- The BOJ abolished negative interest rates and yield curve control in March

- It will continue to buy Japanese bonds to limit rising yields

- Markets are now waiting to see whether BOJ Governor Ueda will signal further hikes to come

- USD/JPY and Nikkei 225 rallied on the as-expected announcements

A historic day for Japanese markets with the Bank of Japan (BOJ) hiking interest rates for the first time since 2007, doing away with negative interest rates in the process. However, having been priced in for months, and leaked to the media prior to Tuesday’s decision, the reaction in markets was negligible. It’s now over to the Fed to drive the price action over the remainder of the week.

What changes did the BOJ make?

The BOJ lifted its key overnight interest rate from -0.1% to a range of between 0 to 0.1%, doing away with negative interest rates in place since 2016. It also announced it will end purchases of ETFs and Japanese real estate investment trusts. Corporate bond purchases will be reduced before concluding the program in around one year.

But it will continue to buy Japanese bonds

It officially scrapped yield curve control, the mechanism of artificially suppressing 10-year Japanese bond yields around 0%. However, the bank said it will continue to purchase Japanese government bonds around the same pace as before. The BOJ said it would respond "nimbly" to a rapid rise in yields, providing a powerful reminder that it is unwilling to relinquish full control to market forces.

The full details of the policy decision can be found here.

One and done or more to come?

Attention now turns to BOJ Governor Kazuo Ueda's press conference where the first question will surely be whether the bank will hike interest rates again. The answer may deliver more volatility than what was seen around the official announcement, which wasn’t a lot. The lack of surprise in today’s decision points to Ueda being non-committal.

