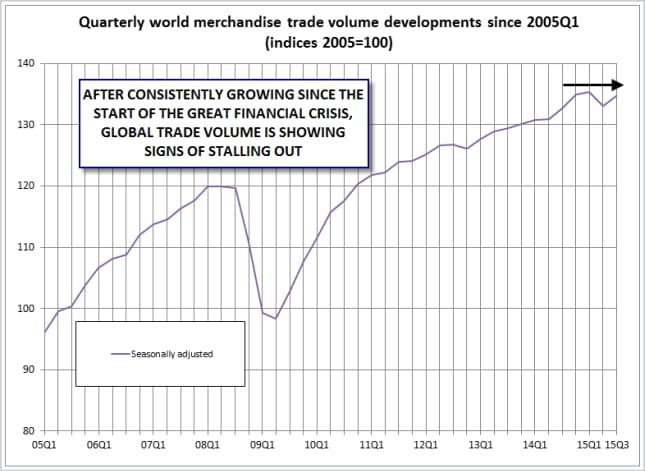

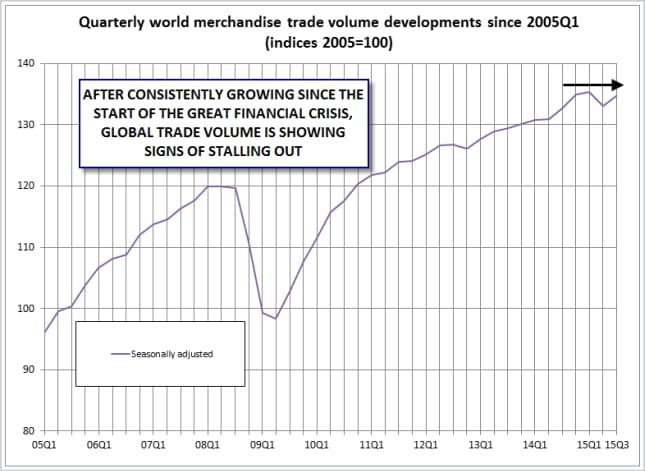

Since the depths of the Great Financial Crisis in 2009, global trade has expanded consistently, quarter-by-quarter, creating an ever-increasing global pie so that each country could see steady growth in international trade. For the first time in seven years though (see below), global trade is showing signs of flattening out, meaning that each country now has to fight harder to secure its same sized piece of the global trade pie. The longer that global trade growth continues to flat-line, the more aggressively central banks will try to devalue their currencies (note we’re not referring to just the value, which can fluctuate with day-to-day currency movements, but the actual volume of trade here).

As a final note, it’s one thing to analyze these figures on a macroeconomic, ivory tower perspective, but what these figures mean on a more granular level is that governments are earning less in tax revenue, international firms are seeing their profits shrivel up (and in some cases are being forced into bankruptcy), and long-tenured employees are getting laid off. Against this backdrop, it’s not surprising that we’ve seen a rise of protectionist, anti-free trade rhetoric and actions in the political sphere; this trend too could get worse before it gets better, though history argues that restricting trade often does more aggregate harm than good.

Source: FOREX.com