- The price of gold extended this week’s losses early on Friday as several Federal Reserve officials, including Fed Chair Janet Yellen, signaled in prepared speeches the likelihood of a mid-March rate hike.

- Specifically, Yellen said, "at our meeting later this month, the committee will evaluate whether employment and inflation are continuing to evolve in line with our expectations, in which case a further adjustment of the federal funds rate would likely be appropriate."

- Earlier in the day, Richmond Fed President Jeffrey Lacker said that the Fed should learn from the past and raise interest rates in order to combat a potential surge in inflation.

- In recent days, other Fed officials, even those who are usually seen as dovish-leaning, have also voiced the strong case for a rate hike sooner rather than later. These officials included New York Fed President William Dudley and Fed Governors Jerome Powell and Lael Brainard. In short, the hawkish signals have been clear and resounding for the past week.

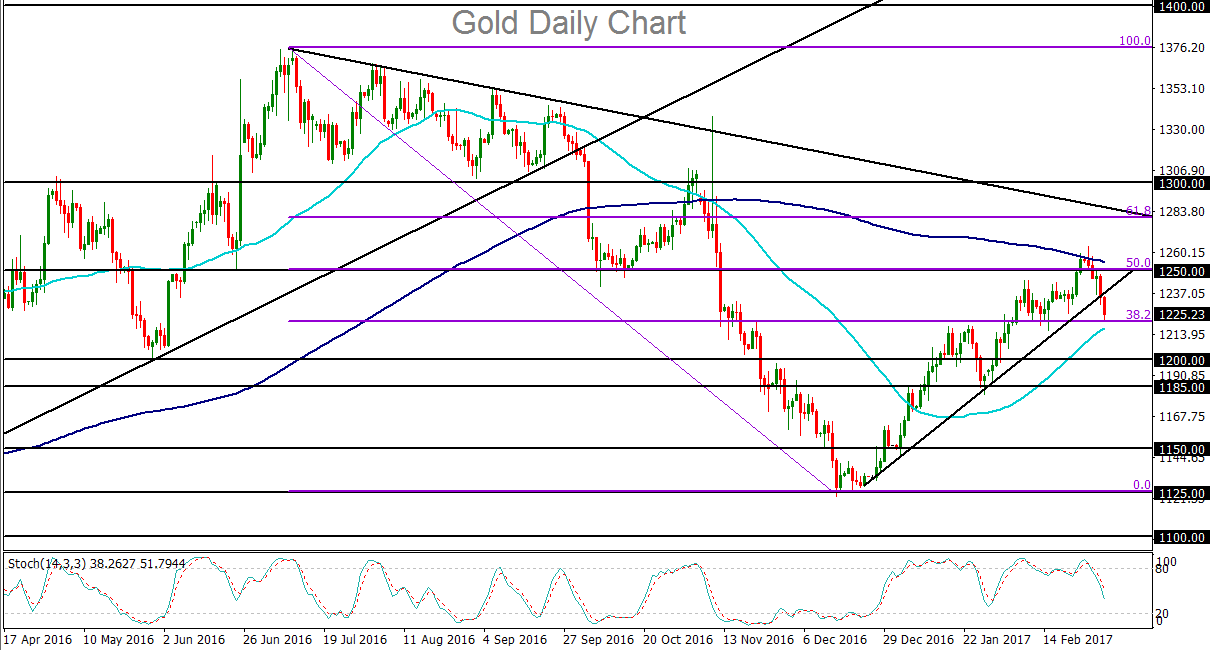

- Partly in response to this hawkishness, the price of non-interest-bearing gold has been in a sharp pullback this week from Monday’s year-to-date high right around $1265. This pullback has resulted in a tentative breakdown on Friday below a key uptrend line extending back to December’s lows.

- Exacerbating the general pressure on safe-haven gold have been stock markets that continue to fear almost nothing. Market complacency is currently reigning supreme in equities, as no uncertainty is seemingly able to faze these markets. Although the major stock indexes slid somewhat on Thursday and slightly into Friday, that slide followed Wednesday’s epic surge on the heels of Trump’s address to Congress this week. With stock markets in a no-pullback mode at the current time, the demand for the perceived safety of gold has been waning.

- After breaking down below the noted trend line on Friday and reaching a low at $1223, price pared much of its losses in the afternoon. Despite this paring of losses, however, the pressure on gold from a hawkish Fed and persistently buoyant stock markets could likely persevere.

- With any further follow-through on the trend line breakdown, the next major short-term targets to the downside are at the $1200 psychological level followed by the $1185 support area.

Latest market news

Today 02:05 PM