USD/JPY Talking Points:

- A strong reversal showed in USD/JPY on Friday following results of Japanese elections.

- That bearish push continued through this week’s open until the 141.69 level came into play, helping to prod a bounce. I’m still looking at USD/JPY as a wild card for this week. I believe there’s bearish fundamental backdrop given the carry scenario in the pair. But, shorter-term, there’s been a deductive bullish push after the pair’s failed breakdown at 140.00 the week of the FOMC rate cut.

- I’ll be discussing these setups in-depth in the weekly webinar: Click here for registration information.

USD/JPY was slammed by more than 400 pips on Friday and that threw a wrench in the recent bullish drive in the pair. To be sure, there’s an explanation for a bearish fundamental backdrop, particularly after the Fed kicked off a cutting cycle.

USD/JPY opened 2021 below 103 and just before the FOMC began hiking in March of 2022, it was all the way down around 115.00. This summer the pair hit a fresh 37-year high above 161.00 and the motive for that drive was rate differentials between the two economies. USD/JPY is perhaps one of the more illustrative examples of the carry trade where traders could earn rollover for being long while being forced to pay rollover if short. That incentive, of course, drove behaviors and this is why USD/JPY put in such a massive incline over a three-plus year period.

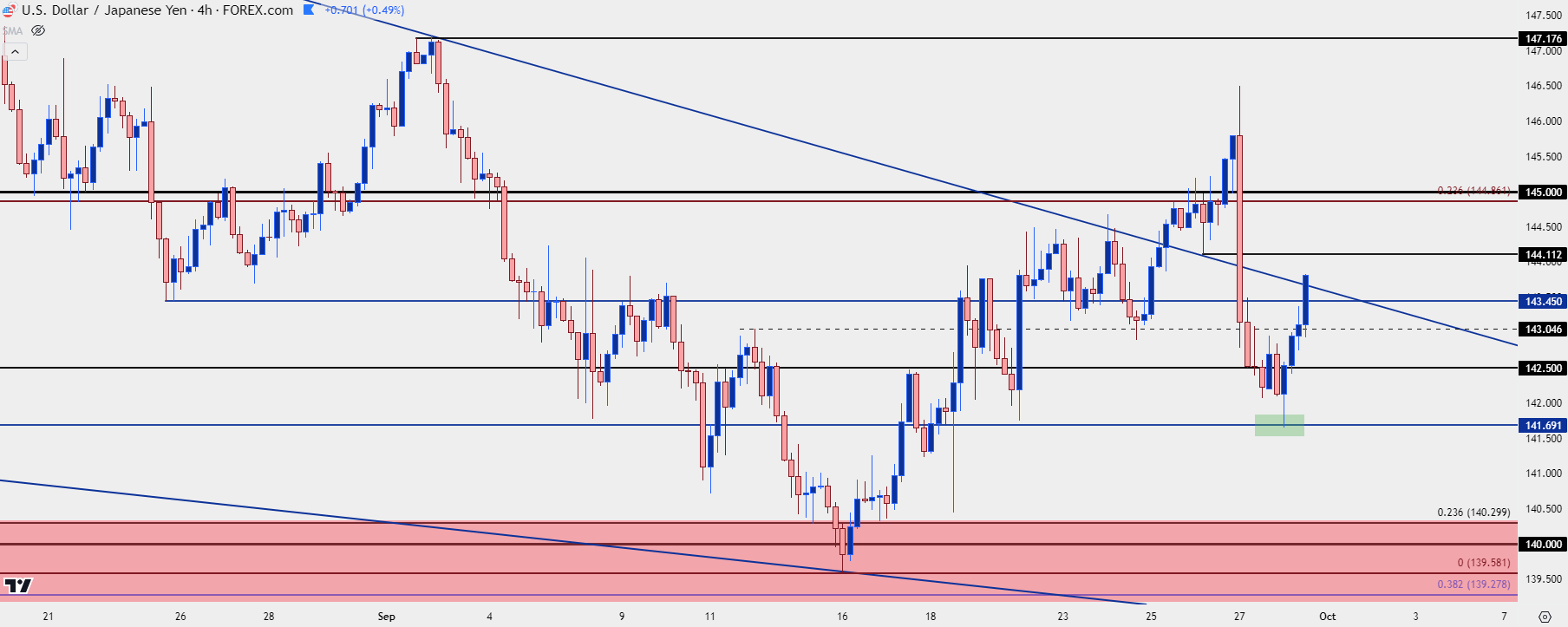

Since I recorded the video linked above, USD/JPY has continued to push-higher and is currently testing through 143.45. I’m tracking next resistance at 144.11 and then am expecting another big test around the same 145.00 handle that was in-play last Thursday.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

