The week started with a paper released by San Francisco Fed President John Williams detailing his mostly-dovish leanings that appeared to oppose a near-term Fed rate hike. On Tuesday morning, however, New York Fed President William Dudley made seemingly conflicting assertions in a televised interview, stating that a rate hike at the Fed’s next policy meeting in September “is possible.” Dudley went on further to state his opinion that the US economy is in “OK shape” and that inflation is “drifting up a little bit.” Then, immediately prior to Wednesday’s FOMC minutes release, St. Louis Fed President James Bullard made a speech reiterating that he saw only one rate hike in the next couple of years, and that hike may not necessarily be happening anytime soon.

Finally, on Wednesday’s actual release of July’s FOMC minutes, the monetary policy outlook became even more muddled, as the minutes revealed a vague divide among the various Fed members. The release stated that some Fed members “anticipated that economic conditions would soon warrant taking another step in removing policy accommodation.” This indicated a significant hawkish element within the Fed’s ranks.

At the same time, however, the Fed’s characteristic abundance of caution and indecision showed clearly through, as it continued to reiterate its consistent stance on requiring more positive economic data going forward in order to act. Also reiterated were ongoing concerns from some members over inflation reaching the central bank’s 2% objective. Additionally, while recent improvements in the employment situation were acknowledged, some members expressed concerns about the future pace of job creation.

Therefore, while the minutes contained some hawkish elements, the Fed’s continued lack of clarity and consensus were evident. As shown through price reactions after the release of the minutes, the financial markets apparently interpreted this lack of direction as more dovish than expected, or at least not as hawkish as previously anticipated. This interpretation was seen most readily as a drop for the US dollar and rallies in stocks and gold on Wednesday. The dollar continued to be punished on Thursday while gold and equities remained supported on further doubts of a near-term rate hike. On Friday, however, the tide has appeared to shift once again as stocks have seen an early pullback while the dollar has rebounded.

Throughout these market vacillations, the Fed Fund futures markets’ view of the situation has remained relatively consistent, with the current implied probability of a September rate hike at around 18%, and around a 53% probability of any rate hike happening at all this year.

Amid the confusion generated by the mixed signals emanating from the Fed, one principle remains crystal clear – there is no clarity and will not likely be any clarity until such time that the Fed actually decides to raise rates, if it does at all. Until that hypothetical time, the situation remains very much of a fluid “wait-and-see” game, as it has been since the beginning of the year. In this light, traders may best be served by working to nimbly identify the swings in Fed-driven market sentiment and avoiding over-commitment to Fed-related trade positioning.

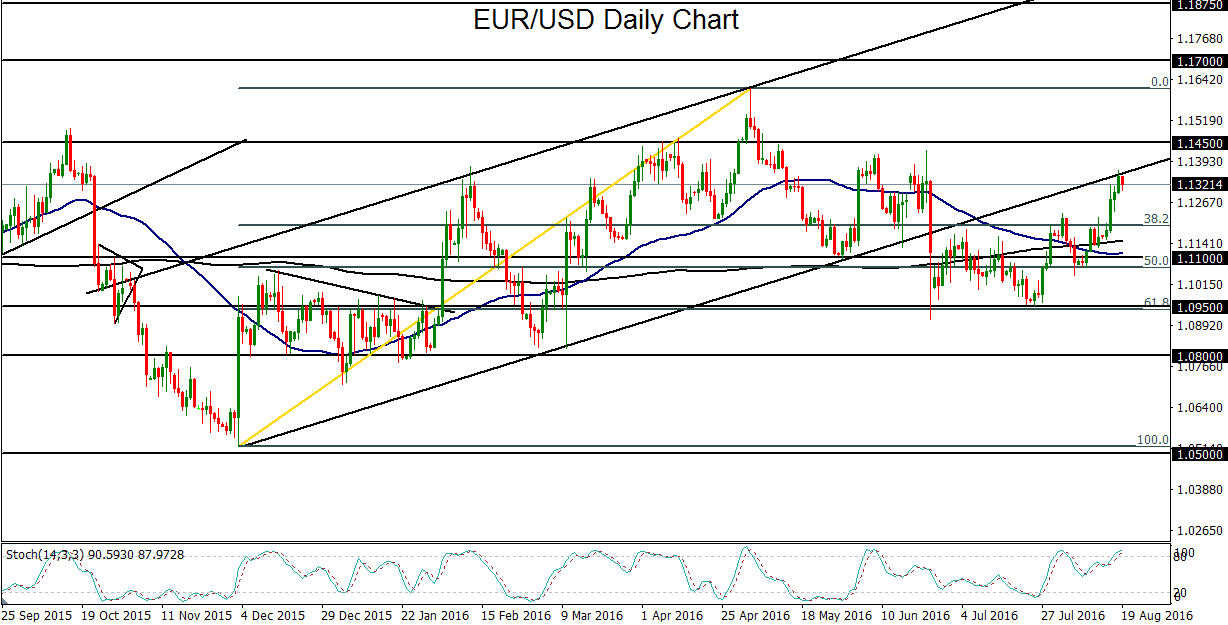

EUR/USD

The past week has seen EUR/USD rise sharply as the dollar weakened on lowered expectations of a near-term Fed rate hike. On Friday, however, the currency pair pulled back from key resistance imposed by the underside of a major bullish trend channel. That trend channel has defined the currency pair’s uptrend from the 1.0500-area lows of last December up to the sharp breakdown of the channel when the Brexit outcome was revealed. For nearly the past month, EUR/USD has been climbing from its post-Brexit lows. This climb has boosted the currency pair from those support lows around the 1.0950 level (which is also at the key 61.8% Fibonacci retracement of the most recent major uptrend), up to a 1.1365 high on Thursday. That represented a new intermediate high that had not been seen since the UK’s EU referendum was held in late June. Having reached the underside of the noted uptrend channel, EUR/USD has hit key resistance. Any continued turn back down from this resistance could once again target the 1.1100 support level to the downside. In the opposite event of any further surge that places the currency pair back into the uptrend channel, major further resistance immediately to the upside resides around the key 1.1450 level.

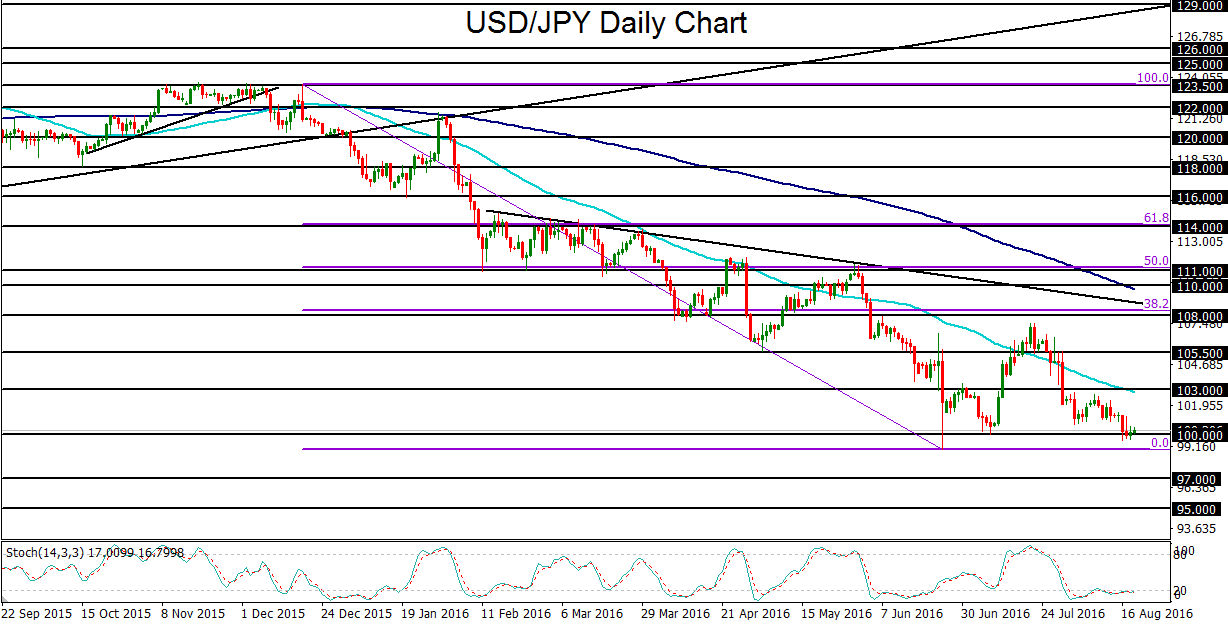

USD/JPY

The past week has seen USD/JPY generally continue to stagnate around the major 100.00 psychological support level in the absence of any clear catalyst for a significant directional move. As the dollar has come under pressure recently, the Japanese yen side of the currency pair has remained strong, fluctuating near long-term highs against its major currency rivals. Within the past month, USD/JPY has dropped precipitously from its July high just below 108.00 resistance down to this key 100.00 level, which sits just above the late-June post-Brexit low around 99.00. A strong potential catalyst for a decisive USD/JPY breakdown below 100.00 should occur if the prospects of a near-term Fed rate hike and further Bank of Japan easing actions BOTH continue to be increasingly doubted by the markets. In this event, any strong breakdown below 100.00 should subsequently begin to target key downside support objectives at 97.00 and 95.00.