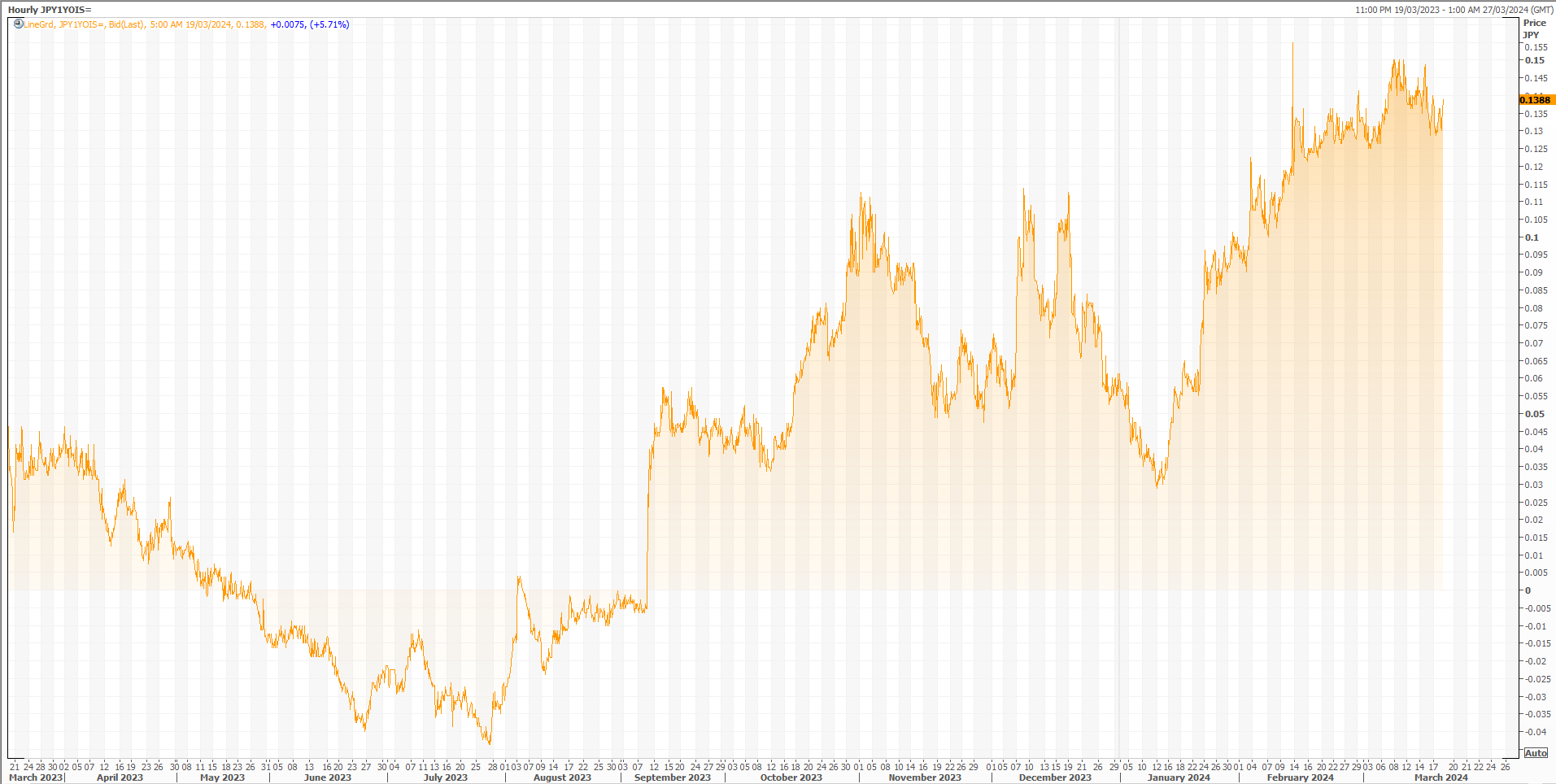

The truth is today's outcome had been priced for months; a fact underlined by almost zero movement in Japanese one-year overnight index swaps which indicate where markets see the BOJ’s overnight rate sitting in 12 months. After today's move, markets are not convinced the BOJ will follow through with another over the next year. A partial risk is priced.

Source: Refinitiv

USD/JPY, Nikkei rally as certainty restored

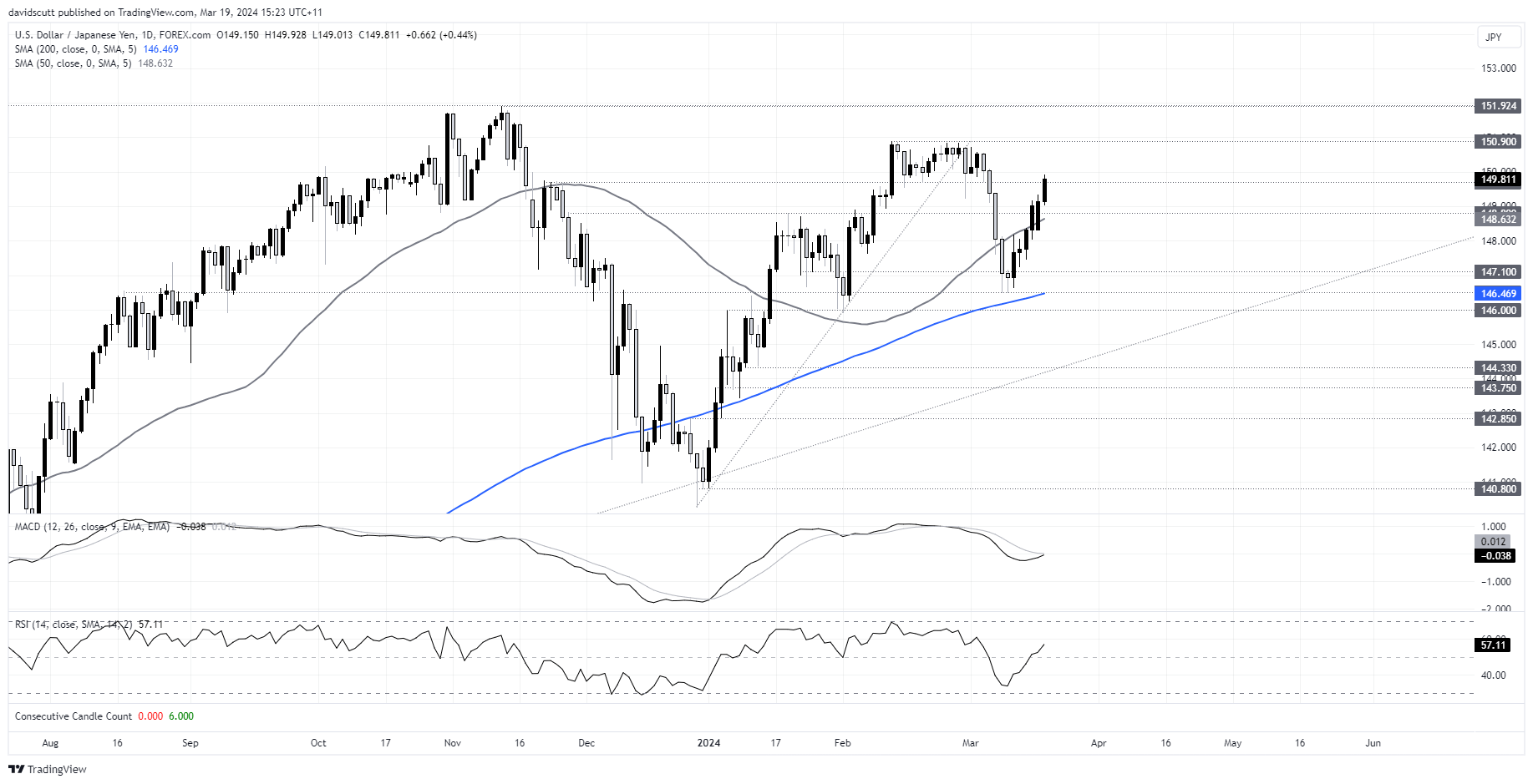

USD/JPY rallied following the BOJ announcement, pushing above resistance at 148.80 in the process. Should it gain a foothold above this level, a retest of resistance at 150.90 could be on the cards. Should the Fed signal fewer rate cuts in its updated economic projections on Wednesday, there's every chance it could get there, putting the multi-decade high just under 152.00 in sight.

