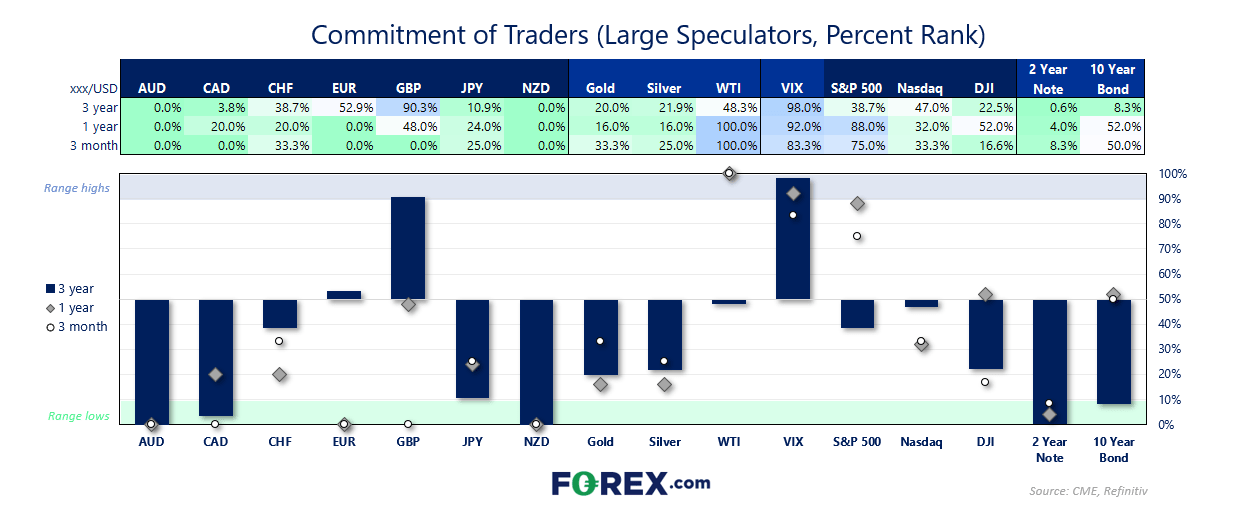

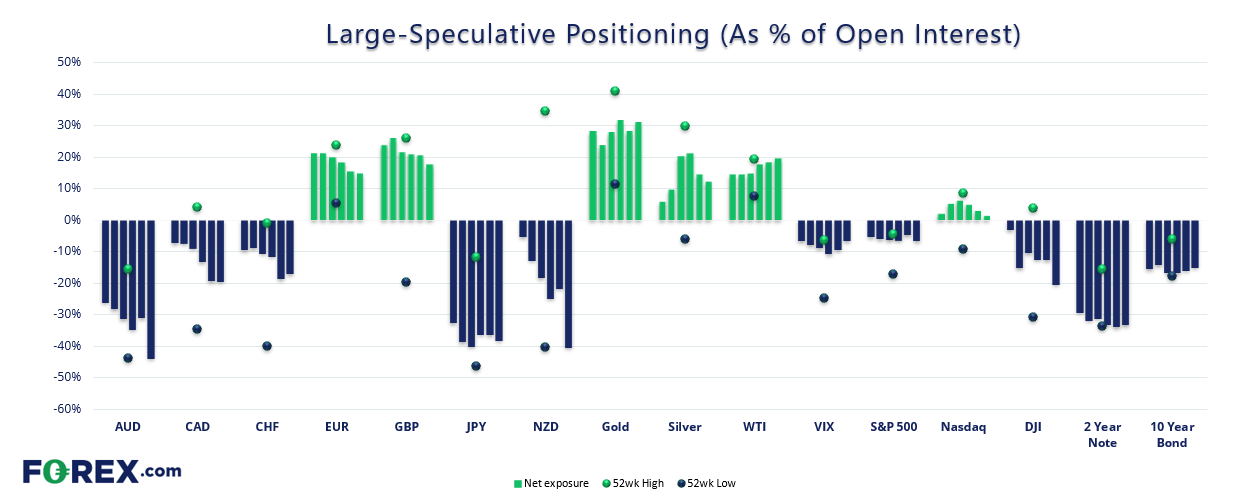

Net-short exposure to AUD, NZD and CAD increased despite each currency holding up to US dollar strength. And in each case, it was the reduction of gross longs which weighed on net positioning, as opposed to fresh shorts being added. Whilst this is not a particularly bullish scenario, neither is it overly bearish.

