Odds of the BOC cutting interest rates in June rose to 48% from 40% following Tuesday’s inflation report, which saw annual trimmed mean inflation join the BOC’s other two key CPI metrics within the 1-3% target band. Core CPI slowed to 1.6% y/y (from 2%), well below the 2% midpoint, median CPI slowed to 2.6% and trimmed mean to 2.9%. More importantly, the high levels of monthly inflation in last month’s report appear to have been a blip, with core CPI slowing to 0.2% m/m (0.6% prior) and CPI down to 0.2% from 0.3%.

USD/CAD reached my upside target mentioned in yesterday’s CPI preview, although it is likely down to the FOMC minutes released later as to whether the pair can extend it rally or the US dollar continue lower.

- Bitcoin formed a shooting star day closed just above $70k, to show a hesitancy to break higher ahead of Nvidia (NVDA) earnings

- Nvidia’s share price is also reluctant to retest it all-time high ahead of the key earnings report released on Wednesday (US), which could dictate which way Wall Street indices trade and drag bitcoin prices along for the ride

- Wall Street indices rose along with Nvidia’s share price on Tuesday, seeing the Nasdaq 100 and S&P 500 close at record high, although the Dow Jones remains the laggard and remains at least a day’s trade below 40k

- My equally-weighed gold chart (against FX majors) formed a small bearish inside day just beneath its record high set in Apil, which shows a hesitancy for gold to continue higher ahead of the FOMC minutes – which has also seen gold against the US dollar pull back beneath its new record high set on Monday

- BOE governor Bailey pointed out the obvious by saying he thinks the next policy change would be a cut, although hinted it could be sooner than later by saying he questions how long they should remain at the current rate

- GBP/USD formed another small dojo in the daily chart on the even of a key inflation report, which could confirm a June rate for the BOE is data comes in soft enough

- The RBA minutes released on Tuesday revealed that the central bank discussed the potential of hiking rates, although this seems like a moot point given wages and employment were softer and US economic data could be paving the way for Fed cuts

Economic events (times in AEST)

The RBNZ meeting and press conference are the main events in today’s Asian session. Whilst they’re very unlikely to change policy today, eyes will be on whether the central bank will lower their forecasts for their OCR (interest rate) or inflation to appease doves and send NZD/USD lower. You can read the full preview by my colleague Scutty - RBNZ preview: Timeline for taming inflation key for New Zealand dollar reaction

Also take note of the FOMC minutes overnight. Whilst I doubt they will provide anything that softer CPI, NFP or haven’t already, it is the kind of release that needs to be monitored, just in case.

- 09:50 – Japan core machinery orders, trade balance

- 12:00 – RBNZ interest rate decision

- 13:00 – RBNZ press conference

- 16:00 – UK CPI, PPI

- 22:45 – BOE member Breeden speaks

- 04:00 – FOMC minutes

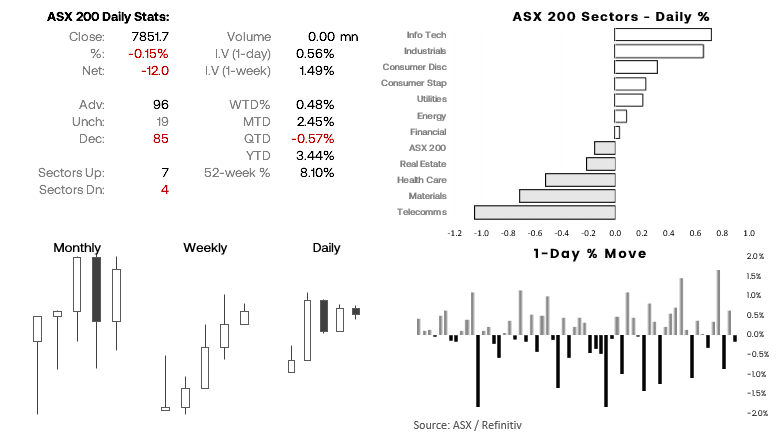

ASX 200 at a glance:

- The ASX 200 is trying to rose for rise for a fifth consecutive week, although currently on track for a small bullish inside week

- Performance was mixed on Tuesday with 7 of the 11 sectors rising (led by info tech and industrials) and 4 declining (led by telecoms and materials)

- The daily chart of the ASX 200 cash market shows a small pennant has formed on the daily chart, which assumes a bullish breakout

- SPI 200 futures were higher overnight, which points to a gap higher for the ASX 200 at today’s cash market open