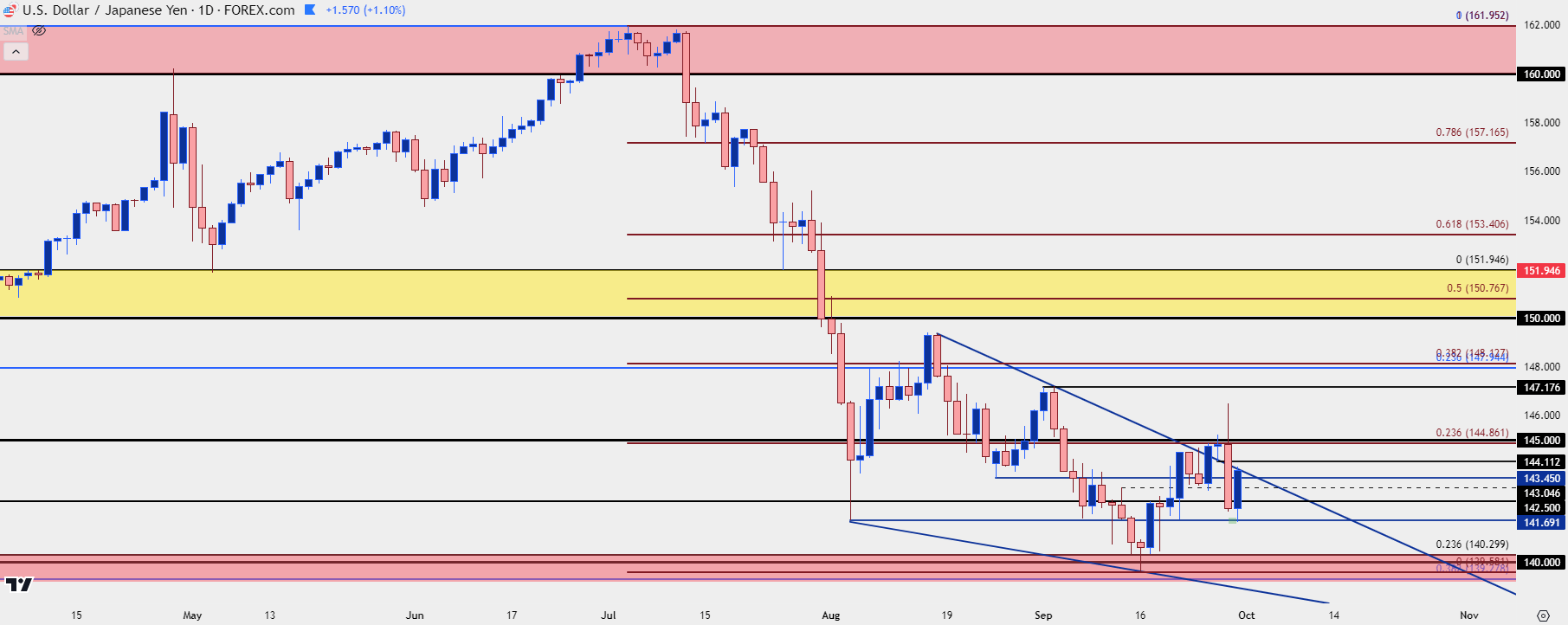

USD/JPY Daily: Why I Consider This a ‘Wild Card’?

I’ve said numerous times over the past couple of months that fundamentals are not a perfectly direct driver of price. And the reason for that is market dynamics. If everyone that wants to be long a market already is, it doesn’t matter how great the news is – there’s nobody left on the sidelines to get long and stoke demand. Deductively, that failure to push higher will likely create at least some unease from long position holders and that could precipitate supply, or selling, thereby leading to a situation where price goes down even on the back of good news. And then as price goes down even in light of that good news, more longs get scared and closed, leading to more supply, and lower prices. This goes on until, eventually, price hits a low point where bulls want to come back in and try to buy the trend after a pullback.

When USD/JPY sold-off by more than 2,000 pips from July to August, the pair went oversold very quickly. And there were a lot of shorter-term bears that probably wanted to take profit, even as the Fed was marking into a cutting cycle.

That oversold nature has hung around which explains the falling wedge that’s built. Tests of lows or support have seen sellers far more timid than tests of highs or resistance, thereby leading to a more aggressive angle on the resistance side of the pair.

That formation was broken through last week as buyers forced the first re-test of the 145.00 psychological level in three weeks. This amounted to a +500 pips move from the failed break at 140 only a couple of weeks prior; a respectable move by most accounts.

What happened on Friday was the prospect of change and I think what we saw was longer-term longs using that bounce to close out of the pair. That’s why I think the pair sold off by more than 400 pips in short-order, even though the incoming Japanese PM has pledged to back ‘loose’ monetary policy.

That sell-off ran all the way until that same August 5th swing low at 141.69 came into the picture to start this week, and that has since led to a bounce.

So, on a shorter-term basis, swing strategies can remain attractive and I’m expecting tests at 144.11 and 145.00, if those levels can come into play. The more dovish that the Fed leans or the more rate cuts that get priced-in, that longer-term bearish motivation could take on more importance.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist

Chart prepared by

Chart prepared by