Asian Indices:

- Australia's ASX 200 index fell by -87.1 points (-1.16%) and currently trades at 7,409.20

- Japan's Nikkei 225 index has fallen by -224.24 points (-0.62%) and currently trades at 35,677.55

- Hong Kong's Hang Seng index has fallen by -312.06 points (-1.92%) and currently trades at 15,904.27

- China's A50 Index has fallen by -18.45 points (-0.17%) and currently trades at 11,017.78

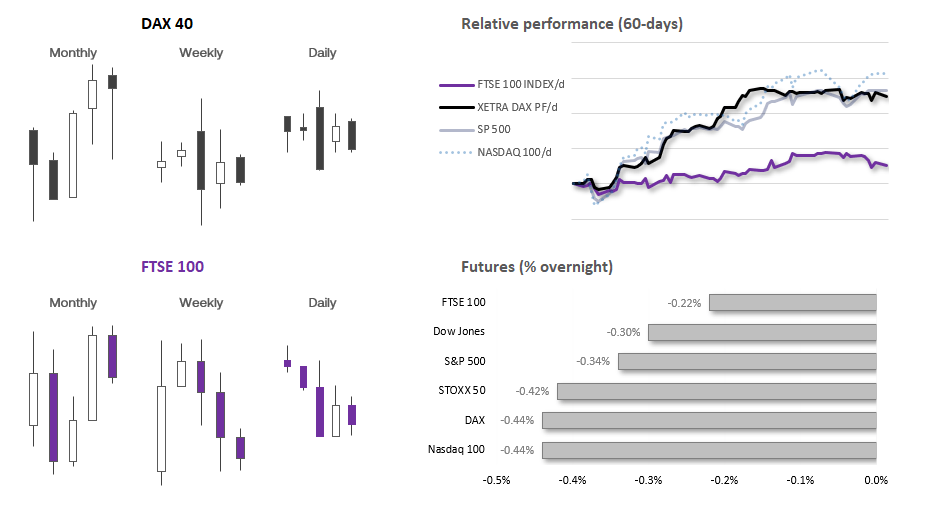

UK and European indices:

- UK's FTSE 100 futures are currently down -18 points (-0.24%), the cash market is currently estimated to open at 7,576.91

- Euro STOXX 50 futures are currently down -20 points (-0.45%), the cash market is currently estimated to open at 4,434.68

- Germany's DAX futures are currently down -77 points (-0.46%), the cash market is currently estimated to open at 16,545.22

US index futures:

- DJI futures are currently down -117 points (-0.31%)

- S&P 500 futures are currently down -16.5 points (-0.34%)

- Nasdaq 100 futures are currently down -76.75 points (-0.45%)

Asian trade provided a mild risk-off session, with AUD/USD breaking last week’s lows and a bullish trendline on the daily chart and index futures markets pointing lower. The ASX 200 also fell to a 4-week low – which nicely into much hunch that the ASX may have seen an important top at the start of the year.

The key event is the speech by FOMC voting member Waller’s at 11:00 EST (16:00 GMT), where I expect him to be more hawkish than markets are currently pricing in. And that could result in a stronger US dollar, yields and lower gold and indices. In fact we’re already seeing money flow into the dollar as it is currently the strongest FX major of the session. Yet volatility is low overall, and it feels like traders across Asia want it to be a risk-off session yet seem hesitant to bet against Wall Street.

I’m not expecting fireworks from the Canadian inflation report, but it could light a hawkish match under dovish sentiment for global markets following a hotter US inflation report last week. Also take note of the ZEW, because if this continues to improve it remains likely that the ECB will also push back on aggressive dovish pricing.

Events in focus (GMT):

- 07:00 – German CPI

- 07:00 – UK employment, average earnings, claiming count

- 10:00 – ZEW economic sentiment for Germany and Eurozone, consumer CPI expectations

- 13:30 – Canadian inflation report

- 14:00 – BOE governor Bailey speaks (Lords Economic Affairs Committee)

