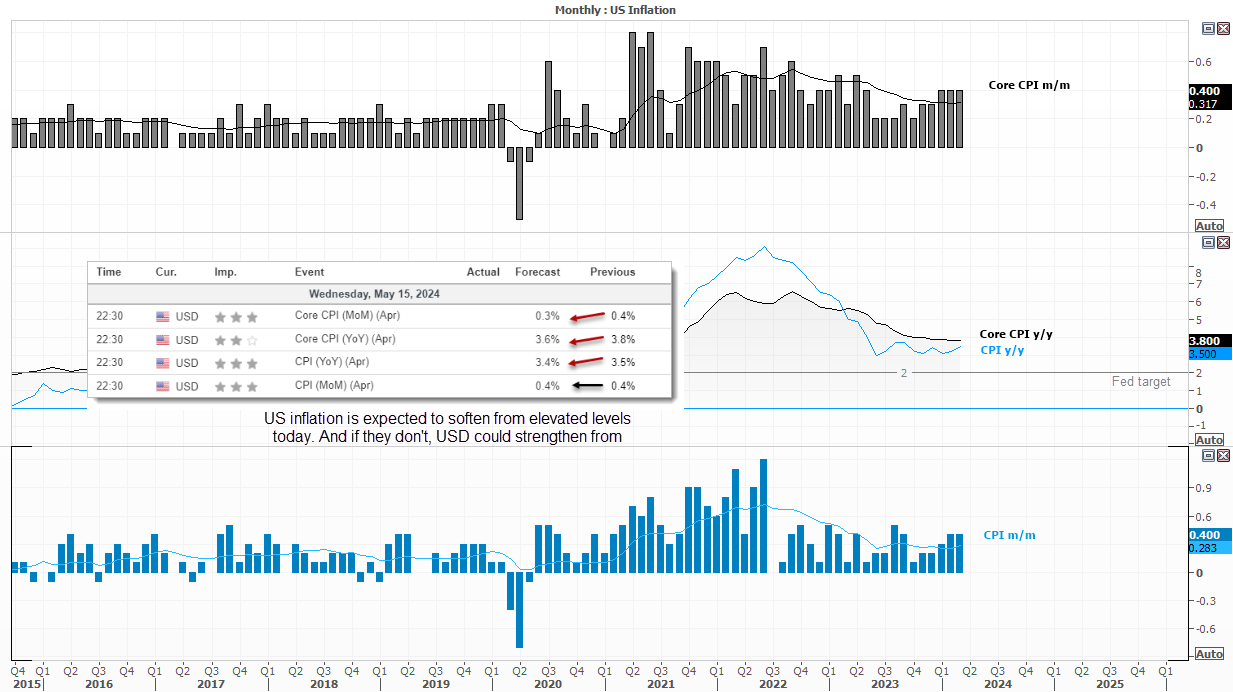

The US dollar continued to weaken during Asian trade on Wednesday after US producer prices were revised lower from the previous report. This is despite PPI data mostly coming in above expectations, and Powell warnings that inflation was taking longer to normalise than expected. Fed fund futures are now implying a 50.5% chance of a cut in September as we head towards a key US inflation report today.

I cannot help but wonder if traders are once again getting ahead of themselves, with markets seemingly pricing in a lower set of inflation figures today. Core CPI is expected to slip from 0.4% to 0.3% m/m (which is still above its long-term average, I should add) after three consecutive prints of 0.4%. Core CPI y/y is expected to slip to 3.6% y/y from 3.8% (which is swill way above the Fed’s 2% target), and CPI down to 3.4% y/y from 3.5%. CPI m/m is expected to remain stable at a relatively high 0.4%.

Even if these numbers are achieved, they are still high by historical standards and not exactly cause for celebration. Not to mention that inflation expectations were higher in one year according to the Michigan University consumer sentiment report. Add into the inflationary tariffs slapped on to China’s imports to the US and the consumer’s might actually be right to expect higher prices. And with producer prices hotter than expected, we could expect some US dollar short-covering if CPI figures were to actually rise in today’s report.

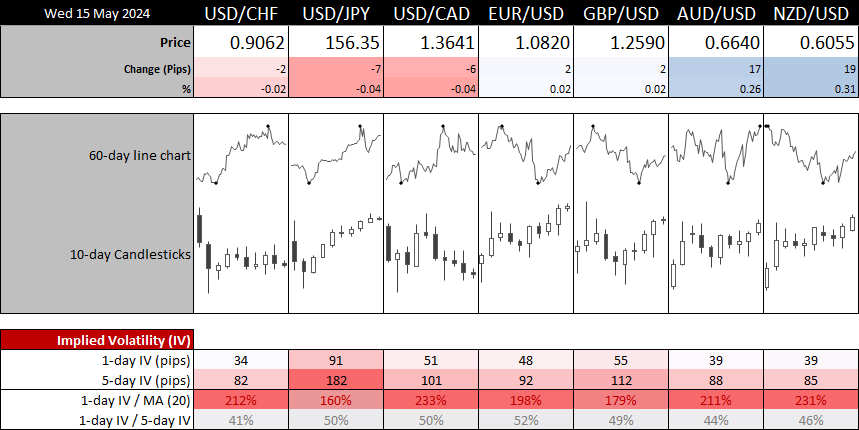

1-day implied volatility levels for FX majors have blown out ahead of today’s report, which underscores the significance of it for Fed policy and market sentiment. IV for USD/CHF, USD/CAD, AUD/USD and NZD/USD are more than twice their 20-day average, EUR/USD and GBP/USD 1day IV is 198% and 179% of its 20-day MA respectively.

