EUR/USD continued to fall on Tuesday, extending the downturn that has been in place since the beginning of the month, amid a slew of less-than-encouraging economic data emerging from the Eurozone and the beginning of US Fed Chair Janet Yellen’s two-day testimony before the US Congress.

Tuesday morning saw the release of several economic data points that disappointed expectations, most notably with respect to GDP. Euro area GDP for the last quarter of 2016 grew by 0.4% against prior consensus expectations of 0.5%. German GDP also disappointed at 0.4% against a 0.5% forecast. On top of these weaker-than-expected readings, the German ZEW economic sentiment indicator once again came in below expectations at 10.4 vs expectations of 15.1. Additionally, euro area industrial production for December declined by more than expected at -1.6% versus expectations of -1.4%. These lackluster data points weighed heavily on the already-pressured euro currency, helping to push EUR/USD closer to its 1.0500 downside target.

Also contributing significantly to the EUR/USD drop was a strongly boosted dollar as Federal Reserve Chair Janet Yellen began her testimony in front of the US Senate Banking Committee. In this testimony, Yellen struck a tone that was decidedly more hawkish than had generally been expected. Her statements indicated relatively robust expectations that interest rate increases this year would be appropriate, and that it would be “unwise” to wait too long to raise rates. She also noted in response to a question that the Fed would be shrinking its balance sheet when interest rates began to normalize. Although Yellen was reluctant as usual to talk about the likelihood of a March or June rate hike, her overall tone was supportive of rate increases going forward. This more hawkish-leaning stance quickly boosted the previously lagging dollar on Tuesday.

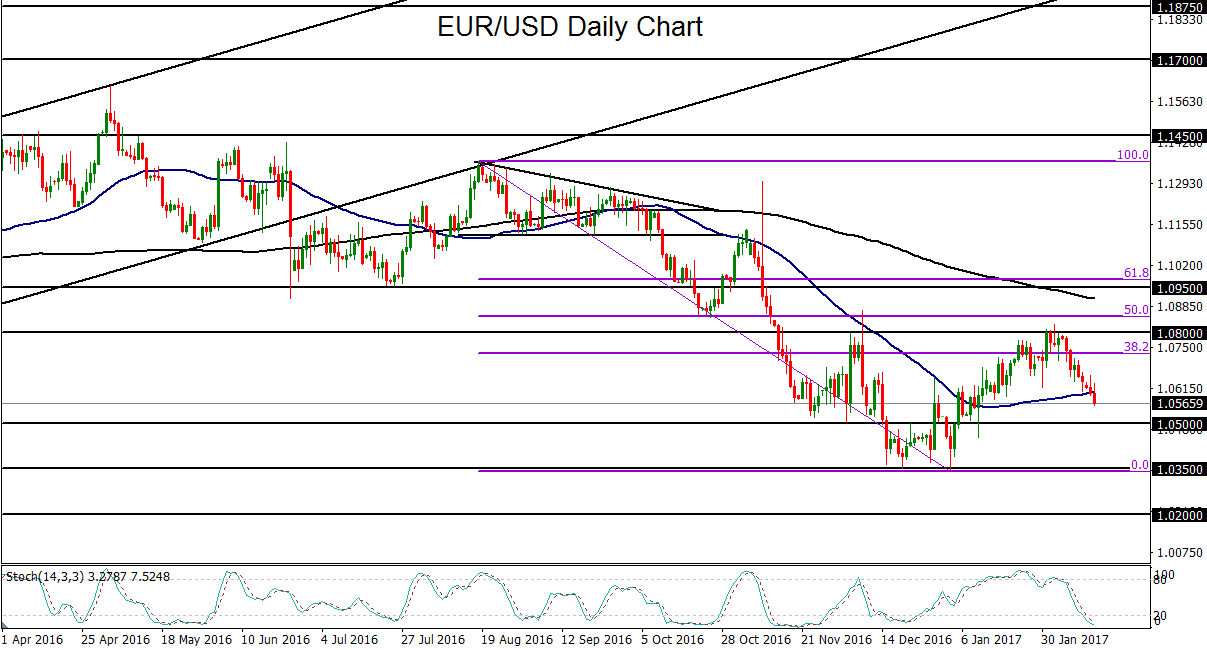

From a chart perspective, EUR/USD has been falling sharply since the beginning of February from the key 1.0800 resistance level, as the greenback has been in recovery mode after January’s dollar-slide. This EUR/USD pullback in February has shifted the currency pair back into the longer-term bearish trend. This bearish trend highlights the still-prevailing monetary policy divergence between the European Central Bank (ECB) and the Fed. Having just fallen below its 50-day moving average, EUR/USD is in position to reach towards its next major downside target at the key 1.0500 support level. With any further extension of the bearish trend below 1.0500, the next target is at the December-January lows around 1.0350.

Tuesday morning saw the release of several economic data points that disappointed expectations, most notably with respect to GDP. Euro area GDP for the last quarter of 2016 grew by 0.4% against prior consensus expectations of 0.5%. German GDP also disappointed at 0.4% against a 0.5% forecast. On top of these weaker-than-expected readings, the German ZEW economic sentiment indicator once again came in below expectations at 10.4 vs expectations of 15.1. Additionally, euro area industrial production for December declined by more than expected at -1.6% versus expectations of -1.4%. These lackluster data points weighed heavily on the already-pressured euro currency, helping to push EUR/USD closer to its 1.0500 downside target.

Also contributing significantly to the EUR/USD drop was a strongly boosted dollar as Federal Reserve Chair Janet Yellen began her testimony in front of the US Senate Banking Committee. In this testimony, Yellen struck a tone that was decidedly more hawkish than had generally been expected. Her statements indicated relatively robust expectations that interest rate increases this year would be appropriate, and that it would be “unwise” to wait too long to raise rates. She also noted in response to a question that the Fed would be shrinking its balance sheet when interest rates began to normalize. Although Yellen was reluctant as usual to talk about the likelihood of a March or June rate hike, her overall tone was supportive of rate increases going forward. This more hawkish-leaning stance quickly boosted the previously lagging dollar on Tuesday.

From a chart perspective, EUR/USD has been falling sharply since the beginning of February from the key 1.0800 resistance level, as the greenback has been in recovery mode after January’s dollar-slide. This EUR/USD pullback in February has shifted the currency pair back into the longer-term bearish trend. This bearish trend highlights the still-prevailing monetary policy divergence between the European Central Bank (ECB) and the Fed. Having just fallen below its 50-day moving average, EUR/USD is in position to reach towards its next major downside target at the key 1.0500 support level. With any further extension of the bearish trend below 1.0500, the next target is at the December-January lows around 1.0350.

Latest market news

Today 02:05 PM