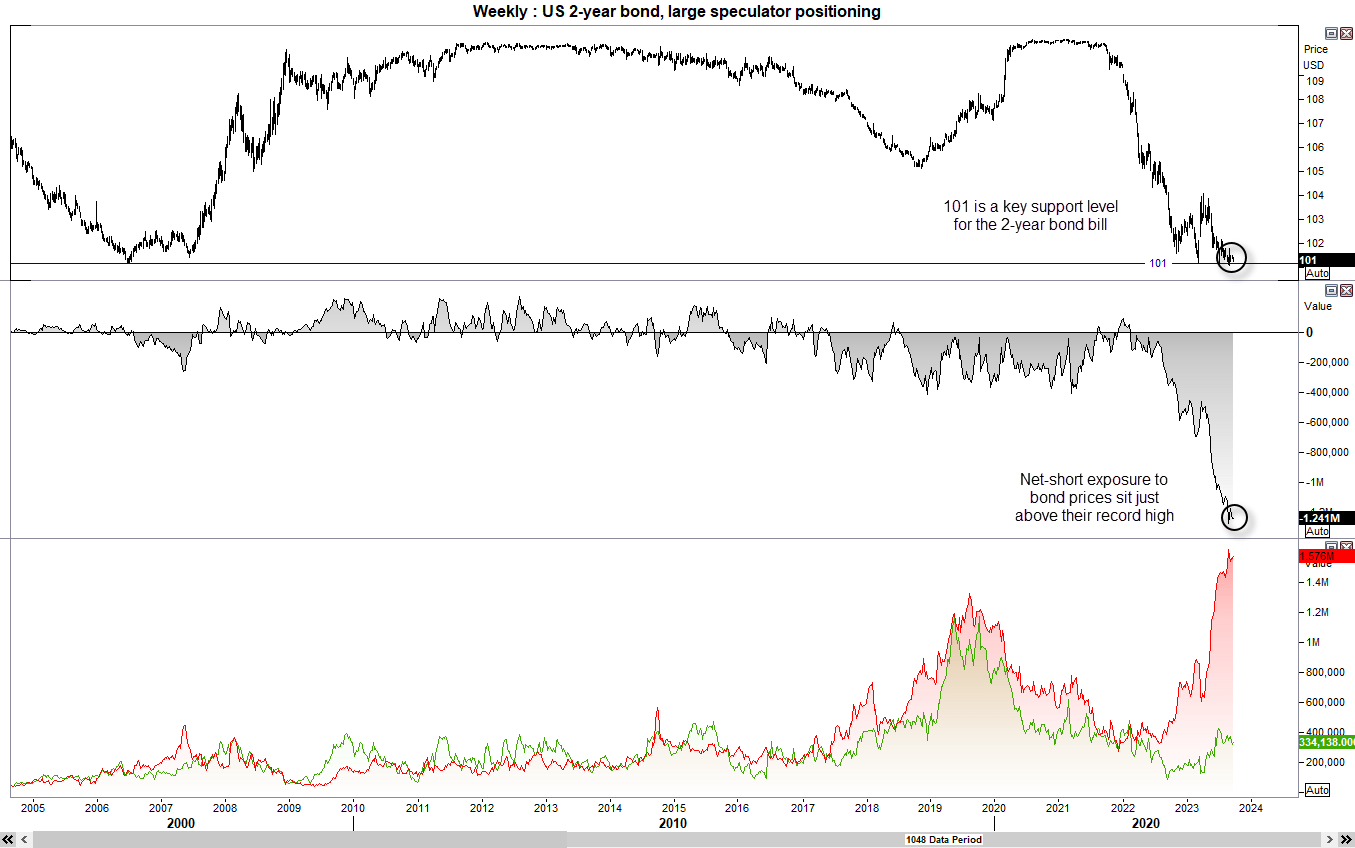

We’re keeping a close eye on the bond market as rising yields continue to weigh on sentiment, but worth noting that the 2-year bond prices continues to hold above key support at 101 despite extreme net-short positioning.

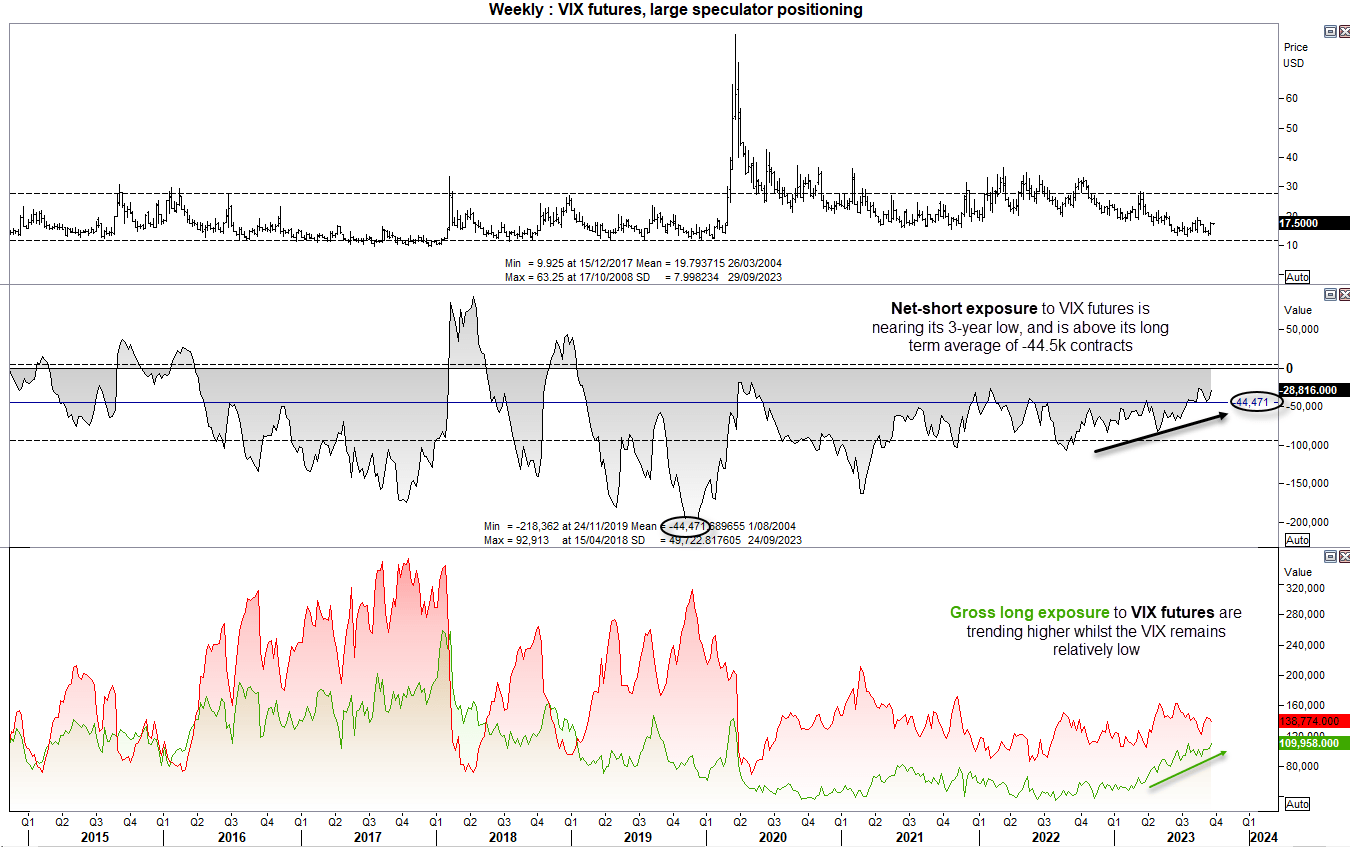

Large speculators and asset managers continued to increase their long exposure to WTI crude oil, and net-short exposure to VIX futures area approaching a 3-year low whilst the VIX remains relatively low.

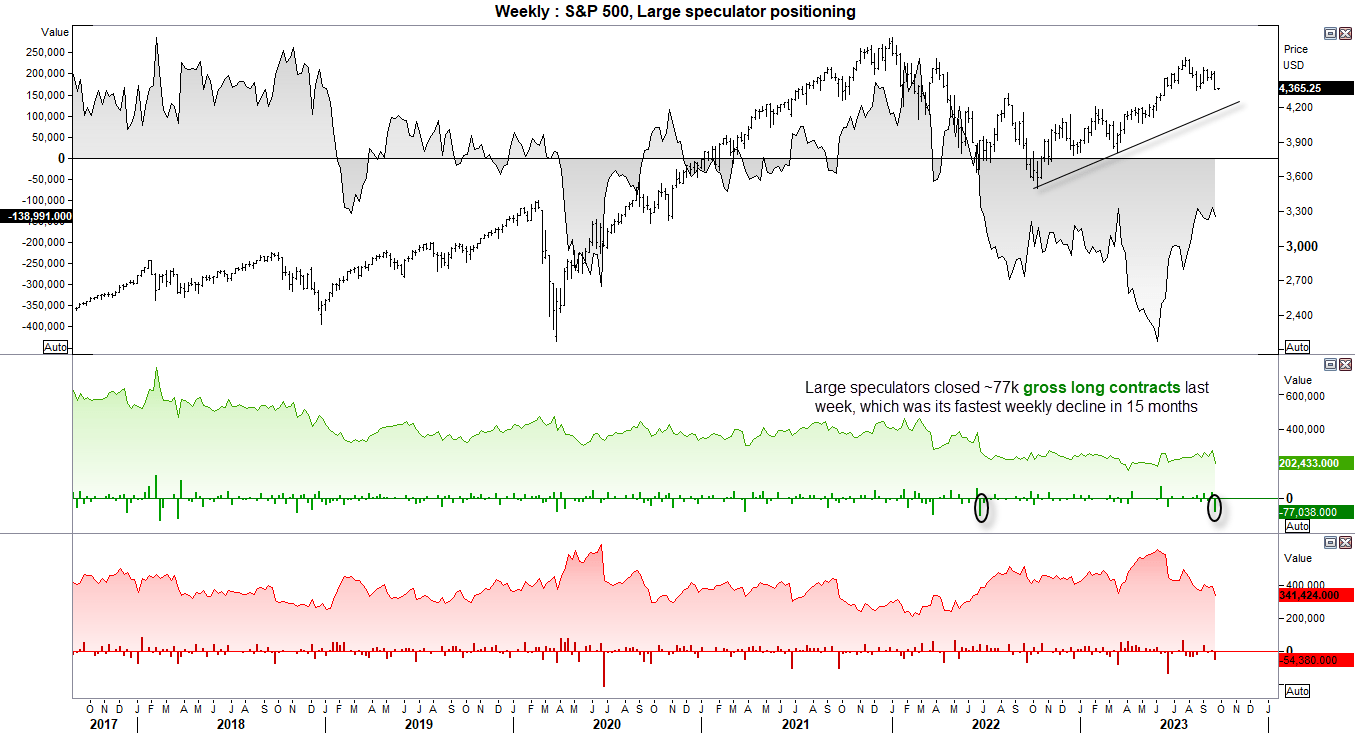

Large speculators also closed 77k gross long contracts of the S&P 500 futures market last week, which was its fastest weekly decline in 15 months.

Commitment of traders – as of Tuesday 2023:

