The heavily anticipated speech by Federal Reserve Chair Janet Yellen in Jackson Hole on Friday disappointed Fed-watchers who were hoping for a glimpse into possible monetary policy moves on the horizon. The speech was long on commending regulatory actions taken after the financial crisis, but very short on any clues about interest rates or other aspects of monetary policy going forward.

Prior to the speech, there had been some anticipation that Yellen might hint at higher interest rates in the near-term, at least by December. Apparently, this was not to be the case. After the speech, futures markets were pricing in less than a 40% probability of a rate hike by the end of the year. Yellen’s silence and hazy stance on policy did not markedly affect equity markets on Friday, but instead led almost immediately to further pronounced pressure on the US dollar. As a result, dollar-denominated gold, which had fallen earlier in the day, rose sharply on the weakened dollar.

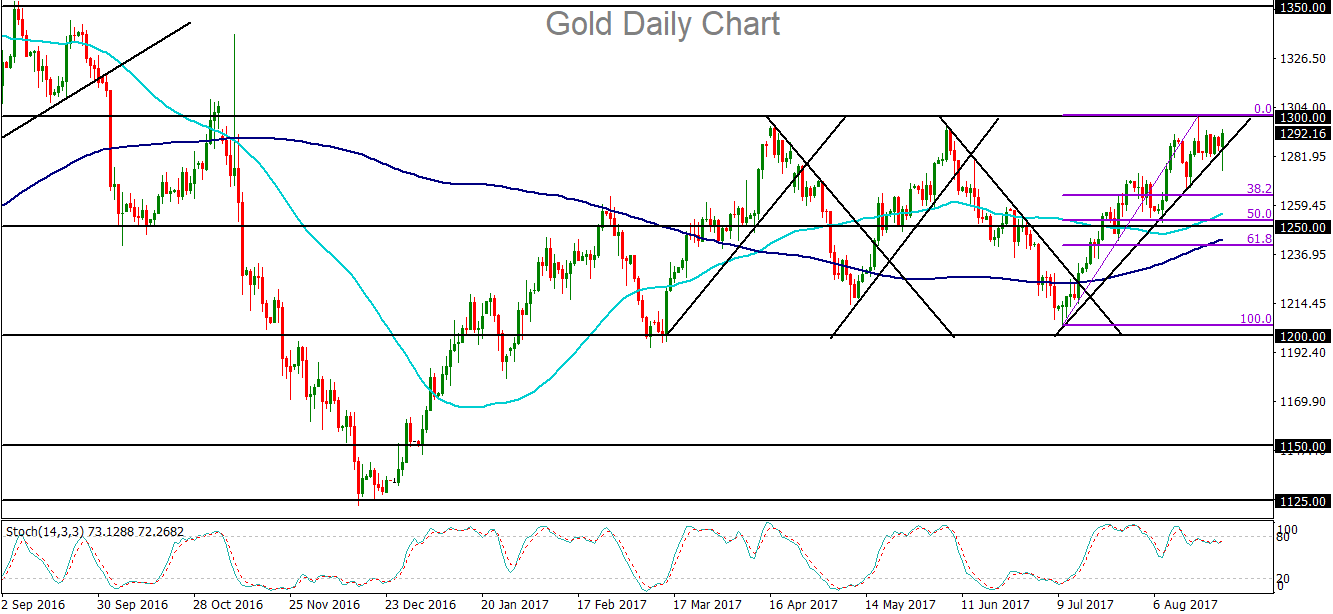

As the dollar fell against all of its major counterparts – most notably against the euro, which was trading in anticipation of a speech by European Central Bank President Mario Draghi in Jackson Hole later in the day – the price of gold surged back above its intra-range trend line after dipping below it earlier on Friday.

From a slightly longer-term perspective, gold has been trading within a wide-range since February, bounded roughly to the downside by the $1200 level and to the upside by the $1300 level. Last week, the precious metal rose to hit a new 9-month peak at the $1300 psychological resistance level before pulling back from that resistance. During the course of this 7-month range-trading, price has traversed the range multiple times in a rather clear pattern. Since early July, this pattern has continued with a well-formed rise from just above $1200 support to its current level just below $1300 resistance. If the US dollar continues its prolonged Fed-driven weakness and/or risk concerns return on major geopolitical fronts, gold has the strong potential to resume its upward march above the noted price range. In this event, a range breakout above $1300 could result in a medium-term move up towards the key $1350 level.