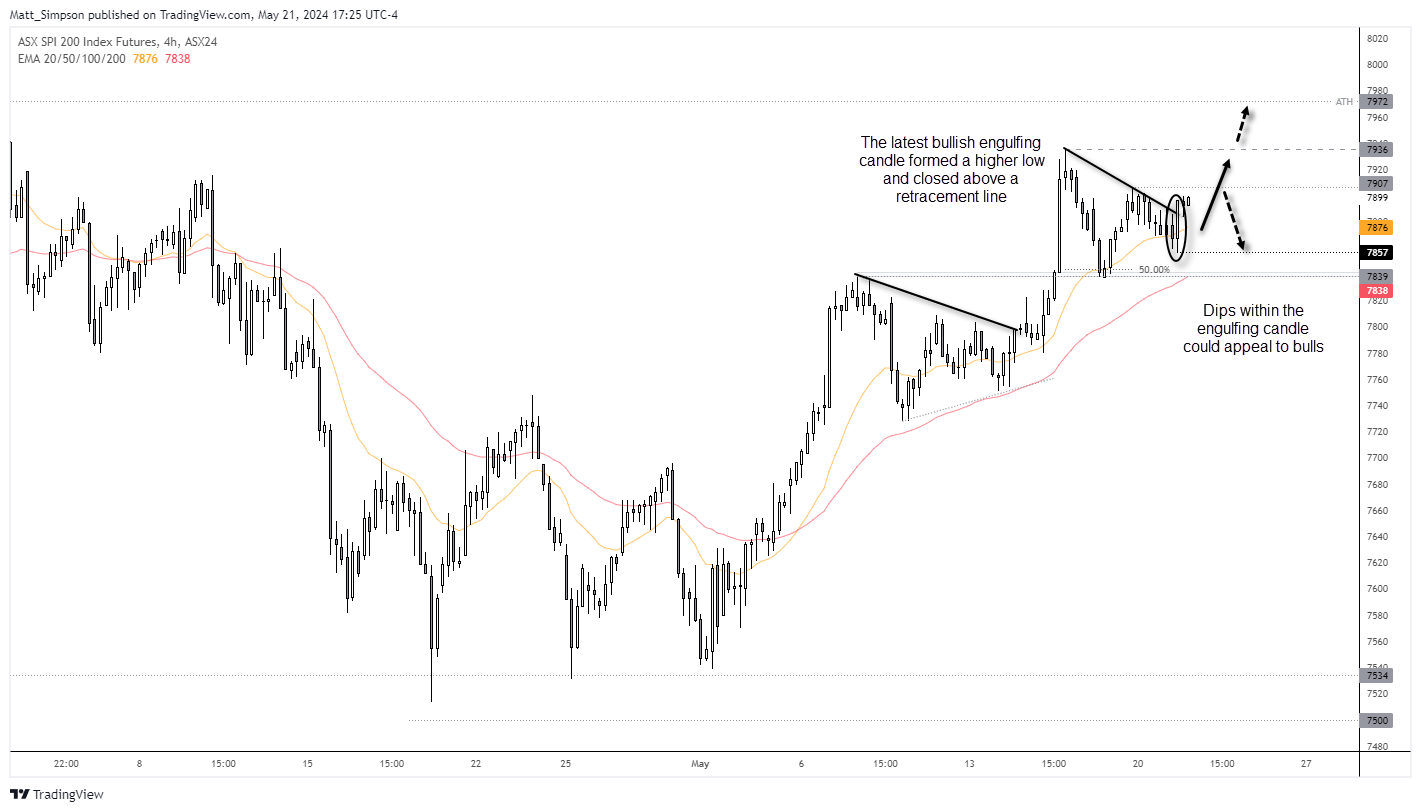

The 1-hour chart shows an established uptrend, where the most recent 1-hour bullish engulfing candle formed a higher low and closed above the bearish retracement line. Support has been found around the 20-hour EMA. The bias remains bullish above the 7857 low, and bulls could seek dips within the range of the latest bullish engulfing candle.

