Thursday brings the highly anticipated rate decision and monetary policy summary from the Bank of England (BoE), the second such decision from the central bank after the historic EU referendum in late June that resulted in the UK voting to leave the EU (Brexit).

The first BoE policy meeting after Brexit, in mid-July, resulted in the committee opting for complete inaction, refraining from cutting interest rates and declining to implement any other stimulus measures for the time being. Essentially, the BoE was signaling a “wait-and-see” approach to the continually unfolding saga of post-Brexit consequences. This inaction surprised the markets to a certain extent, leading to a short squeeze and temporary relief rally for the beleaguered British pound.

While inaction ruled the day in that July meeting, however, the central bank did state that “most members of the committee expect monetary policy to be loosened in August.” Though this was far from a promise, the statement served to indicate that the BoE did indeed have intentions to ease policy at its next available opportunity. That opportunity comes on Thursday, and the consensus opinion is indeed forecasting a rate cut of 25 basis points from the current 0.50% down to 0.25%, which would be a new record low.

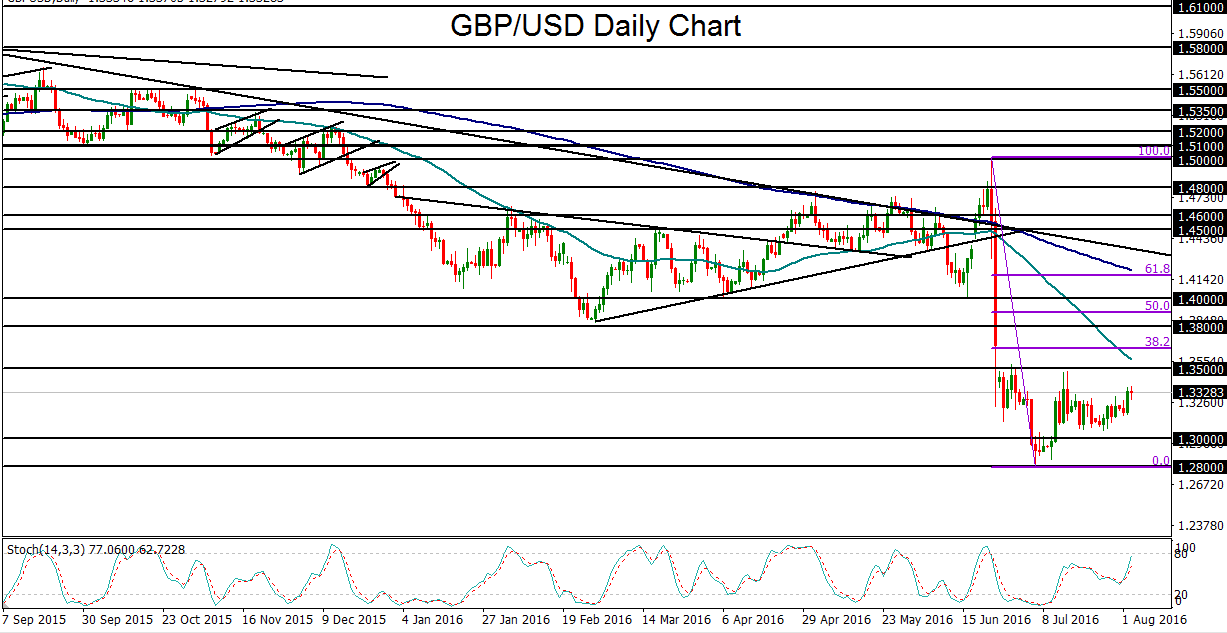

June’s Brexit outcome resulted in GBP/USD immediately plummeting to a 31-year trough in the low-1.3000’s, finally hitting a tentative bottom at 1.2795 in early July. Since that low, the currency pair has rebounded modestly, especially after the noted BoE inaction in mid-July, but has been unable to climb above key resistance at the 1.3500 level. In the past few weeks since that decision, GBP/USD has been fluctuating in a relatively tight consolidation in preparation for Thursday’s BoE event.

As mentioned, the UK is widely expected to see an interest rate cut of 25 basis points on Thursday. As this potential outcome has been well-anticipated and largely priced-in to the struggling pound, such a rate cut and other potential stimulus measures could certainly weigh on sterling but will not likely result in greater losses than have already been suffered. In the event that BoE action meets expectations, the downside target for GBP/USD continues to reside around the important 1.3000 psychological support level.

However, in the unexpected event that the BoE again opts for inaction, or less action than anticipated, GBP/USD could see a significant boost. The key near-term target level in this event remains at the noted 1.3500 resistance level, but any breakout above 1.3500 could potentially see a further relief rally towards key 1.3800 resistance.

The first BoE policy meeting after Brexit, in mid-July, resulted in the committee opting for complete inaction, refraining from cutting interest rates and declining to implement any other stimulus measures for the time being. Essentially, the BoE was signaling a “wait-and-see” approach to the continually unfolding saga of post-Brexit consequences. This inaction surprised the markets to a certain extent, leading to a short squeeze and temporary relief rally for the beleaguered British pound.

While inaction ruled the day in that July meeting, however, the central bank did state that “most members of the committee expect monetary policy to be loosened in August.” Though this was far from a promise, the statement served to indicate that the BoE did indeed have intentions to ease policy at its next available opportunity. That opportunity comes on Thursday, and the consensus opinion is indeed forecasting a rate cut of 25 basis points from the current 0.50% down to 0.25%, which would be a new record low.

June’s Brexit outcome resulted in GBP/USD immediately plummeting to a 31-year trough in the low-1.3000’s, finally hitting a tentative bottom at 1.2795 in early July. Since that low, the currency pair has rebounded modestly, especially after the noted BoE inaction in mid-July, but has been unable to climb above key resistance at the 1.3500 level. In the past few weeks since that decision, GBP/USD has been fluctuating in a relatively tight consolidation in preparation for Thursday’s BoE event.

As mentioned, the UK is widely expected to see an interest rate cut of 25 basis points on Thursday. As this potential outcome has been well-anticipated and largely priced-in to the struggling pound, such a rate cut and other potential stimulus measures could certainly weigh on sterling but will not likely result in greater losses than have already been suffered. In the event that BoE action meets expectations, the downside target for GBP/USD continues to reside around the important 1.3000 psychological support level.

However, in the unexpected event that the BoE again opts for inaction, or less action than anticipated, GBP/USD could see a significant boost. The key near-term target level in this event remains at the noted 1.3500 resistance level, but any breakout above 1.3500 could potentially see a further relief rally towards key 1.3800 resistance.

Latest market news

Today 02:05 PM