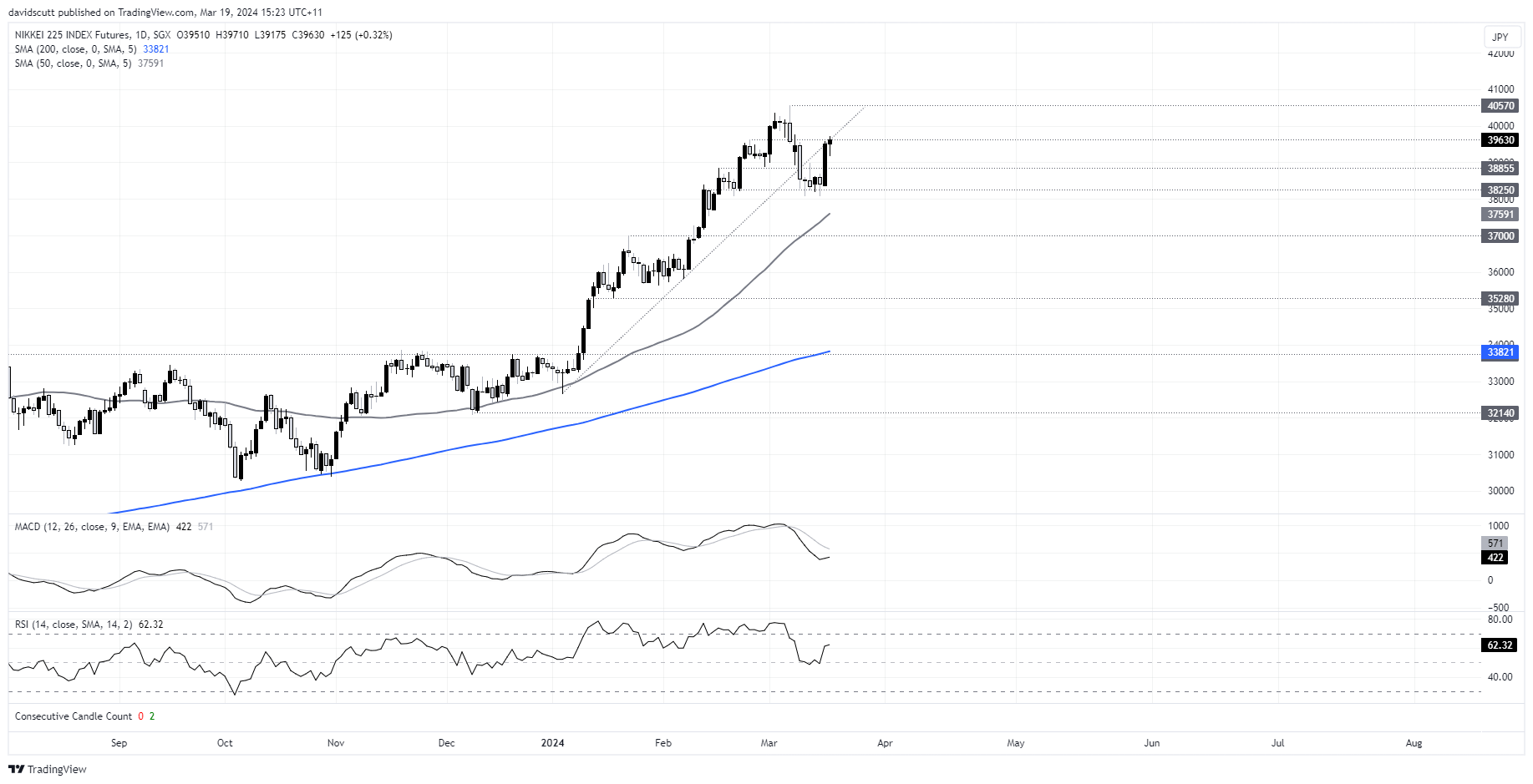

With the yen weakening against a basket of major currencies, Nikkei 225 futures performed an abrupt about face during the session, rebounding to trade around breakeven after momentarily testing the intersection of horizontal resistance at 39620 and former uptrend support. A break higher from there would put a retest of the record highs in play. Given the relationship with USD/JPY, the weaker yen should provide tailwinds for Japanese equity market near-term. Below, support is located at 38855 and 38250.

-- Written by David Scutt

Follow David on Twitter @scutty