Economic events (GMT+1)

- 12:00 – Euro GDP, employment, industrial production

- 13:30 – UC CPI, retail sales

- 15:00 – Fed Vice Chair for Supervision Barr Speaks, US business inventories, retail inventories

- 17:00 – Fed Atlanta GDPnow

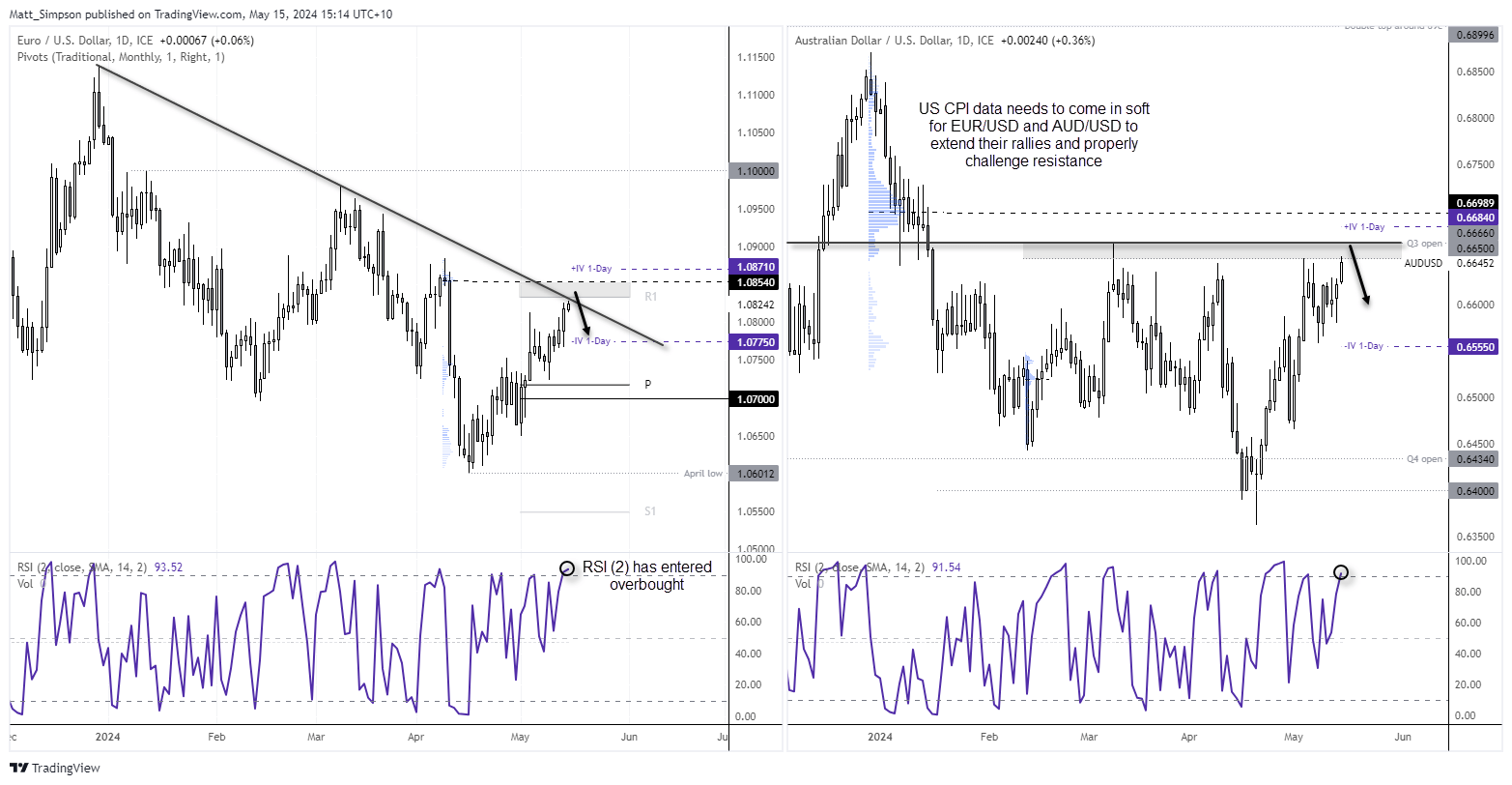

EUR/USD, AUD/USD near approach key resistance zones ahead of US CPI

The euro has continued to defy bears over the past month, closing firmly above 1.08 on Tuesday. Yet key resistance levels loom nearby which include the 2024 bearish trendline, monthly R1 pivot just above today’s high. And at 1.0854 we also have a high-volume node which could act as both a magnet for prices and then resistance. As my bet is for sticky or higher inflation (and not a broad drop as markets hope), I suspect any initial upside break may be the false move. If so, the initial target for bears could be 1.08, or the lower 1-day IV band at 1.0775.

The Australian dollar also finds itself heading into a cloud of resistance levels between 0.6650 – 0.6660. Each time the market has risen to such levels this year has resulted in a hefty pullback. And with traders pushing the US dollar lower on expectations of softer CPI, it may not take much of an uptick in today’s inflation report to topple AUD/USD.

As per usual, we may find markets front-running the move in the hour/s ahead of CPI, in which case I am on guard for a false break above the Q3 open to potentially be followed by a sharp reversal lower. Whereas a daily close above the Q3 open (0.6660) assumes the rally will continue and markets are convinced the Fed will begin easing sooner than later.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge