- The use of the Chinese yuan in the global financial system is growing

- China’s currency does not float freely like other major currencies

- The PBOC sets the yuan’s value through a daily ‘fix’

- It can be used to counteract market forces, creating volatility in other currencies and asset classes

FX transactions involving the Chinese yuan are growing rapidly, making its movements increasingly influential on other currencies, especially in Asia. As China moves towards overtaking the United States as the largest economy in the world, the yuan could one day rival the US dollar in terms of global dominance.

With use of the Chinese yuan likely to grow further, we look at the USD/CNY daily ‘fix’, an event every trader should get familiar with given its importance to broader markets.

CNY share of global FX turnover is growing rapidly

According to the Triennial Survey of OTC FX markets from the Bank of International Settlements (BIS), the Chinese yuan’s share of global turnover turnover rose from 4% in 2019 to 7% in 2022, seeing it jump from the 8th to 5th most traded currency globally.

Turnover involving USD/JPY grew rapidly over the same period, rising from 4.1% of global share in 2019 to 6.6% in 2022, only exceeded by EUR/USD, USD/JPY, USDGBP. It’s now the fourth most traded FX pair globally.

Source: BIS

What is the USD/CNY fix?

The USD/CNY does not float freely like other major currencies, allowing market forces to determine valuations. Instead, it’s heavily influenced by China’s central bank, the People’s Bank of China (PBOC), who establish its starting level each day.

This event, known as the ‘fix’ or central parity rate, occurs around 9.15am in Beijing. The level nominated by the PBOC is the midpoint of where USD/CNY will be allowed to trade during the session. The PBOC allows USD/CNY to trade in a range 2% either side of the fix, providing some scope for market forces to determine its valuation.

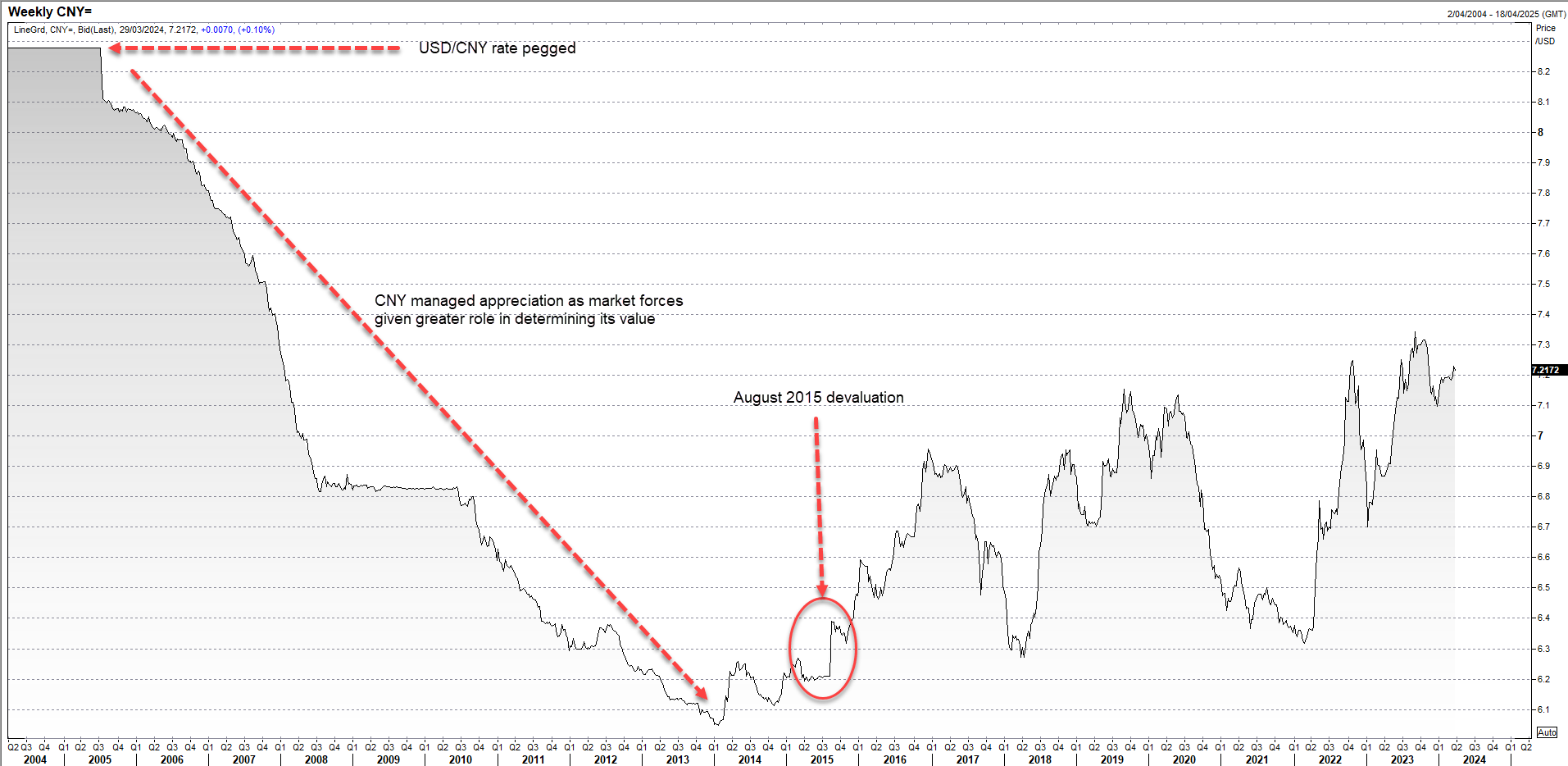

Prior to 2014, the range USD/CNY was allowed to trade in daily was significantly tighter, starting off at just 0.3% either side of the fixing level. Before 2005, USD/CNY was pegged at 8.2765 regardless of underlying fundamentals. While the fix is determined by movements across a basket of major currencies, the USD/CNY rate receives most attention given the sheer level of turnover and trade between the two nations.

Source: Refinitiv

PBOC tolerant of market forces to some degree

While there’s now greater flexibility in the USD/CNY exchange rate, the PBOC has shown it will not tolerate movements deemed as undesirable, often setting the USD/CNY fix at levels not comparable to where market forces would suggest.

In late 2023 and early 2024, the PBOC pushed back against depreciation pressure on the yuan, setting the fix stronger than where overnight movements in FX markets would imply. Concerns over capital flight adding to depreciation pressures, along with China's international competitiveness with trading partners, may explain why the PBOC took these steps.

Market forces have forced the PBOC’s hand before

The PBOC can repel market forces for considerable periods given its US$3.225 trillion in FX reserves, providing a substantial war chest to support the yuan. During periods of sustained yuan weakness, it is not unusual to see Chinese state banks selling foreign currencies to boost its value.

However, prolonged and substantial weakening has forced the PBOC’s hand before.

The most famous instance occurred in 2015 when the PBOC surprised markets by fixing the USD/CNY nearly 2% weaker than expected, resulting in increased volatility in markets and amplifying concerns China was seeking to gain an unfair trade advantage over rivals by competitively devaluing the yuan.

The move led to the United State to label China as a currency manipulator and contributed to the trade war when President Donald Trump took office in 2016.

Should we see a similar devaluation episode again, a scenario that screens as plausible given weakness in China’s economy, the potential for volatility could be even greater given the increased role the yuan plays in the global financial system.

It would be expected to contribute to a strengthening in the US dollar, impacting valuations for other currencies against the greenback, especially Asian FX names. Alternatively, should depreciation pressure swing in the opposite direction, it would likely contribute to US dollar weakness against other currencies.

Given the PBOC's role in determining the USD/CNY starting point, sudden changes in the yuan's value will impact FX markets immediately after the fix. For this reason alone, a casual glance when it's announced is a habit every trader should consider.

-- Written by David Scutt

Follow David on Twitter @scutty