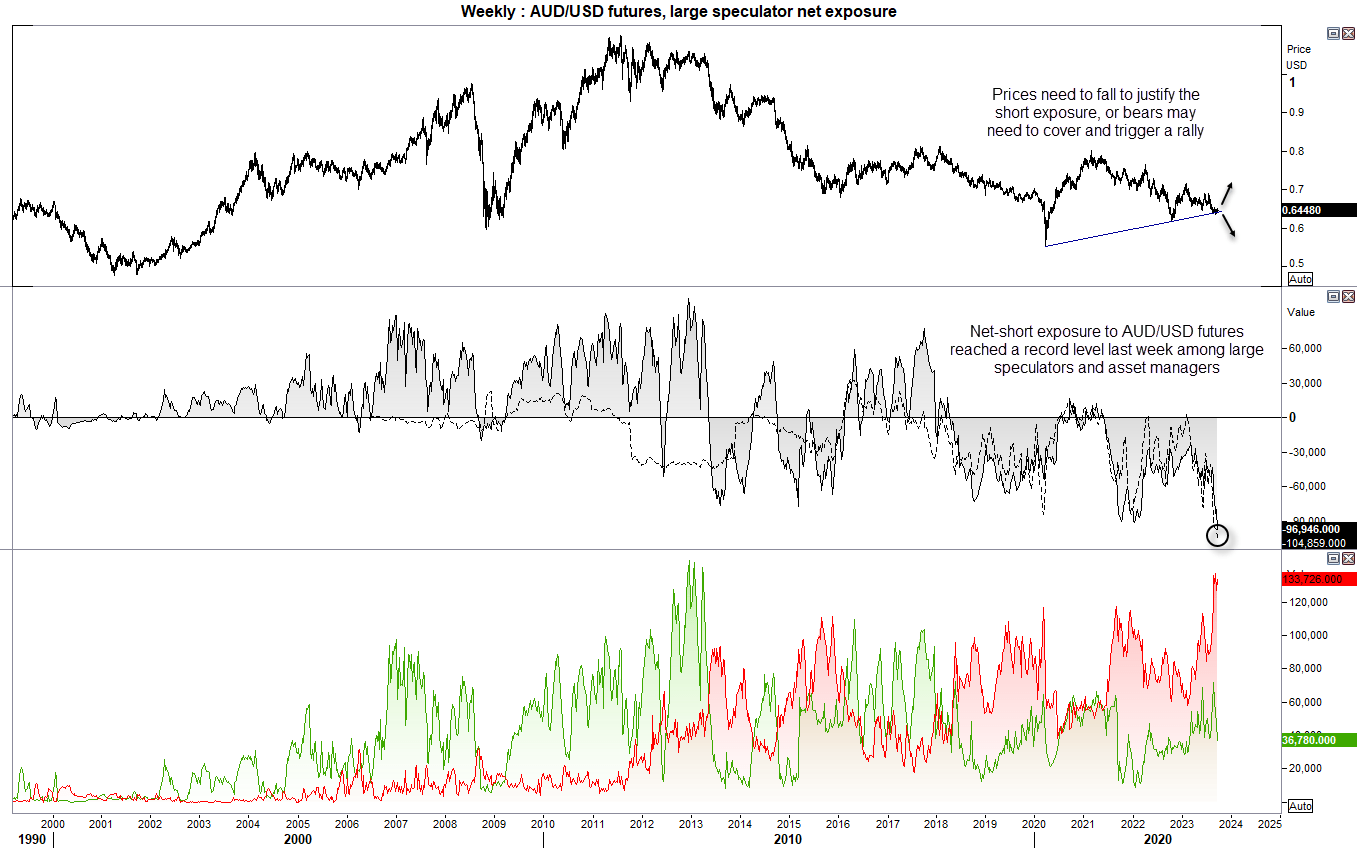

- Large speculators and asset managers reached a record level of net-short exposure to AUD/USD futures

- Net-short exposure to NZD/USD futures reached its highest level since December 2019

- Large speculators reduced longs to push net-long exposure to GBP/USD futures to a 14-week low

- Whilst net-short exposure of JPY/USD remained largely unchanged, both gross longs and gross shorts are rising in tandem to suggest hedging is at play

- Net-long exposure to EUR/USD futures continued to fall and sat at a 47-week low

- Gross-short exposure to WTI crude oil rose for a second week among large speculators, although gross longs rose to an 18-month high

AUD/USD (Australian dollar futures) – Commitment of traders (COT):

Shorting the Australian dollar is not a new idea, but it is worth noting that large speculators and asset managers reached a record level of net-exposure last week. And those shorts need to be justified with lower prices, or bears will be forced to cover and potentially trigger a rally. Yet the fact that bears have failed to hold prices below 64c should come as a warning to bears. And with the US dollar index having rallied for a tenth consecutive week (a bullish streak only seen twice in its history), we’re statistically at a point where the rally either needs to pause or retrace, and that could help lift the Australian dollar. Of course, yields are the market which hold the key to sentiment right now. If they pull back and drag the dollar lower, it adds another reason to expect a bounce in risk assets such as AUD/USD. But if yields march higher then maybe AUD/USD bears will be proven to be right after all.

2-year bond note futures – Commitment of traders (COT):

If one market has the power to dictate sentiment for all others, it is the 2-year note. Extreme levels of short exposure to bond prices have been well documented in the preceding months, and large speculators remained just off level short exposure last week. Yet the 2-year bond note continues to hold above 101 – a key level which has held as support since 2001. If support continues to hold, bears may be forced to cover and send prices higher, yields lower and appetite for risk could be restored. Yet if the key level of 101 breaks, it means the next leg higher for yields has been confirmed and we’re likely to see the next leg lower for global stock market indices. And dare we say AUD/USD might even break below 64c for more than a day.

VIX future (volatility index) - Commitment of traders (COT):

Large speculators remain net-short VIX futures for the majority of the time, which makes the ne long or short indicator less useful. However, we can use its long term average of -44.5k contracts as the threshold instead, so it is interesting to note that large speculators are now above that level. We can see that gross longs are trending higher whilst the VIX remains relatively low and beneath its own long-term average of 19.8. And if yields continue to soar and weigh on stock market indices, perhaps this is a prelude to a spike in volatility in general which could of course send the VIX higher.

S&P 500 futures (ES) - Commitment of traders (COT):

Futures traders closed 77k contracts last week, which was its fastest weekly decline in 15 months. The fact that that happened by Tuesday, and prices continued lower through to the end of the week suggests more gross longs were closed and we may even see a rise in shorts in Friday’s report. In either case, the S&P 500 market remains relatively high and that leaves plenty of room for further downside over the coming weeks if yields and the VIX continue to rise.