- A break above 7907 assumes bullish continuation, which brings the 7936 high into focus – a break above which clears the way for the all-time high

- A break beneath 7835 assumes a deeper correction his underway

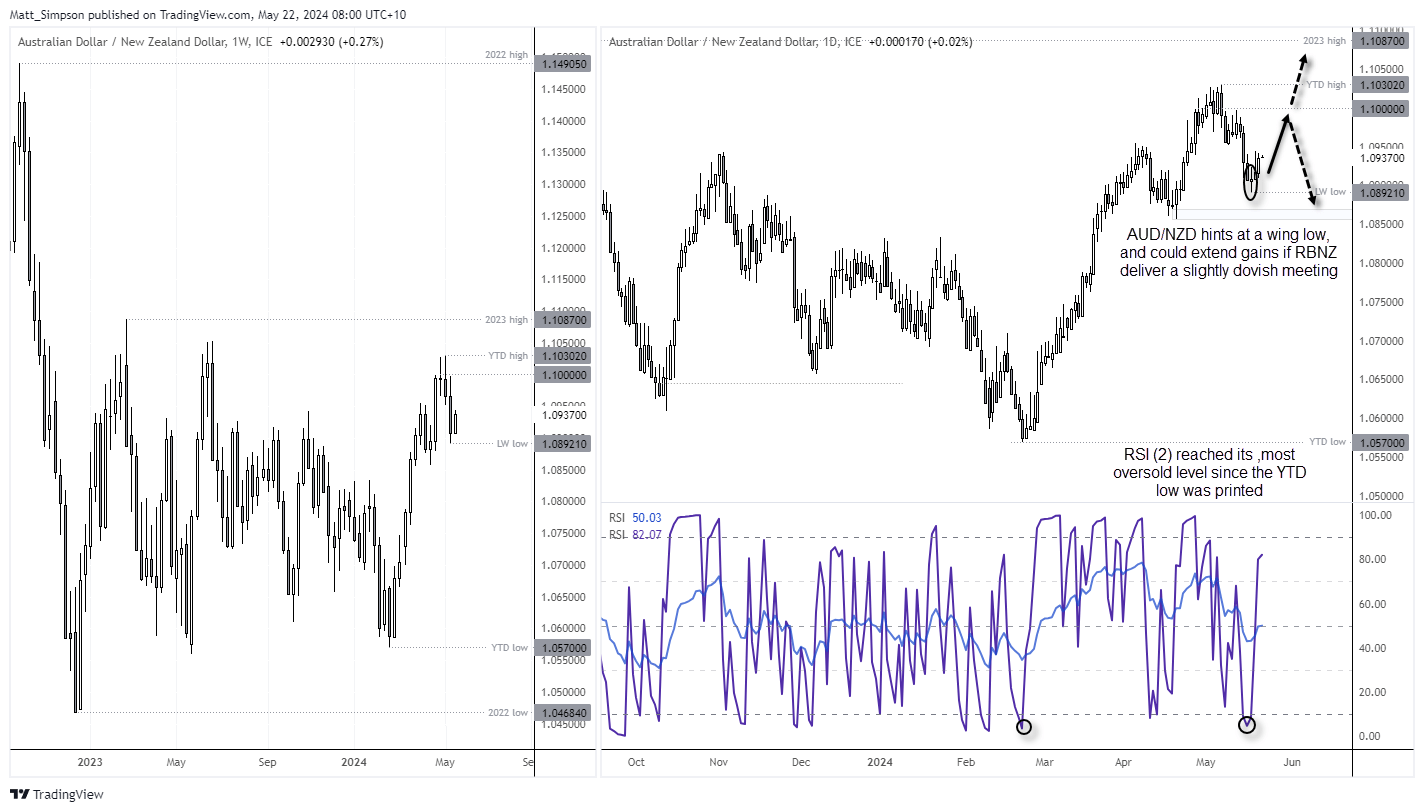

AUD/NZD technical analysis:

The weekly chart (on the left) shows that AUD/NZD has delivered a strong rally from the YTD low, yet it has struggled to close above 1.10 on this timeframe. With the pair near the top of its range, perhaps we’re witnessing a market top. Although that would require the RBA to revert back to dovish mode. For now, AUD/NZD seems reluctant to break beneath last week’s low and momentum has turned higher on the daily timeframe.

The daily chart (right) shows a higher low formed on Friday with a small Doji, which coincided with RSI (2) being its most oversold since February. RSI (14) also closed above 50 to show slightly positive momentum.

From here, the bias is for a rally to 1.10 whilst prices remain above last week’s low. Whether it can continue above the YTD high depends on how dovish the RBNZ may be and whether the RBA retain a hawkish bias. For now, I remain doubtful and this this is a cheeky burst higher before losses resume on the weekly chart. As always, time will tell.

View the full economic calendar

-- Written by Matt Simpson

Follow Matt on Twitter @cLeverEdge