- 03:00 – Fed Waller speech: Economic Outlook

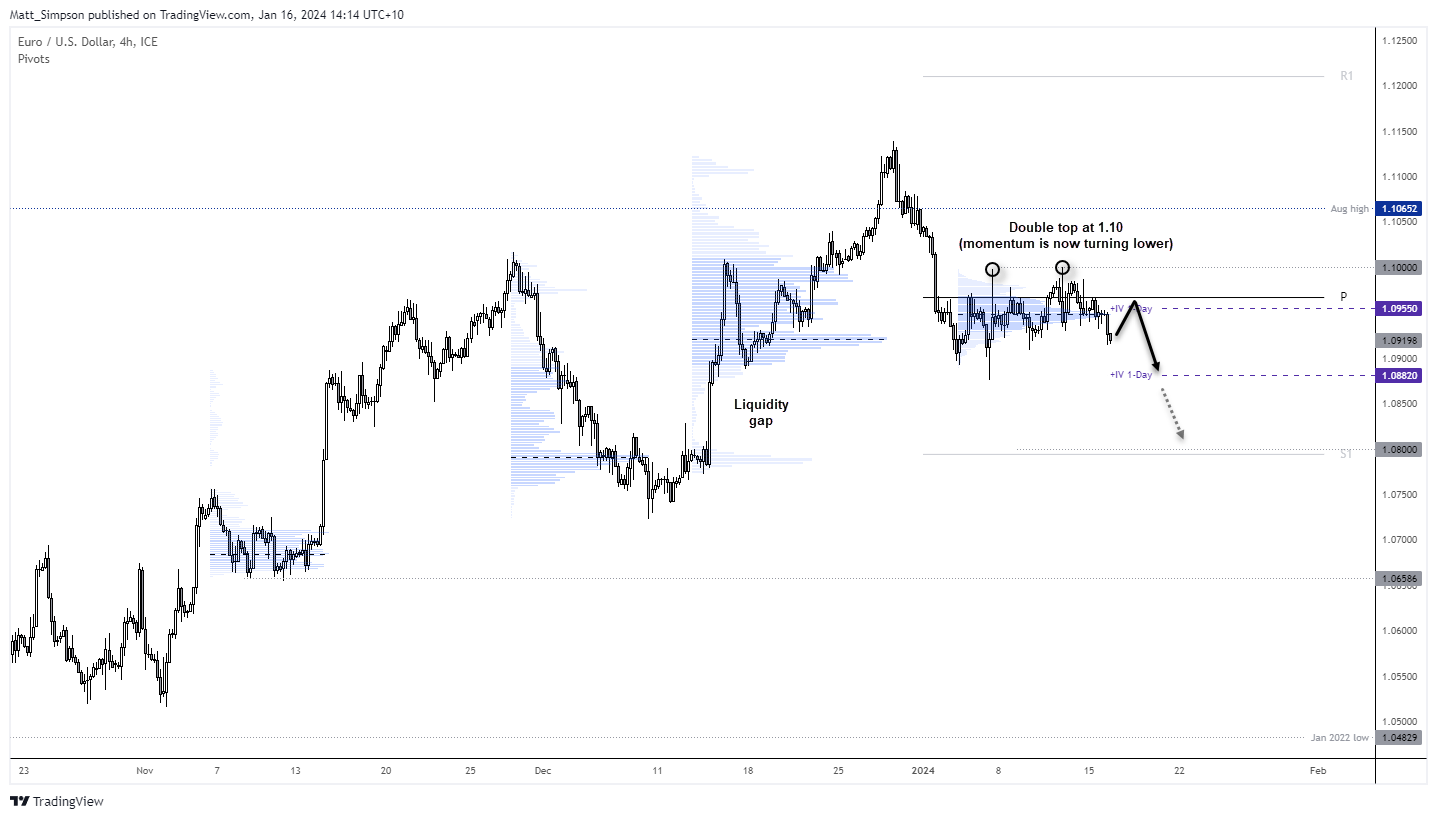

EUR/USD technical analysis (4-hour chart):

Yesterday I outlined a bearish bias for EUR/USD on the daily chart, and with momentum now turning lower ahead of a key Fed member speaking I am left wondering whether we’ve a swing high around 1.10 already.

The 4-hour chart shows a double top around 1.10, with the most traded price during the consolidation sitting around 1.0950. Given the strength of the US dollar during today’s Asian session, my bias remains bearish and to fade into moves towards the 1.0950 HVN 9high-volume node) or monthly pivot point.

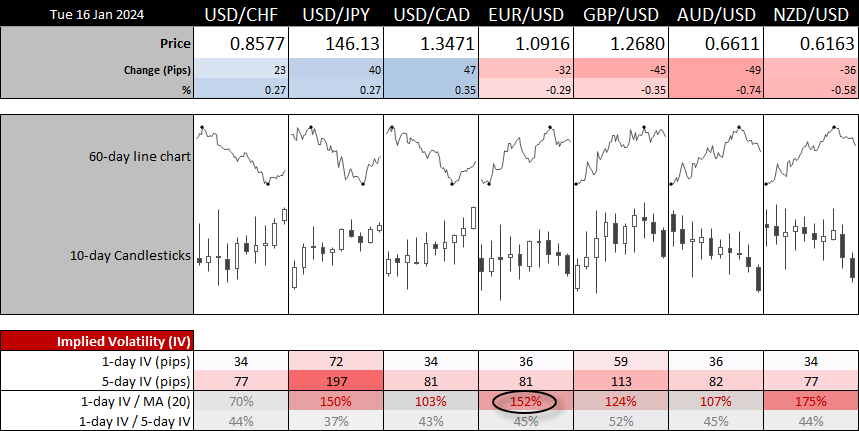

The 1-day implied volatility for EUR/USD is a 36-point move in either direction (which essentially means a 2/3 chance it will close within the 72-pip range). This is not exactly a huge range, but it is 150% of its 20-day average, so expectations for higher volatility are creeping in.

If Waller hits markets with a hawkish speech, we could be looking for an initial move to 1.0880 – a break beneath places prices within a liquidity gap, which can spur quick moves to the next support level (in this case around 1.08).

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge