USD/JPY Talking Points:

- It’s been a strong past week for USD/JPY, even with a dimmer fundamental backdrop for the pair.

- USD/JPY tested below 140.00 for the first time in over a year to start last week, but that’s where sellers stalled and buyers took over. The pair set a higher-low after the FOMC rate decision and continued to push, all the way into today after which resistance showed at a descending trendline taken from mid-August and September swing highs.

- I’ll be going over these setups in the weekly webinar, held each Tuesday at 11am ET: Click here for registration information.

It’s been a busy year for USD/JPY and the final quarter of 2024 looks to be setting up for even more volatility.

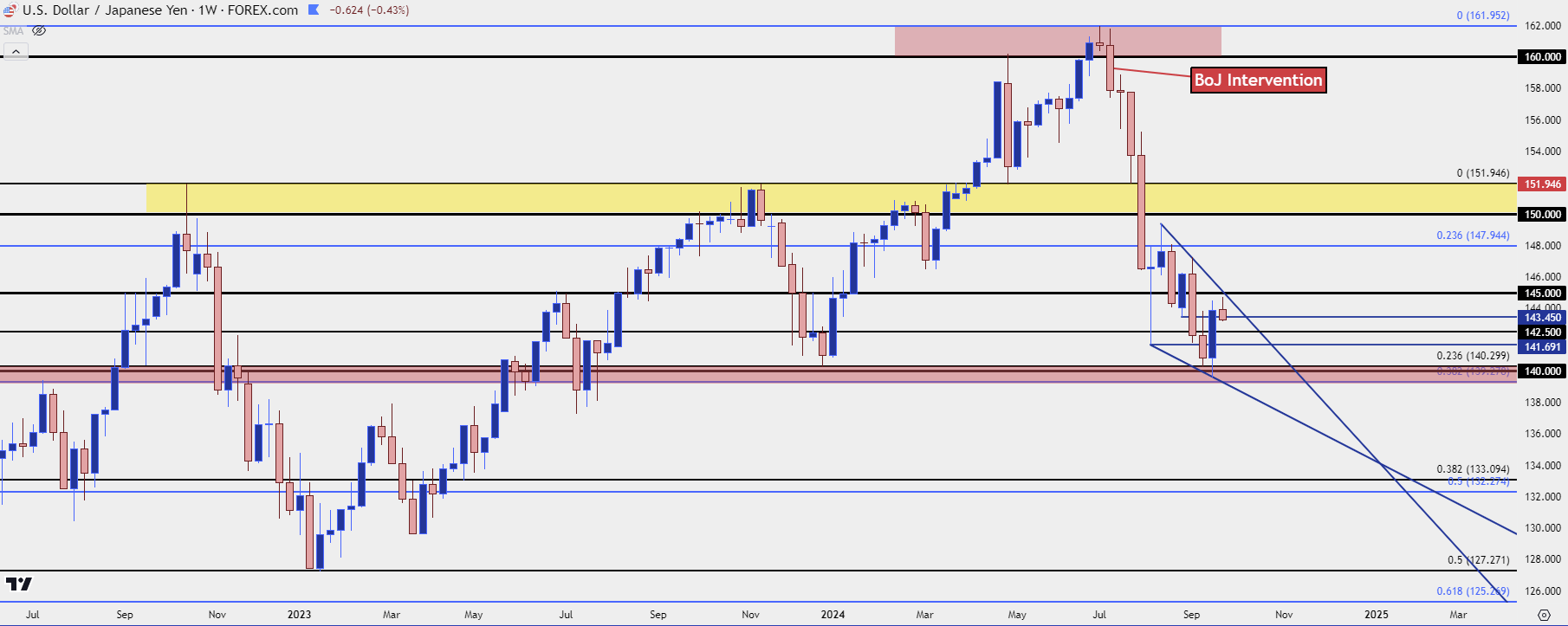

Coming into the year one of the most ideal carry trade scenarios had held in the pair for the past few years. There was continued resistance at the 150-151.95 area but, given the November-December pullback last year, with support setting at the Fibonacci level of 140.30 in late-December, there was still scope for continuation.

The problem was that the Fed was highly expected to begin cutting rates in 2024 and the BoJ was potentially even moving towards a more-hawkish stance. That threatened to up-end the fundamental drive that had pushed USD/JPY from sub-103 at the 2021 open.

That 151.95 level was soon in-play in Q1 and it helped to hold the highs into the end of the quarter, even after the Bank of Japan began hiking rates in a very slight and careful manner. But it was April 10th that the pair broke out as an above-expected US CPI print brought on fears that the Fed may not be cutting soon. With that resistance so well-defined there were likely a lot of stops sitting just above. And stops on short positions are buy-to-cover logic, which adds demand into the market. Once that price was traded over a strong breakout took hold, and price continued to run until a test of the 160.00 handle.

