Canada Consumer Price Index (CPI)

Canada’s Consumer Price Index (CPI) narrowed more than expected in August, with the headline reading falling to 2.0% from 2.5% per annum the month prior to mark the lowest reading since February 2021.

Canada Economic Calendar – September 17, 2024

At the same time, the core CPI slipped to 1.5% from 1.7% during the same period, with the update from Statistics Canada noting that the ‘deceleration in headline inflation in August was due, in part, to lower prices for gasoline.’

The report went on to say that ‘mortgage interest cost and rent remained the largest contributors to the increase in the CPI in August,’ while ‘clothing and footwear prices fell for an eighth consecutive month, down 4.4% in August following a 2.7% decline in July.’

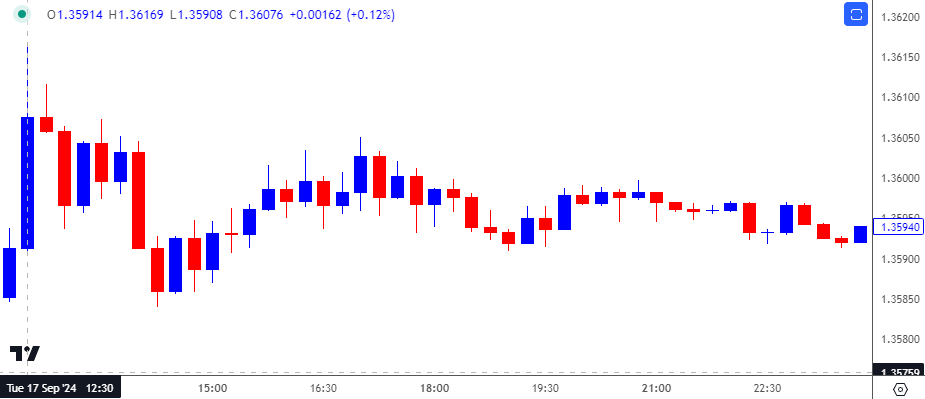

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register HereUSD/CAD Chart – 15 Minute

Chart Prepared by David Song, Strategist; USD/CAD on TradingView

USD/CAD spiked to a fresh session high (1.3617) following the larger-than-expected slowdown in Canda’s CPI, but the market reaction was short lived as the exchange rate closed the day at 1.3598. USD/CAD struggled to hold its ground over the remainder of the week as it closed at 1.3569.

Looking ahead, Canada’s CPI is projected to slow for the fourth consecutive month in September, with the headline reading seen falling to 1.8% from 2.0% per annum in August.

A further slowdown in inflation may push the Bank of Canada (BoC) to retain its current pace in pursuing a neutral policy, and Governor Tiff Macklem and Co. may implement lower interest rates over the remainder of the year as ‘excess supply in the economy continues to put downward pressure on inflation.’

With that said, the Canadian Dollar may face headwinds ahead of the next BoC meeting on October 23, but a higher-than-expected CPI print may generate a bullish reaction in Loonie as it raises the central bank’s scope to pause its rate-cutting cycle.

Additional Market Outlooks

EUR/USD Outlook Hinges on ECB Interest Rate Decision

Gold Price Forecast: Bullion Breaks Out of Bull Flag Formation

USD/CAD Rally Pushes RSI Up Against Overbought Zone

Australian Dollar Forecast: AUD/USD Bearish Price Series Persists

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong