The US dollar rebounded on Tuesday morning, ahead of the highly anticipated speech by Fed Chair Janet Yellen at the Jackson Hole Symposium towards the end of the week, helping push the already heavily-pressured GBP/USD to fall towards a major support level at 1.2800. After closely approaching this key level on Tuesday morning, the currency pair pared some of its losses but remained pressured.

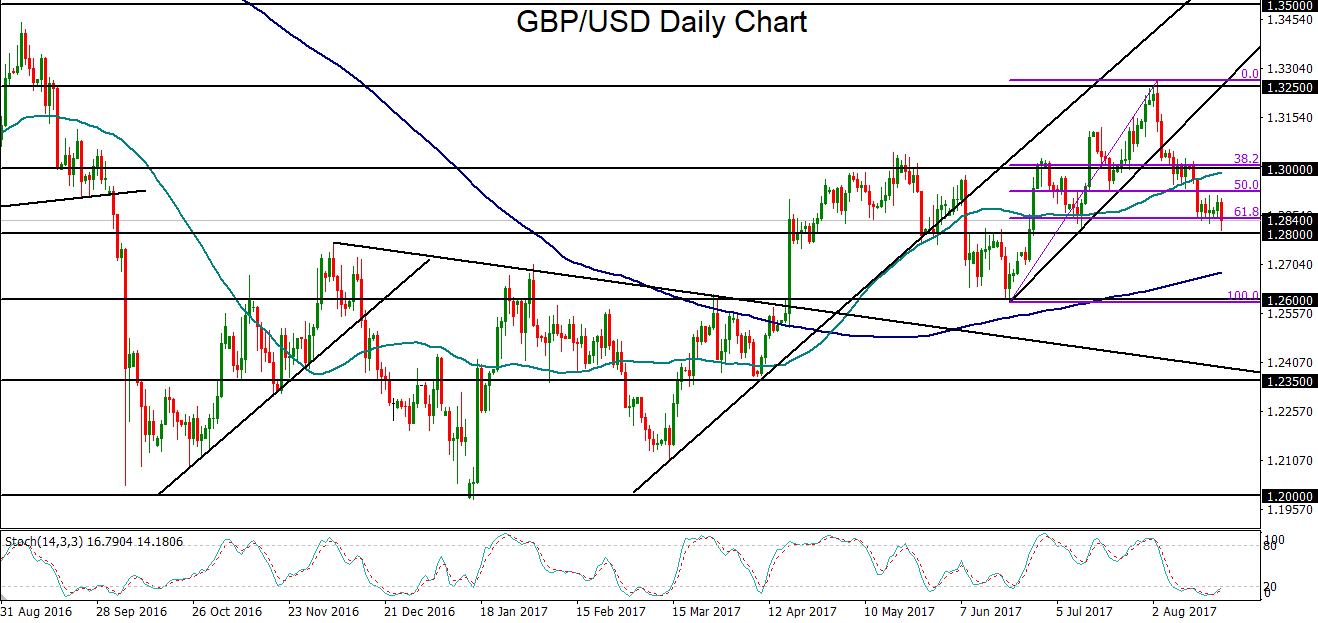

Since its early-August high at 1.3267, GBP/USD has been entrenched in a sharp plunge within the past three weeks that has broken down below several key support levels. This fall has been driven by a combination of a stabilizing US dollar and a weakening pound that has been pressured in part by a dovish-leaning Bank of England during its latest meeting. Most recently, GBP/USD broke down below the psychologically important 1.3000 level and its 50-day moving average before following-through to the downside to approach 1.2800 on Tuesday morning.

Looking ahead this week, two key events are likely to make a major impact on GBP/USD movement. The UK’s quarterly GDP estimate is scheduled for release on Thursday, and is expected to come in at a 0.3% rise. This release will have an impact on the Bank of England’s policy stance, and in turn, will affect sterling movement in the near-term. Also of significant importance for GBP/USD will be the noted Jackson Hole Symposium beginning towards the end of the week, particularly the scheduled speech by Fed Chair Janet Yellen on Friday. Some Fed-watchers are expecting hawkish nuances from that speech, which could provide a much-needed boost for the battered US dollar.

With any further pound weakening and/or dollar rebound, GBP/USD is potentially poised to extend its consecutive breakdowns this month. A major breach below 1.2800 support amid the UK’s GDP release and Janet Yellen’s speech would reinforce the new bearish trend for GBP/USD. In the event of such a breakdown, the next major downside target is at the key 1.2600 support level.