At that point the BoJ stepped in to intervene, but the impact was limited. Price did drop for a little more than a week but support eventually showed at that same 151.95 level that had been defended before. And with US data looking strong and the Fed not yet ready to cut, price accelerated higher, pushing right back to 160 and this time, it didn’t stop. That breakout ran into early-July at which point the BoJ had to step in again.

It was July 11th when a below-expected US CPI report was released and with the help of intervention from the Bank of Japan, an aggressively bearish move showed up.

USD/JPY Weekly Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

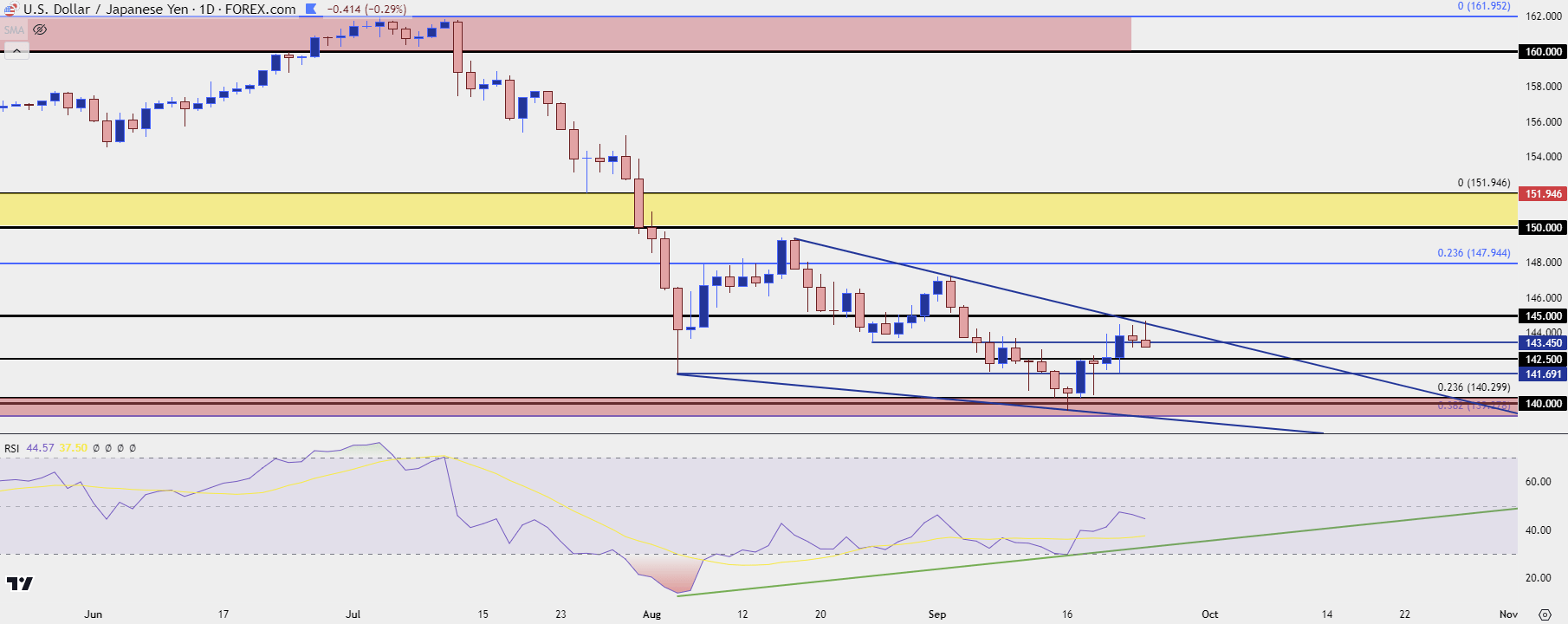

There was a spiraling effect that ran through the rest of July and into the August open. But as you can see from the above falling wedge, selling pressure slowed at 141.69 in August and then at the 140.00 test in September.

Such scenarios can be symptom of short-term oversold conditions and despite the fact that there’s a less bullish backdrop on the fundamental side – positioning matters. I’ve said quite a few times over the past month that fundamentals are not a direct driver of price; because what does push prices is supply and demand and while this can often be driven by fundamental nuance, that’s not always the case. And this is where divergences can show.

In USD/JPY that divergence can be seen as both figurative and literal. There’s been RSI divergence after that failed breakdown to open last week and there’s also been the bullish move showing in and around the FOMC rate decision even as the Fed took the more dovish route by cutting 50 bps.

At that rate decision USD/JPY perched down for a fresh low but it could not re-test the 140.30 Fibonacci level that had held the lows the previous Friday. That led-in to a rally of more than 400 pips into this morning’s high, all the way until the top side of the falling wedge was tested as resistance.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

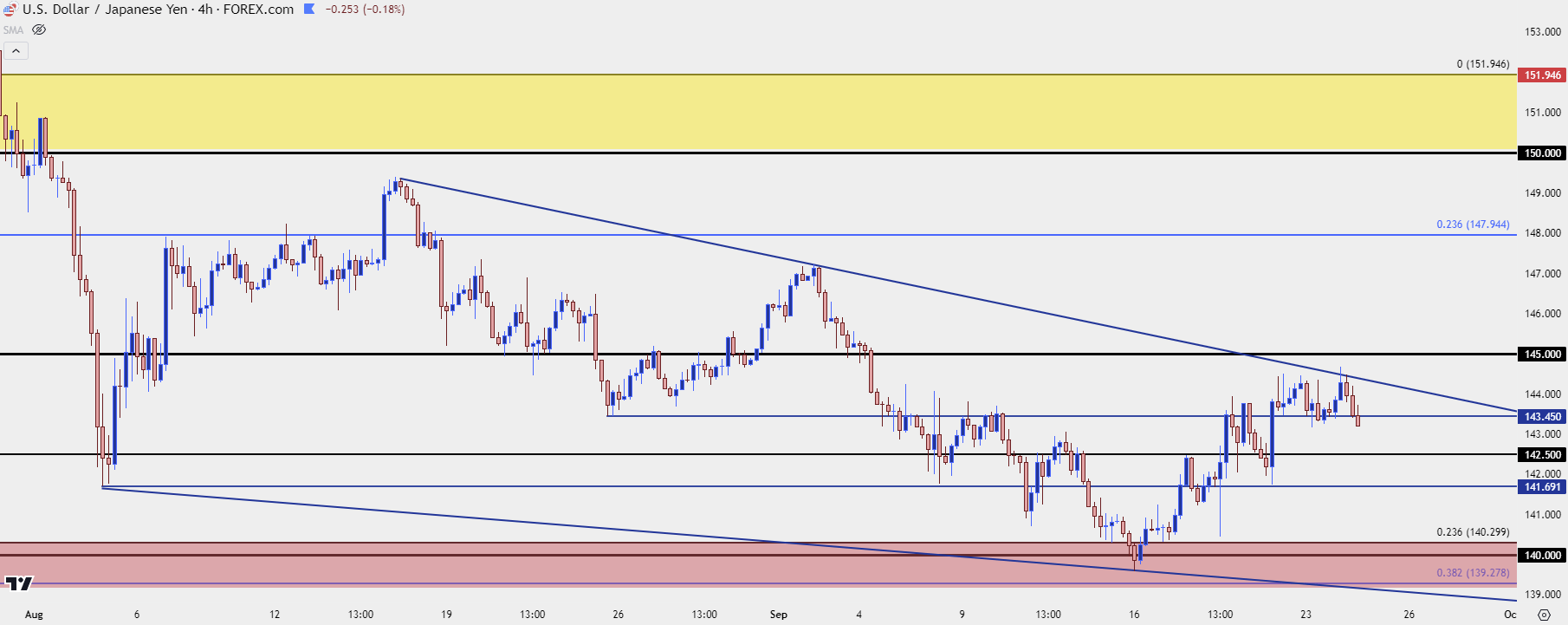

USD/JPY: Short-Cover Bounce v/s Return of Carry Unwind

Given the fact that we haven’t yet re-tested the 38.2% Fibonacci retracement of the 2021-2024 move, the trend that was largely driven by higher US inflation and, eventually, rate hikes from the FOMC, it’s logical to reason that there could be more room to go.

But – there’s also been an aggressive short-side trend that’s built in the case of RSI divergence looked at above. And sellers haven’t seemed so active upon tests of lows, leading to that lesser angle on the underside trendline.

So the big question here is whether longer-term longs are suddenly getting more motivated to close carry positions. Given the fact that price held inside of 145.00 overnight, with the bearish trendline in the wedge coming into play, that could be the case. Although it would be too early to say that with any degree of certainty.

The big test here will be whether shorter-term bulls show up to protect higher-lows in the week-long trend. There’s specific interest at the 142.50 psychological level, after which the 141.69 swing-low from early-August comes back into the picture. Notably, that latter level was defended on Friday so that remains a key spot of interest in shorter-term scenarios.

As I had discussed in the webinar earlier today, I’m expecting the USD to continue to drive on the basis of USD/JPY and that could have impact on other major pairs, such as EUR/USD or GBP/USD. If we do see a break of the 140.00 level in USD/JPY, that could lead to bullish breakouts in each of the above two pairs, along with AUD/USD and many other major FX markets.

USD/JPY Four-Hour Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

--- written by James Stanley, Senior Strategist