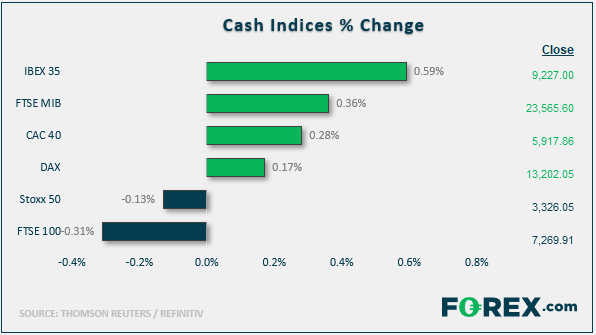

Stock market snapshot as of [15/11/2019 2:30 pm]

View our guide on how to interpret the FX Dashboard

- Stocks are buying the White House’s latest blast of trade optimism, though bond markets are reserving judgement. U.S. stock index futures range between gains of 0.3% to 0.4%, tracking European shares gauges that are in the green with few exceptions

- The deepest equity measure for the region, STOXX Europe 600 opened higher, saw a brief spell in the red, then traded 0.4% higher at last look

- White House Economic Advisor Larry Kudlow, the provider of a number of beneficent bromides in recent week, said talks were “coming down to the short strokes”, adding: “We are in communication with them every single day right now.”

- It’s hard to believe that a degree of scepticism isn’t broadening among investors, given several false dawns now, on the road to a skeleton of a skeleton ‘phase one’ deal. There’s no capping the reaction of sentiment. However, the high chance of reversals when optimism is countered from elsewhere in the White House is a recipe for volatility into year-end

Stocks/sectors on the move

- Most STOXX super sectors are holding higher, though European tech shares rise the most. Hardware and chips lead. ASMI gained 3.2%. This tracks NVIDIA’s Q3 beats overnight, even though the graphics GPU maker’s outlook was soft

- The typical trade-sensitive industries also again. Miners are led by London-listed Glencore, Anglo, BHP, Rio and Sweden’s Boliden. Auto part stocks were, again, easier to buy than car shares

- Troubled retailer JC Penney surged 18% in pre-market deals, suggesting the heavily borrowed stock was seeing a short squeeze. Same-store sales missed, and it kept its negative comparable sales outlook. But a $0.30 adjusted loss per share was better than $0.56 estimated, a possible sign that turnaround moves are gaining traction

- U.S. tech stocks are also eyed as seasonal hedge fund disclosure reveals big buys of Facebook, Netflix and other FAANG shares. Microsoft was studiously avoided, according to the filings. Nasdaq traded 0.5% higher into Wall Street’s open

- Techs saw even broader attention after China’s Alibaba rival JD.com released Q4 guidance well above forecasts, lifting the stock. Alibaba Group itself has reportedly ‘covered’ its planned Hong Kong secondary listing multiple times, a boost to sentiment for the already traded stock

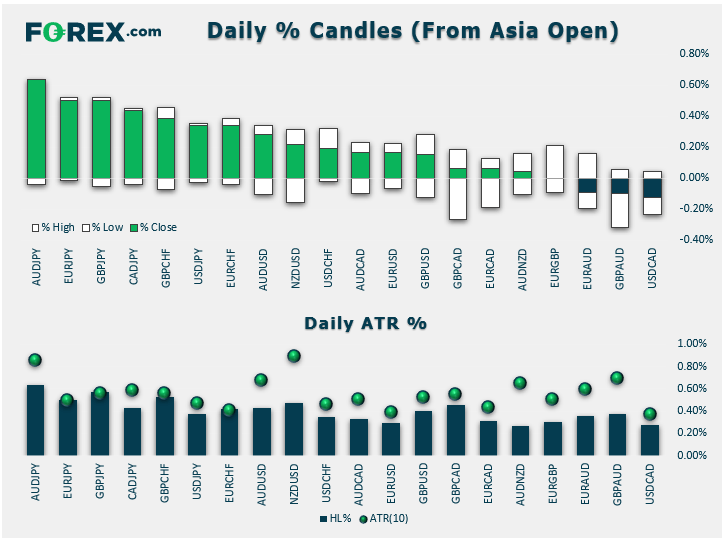

FX snapshot as of [15/11/2019 2:28 pm]

FX markets and gold

- As Senior Technical Analyst Fawad Razaqzada wrote, before the release of U.S. retail sales data, ‘Whether or not the USD/CAD will push higher today will depend to a great extent on the outcome of today’s US macro pointers’

- As it turned out, the top-tier release, U.S. retail sales was lacklustre: the headlines beat, but core measures missed and there was a small revision lower from the prior month

- Lower tier data in the shape of New York’s manufacturing index printed 2.9 in November vs. 6 expected

- Dollar/Canadian dollar duly heads lower, with AUD/JPY a standout, leading yen crosses higher as a risk-on feel returns

- USD/JPY rises for the first time in six days. Swissie retreats

- The euro joined the fray vs. yen after recent promising data (e.g. German GDP) that could be corroborated by readings next week, including a manufacturing PMI

- Factor in Bank of Canada governor Stephen Poloz’s comment: “In the last seven or eight months, things have picked up nicely and now we’re above 4% -- most of all our measures of wage inflation.”

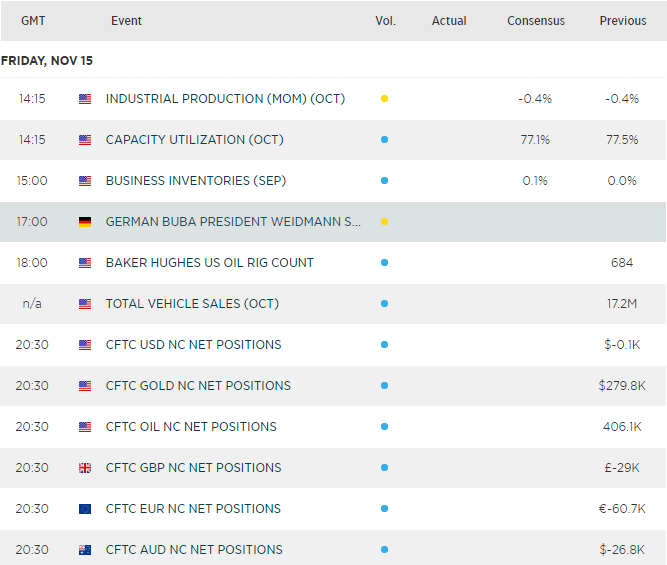

Upcoming economic highlights

Latest market news

Yesterday 11:06 PM

Yesterday 01:00 PM

November 30, 2024 12:00 PM

November 29, 2024 05:53 PM